- Bitcoin derivatives metrics looked bullish.

- But selling pressure remained dominant in the market.

Bitcoin [BTC] has struggled with its price action as it has failed to please investors of late. This has sparked fear throughout the community, as evidenced by the latest data sets.

However, this market panic could have the potential to change the situation for the king coin.

Bitcoin Investors Are Panicking!

The price of Bitcoin witnessed a price correction of over 11% last week, pushing the price below $95,000. Basically AMBCrypto reported rather that Bitcoin was struggling as we approached the Santa Claus rally, an event that has historically pushed the crypto market higher.

At the time of writing, the king coin was trading at $94,078 with a market cap of over $1.86 trillion.

It was interesting to note that despite the double-digit weekly correction, only 1.98 million BTC addresses were “out of the money,” which made up less than 4% of the total number of Bitcoin addresses, according to IntoTheBlock’s report. facts.

In the midst of all this, Santiment, a data analytics platform, posted tweetwhich highlights a remarkable development. According to the tweet, crypto markets have opened further into the week, causing panic among the retail crowd.

Especially Bitcoin and Ethereum [ETH] are seeing huge FUDs from newer traders who have joined the market in the last 2-3 months.

The tweet mentioned

“Historically, when retailers start selling based on panic and emotion, whales and sharks have the ability to scoop up more coins with little resistance, creating bounces.”

Therefore, there is a high chance of a trend reversal if we count the remaining days of this year.

Will BTC register greens soon?

According to our analysis of CryptoQuant’s factssales sentiment remained dominant on the market. This was evident from the increasing foreign exchange reserve.

However, Santiment’s tweet mentioned that if whales snap up BTC, it could cause a reversal. But that didn’t happen either.

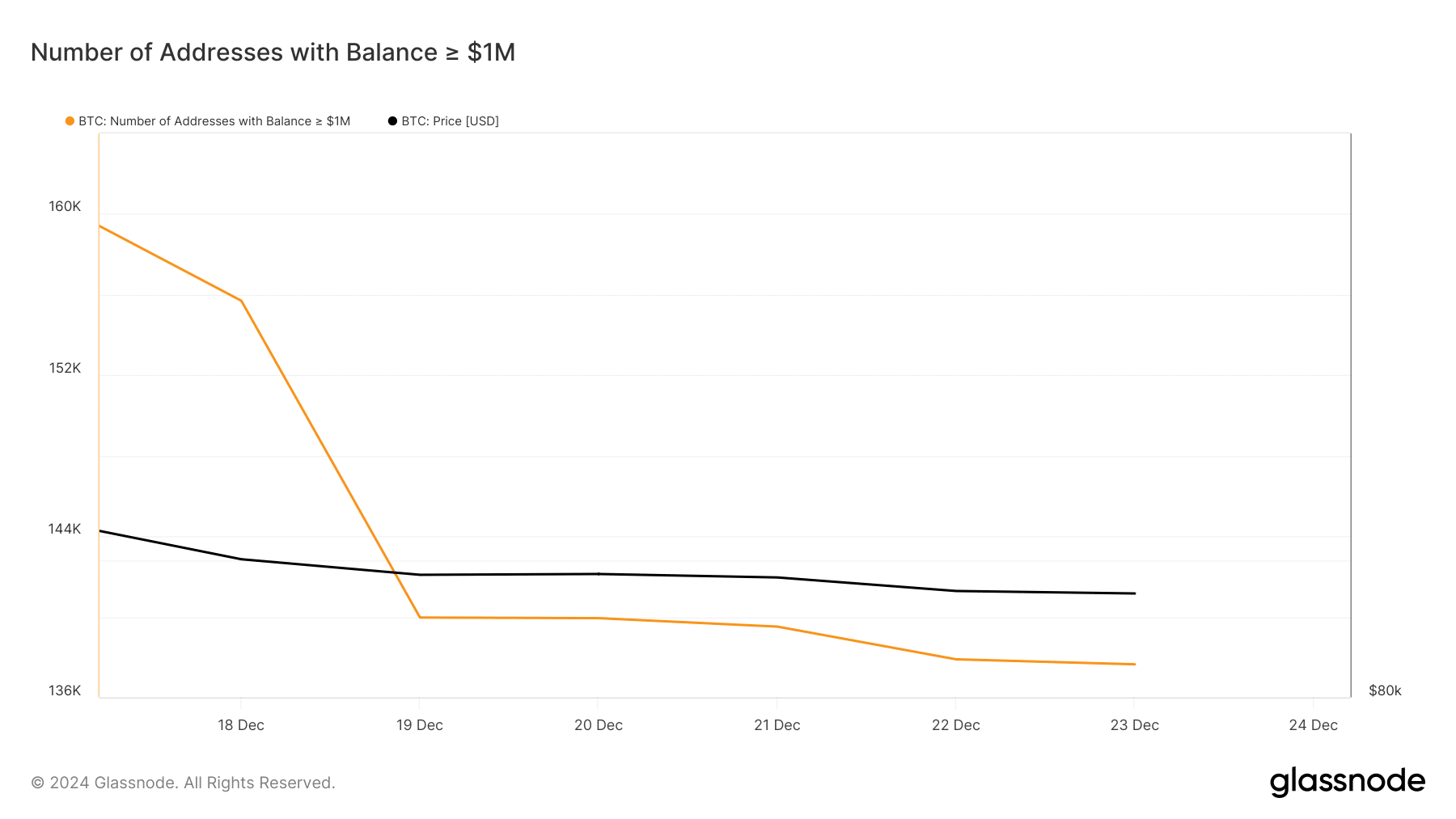

The number of Bitcoin addresses with balances over $1 million fell sharply last week, indicating that the deep-pocketed players were also selling off their holdings, which could spell more trouble for BTC in the coming days.

Source: Glassnode

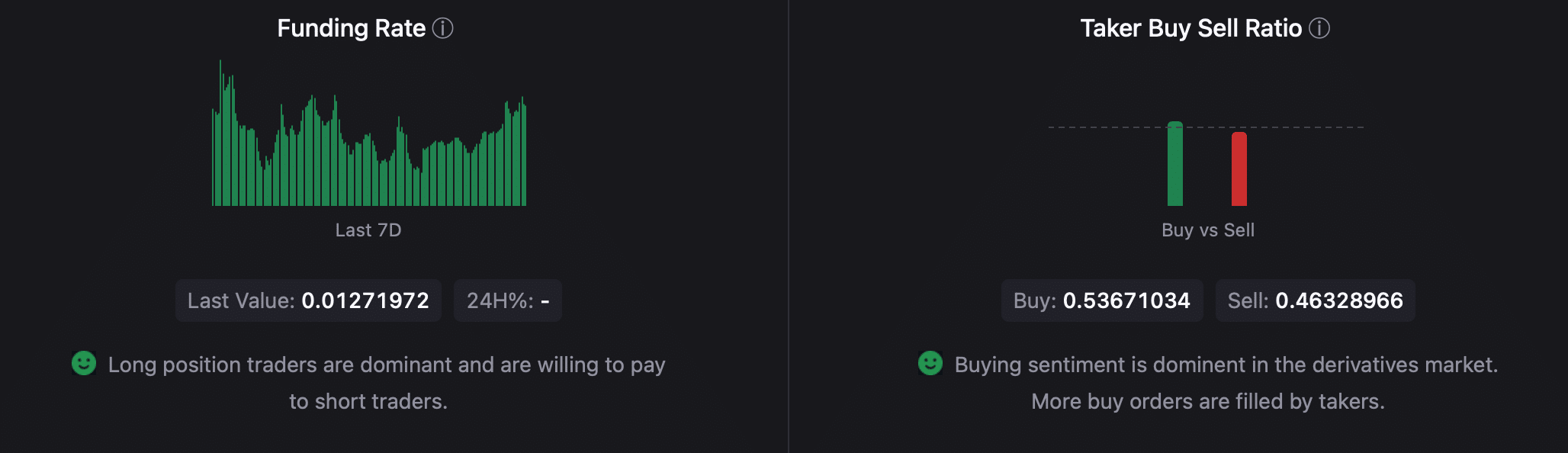

Nevertheless, things seemed optimistic in the derivatives market as BTC’s funding rate increased.

Read Bitcoin [BTC] Price prediction 2024-25

An increase in the funding rate in the crypto market means that the cost of holding long positions increases – a sign of rising bullish sentiment around an asset.

The taker’s buy/sell ratio was also green. This meant that buying sentiment was dominant in the derivatives market. If these numbers are to be believed, it is not too ambitious to expect a trend reversal for BTC.

Source: CryptoQuant