- MicroStrategy expects volume of $22 million on launch day as Bitcoin’s historical pattern will repeat itself.

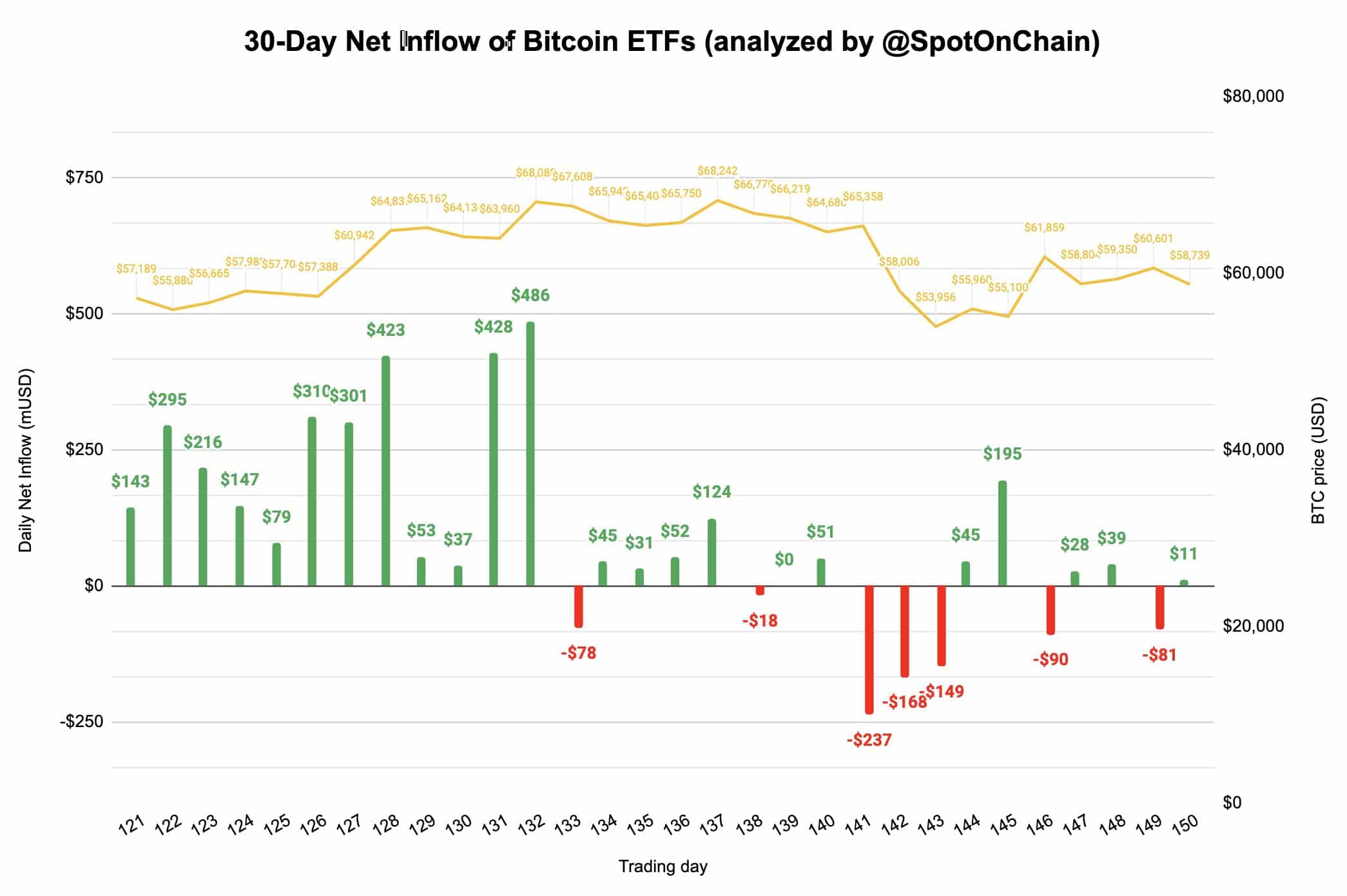

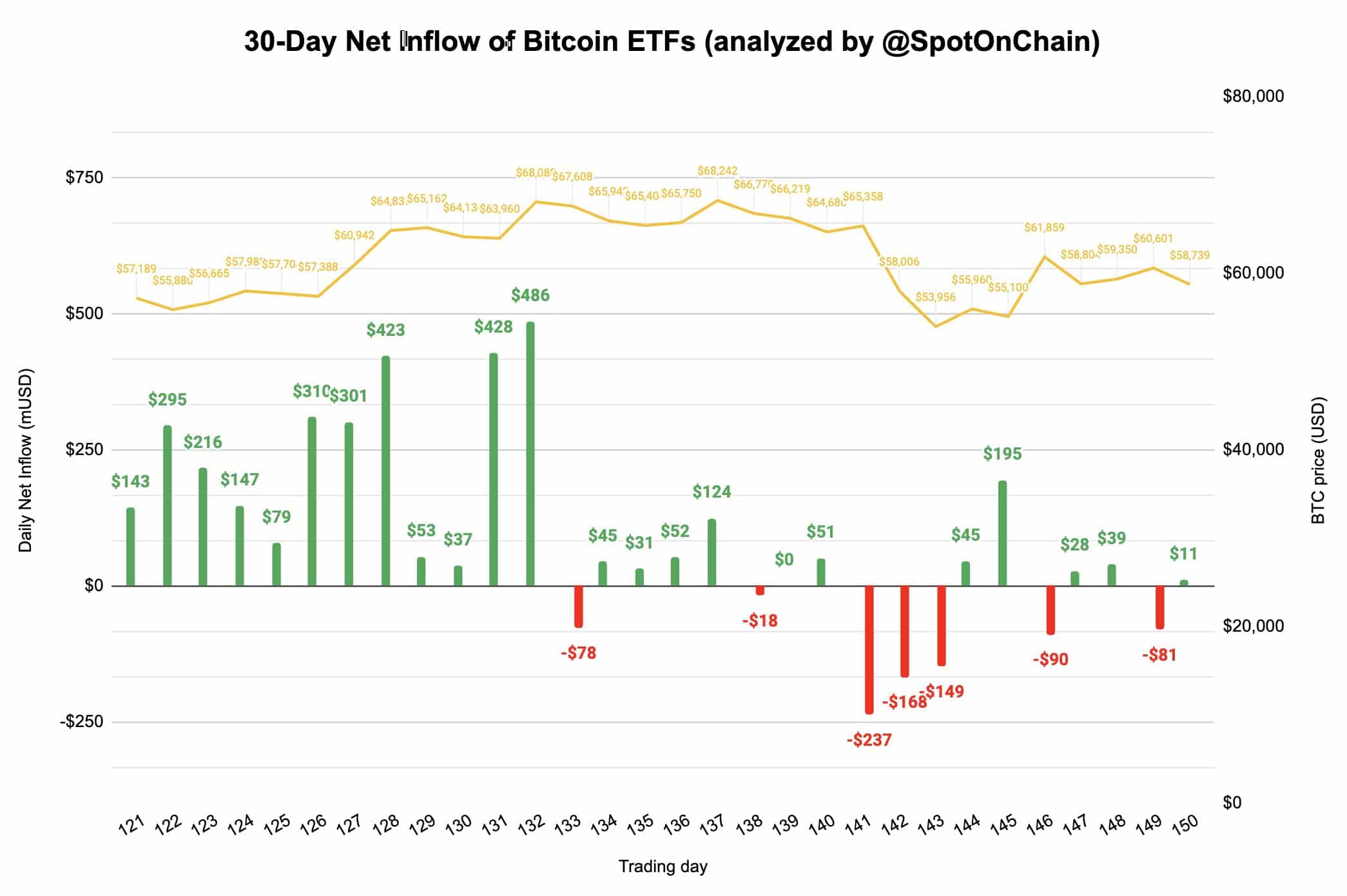

- Bitcoin ETF net flows turned positive again after one day of outflows, despite fearful market sentiment.

MicroStrategy, a major Bitcoin [BTC] player, achieved $22 million in volume on the ETF’s first day, potentially setting a record for leveraged ETFs, as first shared by Bloomberg’s ETF analyst Eric Balchunas on X (formerly Twitter).

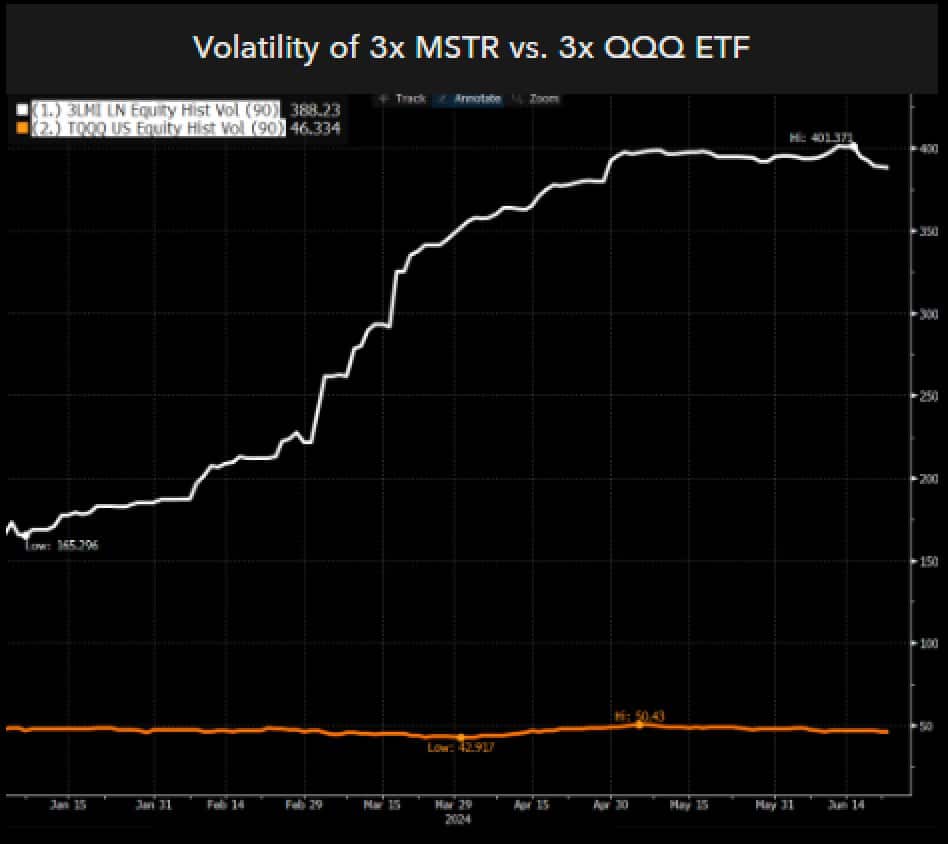

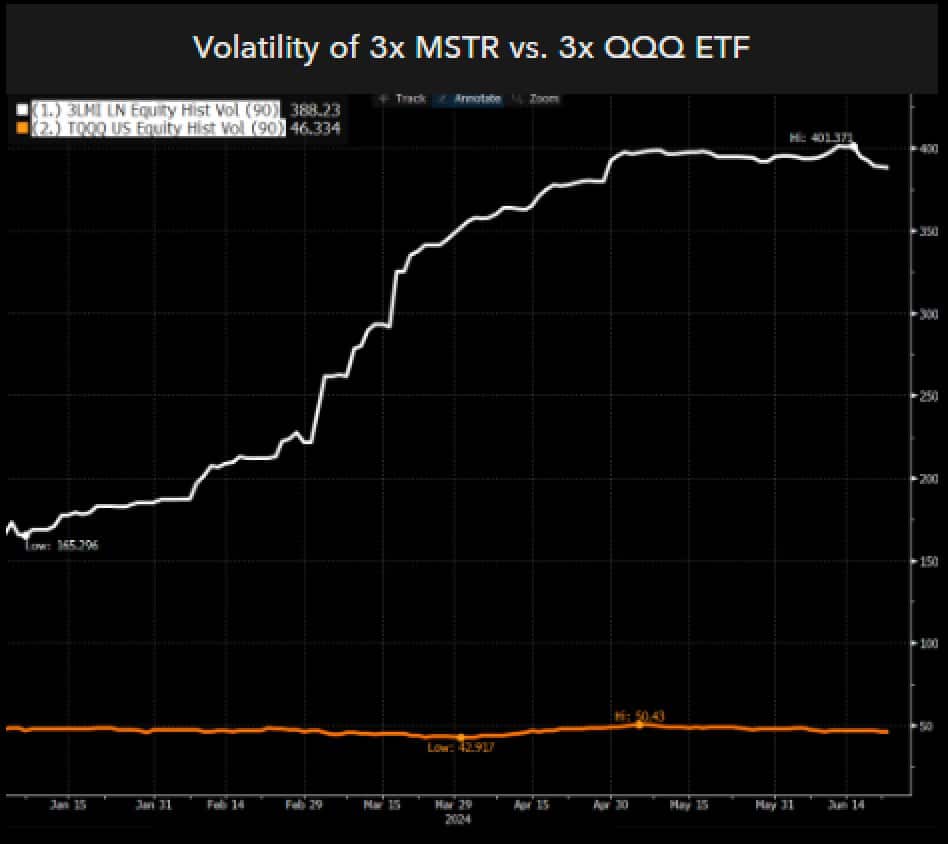

Based on the 90-day volatility indicator, this ETF is expected to lead the volatility of the US ETFs. However, its volatility may increase further as issuers push their limits to attract investors.

Despite the high volatility of the US $MSTX, it will still be less extreme compared to the European $3LMI LN, which has a 90-day volatility of over 350%.

Source: Eric Balchunas/X

$MSTX’s volatility and trading volume suggest that it could become a major player in the ETF market, thereby influencing the future price of Bitcoin.

This may have caused Bitcoin ETFs to see a positive shift, with $11 million deposited, reversing a short outflow as Spot On Chain shared on X.

Source: Spot On Chain

Below the top of the US Bitcoin ETFs, only BlackRock’s IBIT, saw no significant increase in net flows, while Fidelity, Grayscale and Bitwise saw notable inflows.

The ETF market is poised for further growth, supported by the record trading volume of the MicroStrategy ETF.

Given MicroStrategy’s significant Bitcoin holdings, its influence suggests that Bitcoin prices are likely to rise.

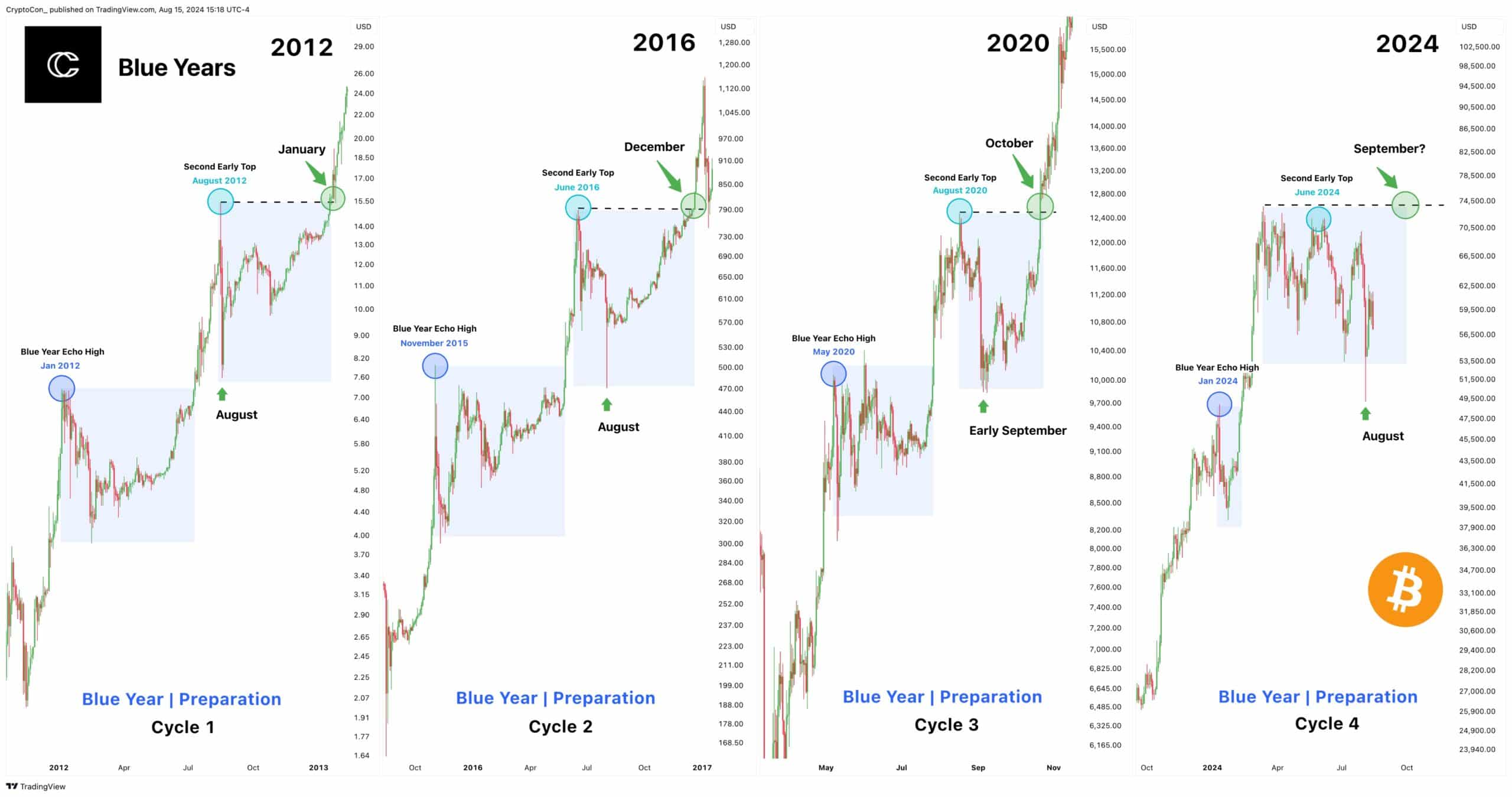

BTC Current Cycle Reflects ‘Blue Years’

Bitcoin’s current cycle reflects the past “Blue Years,” characterized by consistent patterns of two major highs and two sideways periods.

This cycle had a strong move from January to March, followed by a prolonged correction. Unlike previous cycles, this one has not yet reached new all-time highs, extending the correction.

Source: CryptoCon, TradingView

Historically, similar cycles have found an early top bottom (light blue circle) every second around August, indicating that the recent decline is typically before new highs are made the following year.

Despite some differences, the Halving Cycles Theory indicates that a top at the end of 2025 remains on track. New highs seem likely as the cycle progresses.

Furthermore, major banks and major financial institutions worldwide are increasing their Bitcoin holdings despite the current fearful market sentiment.

Source: Alternative.me

It would be wise to follow the example of these influential investors. With strong buying activity and positive market numbers, traders and investors can anticipate a potential upward move in Bitcoin’s price.