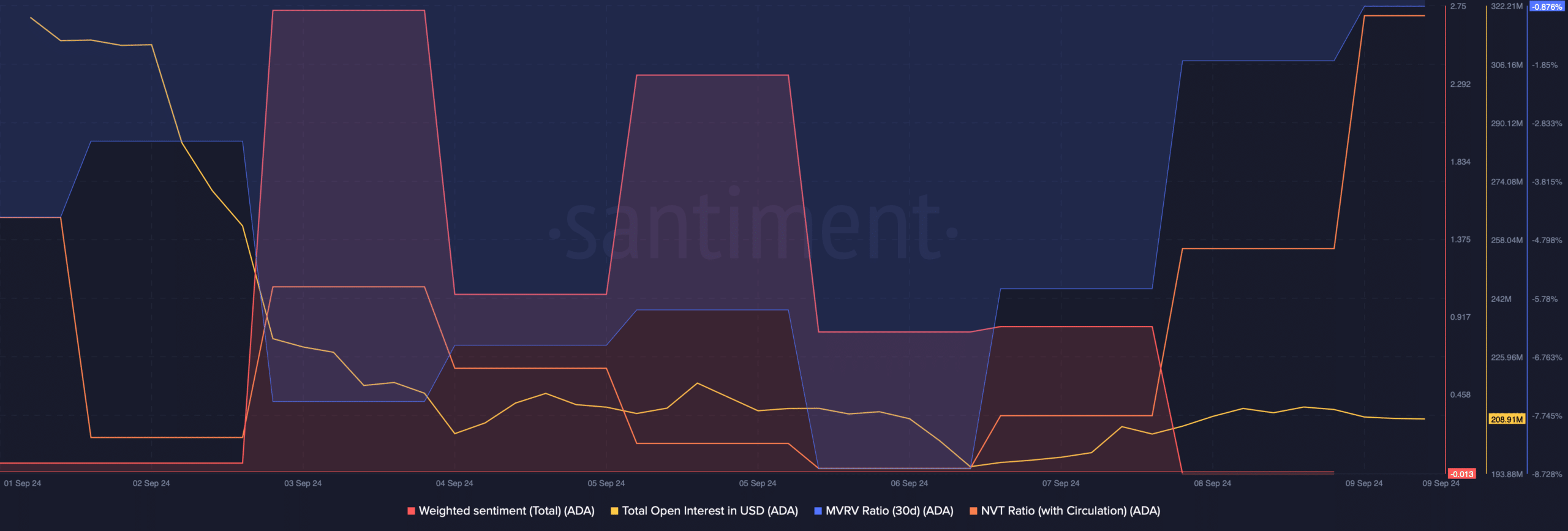

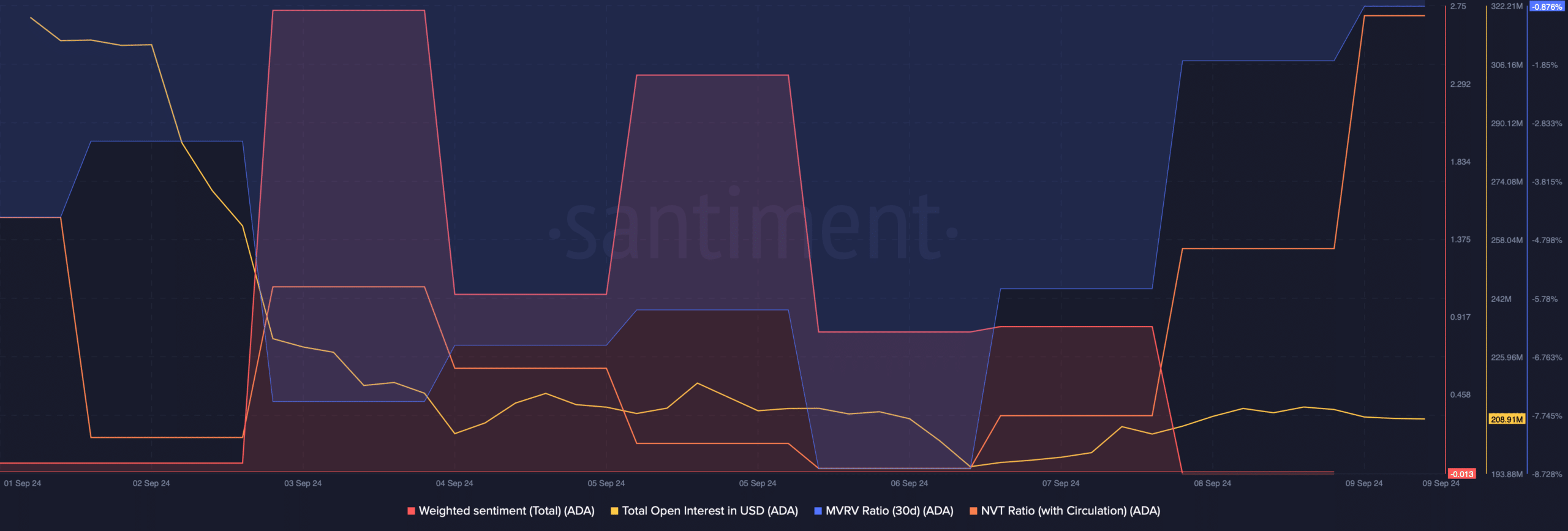

- Cardano’s NVT ratio indicated that the token was overvalued.

- However, indicators were bullish and pointed to a soon rise towards $0.45.

Cardano [ADA] was among the lucky cryptos that managed to paint both the daily and weekly charts green.

But this could be the start of a huge bull rally as there were chances that ADA could start a rally towards $1 soon.

Cardano is aiming for $1

CoinmarketCaps facts revealed that ADA’s price rose more than 1.5% last week. Also in the last 24 hours, the bulls remained dominant over the bears as the price of ADA rose marginally.

At the time of writing, the token was trading at $0.3407 with a market cap of over $12.2 billion, making it the eleventh largest crypto.

While the bulls were ruling the market, World Of Charts, a popular crypto analyst, recently posted tweet which highlights a bullish pattern on Cardano’s price chart.

The bullish falling wedge pattern emerged in December last year and since then ADA has consolidated within this pattern.

After more than half a year, ADA finally showed signs of a possible breakout from the pattern. If that happens. Next, investors could witness a big rally, which could push the ADA to $1 in the coming quarter.

Source:

Other goals to consider

Although a bullish breakout would suggest a climb to $1, AMBCrypto first planned to assess whether Cardano would break above resistance.

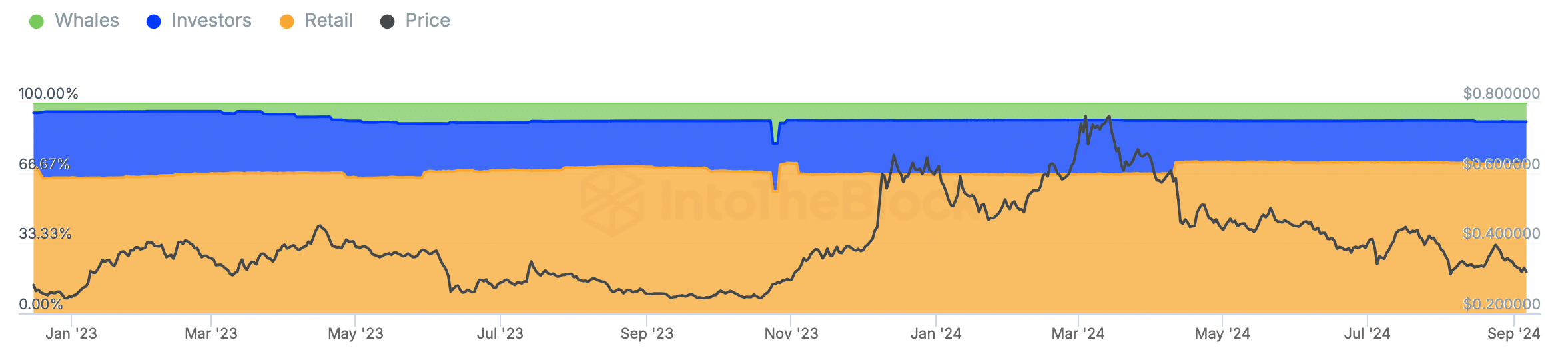

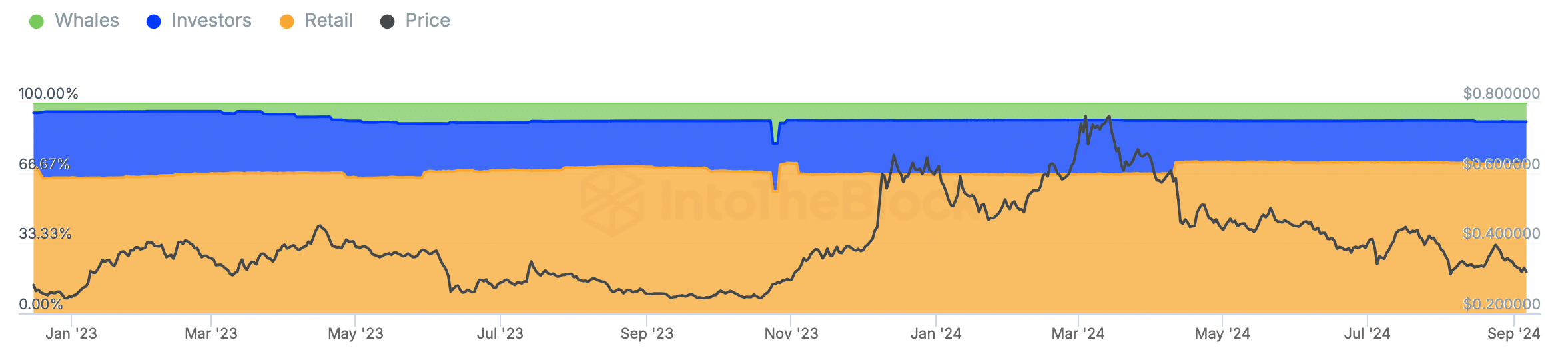

AMBCrypto’s analysis of Santiment’s data showed that ADA’s MVRV ratio improved last week. In fact, the whale concentration also increased.

According to IntoTheBlock data, the percentage of whale concentration increased from 4% in February 2023 to 9% in September 2024.

Source: IntoTheBlock

However, the rest of the metrics looked bearish. For example, ADA’s Open Interest decreased, while the NVT ratio showed a sharp increase. This suggested that Cardano was overvalued, indicating a price correction.

Source: Santiment

Weighted sentiment also fell, meaning bearish sentiment increased. Other than that, at the time of writing, ADAs fear and greed index was in a “greed” zone.

When the measure reaches this level, it indicates that the likelihood of a price correction is high.

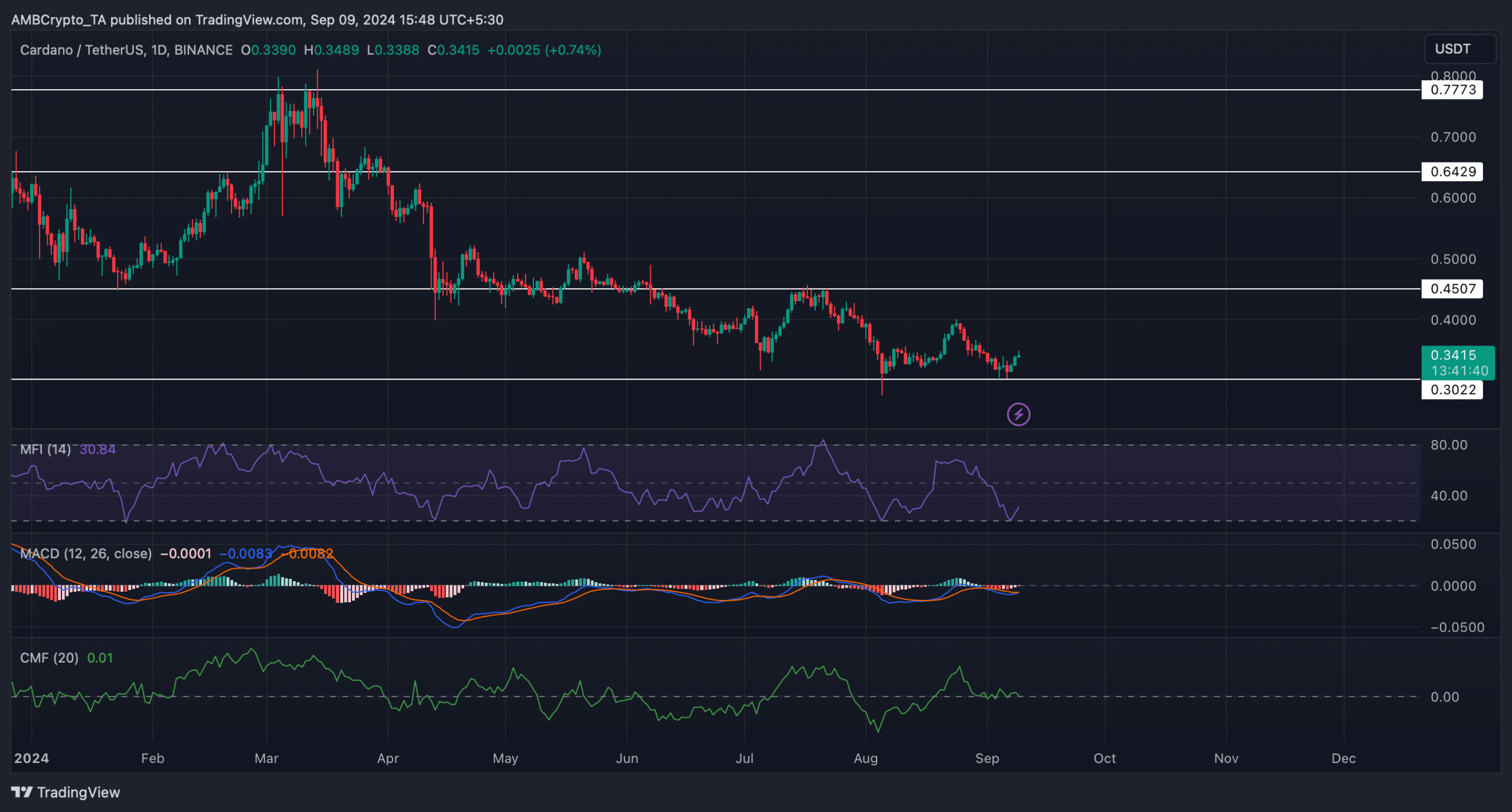

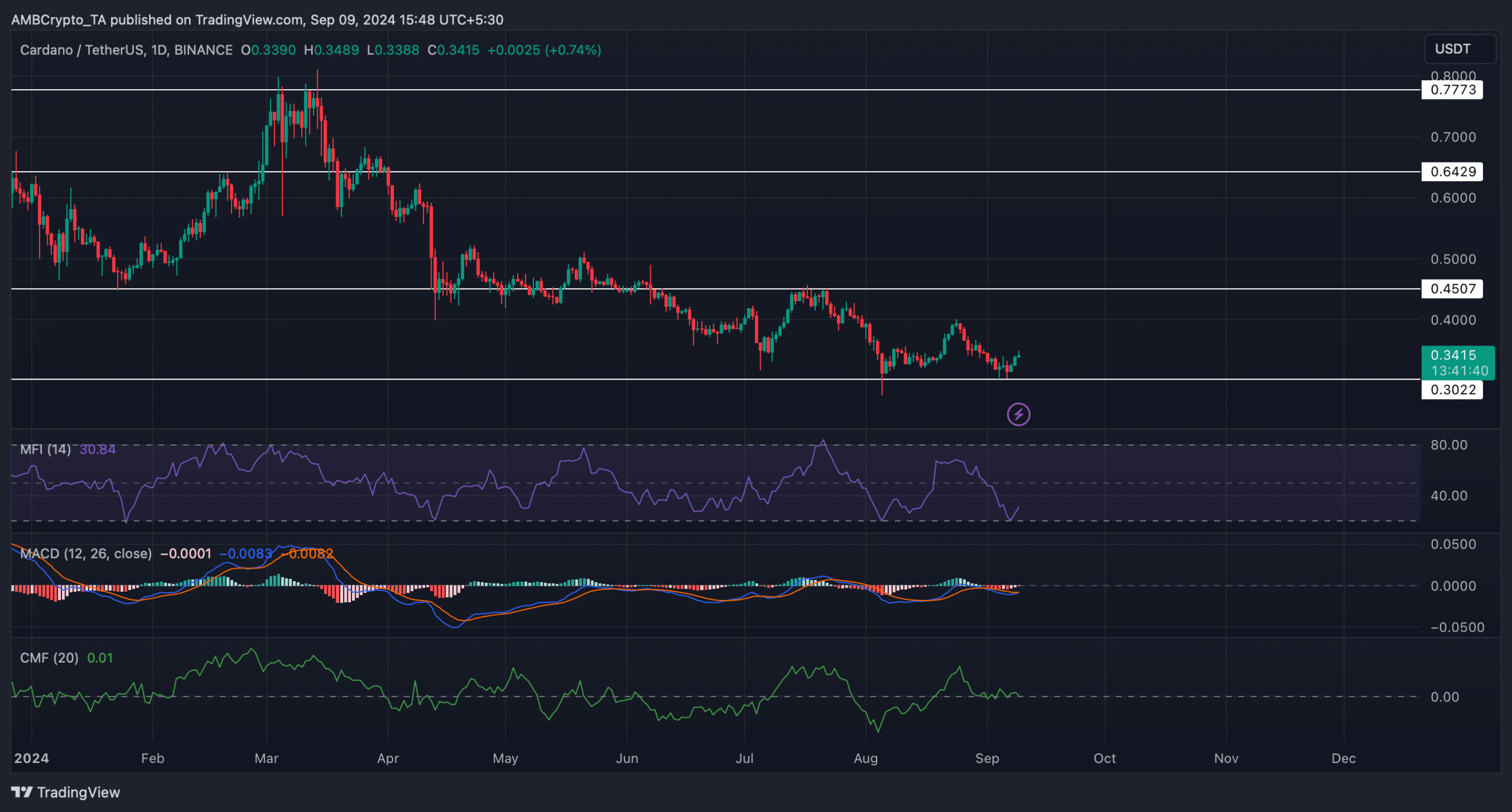

So we next checked ADA’s daily chart. The technical indicator showed a bullish crossover. The Money Flow Index (MFI) also registered a rebound, indicating that the ADA is likely to rise above the bull pattern.

Realistic or not, here it is The market capitalization of ADA in terms of BTC

If that happens, the ADA could first reach $0.45 in the coming days. A slip above that would see the token target $0.54. Moving further north, the last stop before $1 could be $0.77.

Nevertheless, the Chaikin Money Flow looked bearish as it moved sideways near the neutral point. If the bears take back control, the ADA could fall back to $0.3.

Source: TradingView