The NFT market, notorious for its unpredictability, recently witnessed another dramatic shock. As the Milady Maker NFT collection continues its path to glory, other giants such as the Mutant Ape Yacht Club (MAYC) and the Bored Ape series face significant valuation challenges.

Let’s dive into this surprising development.

Milady continues to climb

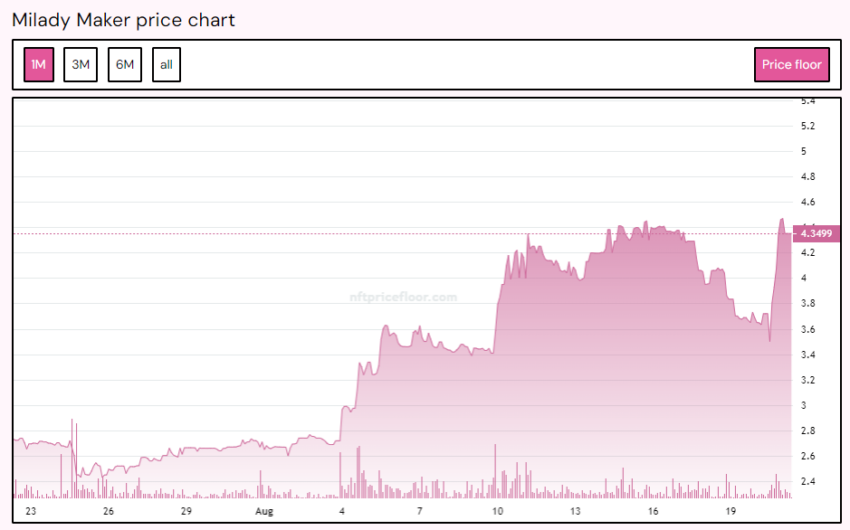

Originating from the Ethereum blockchain, the Milady Maker NFTs have reached another milestone with an all-time high (ATH) bottom price of 4,468 ETH. This recent spike surpasses their previous all-time high of 4.44 ETH just days earlier.

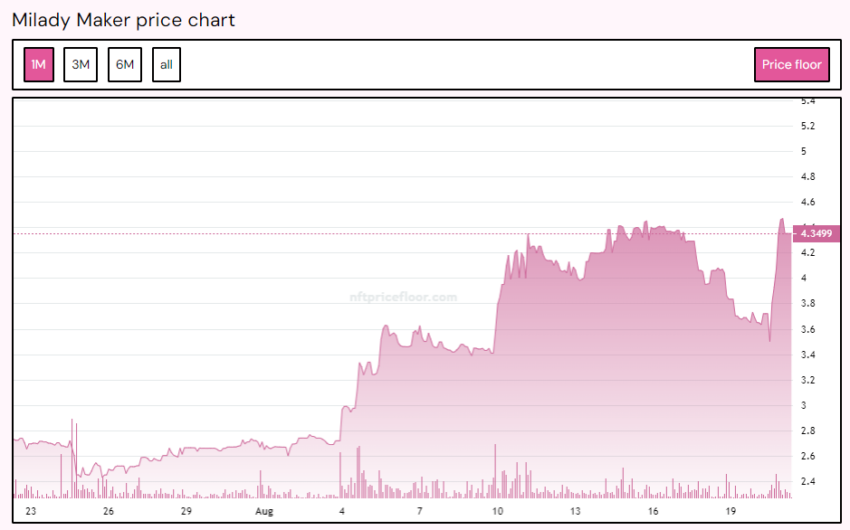

Milady Maker NFT price floor. Source: NFT Price Floor

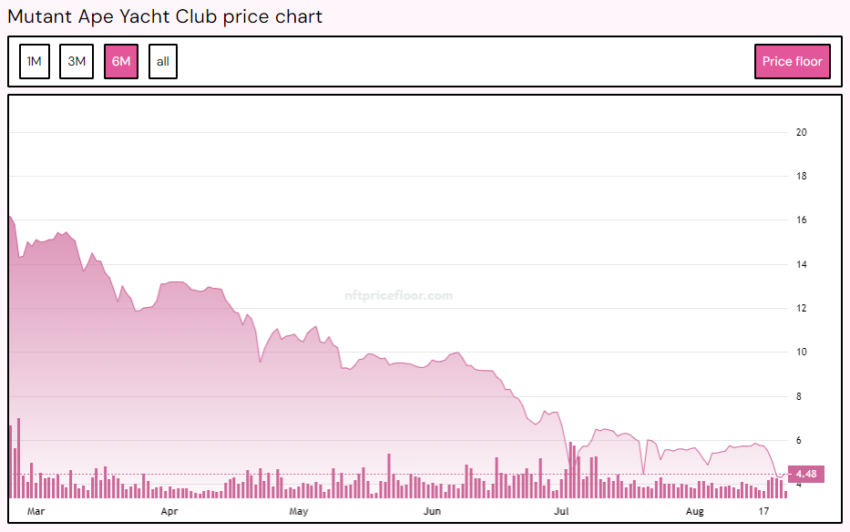

But what makes Milady’s rise even more remarkable is that it has officially overtaken the lauded MAYC, which has now dropped to 4,405 ETH from an impressive high of 17.5 ETH earlier this year.

Mutant Ape Yacht Club (MAYC) NFT price floor. Source: NFT Price Floor

Rooted in the vibrant street fashion trends of Tokyo in the 2000s, the Milady collection consists of 10,000 uniquely crafted profile photos (PFPs). Their captivating “neochibi” aesthetic has become a symbol of meme culture’s virality on platforms like Twitter.

Additionally, crypto influencers such as Su Zhu and Ansem (@blknoiz06) have cemented Milady’s reputation by choosing these NFTs as their digital badges.

I’m coming for your monkeys

In contrast, Bored Ape prices are on a strong downward trajectory. From a staggering floor of 128 ETH in May 2022, it has dropped to just 23.59 ETH.

The BAYC series, especially the iconic BAYC #8585, is an indication of this decline. This particular monkey was once celebrated as the most expensive ‘Trippy’ BAYC for a whopping 777 ETH in October 2022. However, it recently changed hands for a reduced 153 ETH.

While it maintains its position in the top five most expensive Bored Apes on OpenSea, recent trading highlights the volatile nature of NFT valuation.

In this digital age, the volatility of the NFT marketplace remains evident. While collections like Milady chart an upward trajectory, others face major valuation challenges.