- Mog Coin maintained its bullish market structure even after last week’s market-wide price crash

- The Fibonacci extension levels underlined the possibility of another 55% and 91% moving north

Mog coin [MOG] quickly recovered from last week’s losses. The memecoin maintained its bullish price structure, gaining 71% in just over six days. However, it later fell and lost 15% of its value in the last 24 hours.

At the time of writing, the memecoin was ranked 99th on CoinMarketCap and had a market cap of just $583 million. However, these numbers are relatively small, so some volatility is not uncommon.

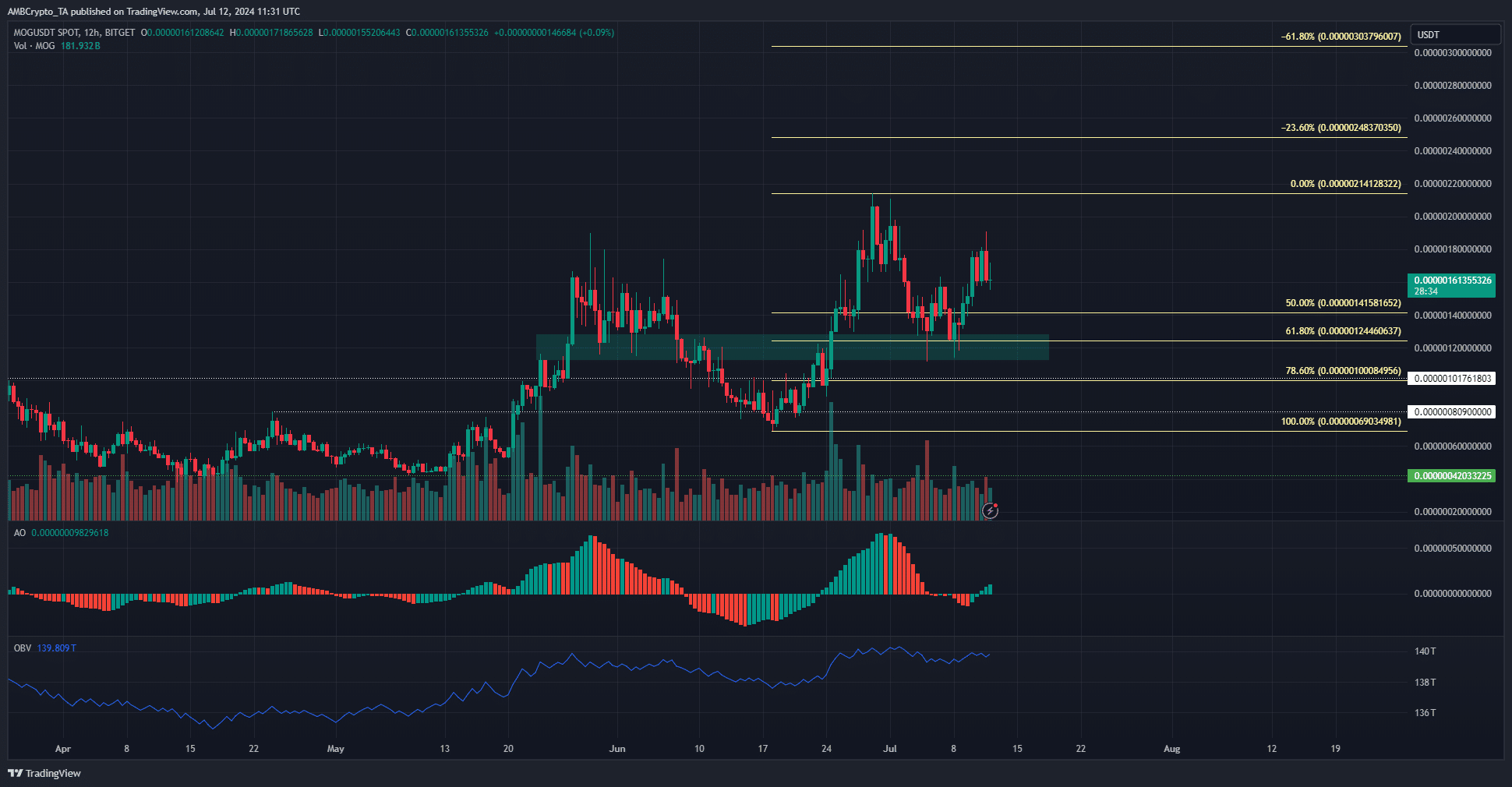

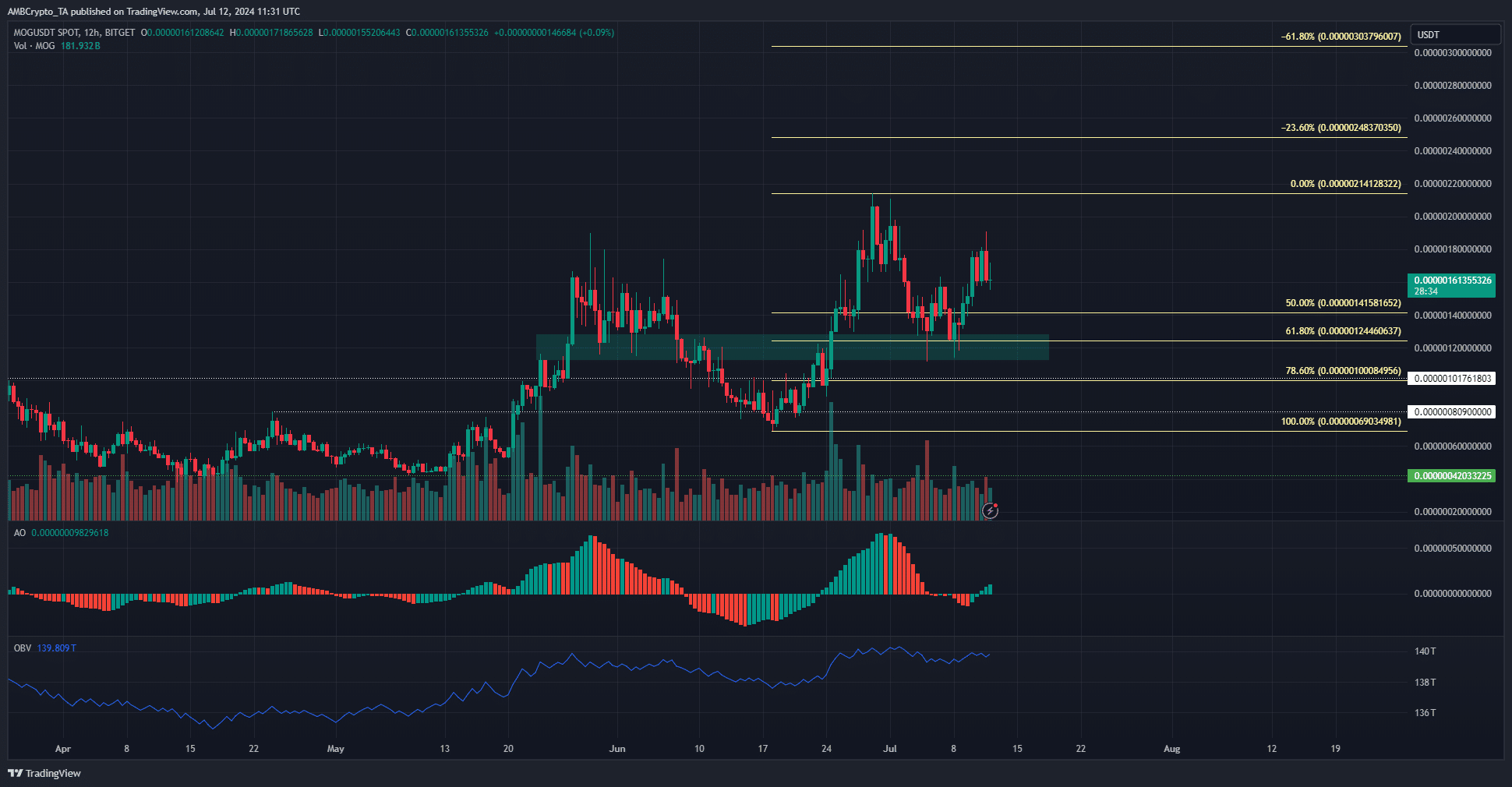

Fibonacci levels explained the next move for Mog Coin

Source: MOG/USDT on TradingView

Based on the mid-June rally, a series of Fibonacci retracement and extension levels (light yellow) were plotted. The defense of the $0.00000124 region (green) was a strong bullish sign. Buyers were able to reclaim a support level from early June, which coincided with the 61.8% retracement.

The OBV has been on a continuous upward trend since May, reflecting the steady buying pressure behind the memecoin. The Awesome Oscillator crossed the neutral zero to indicate bullish momentum.

The $0.00000165-$0.00000175 zone has been a hurdle for buyers over the past two days, but MOG bulls are likely to convert this zone into a support zone soon.

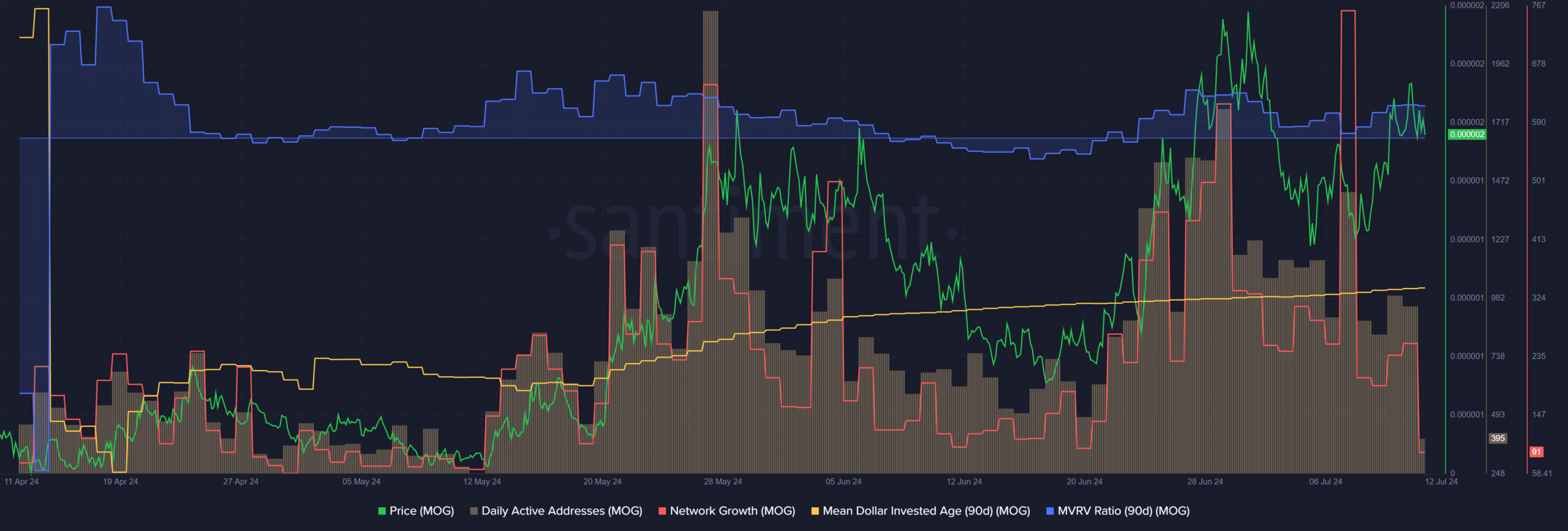

Increased network activity and holders sit nicely

The network growth metric peaked on July 7, showing that 760 new addresses were created on that day. A consistent upward trend in this metric would be a sign of increasing adoption and growth. Meanwhile, the 90-day MVRV had a value of 41.87%.

Read Mog Coin’s [MOG] Price forecast 2024-25

This showed that a large portion of the holders made a profit. MOG reached its all-time high on July 1, which explains their gains and also the bullish sentiment behind the token. It could also trigger a sell-off from profit-taking activity, which traders should be wary of.

However, it’s worth pointing out that at the time of writing, the average dollar investment age was slowly rising – a sign of long-term investing.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.