- In addition to the strike, MATIC’s share price also fell by double digits last month

- Buying pressure on the token increased slightly, indicating a possible price increase

Polygon [MATIC] has lost a significant portion of its market capitalization in recent months. But that’s not all: the latest data shows that things in the staking ecosystem weren’t looking good either. Is this happening because investors are losing confidence in the token?

Focusing on the decline

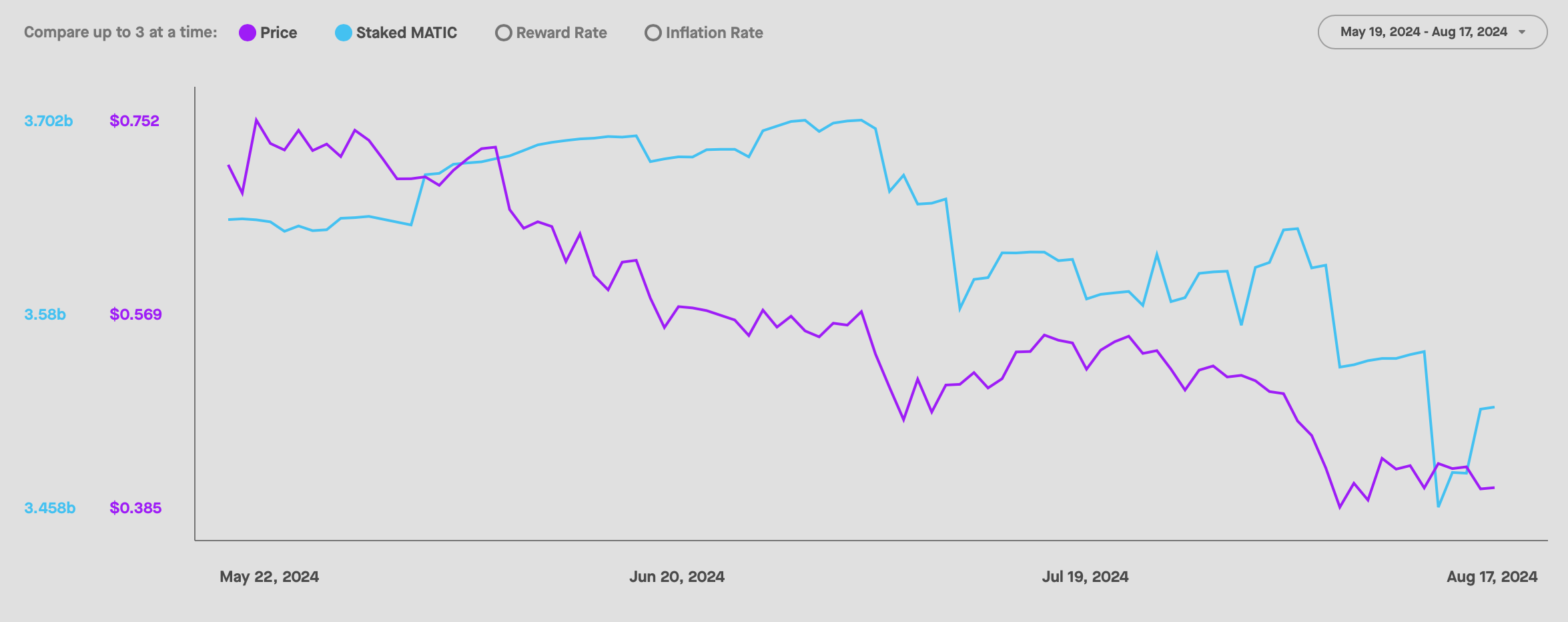

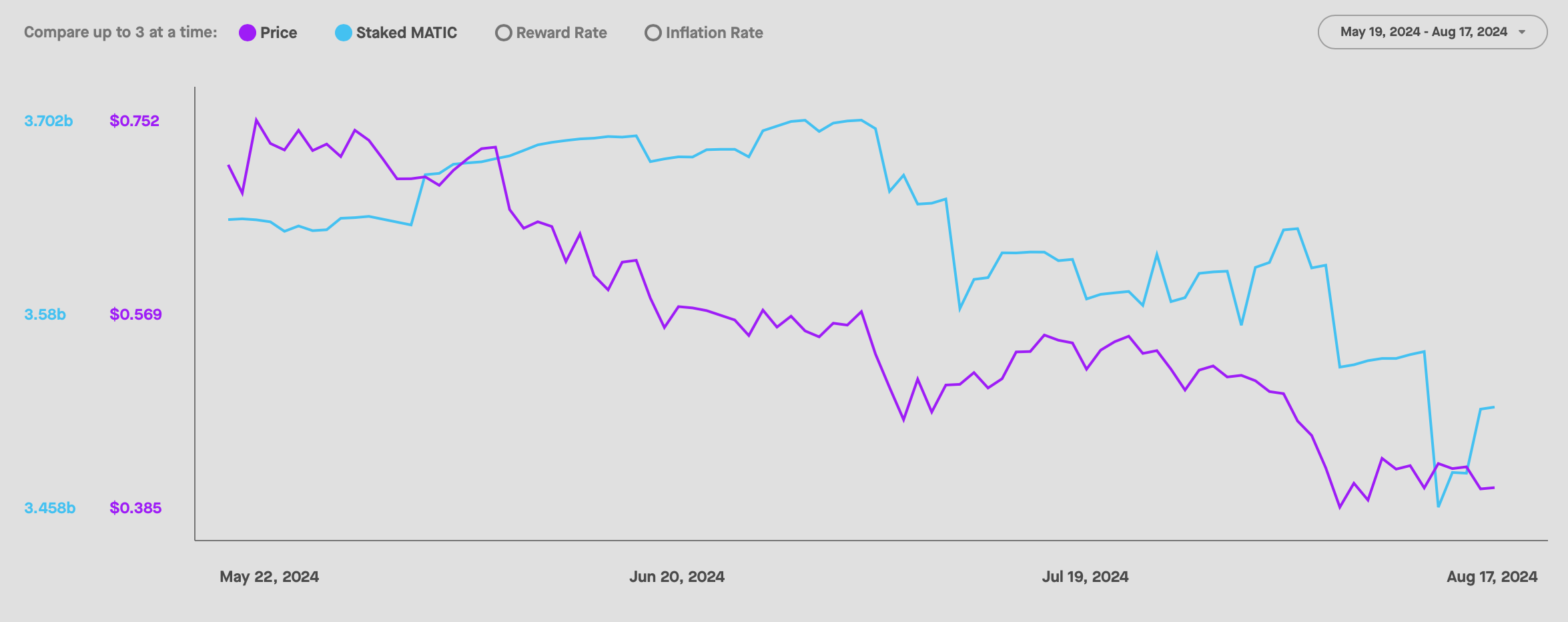

Polygoninans, a popular X-handle that shares updates related to the Polygon ecosystem, recently released a tweet highlighting the state of the blockchain’s staking ecosystem. According to the same figure, MATIC’s total stakes reached a figure of 3.4 billion this week – a decrease of 35% compared to the previous week.

AMBCrypto reviewed Staking Rewards data to better understand MATIC staking. We found that the number of discontinued MATICs increased through July 3. However, since then the numbers have started to decline, indicating waning investor interest.

Source: Staking Rewards

Do investors not trust MATIC?

CoinMarketCaps facts revealed that, similar to staking, MATIC’s price also witnessed a decline of over 27%.

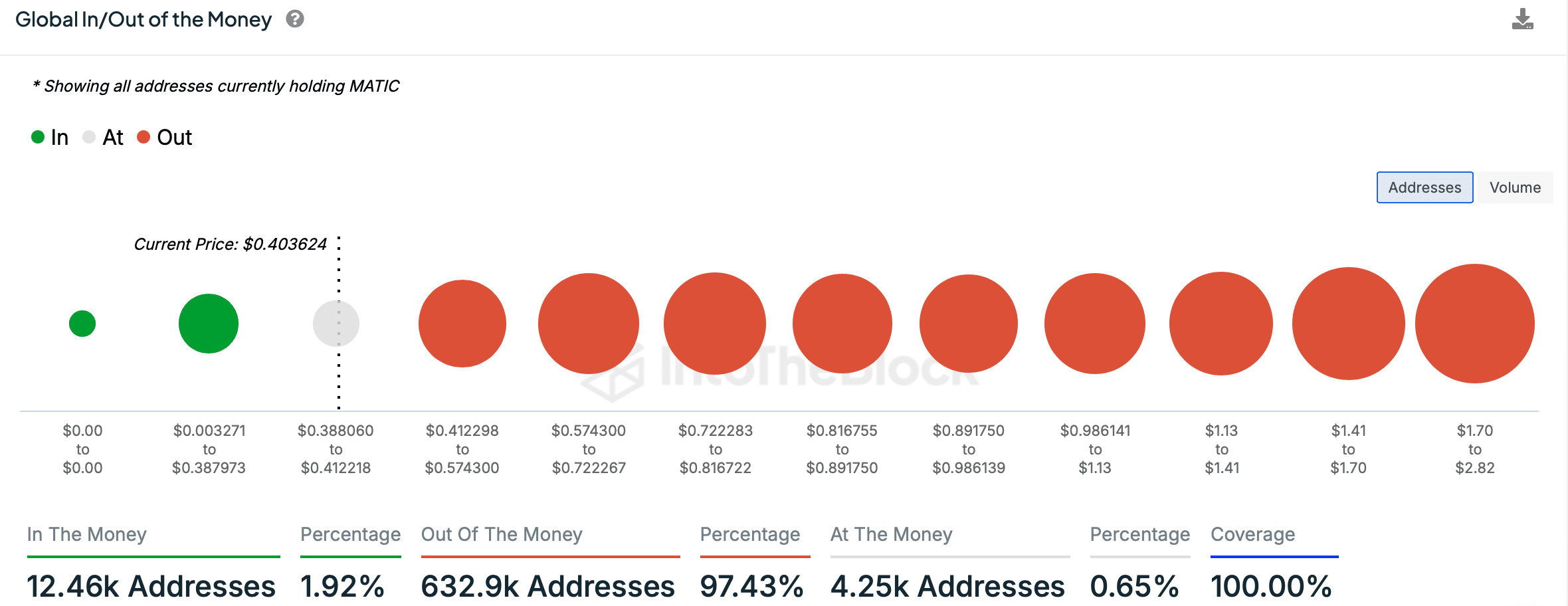

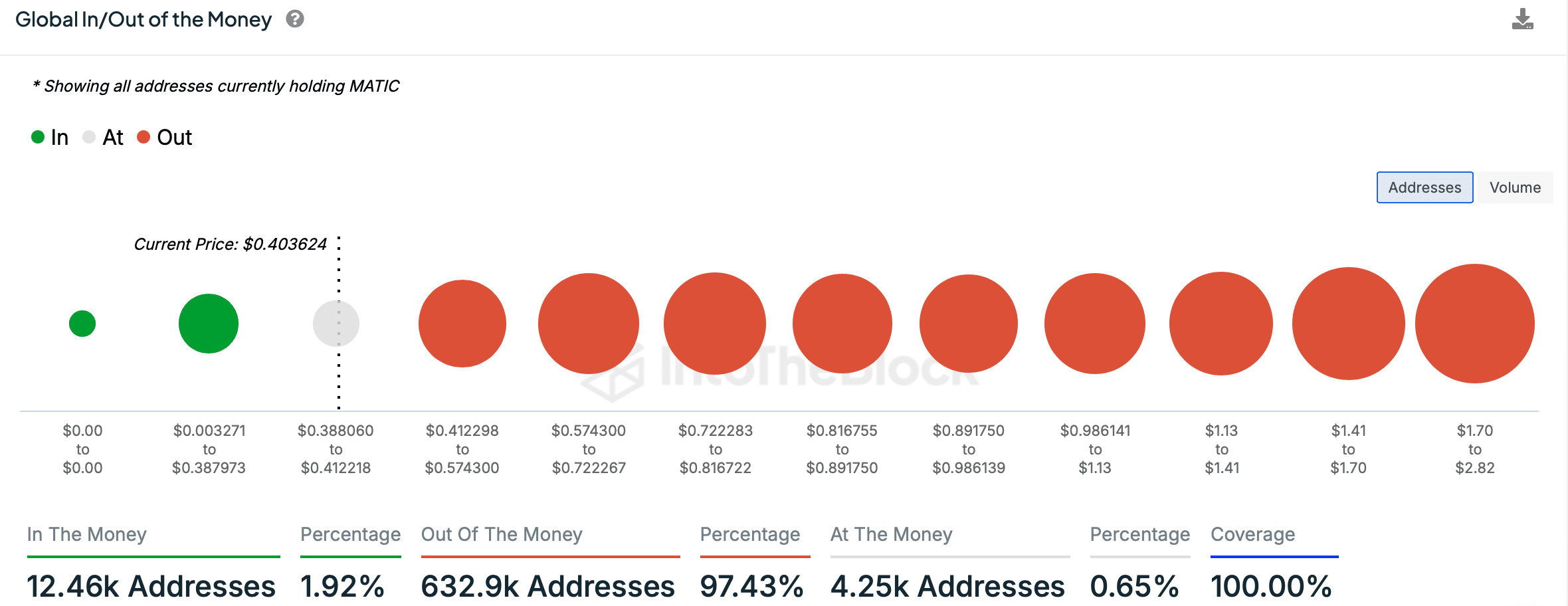

At the time of writing, MATIC was trading at $0.4035 with a market cap of over $4 billion, making it the 22nd largest crypto. And because of the massive price drop, only 2% of MATIC investors continued to make profits, according to IntoTheBlock data.

Source: IntoTheBlock

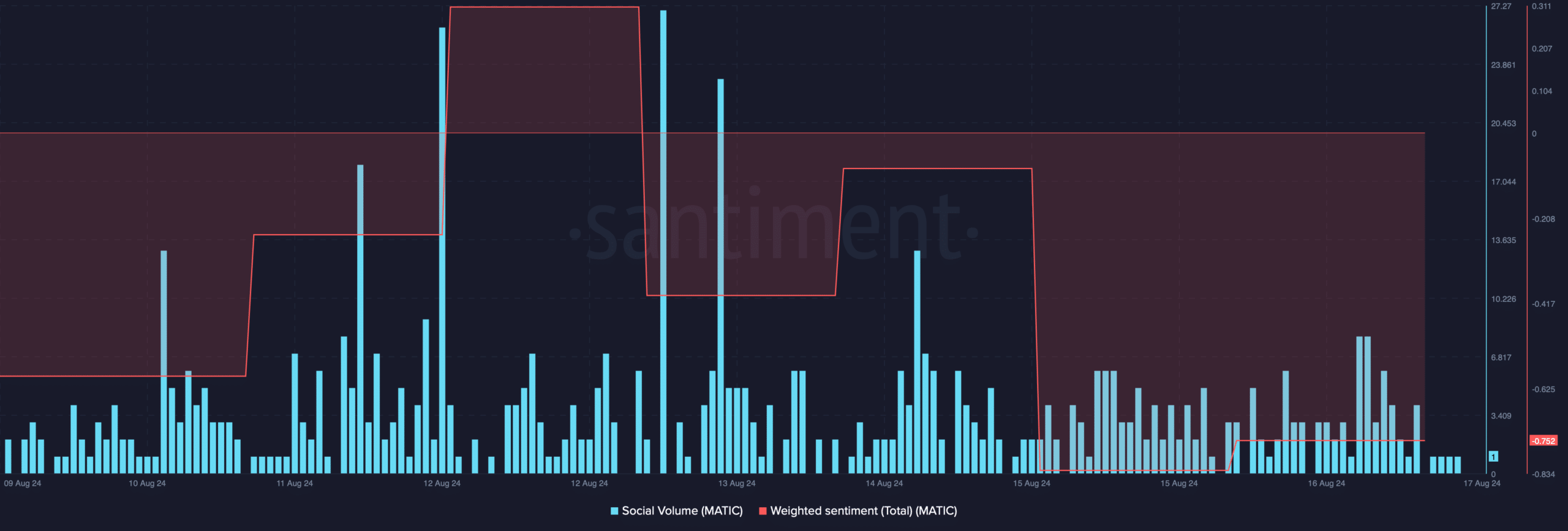

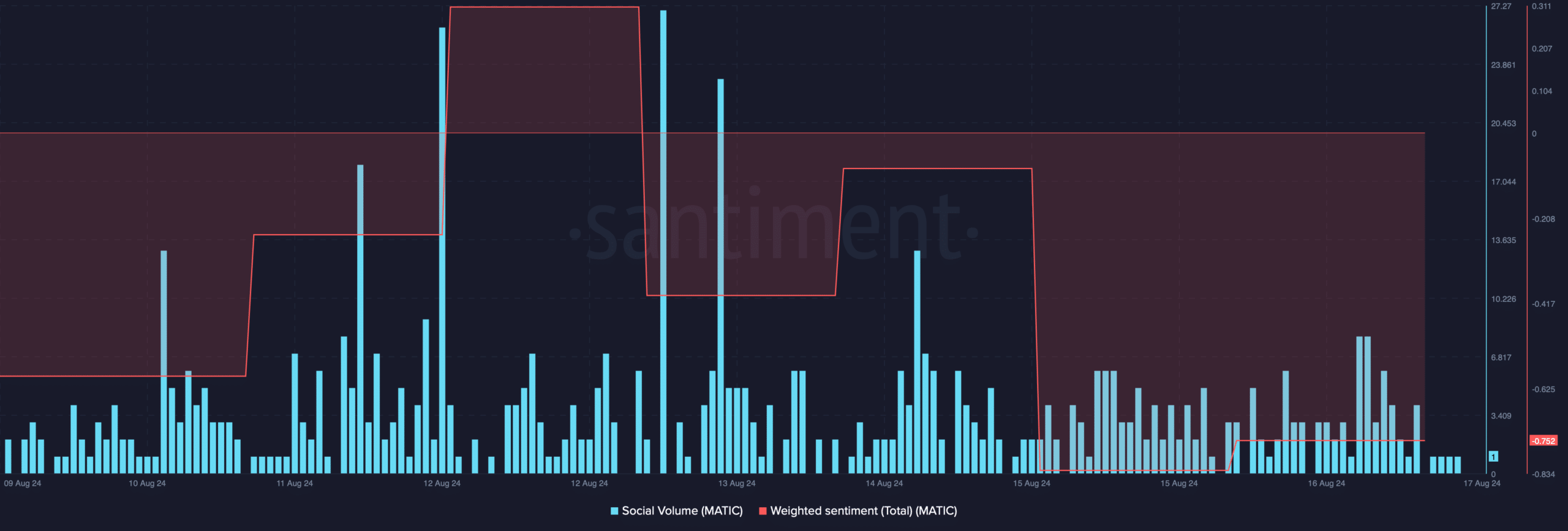

AMBCrypto then reviewed MATIC’s on-chain data to better understand investor sentiment around the token. According to our analysis, the altcoin’s weighted sentiment was in the negative zone.

What this means is that bearish sentiment surrounding the token has remained dominant in the market. After a peak, social volume also showed a decline, reflecting a decline in popularity.

Source: Santiment

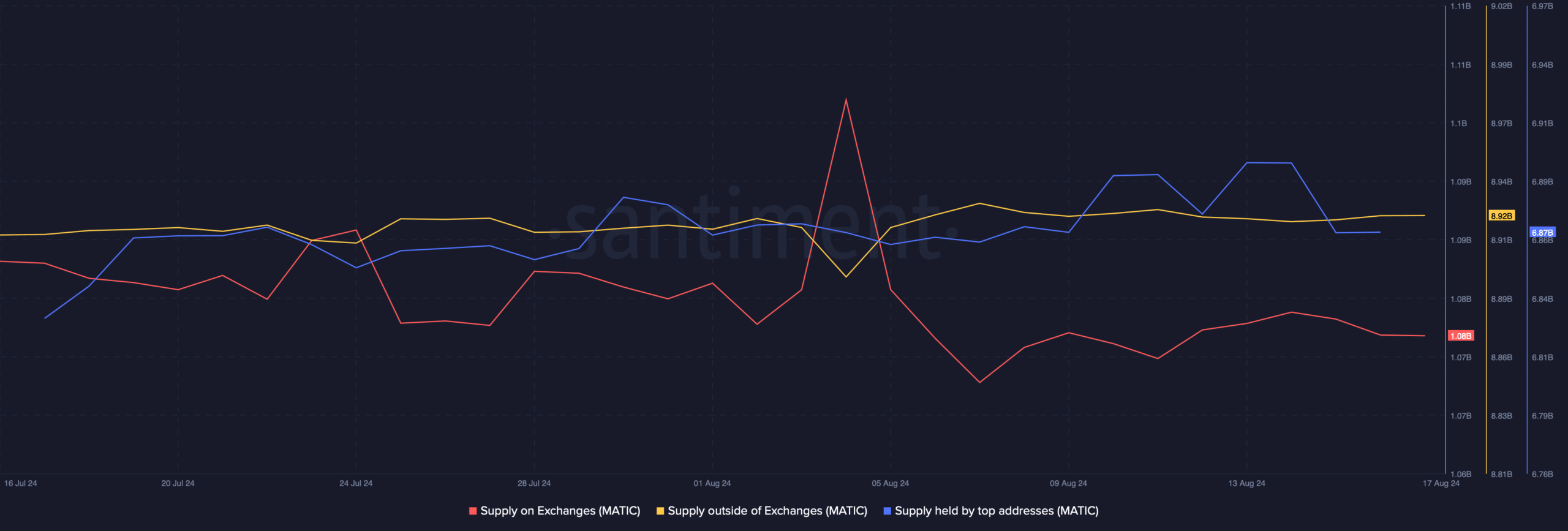

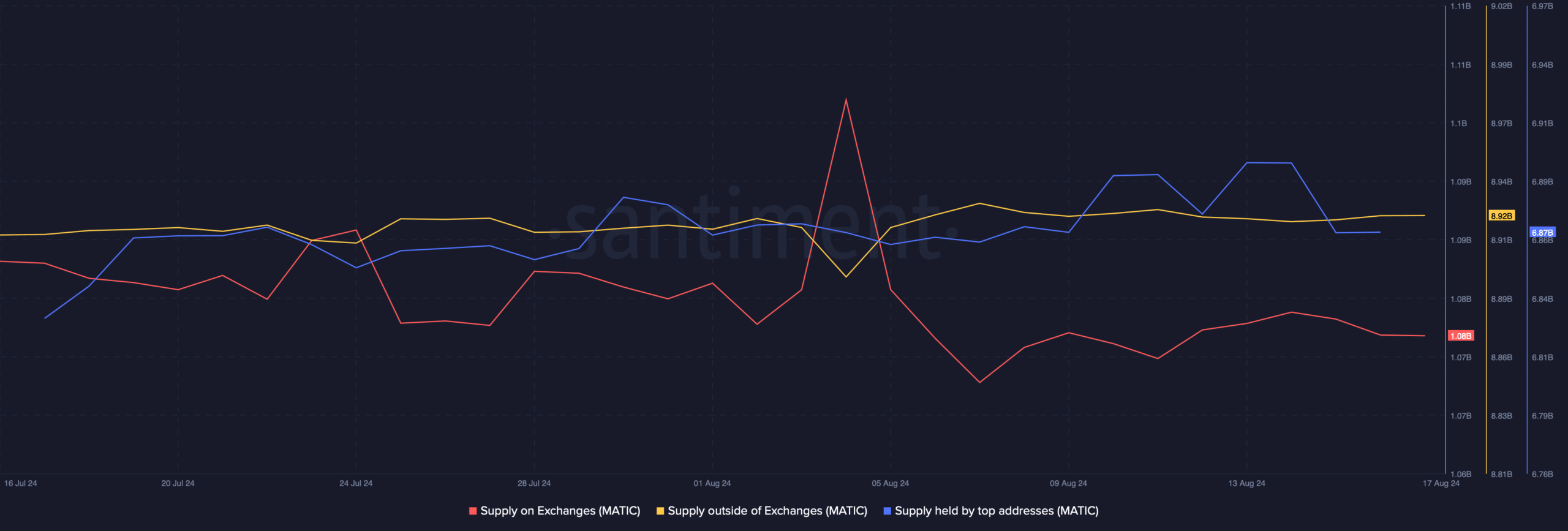

Unfortunately, closer inspection revealed a different story. Over the past 30 days, MATIC’s supply on the stock exchanges has fallen slightly.

While this was happening, off-exchange supply increased. This suggested that a few investors have considered accumulating MATIC.

Prime supply also rose marginally – a sign of whales putting buying pressure on the altcoin. By extension, this also meant that several parties expected the price of MATIC to rise in the coming days.

Source: Santiment

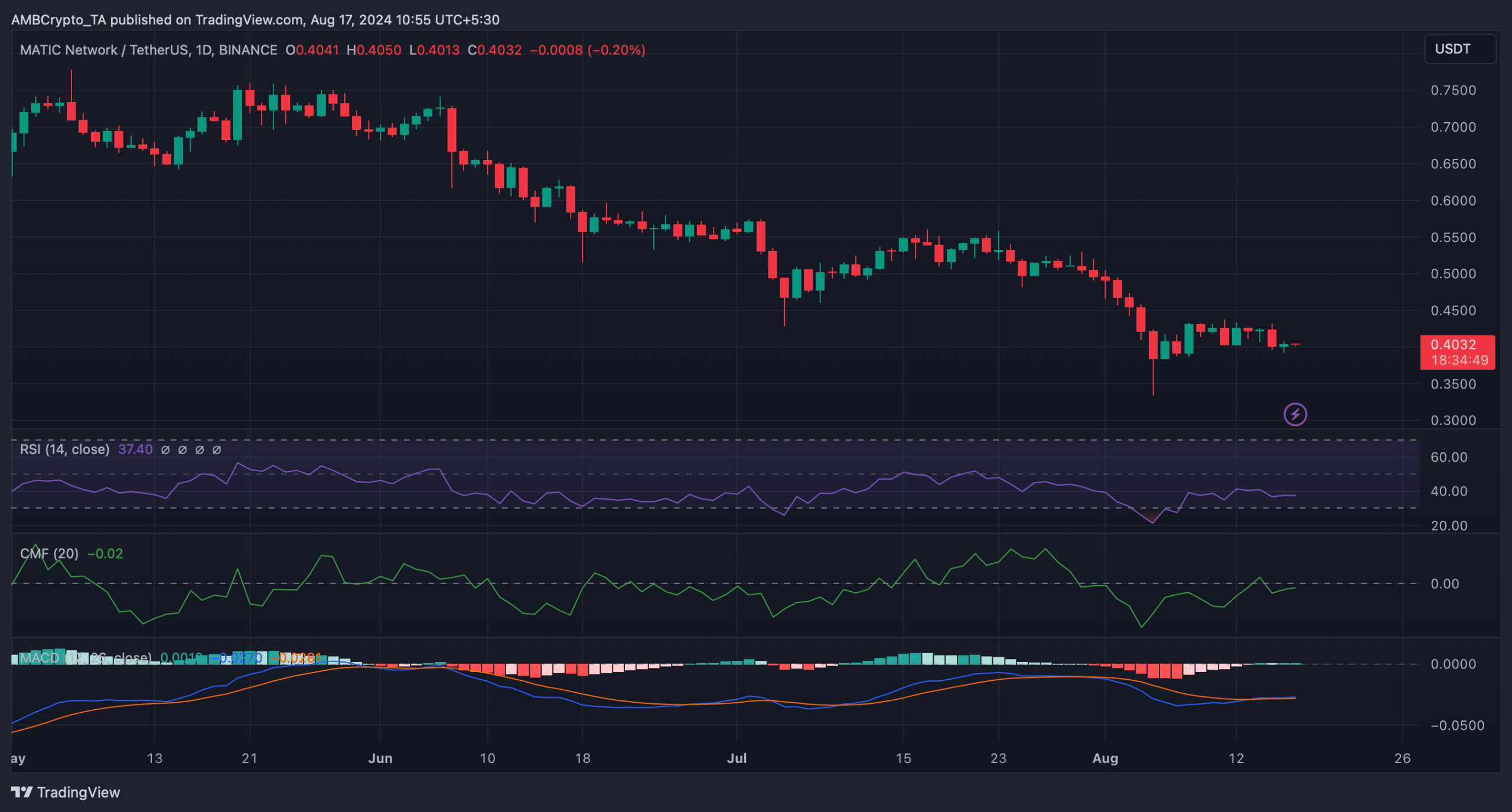

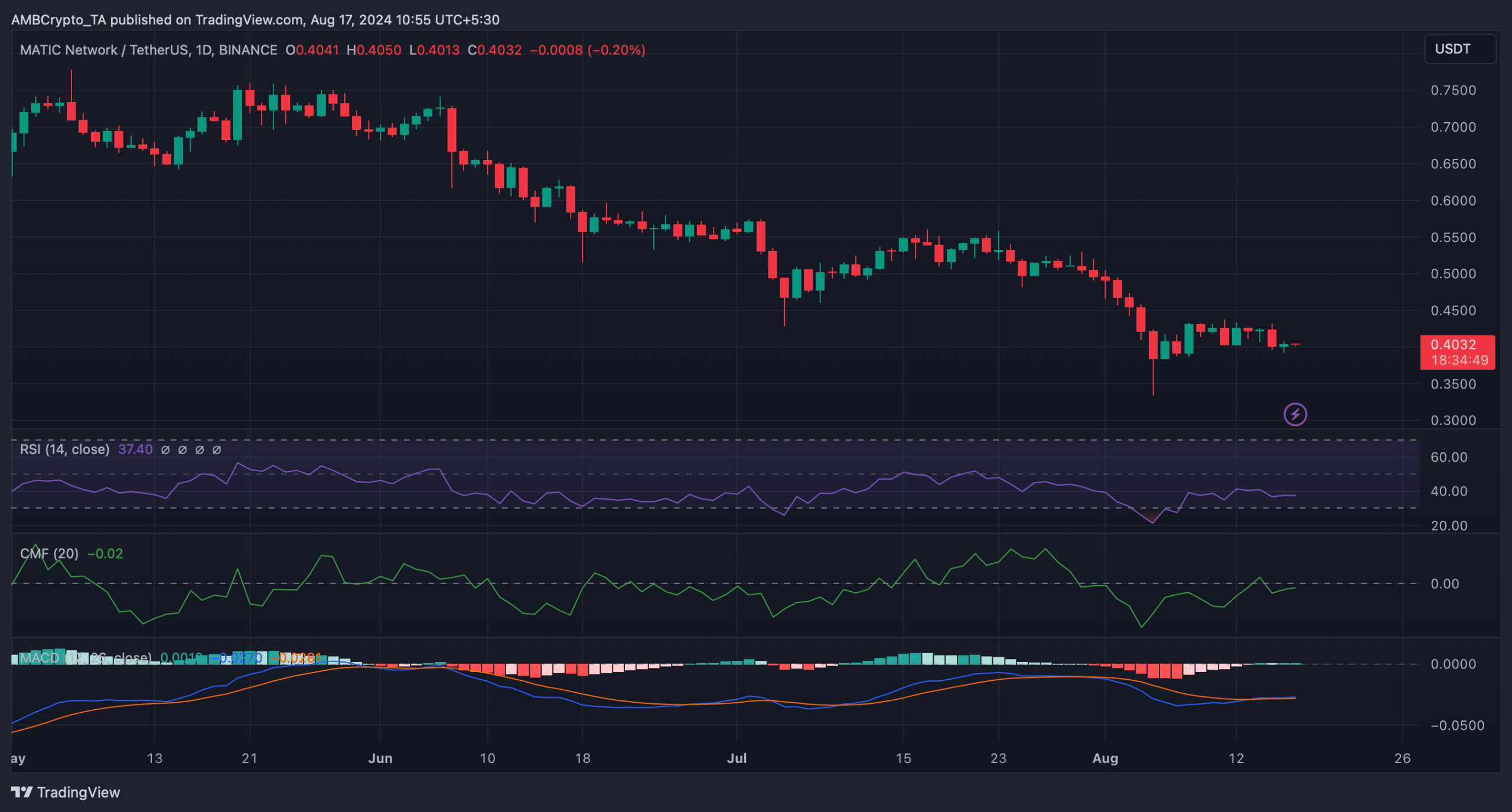

Therefore, AMBCrypto looked at the token’s daily chart to see what market indicators were suggesting. The technical indicator MACD showed a bullish crossover. MATIC’s Chaikin Money Flow (CMF) also registered an increase and was heading towards neutral at the time of writing.

Both indicators suggested that there were chances for MATIC to gain bullish momentum on the charts.

Read Polygon [MATIC] Price prediction 2024-25

However, it may still take some time for MATIC to turn bullish as the Relative Strength Index (RSI) also moved sideways.

Source: TradingView