- MicroStrategy releases second quarter earnings report.

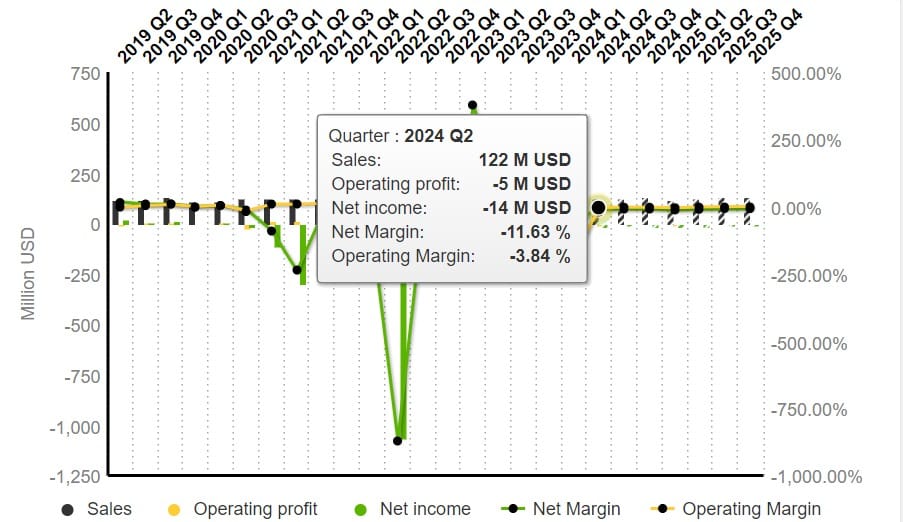

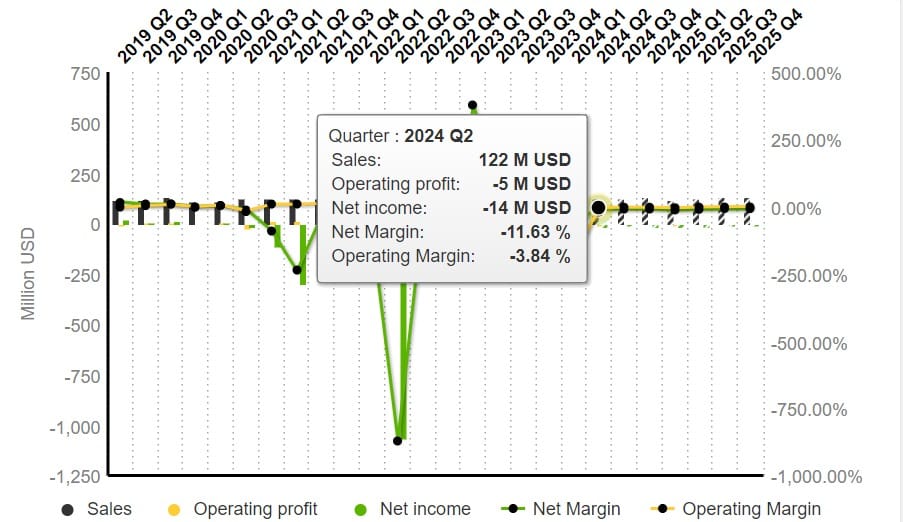

- Preview shows uncertainty and decline in net profit.

Over the past four years, MicroStrategy has been actively looking to grow its holdings and resulting stock value.

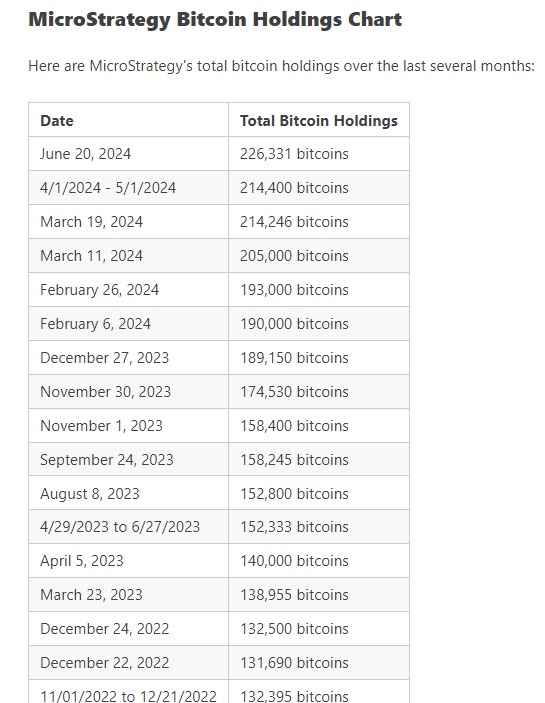

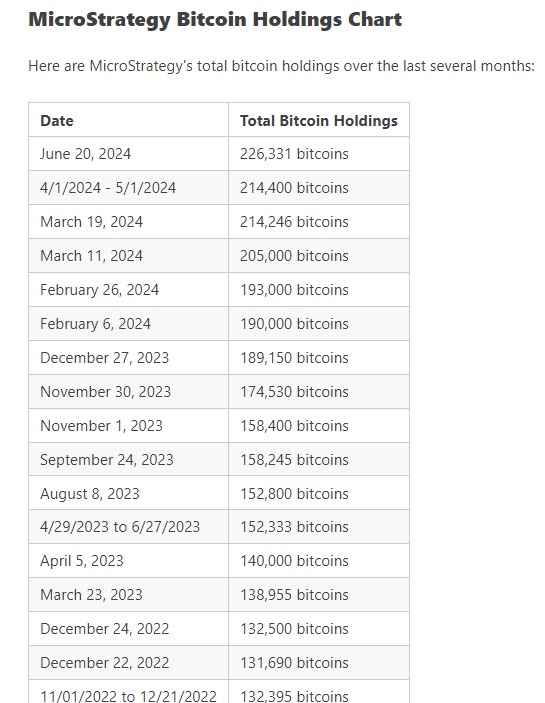

In the past, MicroStrategy has created Bitcoin [BTC] buys every month except July 2024 and September 2020. This accumulation has propelled the company to become the largest corporate BTC holder in the world.

After BTC endured a few extremely volatile months, MicroStrategy is expected to report its second quarter earnings on August 1, 2024. With the expected second quarter earnings report, there is increasing speculation about MicroStrategy’s true financial status and its future.

MicroStrategy is all about macro strategy

The amount of Bitcoin it holds makes MSTR a valuable and attractive company for investors. Across all its operations, MSTR has acquired 226,331 BTC tokens over the past four years.

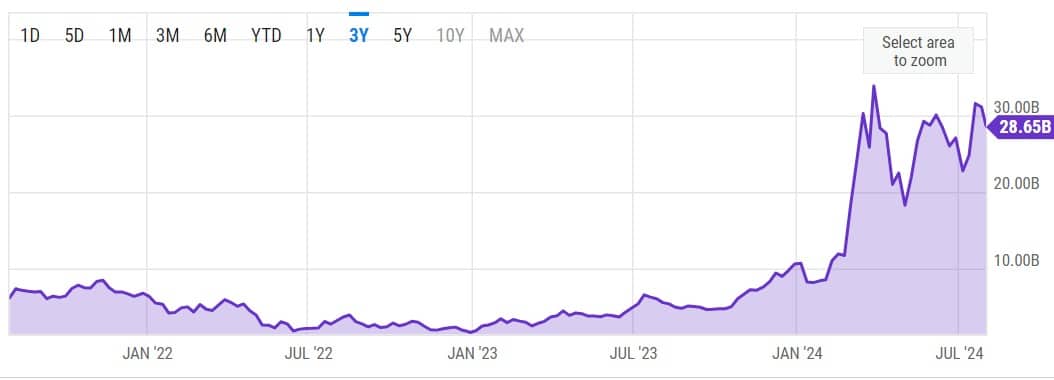

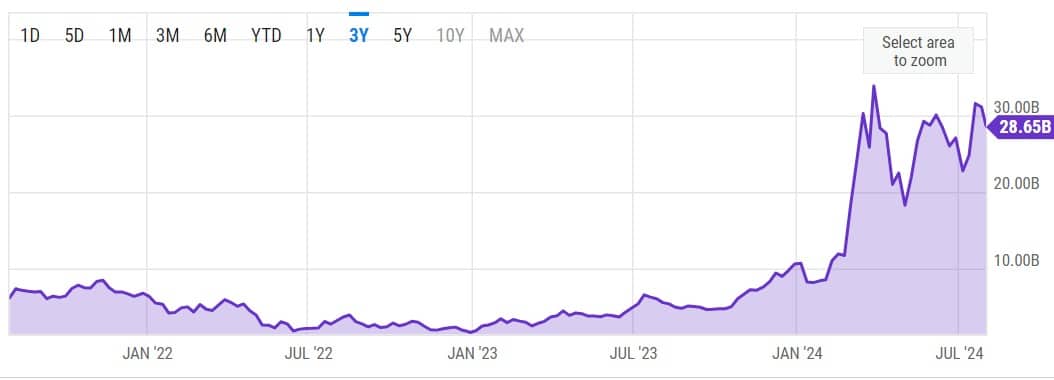

This BTC holding makes a compelling case for MSTR to take its market cap to $28.65 billion, a significant increase from $9 billion a year ago.

Source: Y-graphs

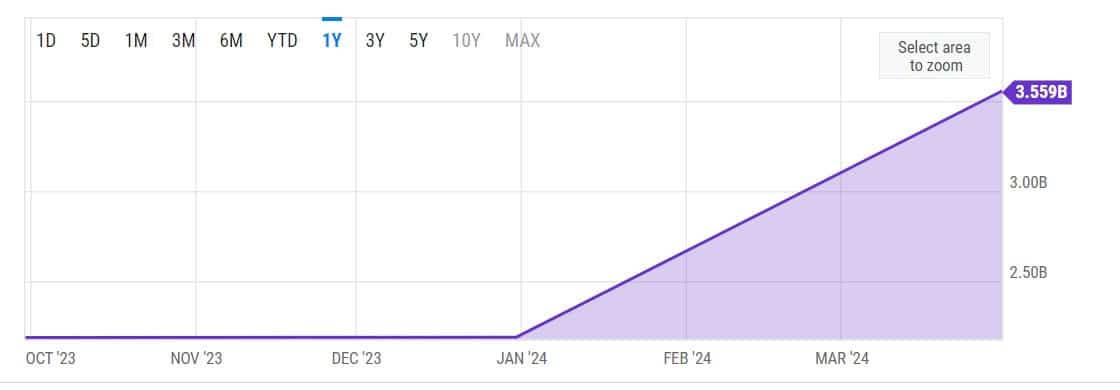

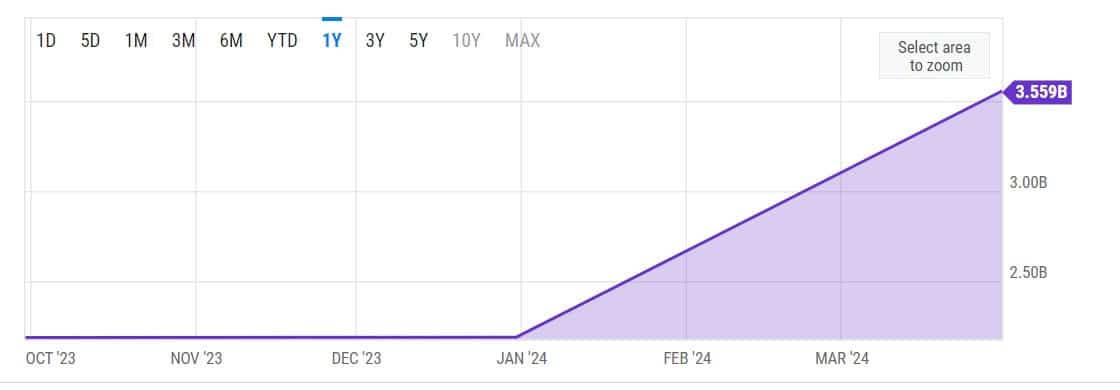

However, MicroStrategy builds its assets through long-term, low-interest and equity insurance. According to its first-quarter 2024 earnings reports, the company has long-term debt of $3.5 billion.

The liabilities are a bet on BTC earning value against fiat losing value over time. Although investors prefer MSTR, especially over the crypto approach, its subsidiary Macrostrategy holds the most BTC investments.

Source: Y-graphs

Therefore, MicroStrategy buys BTC but transfers most of the shares to Macrostrategy. According to a previous report, Macrostrategy owns the most BTC with 175,721 BTC tokens, while MicroStrategy only owns 38,679 BTC tokens.

This approach gives investors the illusion that MicroStrategy owns the most BTC, when that is not the case. This is a huge risk for creditors, especially if the company goes bankrupt. This may happen because Macrostrategy is protected from recourse if its parent company, MicroStrategy, goes bankrupt.

This implies that shareholders only have assets owned by the parent company. In the event of bankruptcy, creditors cannot claim BTC held by Macrostrategy, even though Macrostrategy holds the majority of MicroStrategy’s BTC investments.

This shows how little BTC is owned by MicroStrategy, and in the event of liquidation, creditors would suffer huge losses.

Second Quarter Earnings: What to Expect

Source: Bitcoin Treasuries

At the time of writing, BTC was trading at $64,462, having dropped 2.8% in the past 24 hours. So, based on data from Bitcoin Treasuries, MSR owns 226,331 BTC, an investment of $8.37 billion with an average of $36,990.

Based on current rates, investments in MSR have yielded more than $6 billion, with a profit of more than 70%.

Source: Market Screener

With these gains, the company is expected to report higher revenue this fiscal year than the previous year, at $122 million versus $115 million.

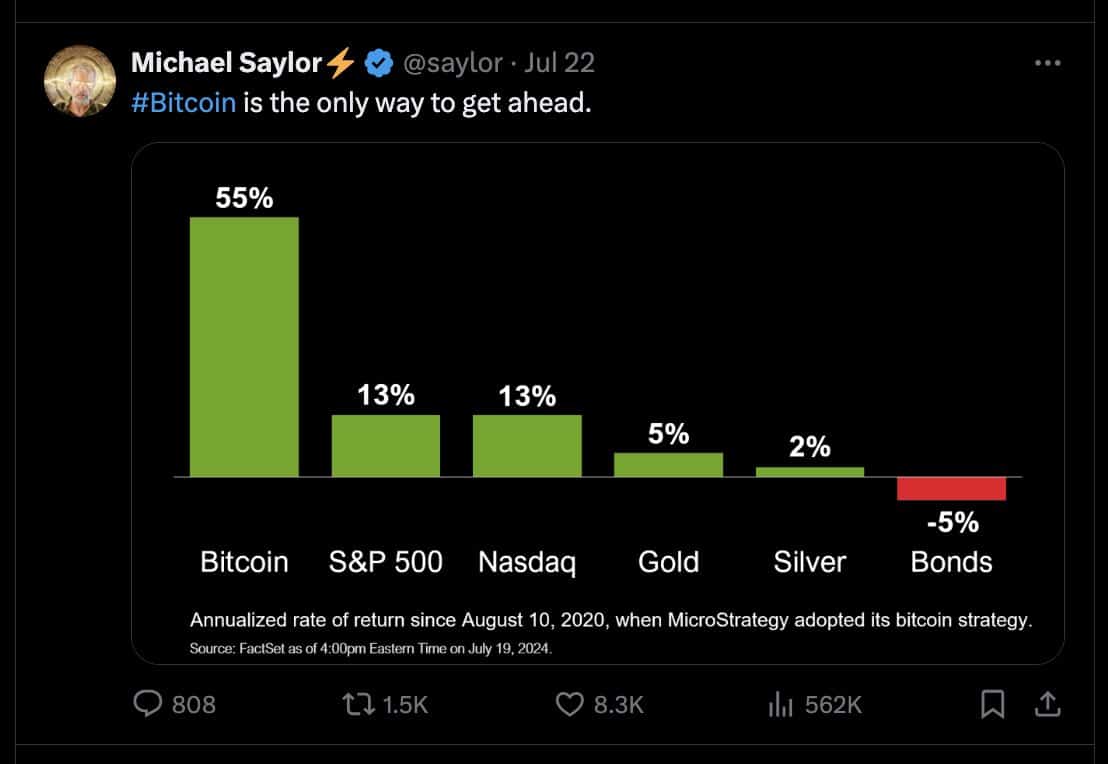

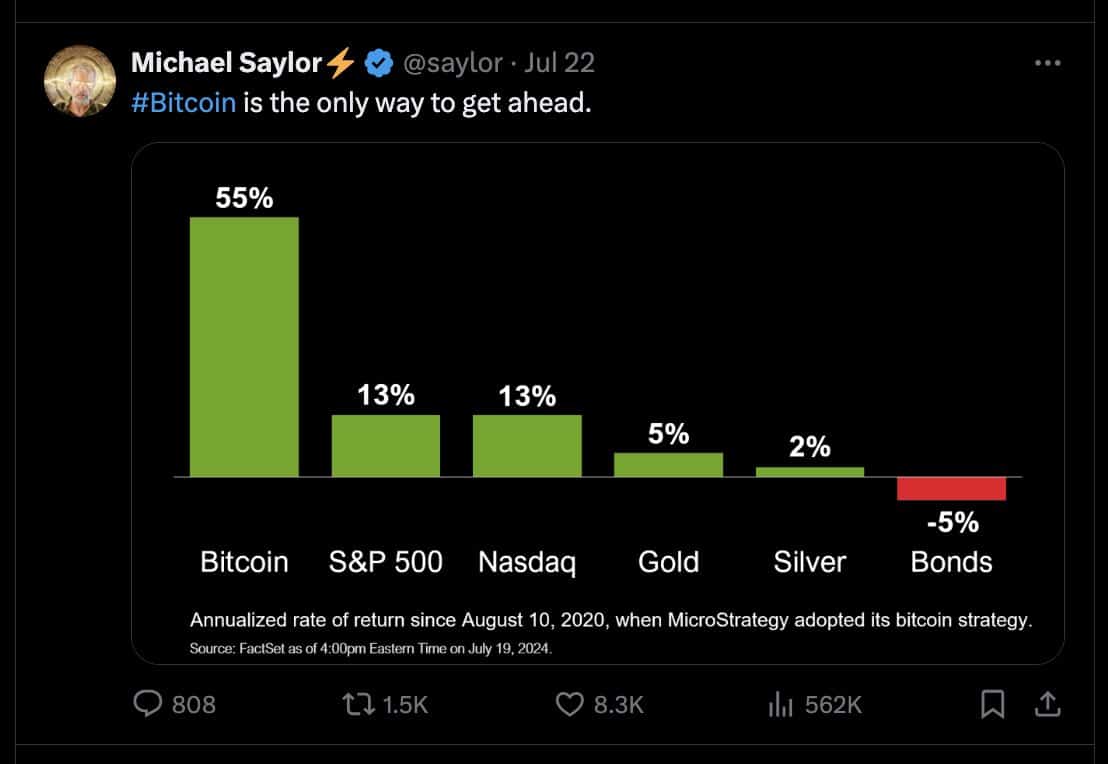

MicroStrategy’s case for BTC

Source:

Despite the prevailing concerns, MicroStrategy has high hopes for BTC. Michael Saylor, the chairman, predicts that BTC will reach $13 million by 2045.

According to the company’s projection, BTC’s market cap will rise to $273 trillion, surpassing gold and all major companies. In such a scenario, Microstrategy’s portfolio would reach $3 trillion from initial investments of $8 billion.

Source: