The cryptocurrency market is currently experiencing significant turbulence, leading to a shift in investor behavior towards Bitcoin, which has traditionally been seen as the safest asset within the digital currency ecosystem.

Related reading

Flight to Safety: Bitcoin’s Increasing Dominance

In times of market uncertainty, investors often gravitate toward what they consider safer assets. This behavior is clearly visible in the recent dynamics in the crypto market Bitcoin has become the preferred choice of investors looking to weather the storm.

The broader market sell-off, which saw as much as $110 billion in market value disappear in just one week, has particularly affected altcoins. Projects like Akash Network, Floki and Chiliz have seen significant declines, each plummeting by more than 30%.

The appeal of Bitcoin

Bitcoin’s appeal lies in its established track record and perceived stability compared to newer, more volatile altcoins. This perception has prompted many investors to take refuge in Bitcoin altcoins are exposed to harsh market conditions. This shift in preference underlines a broader belief that Bitcoin provides a safer haven during periods of market distress.

Long-term perspective on Bitcoin’s dominance

Despite Bitcoin’s current dominance, some analysts advise caution. Jelle, a veteran crypto trader, suggests that Bitcoin’s dominance may not be sustainable in the long term.

#Bitcoin The dominance continues to lose momentum as the price consolidates just below all-time highs.

Almost as if #Altcoins will perform better once BTC breaks out.

Almost. pic.twitter.com/tjVOaUHskm

— Jelle (@CryptoJelleNL) June 17, 2024

He argues that altcoins, with their innovative features and potential for significant growth, could regain lost ground once Bitcoin surpasses its previous all-time high of $74,000. This perspective highlights the cyclical nature of the crypto market, where different assets can outperform at different times.

Market sentiment and future prospects

The current recession in the broader market has led to bearish sentiment Bitcoin is having a hard time to maintain its position within a crucial support zone around $64,500. The prevailing sentiment is one of caution as the market grapples with uncertainty.

However, there is a glimmer of hope on the horizon. Interestingly, while the crypto market has suffered a decline, technology stocks have performed well, marking their seventh straight day of gains. This divergence suggests that the current downturn could be specific to the crypto market and not indicative of a broader economic malaise.

Volatility and potential reversals

The notorious volatility of the crypto market means that quick reversals are always possible. Historically, digital assets have been subject to dramatic swings, and what goes down can go back up just as quickly.

Related reading

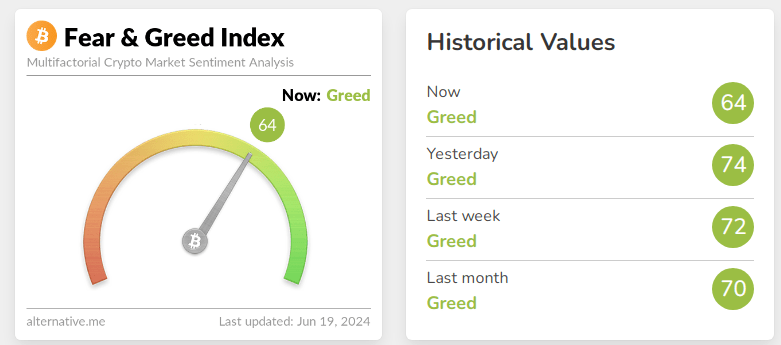

This inherent volatility is both a risk and an opportunity for investors. The recent increase in the Fear and greed index to 64 indicates that despite the sell-off, some investors remain optimistic and are showing a degree of irrational exuberance.

Featured image of Photlurg, chart from TradingView