- An increase in development activity indicates NEAR’s potential to break through existing resistance levels.

- Trading activities in the NEAR market have also played a major role in driving the expected growth.

Over the past week, market dynamics have favored bullish traders, evidenced by a 6.53% increase, mirroring Near Protocol’s price. [NEAR] daily performance gains.

NEAR is currently facing significant resistance at $4,662, which has dampened 24-hour gains somewhat. Nevertheless, NEAR remains well positioned for an upward trajectory.

The surge in development activities supports the expected NEAR rally

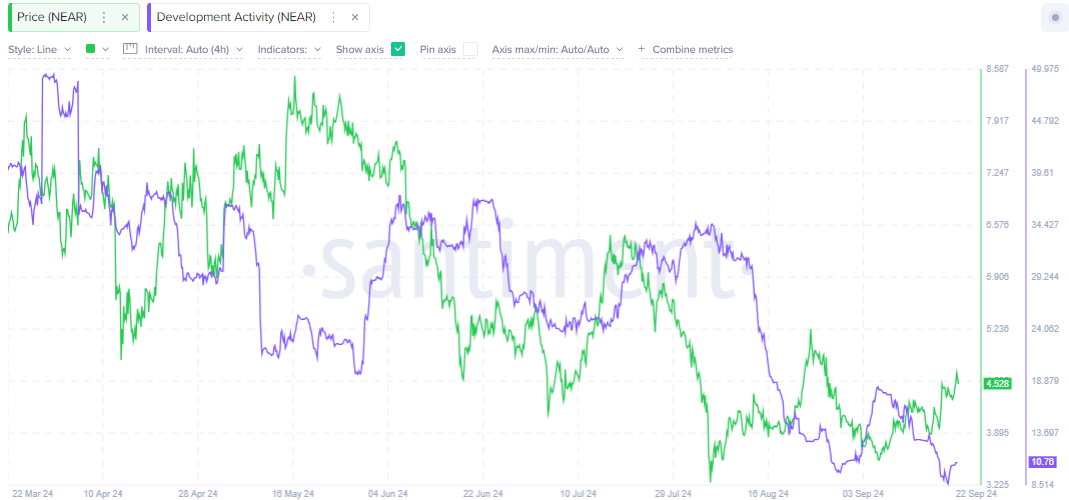

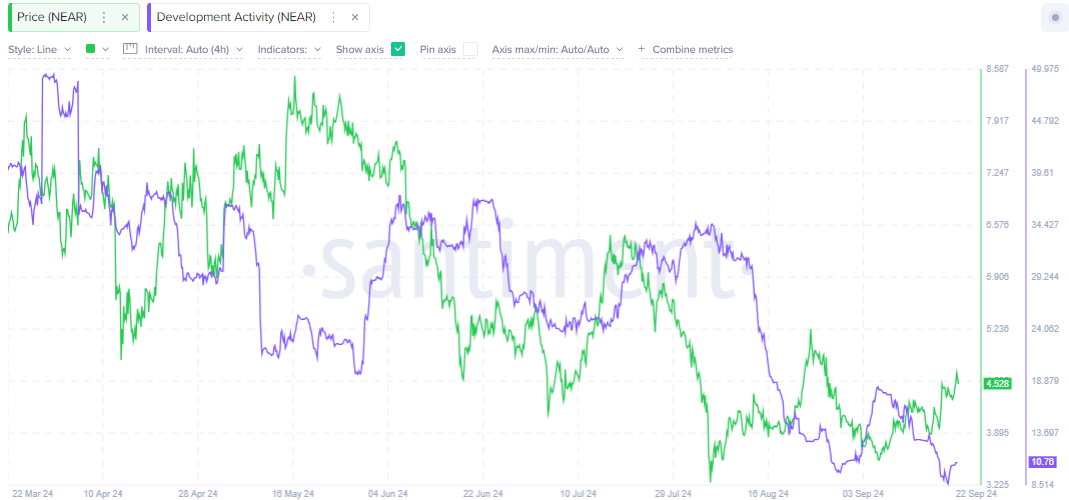

According to SantimentNEAR has experienced a notable increase in development activities after a period of downward trend. Market trends often reflect movements in development activities.

In this case, an upward trend in development activity indicates a potential increase in the price of NEAR. Such activities typically indicate that the NEAR team is addressing issues or implementing new enhancements and major enhancements to the protocol.

Source: Santiment

While continued development activity points to a bullish outlook for NEAR, other factors could also impact the asset’s rally.

NEAR is facing selling pressure at the resistance line

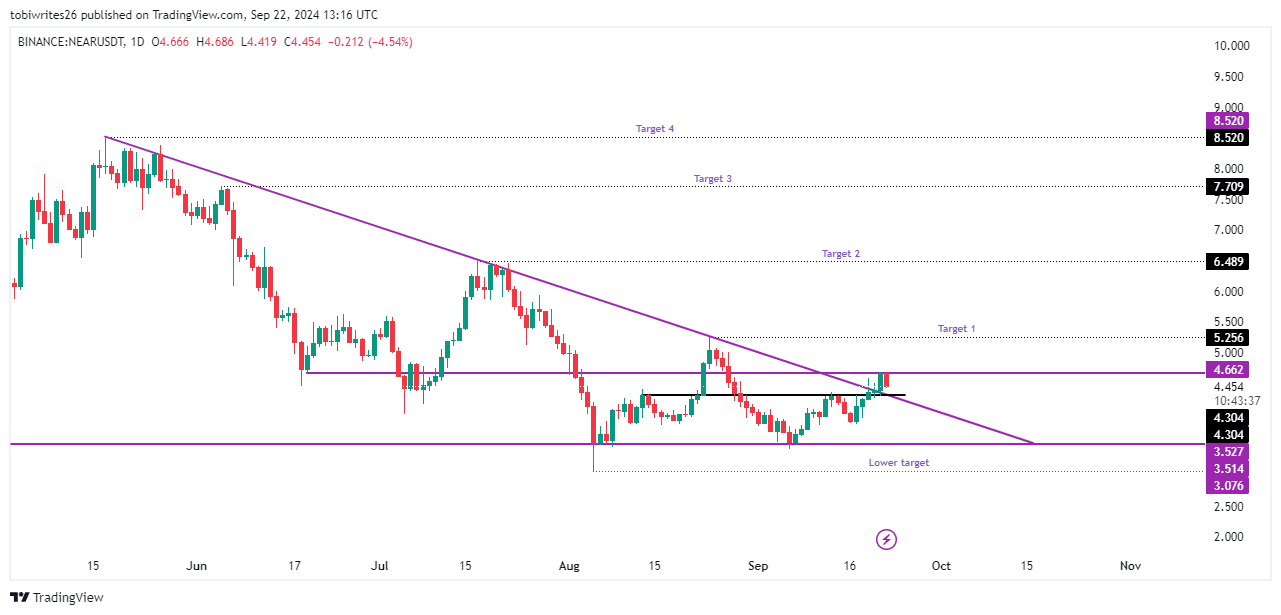

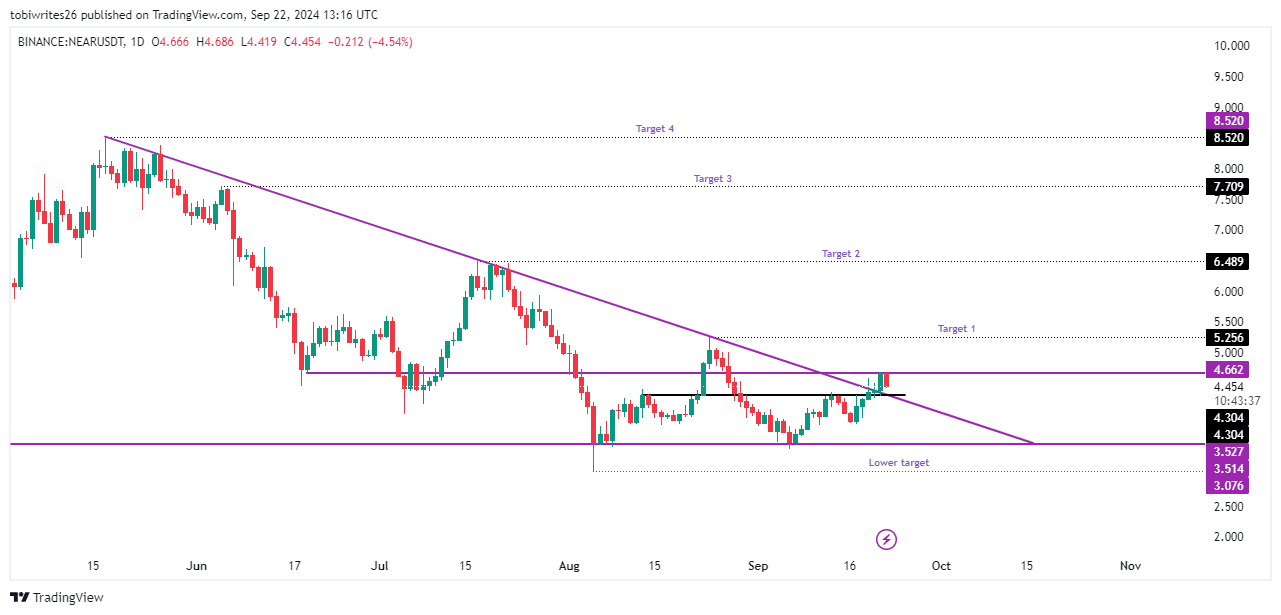

NEAR is currently trading within a bullish triangle pattern, indicating an impending upward move. This pattern is characterized by a diagonal upper resistance line and a horizontal support line.

However, at the time of writing, NEAR has broken this pattern and encountered a new resistance area at $4,662, pushing the price lower.

While this appears to be a retracement move before price trends turn higher, it is highly likely that NEAR will regain momentum and target prices at $5,256, $6,489, $7,709, and $8,520.

Source: trading view

Should this breakout prove to be a fakeout, NEAR could find the next local support at $4,304. Intense selling pressure could drive the price back to the horizontal support line or even lower to $3,076.

Interest in NEAR remains high

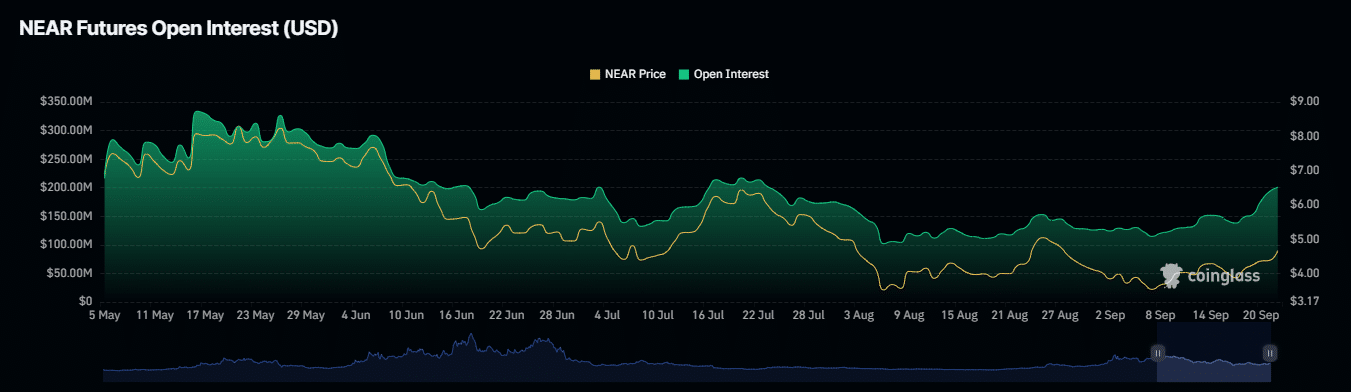

According to the Open Interest statistic of Mint glassNEAR is poised for further price appreciation and is currently trading at $200.76 million, above the September 17 low of $138.25 million.

Realistic or not, here is NEAR’s market cap in BTC terms

This notable increase indicates that buyers are actively accumulating NEAR in anticipation of continued upward price movement, aiming for even higher trading levels.

Source: Coinglass

This increase in Open Interest was accompanied by a corresponding 56.52% increase in NEAR’s trading volume over the past 24 hours.