- According to AMBCrypto’s NEAR Protocol price prediction, the token’s first target could be $7.8.

- Some market indicators pointed to a continued price increase.

After days of decline, Close to protocol [NEAR] bulls took over the market but painted the token’s cards green. Therefore, AMBCrypto assessed the token’s statistics and technical indicators to predict Near Protocol’s price.

NEAR remains bullish

NEAR bulls managed to keep the week in check as the token’s price rose over 2% last week. Things have picked up over the past 24 hours as the value of the tokens has increased by more than 3%.

At the time of writing it was NEAR trade at $4.02 with a market cap of over $4.5 billion.

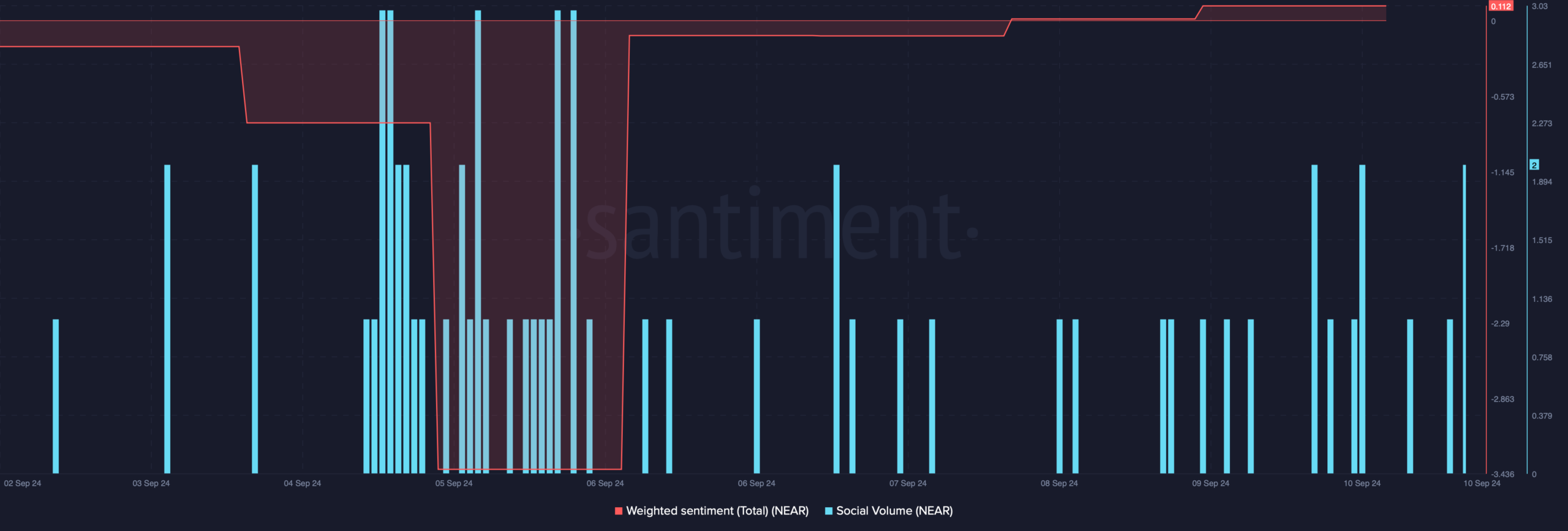

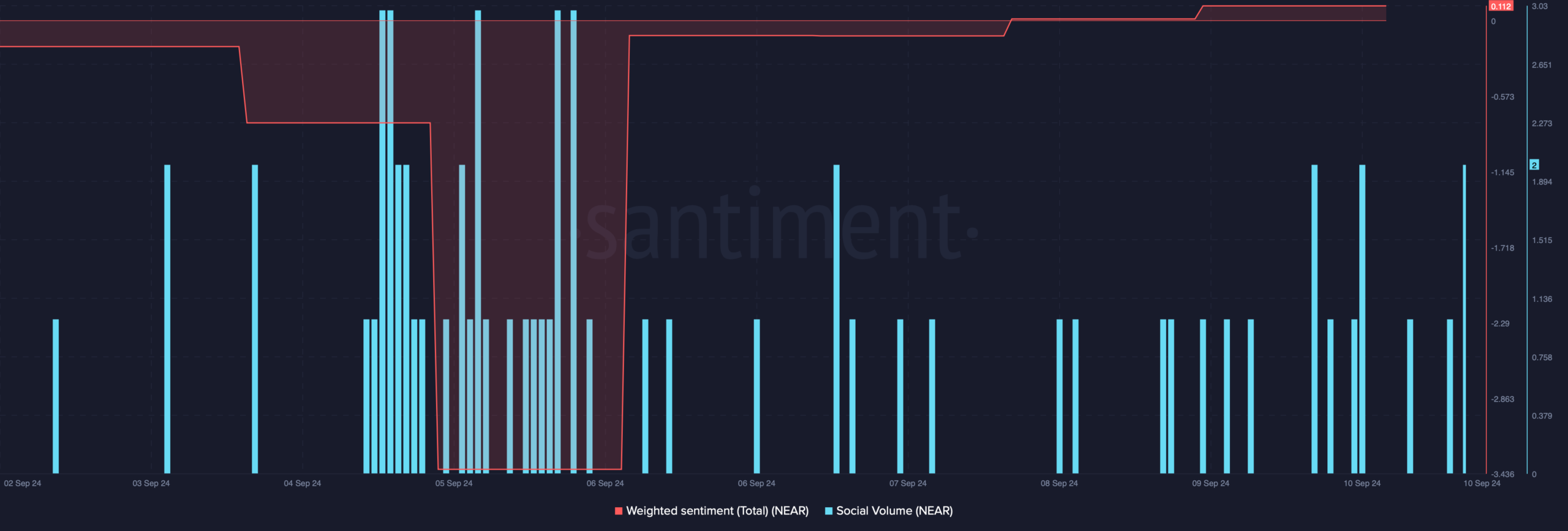

The price increase also positively impacted the token’s social metrics. For example, NEAR’s Weighted Sentiment entered the positive zone.

This meant that bullish sentiment surrounding the token was dominant in the market. Social volume also remained stable last week, indicating that the token’s popularity remained intact.

Source: Santiment

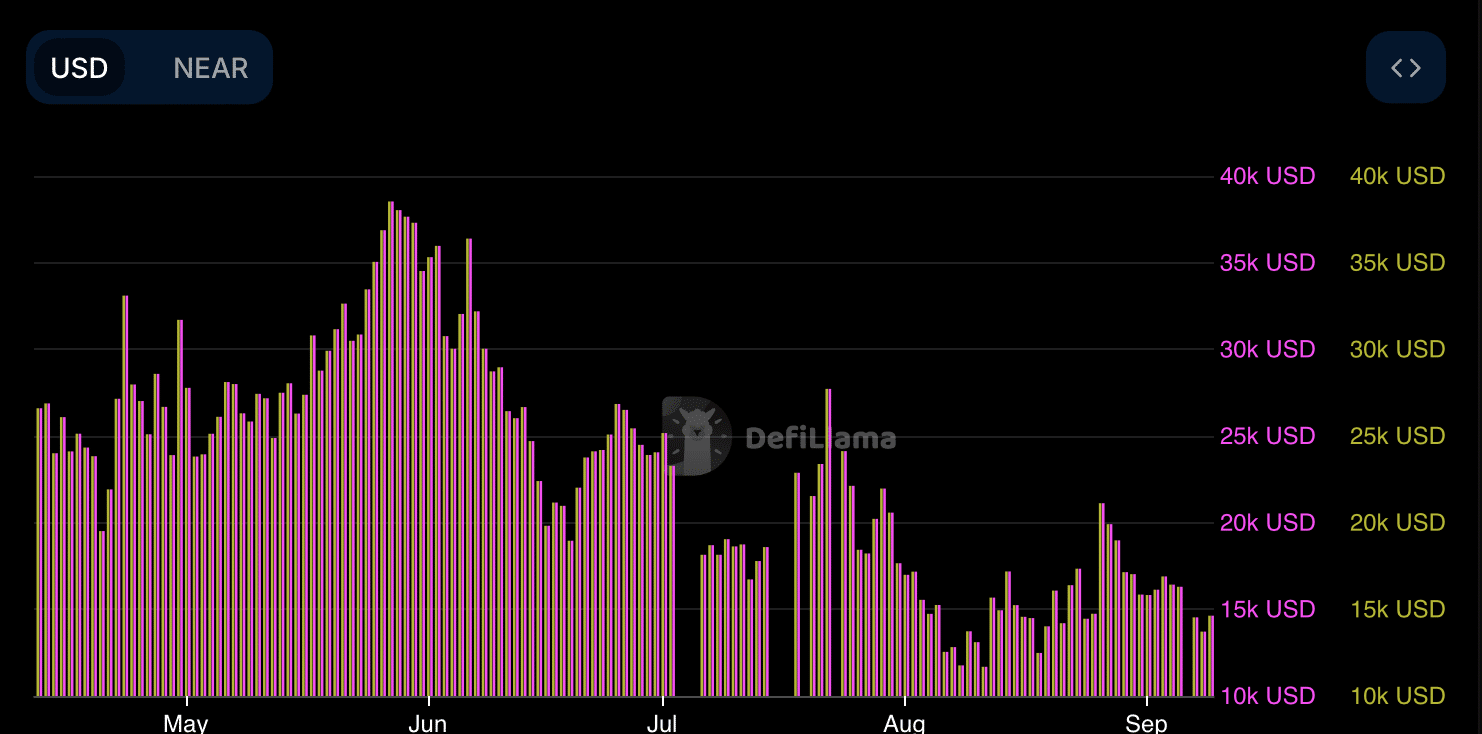

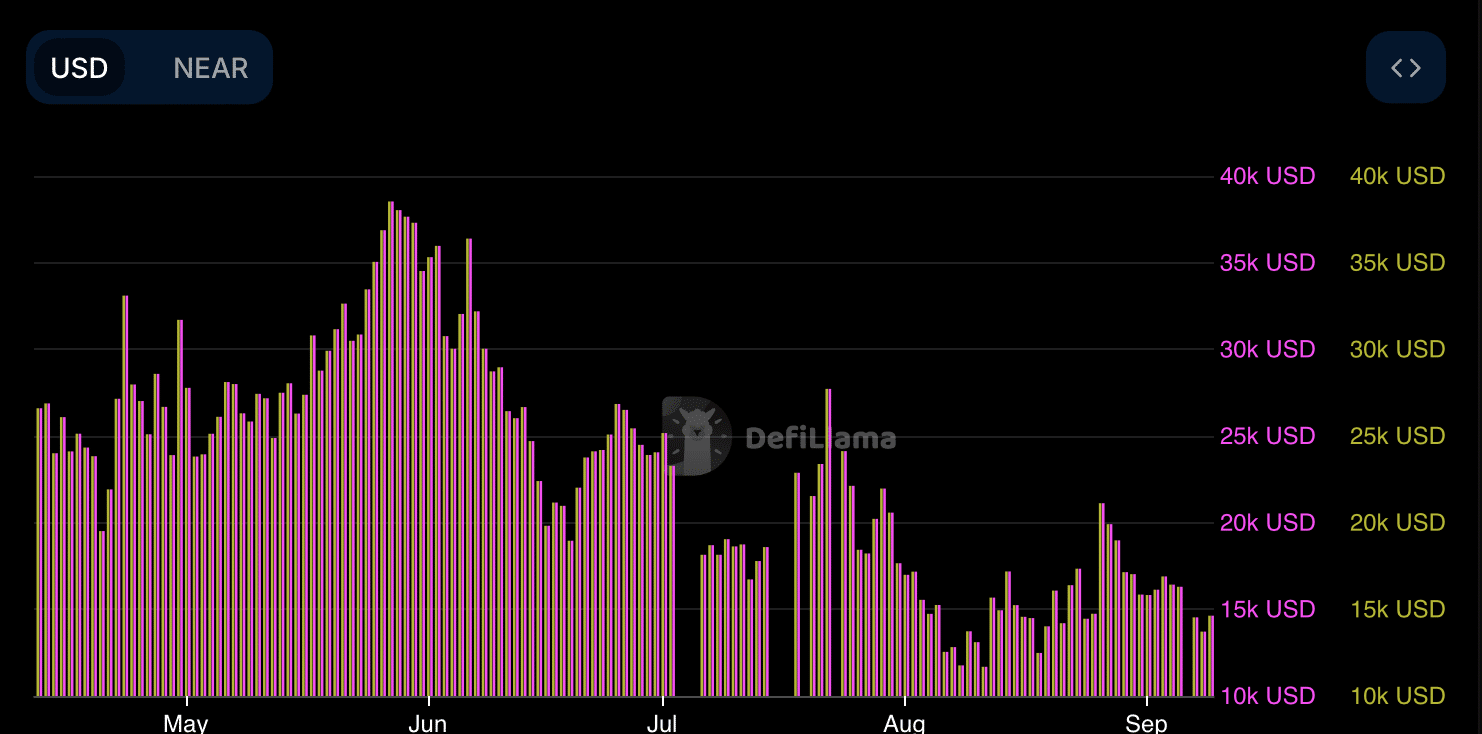

It was interesting to note that while the token’s price gained bullish momentum, the NEAR protocol’s captured value fell.

AMBCrypto’s look at DeFiLlama’s data revealed that both NEAR’s fees and revenues have seen declines in recent months.

Source: DeFiLlama

NEAR Protocol price prediction

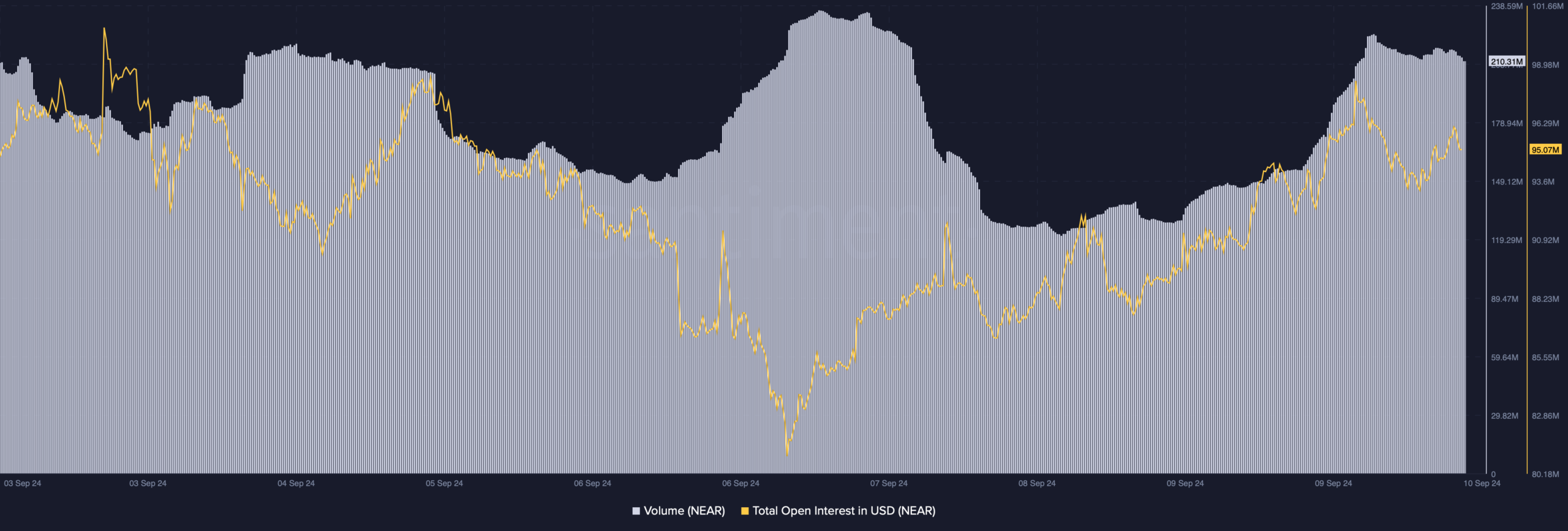

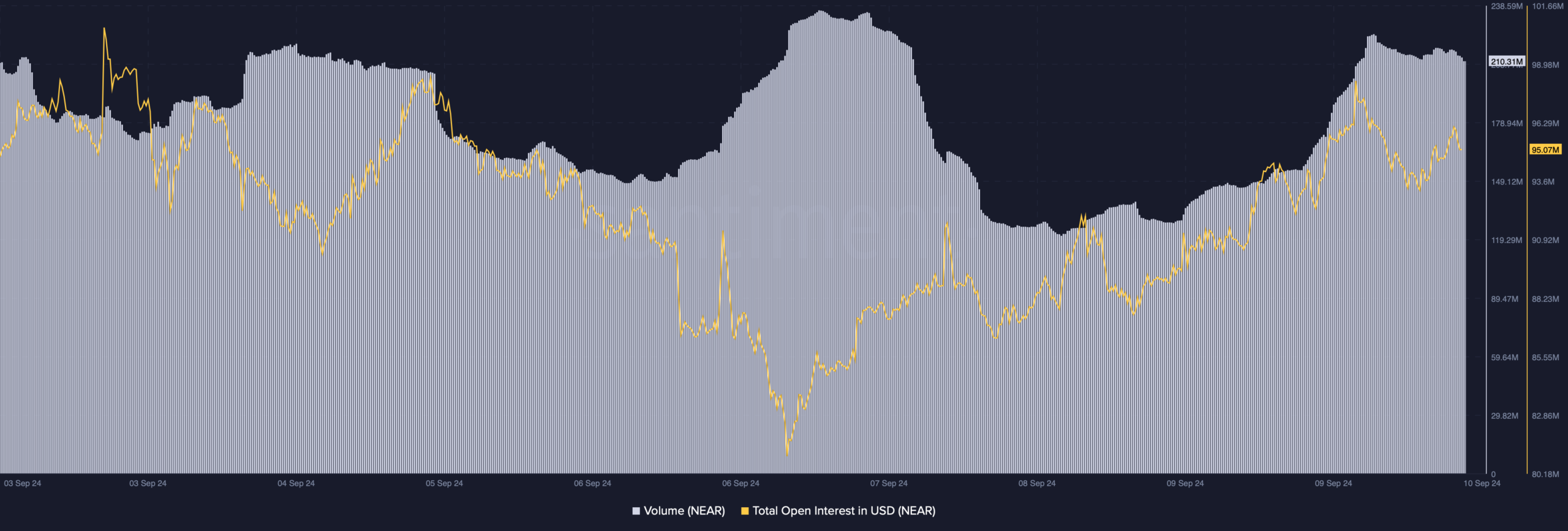

AMBCrypto then checked the token’s on-chain data to see if a continued price increase was possible. According to our analysis, NEAR’s trading volume rose along with its price. In addition, Open Interest also increased.

Whenever the Open Interest increases, it suggests that the ongoing price trend is likely to continue, which was bullish on this occasion.

Source: Santiment

However, not everything worked in the token’s favor. For example the token Long/short ratio registered a decline.

This meant that there were more short positions in the market than long positions, indicating a rise in bearish sentiment in the market.

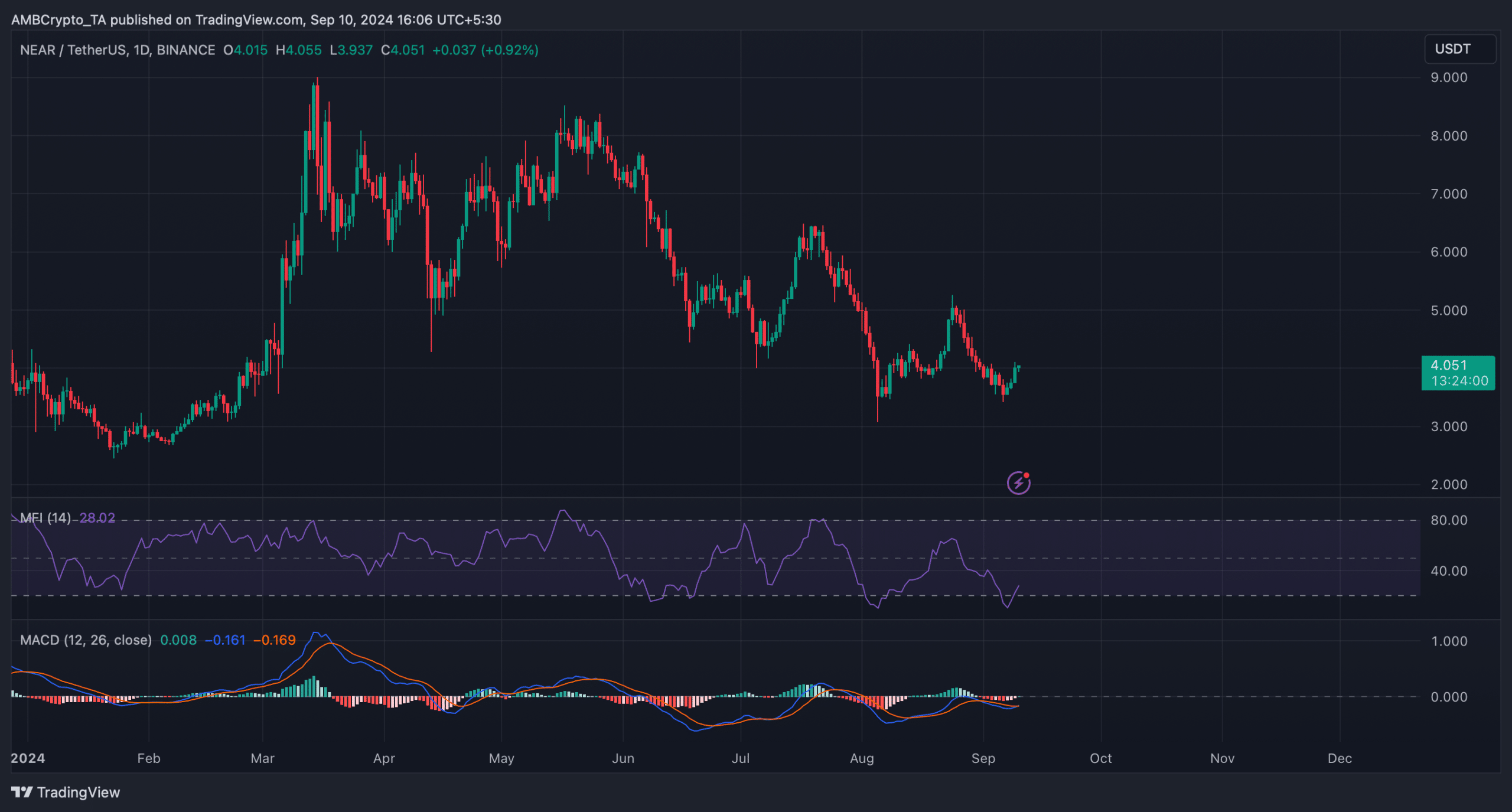

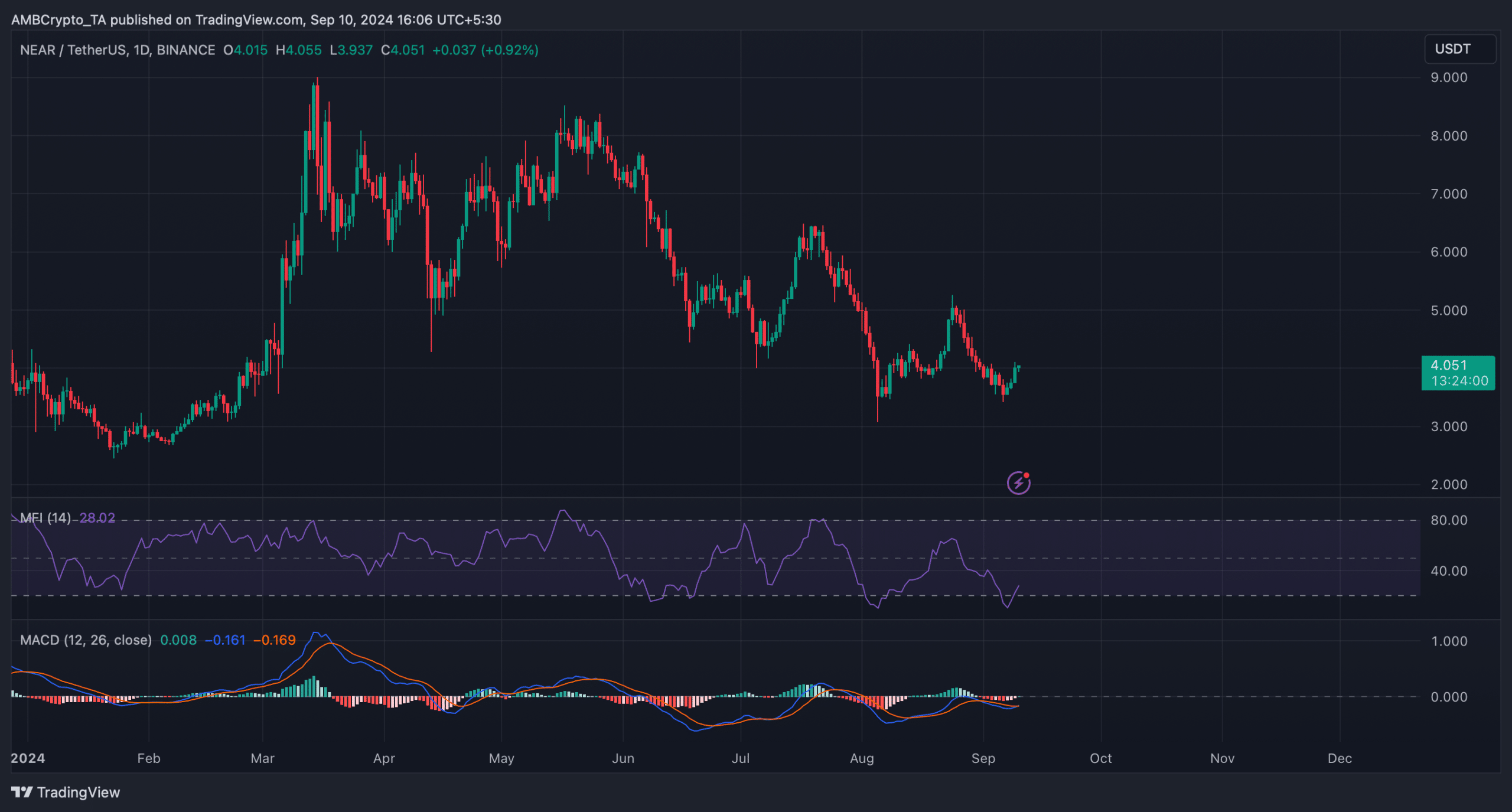

But the technical indicators looked bullish. The MACD showed a bullish crossover. The NEAR Protocol’s Money Flow Index (MFI) registered an upswing, indicating a continued price increase in the coming days.

Source: TradingView

Realistic or not, here it is NEAR’s market cap in BTCs conditions

So, going by the NEAR protocol price prediction, investors should keep an eye on the USD 7.8 mark as it is a crucial resistance level.

A breakout above could result in a full-fledged recovery, pushing NEAR back up to $15 in the coming months. However, if the bears reverse the bulls, it won’t be surprising to see NEAR fall to $1.

Source: TradingView