RUNE, the native token of the cross-chain decentralized exchange, THORChain, is under pressure. On the daily chart, the token is down nearly 60% from May highs and remains flat even as the broader crypto market recovers.

Even with RUNE remaining flat, there is confidence that prices could rise in the coming days, mainly due to fundamentals and efforts by the development team.

THORChain revenue increases after swap fee increase

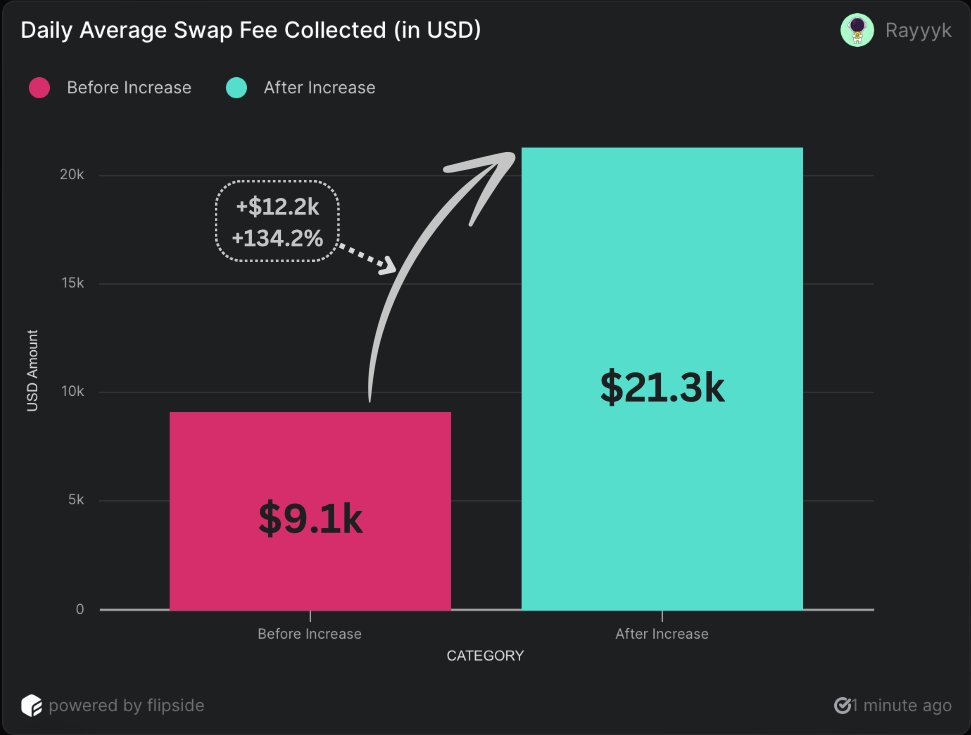

In a post on X, an analyst noted that THORChain has almost doubled its revenue in the last two days following the community’s decision to increase the minimum swap fee on the DEX.

Recently, THORChain node operators approved and implemented a proposal to increase swap fees for layer 1 native exchanges to 0.05%. The seemingly small change, the analyst notes, has had a profound impact on THORChain’s protocol, increasing daily revenue by almost 100%.

Interestingly, the analyst noted that while protocol fee increases can negatively impact user experience, it had the opposite effect on THORChain. While the swap fee rose, users were undeterred. Instead, swap volume remained stable while the average fee for each transaction soared.

As transaction fees rise, weekly liquidity fees on THORChain now exceed the block reward, a major milestone for the DEX. Notably, the significant shift in monetization would further drive the RUNE burn rate once ADR 17, a community proposal, is implemented in the coming days.

The more RUNE is taken out of circulation, the scarcer the token becomes, driving prices higher. Once ADR 17 is implemented, so will the protocol buy and burn $1 worth of RUNE for every $10,000 in sales generated. For this reason, increasing sales due to the increase in swap fees means that more RUNE will be fired.

Impact of RUNEPool on Liquidity: Will RUNE Break $5?

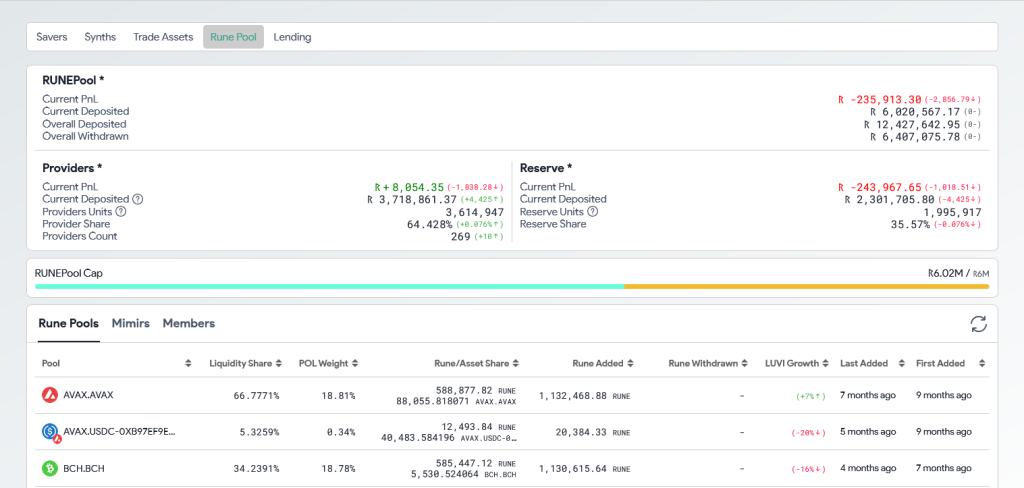

At the end of July, THORChain also introduced RUNEPool to further boost liquidity provision. Through this feature, users can freely deposit their RUNE into a pool of diversified tokens via THORSwap and THORWallet interfaces.

In this way, they help reduce the risks of temporary losses while increasing liquidity. On August 9, more than 3.7 million RUNE were deposited into the RUNEPool.

Despite these changes, RUNE remains under enormous selling pressure, even though it is stable at the time of writing. After the bear breakout in early August, which pushed prices below July’s lows, the token has struggled. However, if there is a recovery in spot rates to July highs of around $5, the coin could rise to above $7.5.