- MANA continued its long-term downward trend, but recently regained some crucial support levels

- Derivatives data for the altcoin indicated a bullish edge, while broader market sentiment remained uncertain

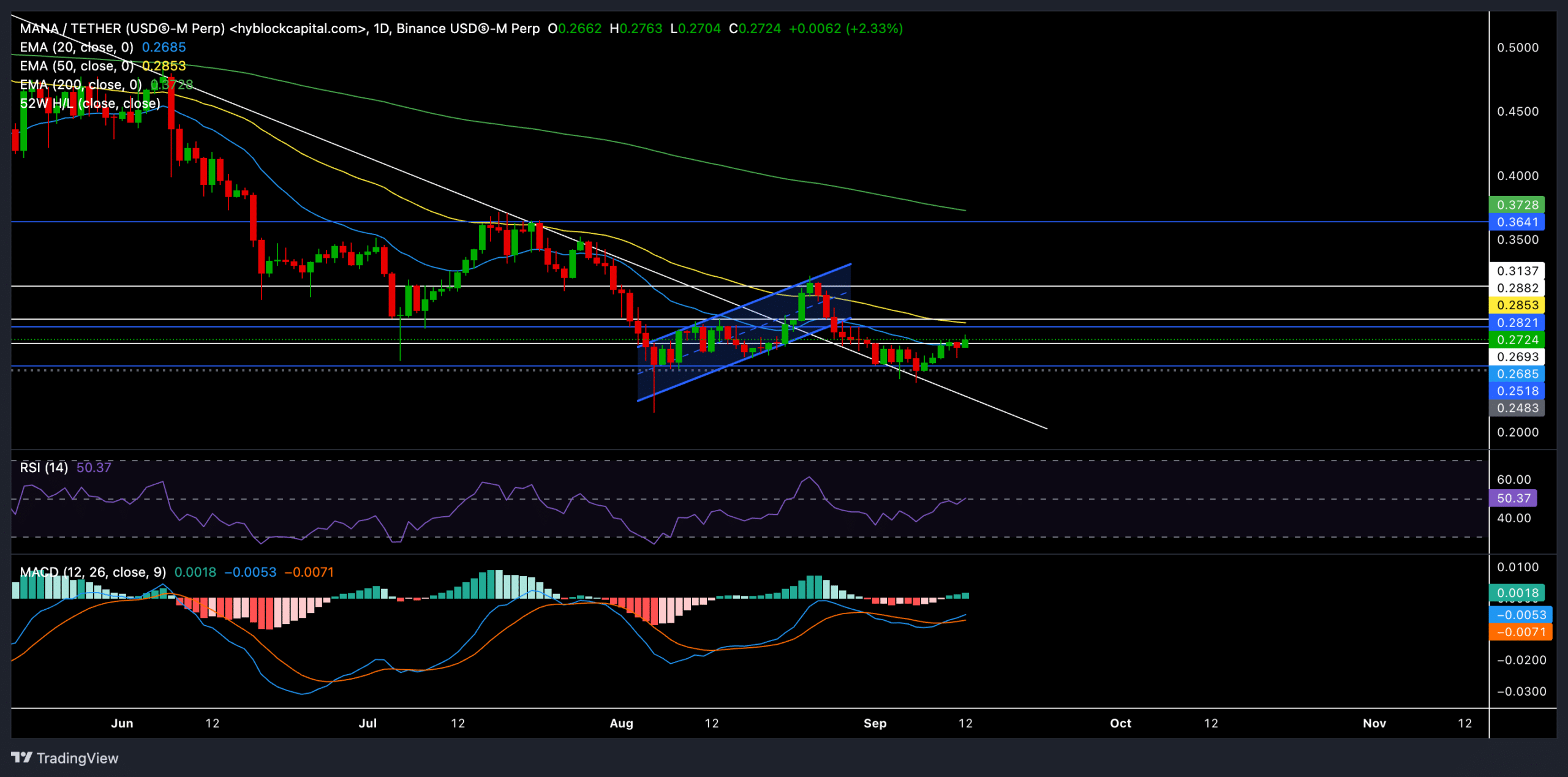

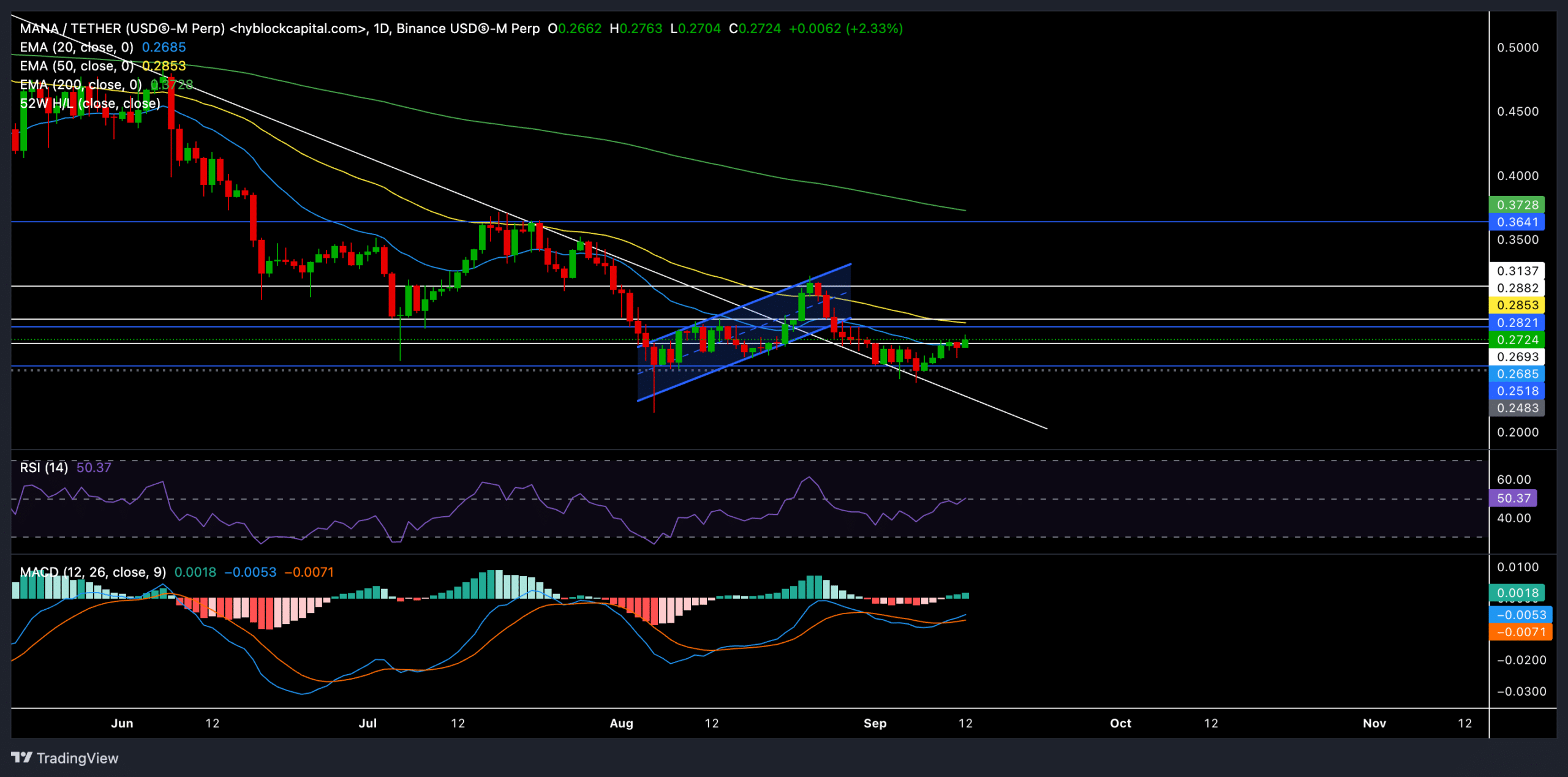

MANA recently retested multi-year lows around $0.25 after charting a bearish flag breakout on the daily chart. However, the expected collapse found a recovery at the $0.25 level. This allowed MANA to bounce back and reclaim the $0.269 support above the 20 EMA. At the time of writing, MANA was trading at $0.275, up almost 5.8% in the past 24 hours.

Can MANA bulls regain a spot above the 50-day EMA?

Source: TradingView, MANA/USDT

The latest bullish push came after sellers retested the $0.25 support level last week. As a result, the altcoin remained above the 20-day EMA and showed early signs of a near-term recovery.

A sustained upward trajectory from here could encounter immediate resistance near the 50-day EMA at $0.285 and the $0.28 resistance zone. Should bulls breach these levels, a retest of the $0.31 resistance could become possible in the coming weeks.

However, since the broader sentiment was still in the ‘fear’ zoneBuyers should look for substantive signals before entering a long position.

It is worth noting that the recent recovery was further supported by a bullish divergence on the Relative Strength Index (RSI). The RSI recovered from the oversold level and was hovering around the neutral 50 at the time of writing. A jump above this level could confirm a more persistent bullish bias.

The MACD showed declining bearish momentum and saw a bullish crossover between the MACD and the Signal line. If these lines close above zero, the altcoin could see an extended uptrend.

Derivatives data revealed THIS

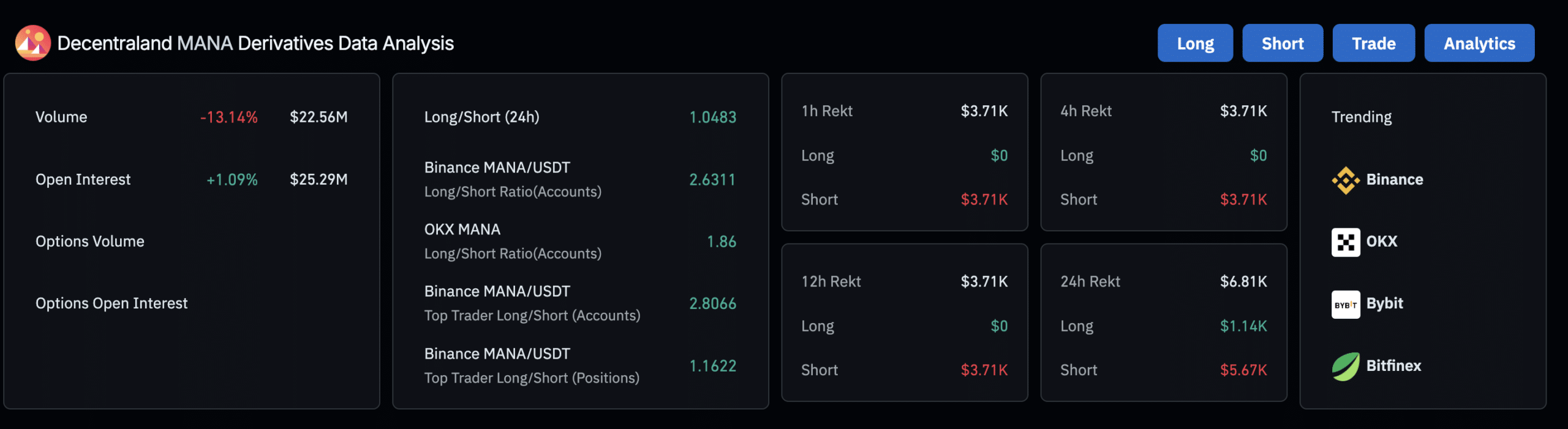

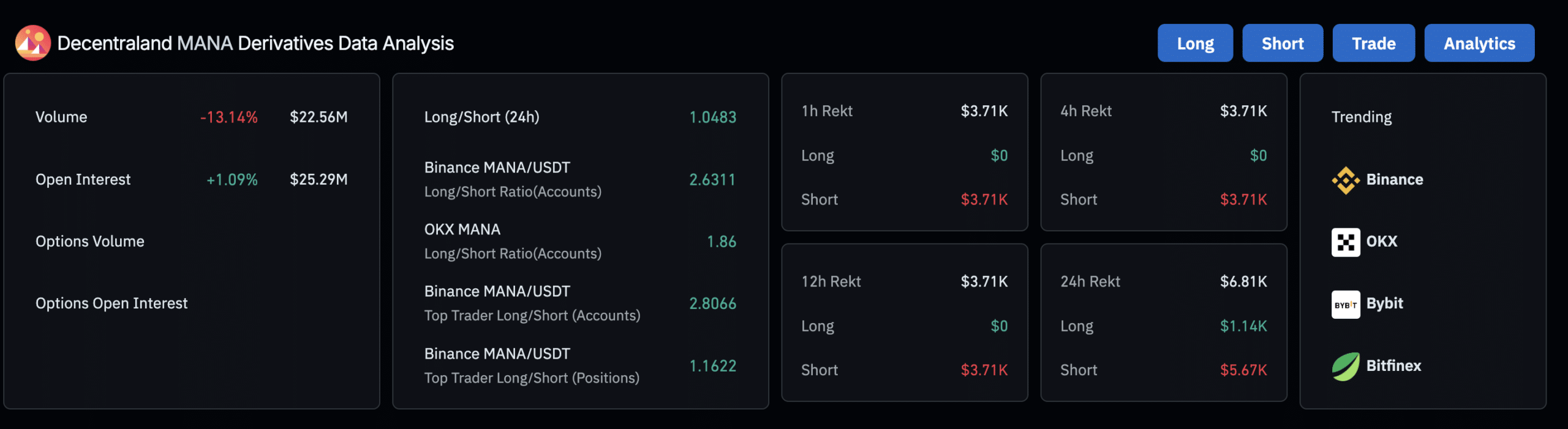

Source: Coinglass

The long/short ratio was 1.0483. The market showed a slight bullish bias with more longs than shorts, especially with Binance’s MANA/USDT long/short ratio showing a value of 2.63.

On the other hand, liquidation data indicated that shorts were under pressure, with $3.71K in short liquidations in the last 1 to 12 hours and $5.67K in liquidations in the last 12 to 24 hours. This data further supported the recent bullish price action.

MANA’s near-term prospects depend heavily on whether the bulls can maintain control above the 20-day EMA and break the resistance at $0.2854. A close above this level would open the door for a retest of the $0.31 resistance zone and strengthen the recovery. Traders should also keep a close eye on the RSI and MACD to see if there is a persistent bullish bias.

As always, keeping an eye on Bitcoin price action can provide important insights. Especially since MANA has a strong correlation with BTC.