- Bitcoin fell 3.89% due to Mount Gox redemptions and the German government’s sell-off.

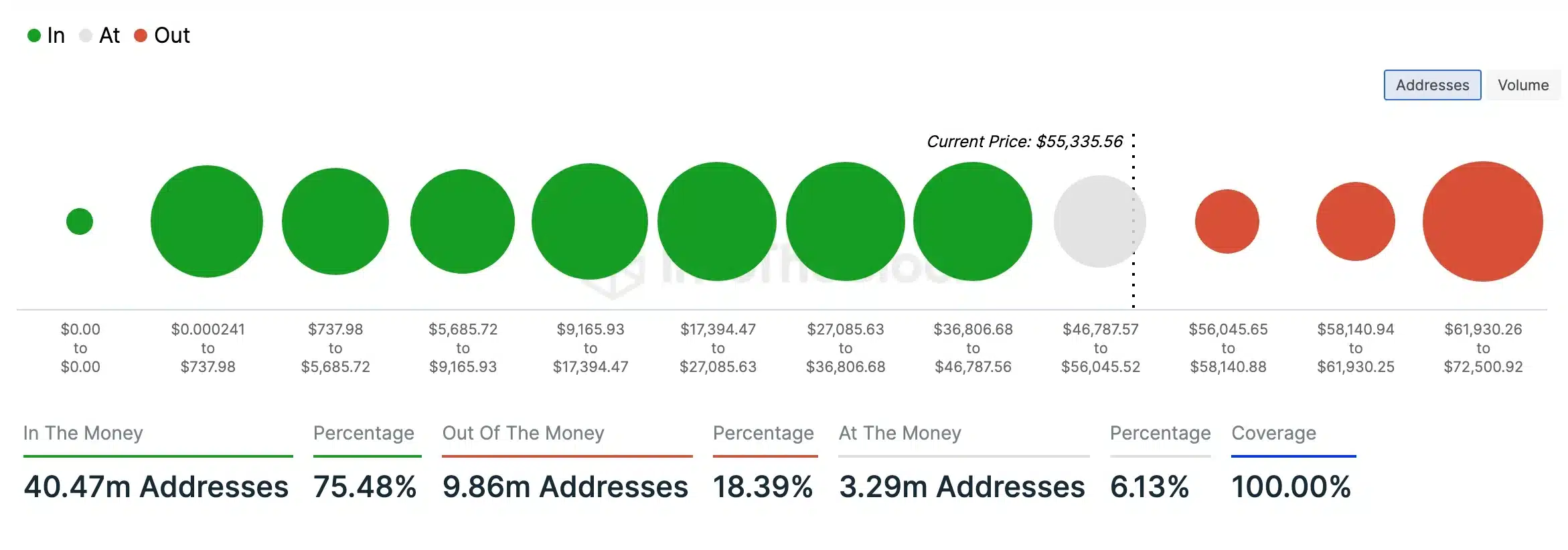

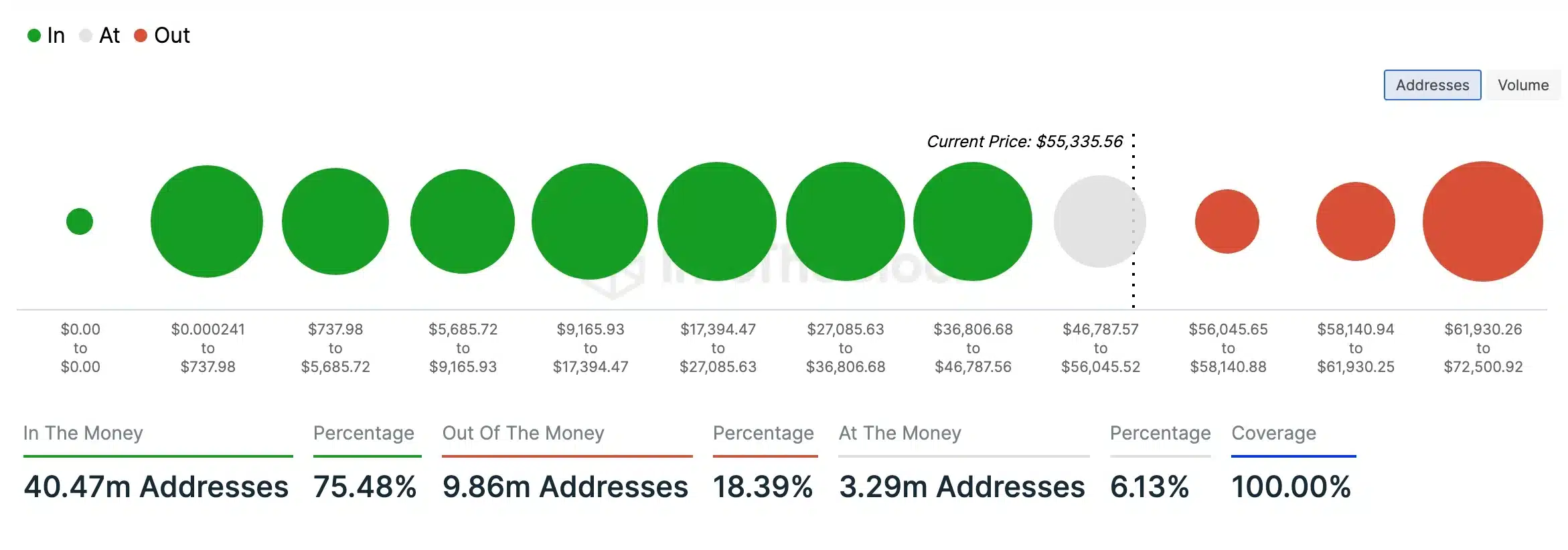

- 75.48% of BTC holders were in the money, indicating potentially bullish sentiment.

The crypto market had another challenging day as the global market capitalization dropped to $2.04 trillion, marking a decline of 3.33% in the past 24 hours.

Bitcoin takes a hit!

Bitcoin [BTC]In particular, it has received a lot of attention due to a sharp decline in the past week, fueled by rumors surrounding Mount Gox’s refund process.

On July 5, when Mount Gox started redeeming, BTC even fell to its lowest level since February.

Source: www.mtgox.com

Complicating the issue further, the German government also chose this moment to sell off their Bitcoin holdings, increasing fear, uncertainty and doubt (FUD) within the community.

Making the same comment on this, Developernoted co-founder ChartAlerts,

“The awkward moment when you want to replenish this dump, but you also realize that Mount Gox and the German government have $10 billion worth of #BTC ready to hit the market in the near future.”

As of the last update, BTC was trading at $55,459.62, reflecting a decline of 3.89% in the past 24 hours.

This downward trend was further confirmed by the Relative Strength Index (RSI), which has fallen well below the neutral level and was approaching the oversold zone at the time of writing.

Source: TradingView

Historically, oversold and overbought conditions have often signaled a possible pullback. Therefore, hope remains that BTC could recover once Mount Gox’s refund process is completed.

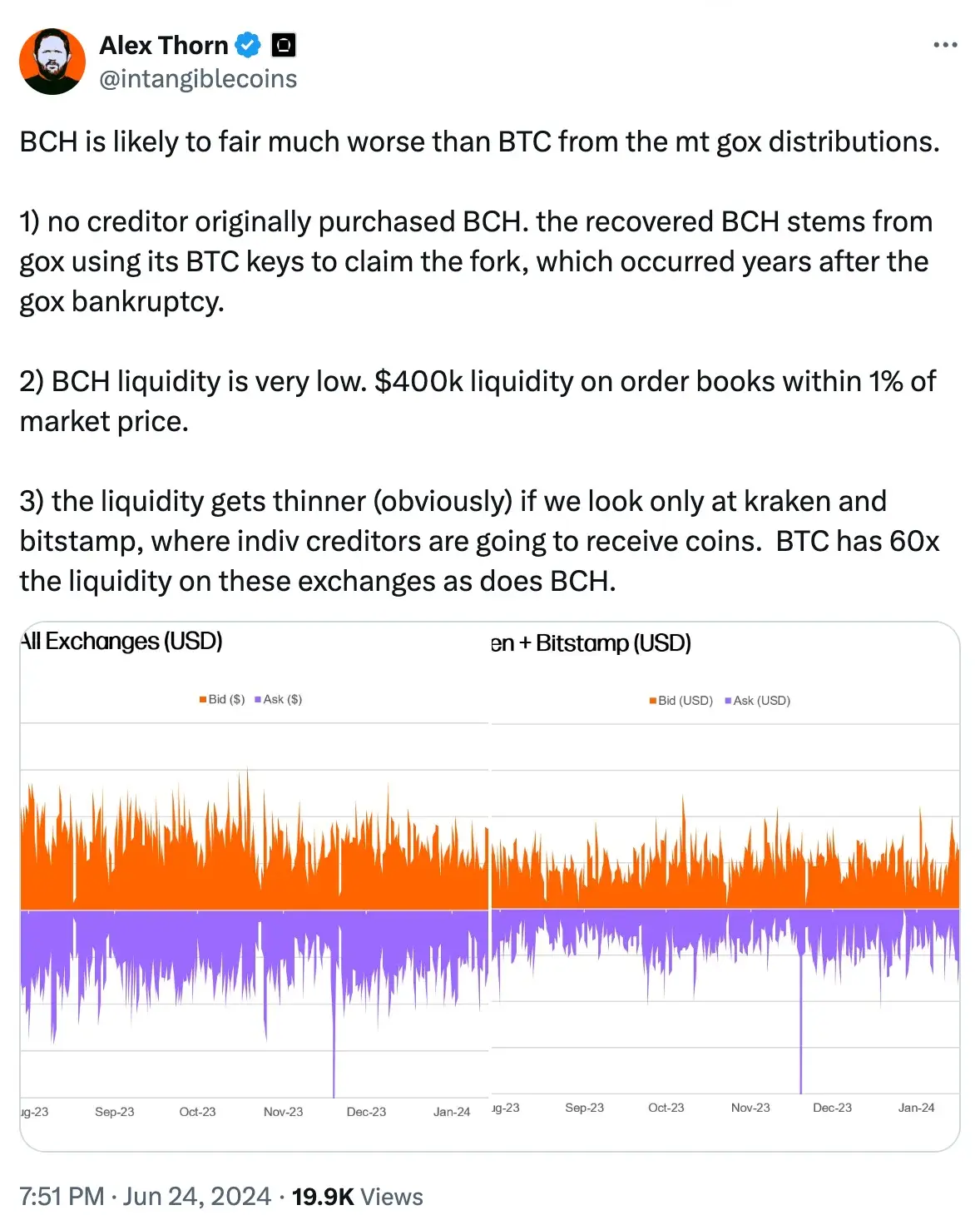

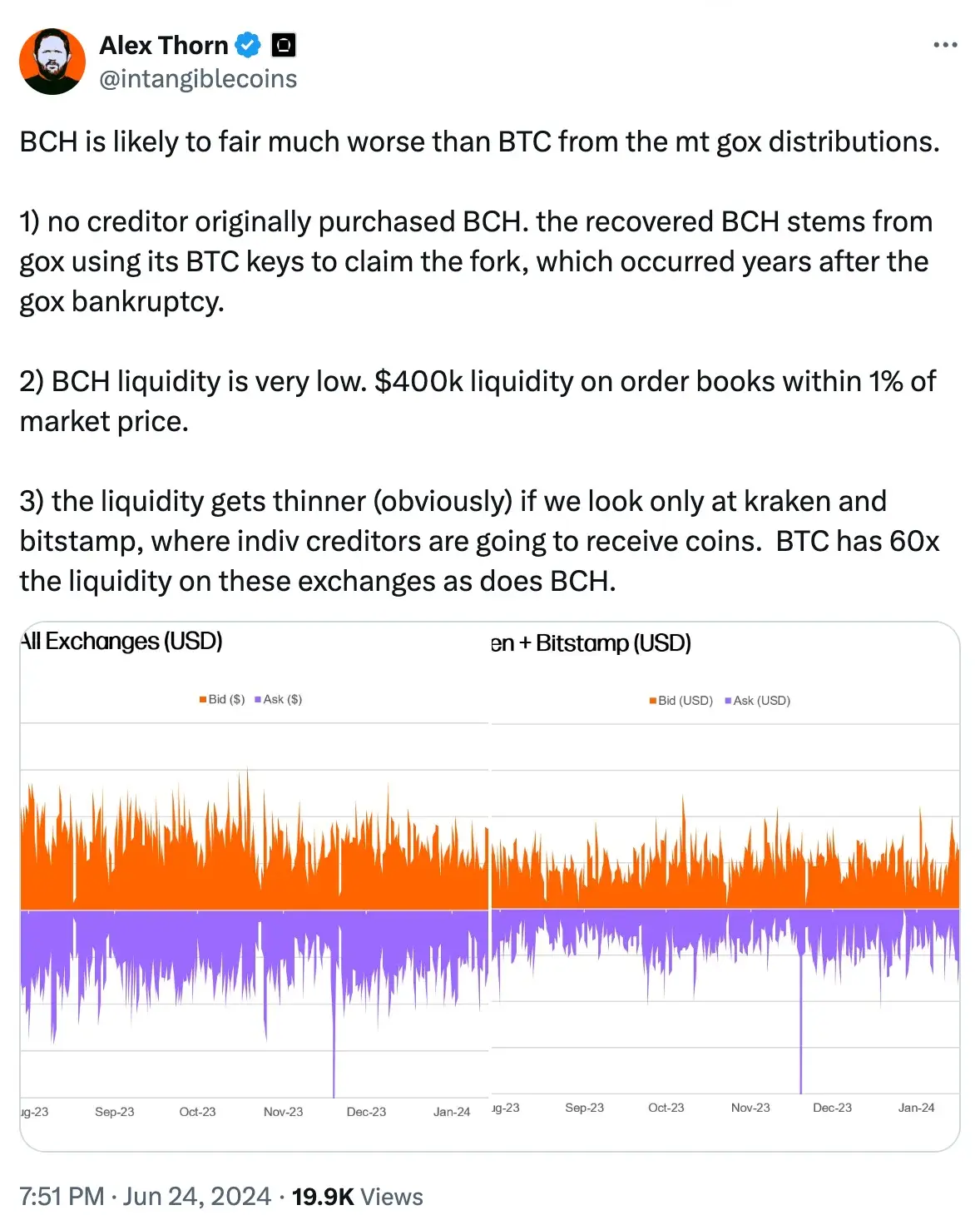

The impact on Bitcoin Cash cannot be overlooked

Bitcoin cash [BCH] also fell 6.79% and changed hands to $311.35 at the time of writing.

The difference in the decline suggests that BCH suffered a significantly larger loss than BTC. This was previously highlighted by Alex Thorn, Head of Firmwide Research at Galaxy Digital, when he noted:

Source: Alex Thorn/X

However, AMBCrypto’s analysis of IntoTheBlock data found that a significant majority (75.48%) of BTC holders owned tokens valued higher than their purchase price at the time of writing, indicating they were “in the money.”

Source: IntoTheBlock

In contrast, a smaller segment (18.39%) owned BTC tokens worth less than their purchase price, putting them ‘out of the money’. This suggested bullish sentiment or a possible upcoming price increase for Bitcoin.

CEX HTX summed it up well when they noted:

Source: HTX/X