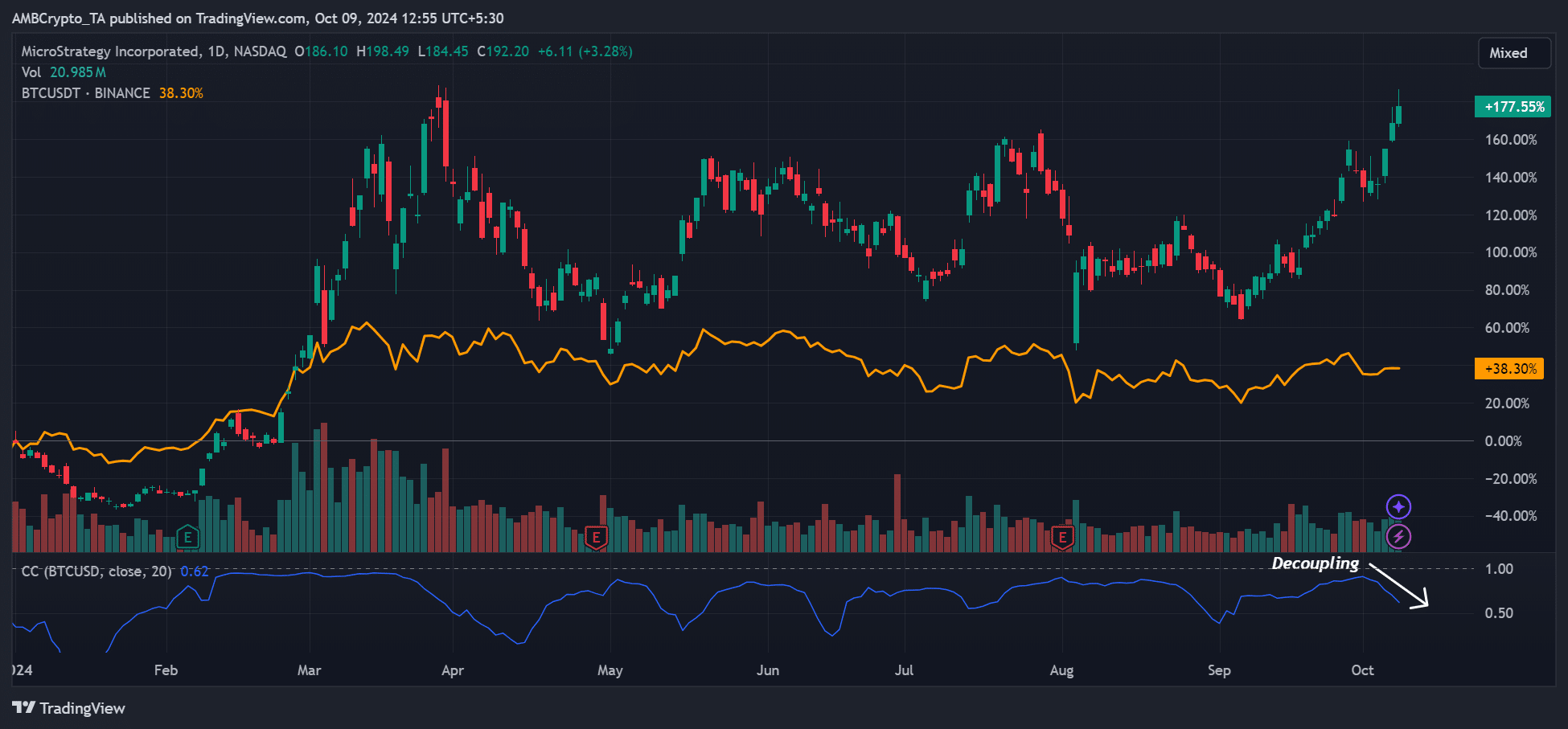

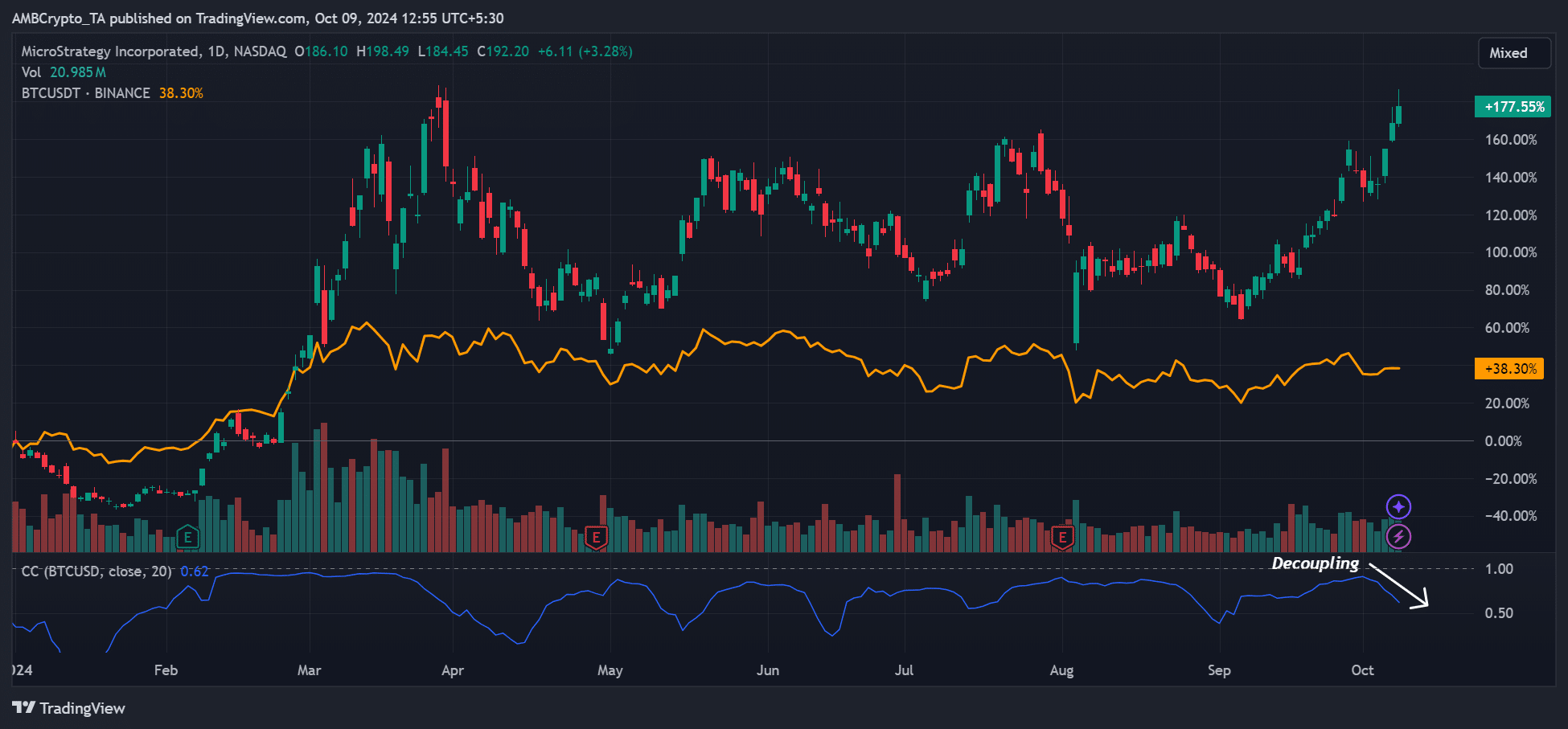

- MSTR has outperformed and decoupled from BTC.

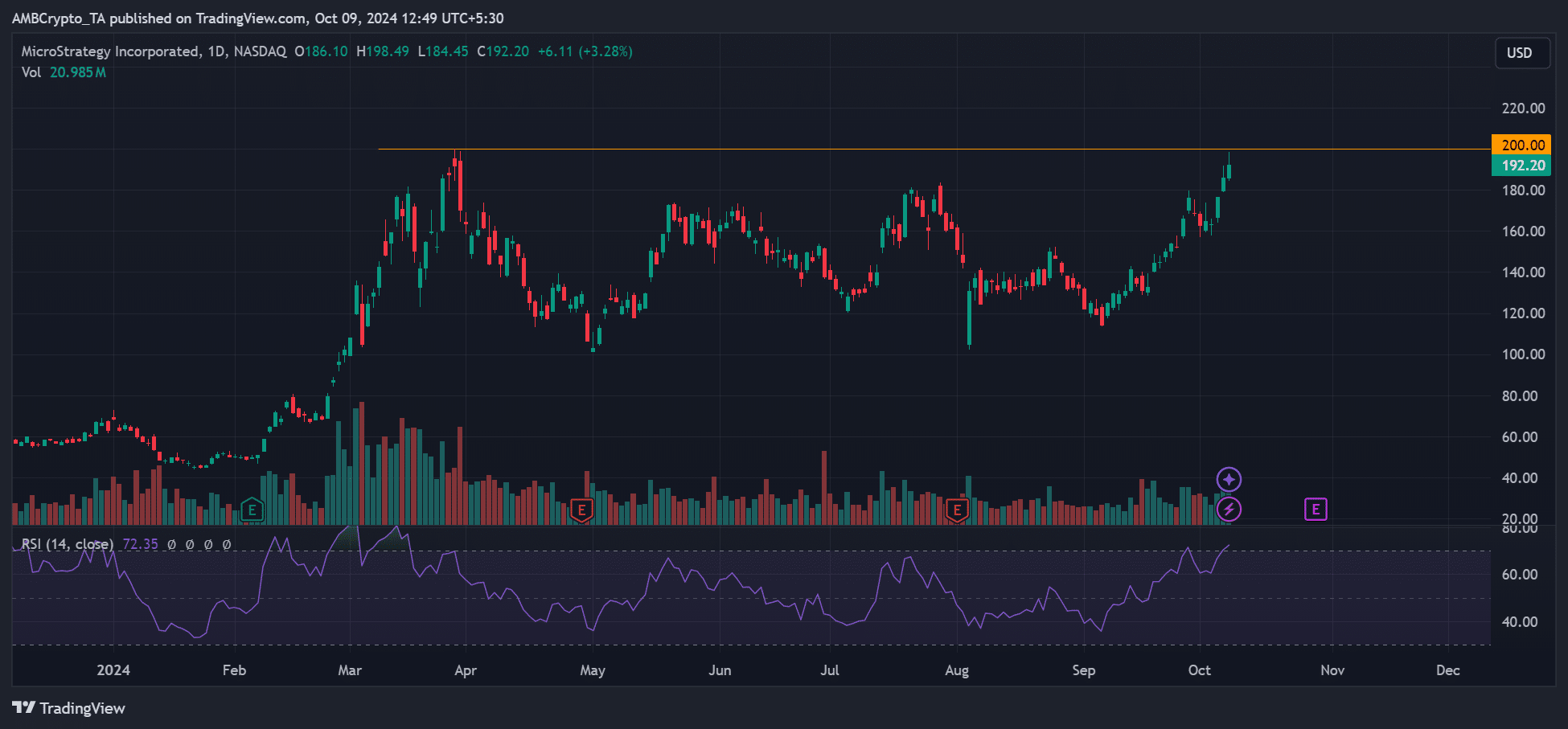

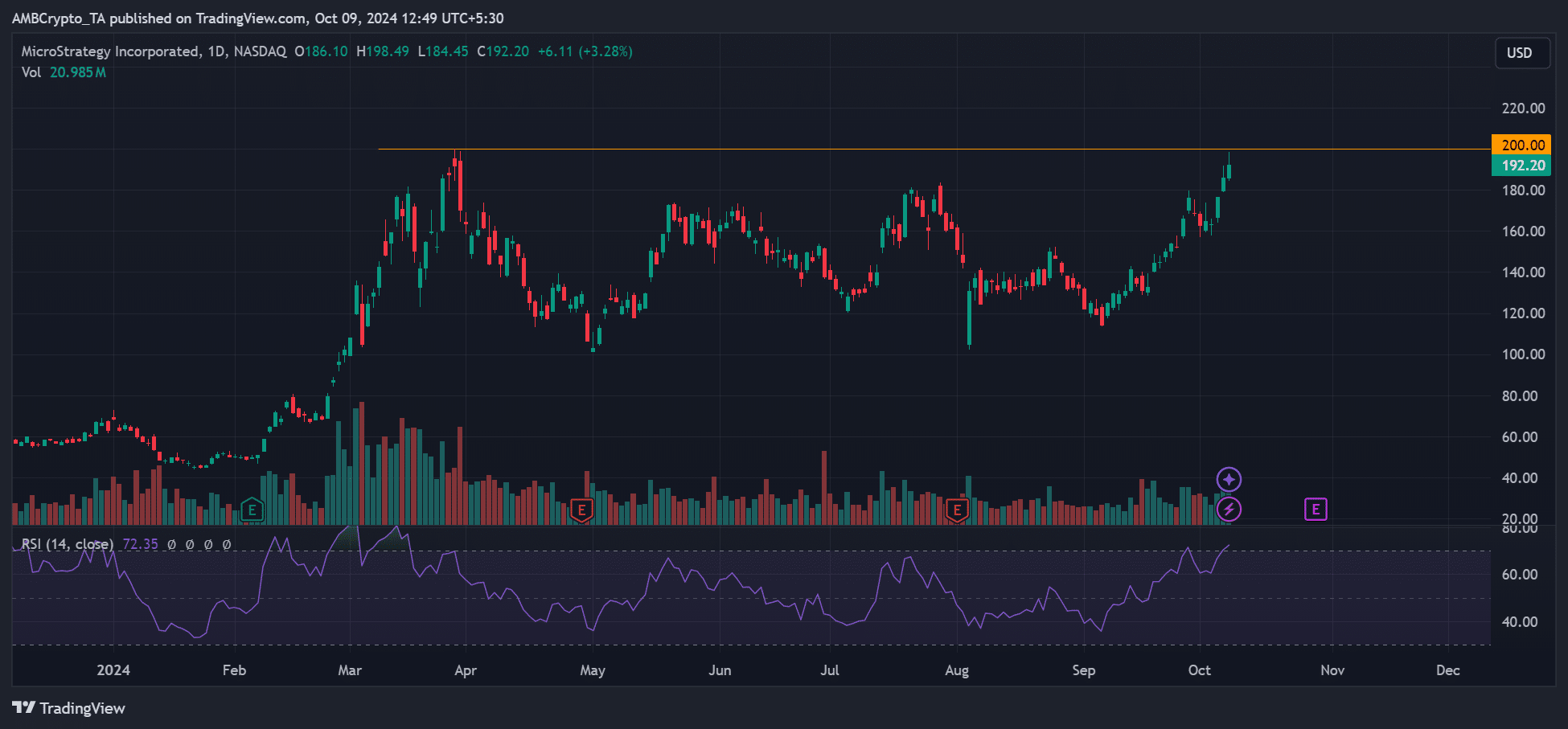

- Since September, the price has risen 68%, almost the ATH.

MicroStrategy [MSTR]has hit a six-month high of $198, just below the ATH of $200. The latest revival coincided with the cryptic message from its founder, Michael Syalor.

In his latest X (formerly Twitter) afterSaylor wore gladiator-like attire, a Bitcoin [BTC] pendant and a sword.

This can be interpreted as his willingness to publicly defend and defend BTC amid fiscal instability and fiat-driven inflation.

Saylor is perhaps the most notable BTC bull to be Uber-bullish on the asset. He believes BTC is the most superior asset and store of value in human history, given its steady supply and resistance to censorship.

His position formed the basis for BTC’s treasury strategy, which he pioneered with MicroStrategy.

The Bitcoin-focused software provider now has nearly $16 billion in BTC (252,000 coins), having acquired over $1.5 billion in Q3 2024.

A $16 billion BTC stock sparks an MSTR rally

MicroStrategy’s MSTR rally has been linked to the company’s massive BTC supply noted by CryptoQuant.

“Since MicroStrategy started buying $BTC on August 11, 2020, shares are up 1,208%, while Bitcoin itself is up 445%.”

That said, MSTR’s massive BTC supply, acquired primarily through debt (convertible notes), has made it highly correlated with the digital asset.

However, the stock’s recent rally marked a complete disconnect from BTC.

Source: MSTR vs BTC, TradingView

Since September, the MSTR has risen 68%, from $114 to almost $200. On the contrary, BTC rose 18% during the same period and was struggling with crucial support at the time of writing.

The rally even passed BTC critic Peter Schiff surprise.

“What’s going on with $MSTR? Over the past three days, the value rose by 18%, while #Bitcoin rose only 1%.”

On a YTD (year-to-date) basis, MSTR rose 177%, while BTC was up 38%. This underscored that MSTR investors saw more gains than their BTC counterparts.

This also meant that MSTR was trading at a premium to BTC.

However, MSTR’s RSI was signaling an overbought signal at the time of writing, which could complicate the short-term outlook, especially ahead of earnings season.

Source: MSTR, TradingView

Some market observers have wondered why investors would choose MSTR to indirectly hold BTC rather than purchase the asset directly. But Jeff Park from Bitwise viewed MSTR as a simultaneous long and short global carry trade.

“$MSTR is simultaneously long and short global carry. Taking on debt at low rates to invest in Bitcoin is a long global carry. Bitcoin in itself is a short global carry.”

From a perspective, carry trading involves borrowing from low-interest currencies to invest in high-interest assets. MicroStrategy’s BTC stock was acquired via debt.

However, BTC is also considered a risky asset and a hedge against inflation linked to fiat currencies. Therefore, MicroStrategy’s move could be seen as a bet against global inflation – a short global carry.