- Token broke a descending channel and at the time of writing was testing a key support level that could serve as a price catalyst

- More sellers in the derivatives market will impact MKR’s rally

Compared to the rest of the market, MKR has struggled to make significant gains on the monthly charts, gaining just 25%. In fact, the market price has seen notable fluctuations recently, down 0.25% over 24 hours. However, at the time of writing, market sentiment pointed to a potential recovery from current levels.

According to AMBCrypto’s analysis, big investors now appear to be the driving force behind MKR’s recent decline. A recovery remains likely if the critical support level holds, potentially paving the way for further upside potential.

Can MKR reach $3,970 in the coming sessions?

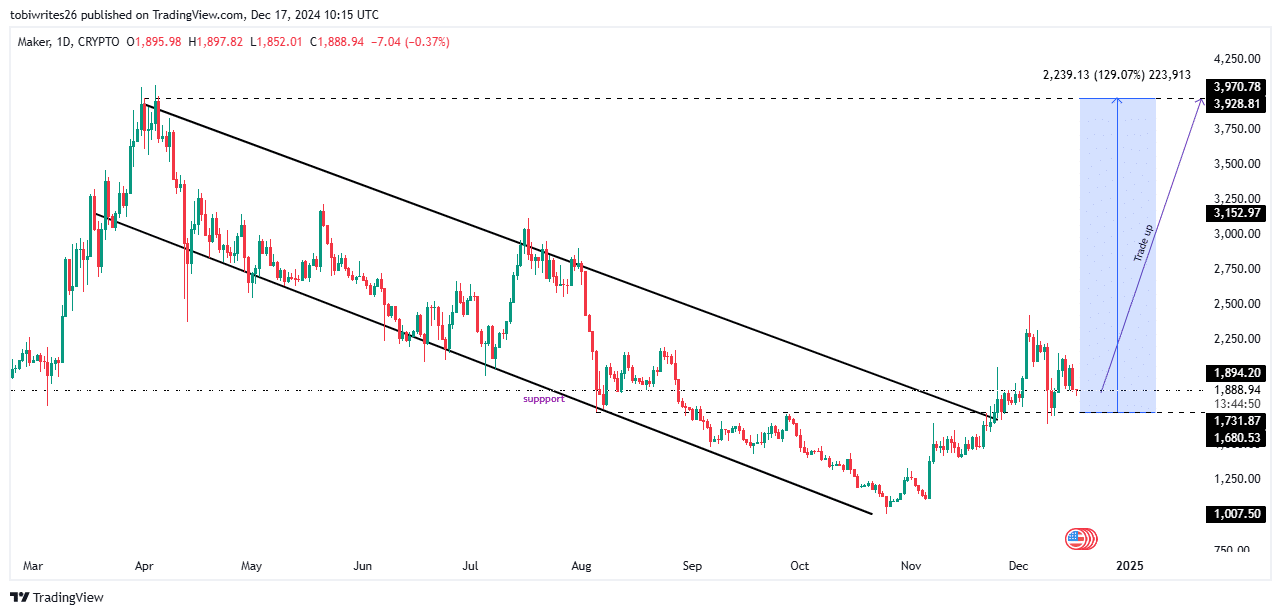

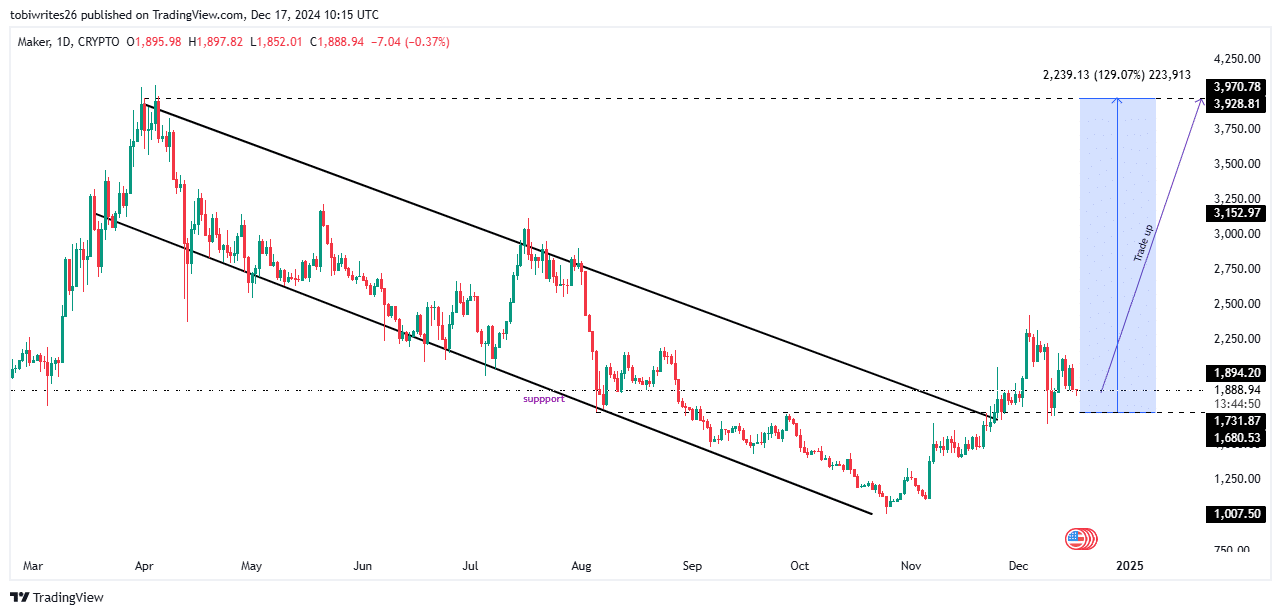

MKR recently broke out of a declining channel, a pattern it has been fluctuating in since March. However, despite this breakout, the token has struggled to gain upward momentum and remains below expected levels.

At the time of writing, MKR was trading in a key support zone around $1,854.09, with the range extending to $1,656.55. This zone has historically acted as strong support, and if it holds, MKR could rise to $3,970.

Source: trading view

To achieve this move, MKR must stay within the defined range and maintain buying interest at these levels.

Therefore, AMBCrypto examined trader activity to assess whether the support zone was likely to hold, with a focus on placing bids for MKR.

Large buy order placed for MKR at key support level

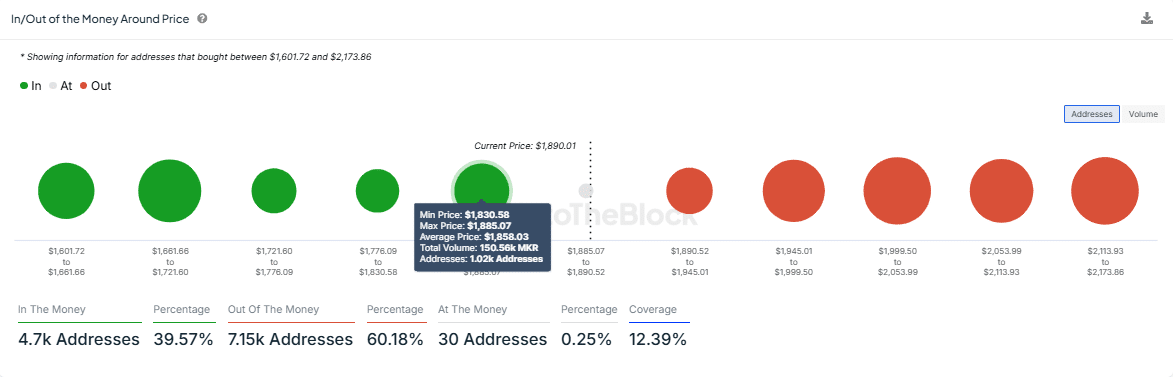

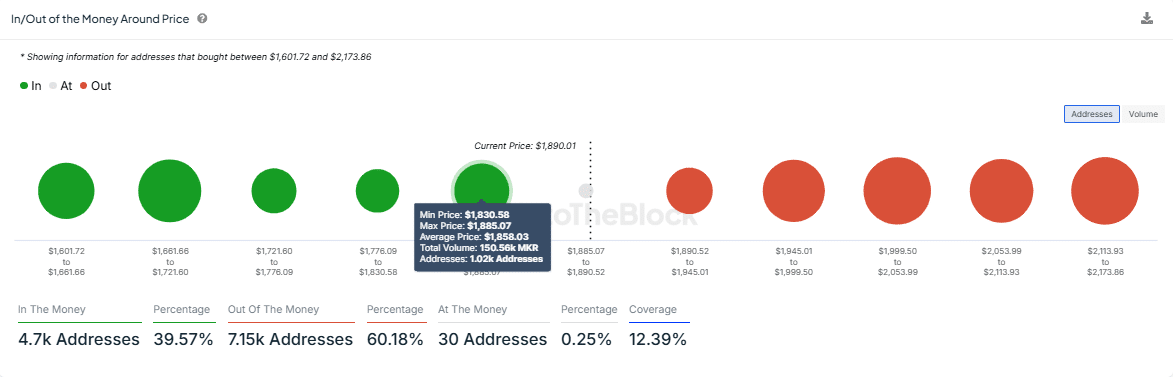

According to insights from IntoTheBlock, a significant buy order for MKR has emerged at a key support level identified using the In/Out of Money Around Price (IOMAP) metric. Here the IOMAP is a tool that highlights critical support and resistance levels, allowing traders to anticipate potential price movements.

The data showed a strong support zone at $1,858.03, which closely aligns with the support line on the technical chart. At this level, 1,020 addresses have jointly placed purchase orders for an amount of MKR 150,560 – a sign of concentrated purchasing interest.

This buying activity suggested that the $1,858 support zone could be a potential catalyst for MKR’s upward move. If this level continues, it could allow for a price rebound.

Source: IntoTheBlock

At the same time, signs of a bullish divergence also appear to be emerging. For example, the number of large transactions dropped significantly, from 124 to just 27. This drop caused the large transaction volume to drop to MKR 9,270 over the same period, coinciding with a recent price drop.

A sharp decline in high transaction volume often signals a weakening of selling pressure. As MKR approaches this support zone, waning selling strength increases the likelihood of a rally to higher levels, likely $3,970.

Warning of problems in the derivatives market

The derivatives market indicated growing bearish sentiment as more traders bet on a decline in the MKR rather than a rally, based on the long-to-short ratio.

At the time of writing, the long-short ratio was around 0.75 – a significant drop below the neutral threshold of 1. A ratio this low indicates a notable increase in short positions opened on MKR.

If this trend continues, it could reduce the likelihood of a price rebound from the press period support range. A turnaround would require a shift in sentiment, with more derivatives traders placing long bets on MKR.