- NEAR Protocol’s partnership with Valor produced their first ETP, which is now available for trading.

- The announcement highlighted the pace at which the NEAR Protocol was evolving for current market narratives.

NEAR protocol [NEAR] is celebrating a major milestone in real-world assets (RWA) following a recent announcement by its partner Valour.

The latter is an issuer of exchange-traded products (ETPs) for digital assets.

The official announcement revealed that Valor has successfully deployed its first ETP powered by the Near Protocol. The ETP is the first of its kind and can be traded on the Swedish Spotlight spot market.

NEAR Protocol investigates RWAs, AI and DePIN

The announcement marked an important development for the NEAR protocol as it highlighted a step toward realizing RWAs on blockchain.

Blockchain-based RWAs are being championed as one of the key stories for the next bullish wave. This is because they can push blockchain technology much deeper into the mainstream and increase its adoption.

It makes sense that the NEAR Protocol explores growth opportunities in the key areas highlighted this year and going forward.

The same applies to the AI segment, where the protocol has also done research.

Short term price analysis

NEAR Protocol’s involvement in key WEB3 growth areas could positively impact NEAR’s price action over the long term.

In terms of near-term performance, NEAR has posted a 35% recovery over the past seven days. It was exchanging hands for $6.13 at the time of writing.

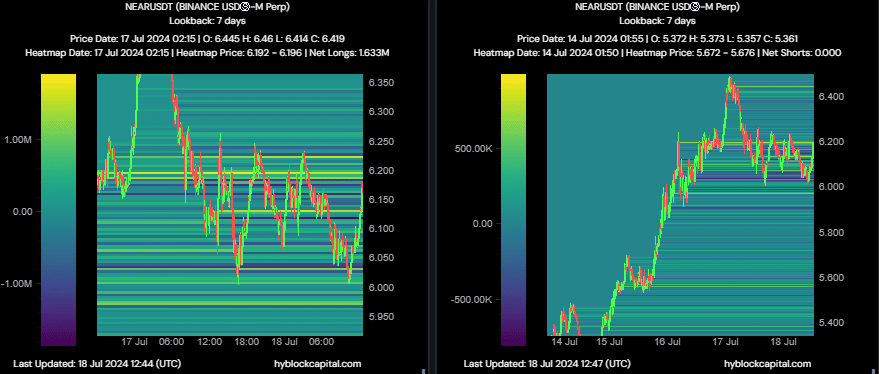

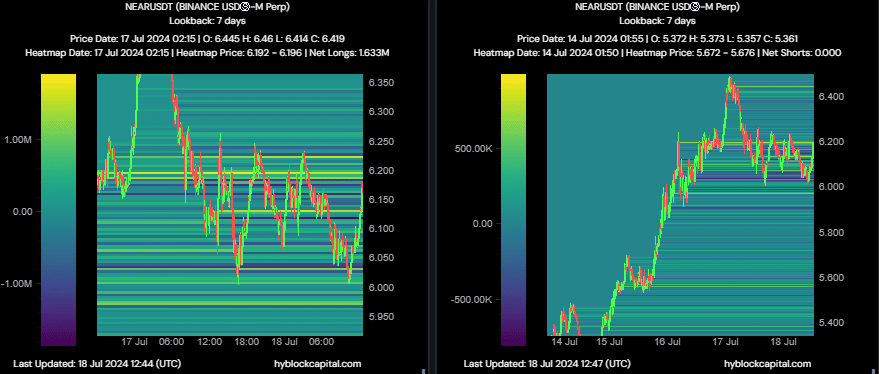

Will this new-found short-term momentum rebound above current yearly highs? A look at the ratio of shorts to longs at NEAR’s press-time price level indicated that sentiment was overwhelmingly in favor of the bears.

Source: Hyblockcapital

Is your portfolio green? Check out the NEAR profit calculator

There were approximately 528,000 shorts against 263,000 longs on Binance [BNB] at the same price level. This isn’t surprising, considering that traders who bought at recent local lows were up 35% on their investment at the time of writing.

So this provided an incentive to sell when overall market sentiment failed to maintain strong support for the uptrend.