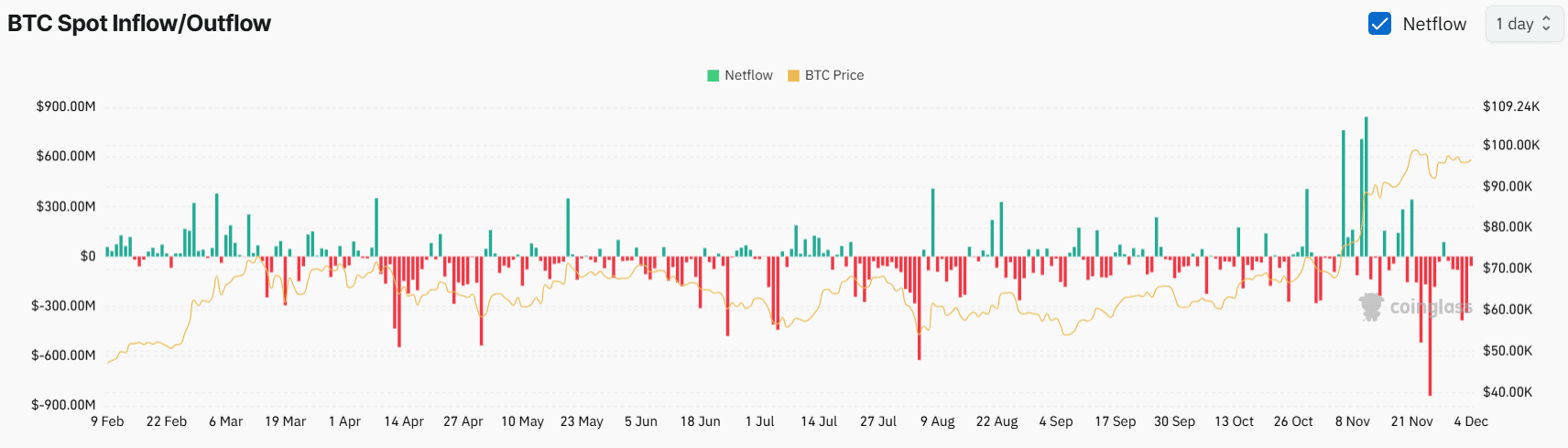

- BTC’s spot inflows/outflows data shows that the exchanges have seen a significant outflow of $860.52 million.

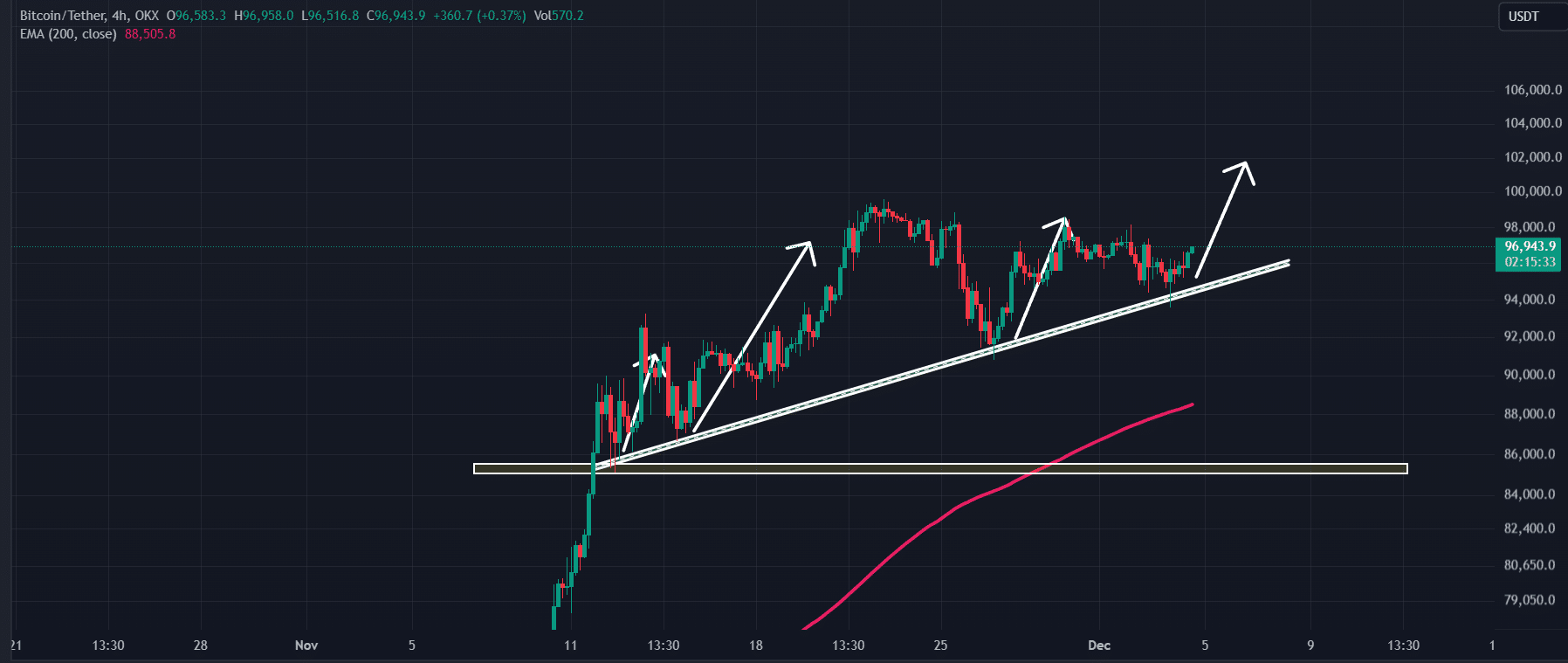

- BTC’s recent price action indicates that it could rise 3% to reach the $99,588 level.

Bitcoin [BTC]The world’s largest cryptocurrency by market capitalization appears to be in a danger zone, as reported by a crucial on-chain metric.

At the time of writing, the market as a whole appears to be recovering after a modest price decline following the South Korean president’s declaration of martial law.

Bitcoin MVRV metric sends an alert

According to on-chain analytics firm Santiment, the average returns of Bitcoin portfolios active over the past 30 days have entered a danger zone.

This danger zone occurs when BTC’s MVRV approaches or exceeds +5%. At the time of writing, the statistic stands at +4.2%, indicating that the price is approaching a correction.

Source: Santiment

MVRV is a crucial on-chain metric that traders and investors use when building positions. If the MVRV is close to +5%, it indicates a possible price correction.

Conversely, if the MVRV is close to -5%, it indicates a potential buying opportunity and indicates that a price increase is imminent.

$860 million in grant outflows

Despite the price of BTC being in the danger zone, whales and institutions have shown strong interest and confidence in the asset. Coinglass’s BTC spot inflow/outflow data shows that exchanges have seen significant outflows of $860.52 million over the past four days.

Source: Coinglass

These substantial outflows suggest that whales or investors have withdrawn tokens from exchanges into their wallets, with the intention of holding them for the long term.

Currency outflows also indicate a bullish sign as they reduce the likelihood of selling pressure and attract new investors.

Bitcoin technical analysis and key level

According to AMBCrypto’s technical analysis, BTC is in an uptrend. It has recently found support from an uptrend line and is now heading towards its all-time high near $100,000.

Based on the recent price action, there is a high possibility that it could rise by 3% to reach the $99,588 level in the coming days.

Source: TradingView

On the upside, the asset’s Relative Strength Index (RSI) stands at 55, which is below the overbought area. This indicates that BTC still has plenty of room to rise in the coming days.

Read Bitcoin’s [BTC] Price forecast 2024–2025

At the time of writing, BTC was trading around $96,900 and has registered an upside momentum of 1.75% over the past 24 hours.

During the same period, trading volume increased by 7.5%, indicating a modest increase in trader and investor participation against the backdrop of a bullish outlook.