In a brutal turn, mantra [OM] More than 90% fell in 24 hours and fought $ 68 million in value.

Co-founder JP Mullin blamed ‘reckless’ liquidations and denied misconduct but investors remain skeptical. With graphs in free fall and sentiment crashing, many call it a live carpet trekking.

Whether it is lost or something worse, the collapse of the mantra is the last warning story in Crypto.

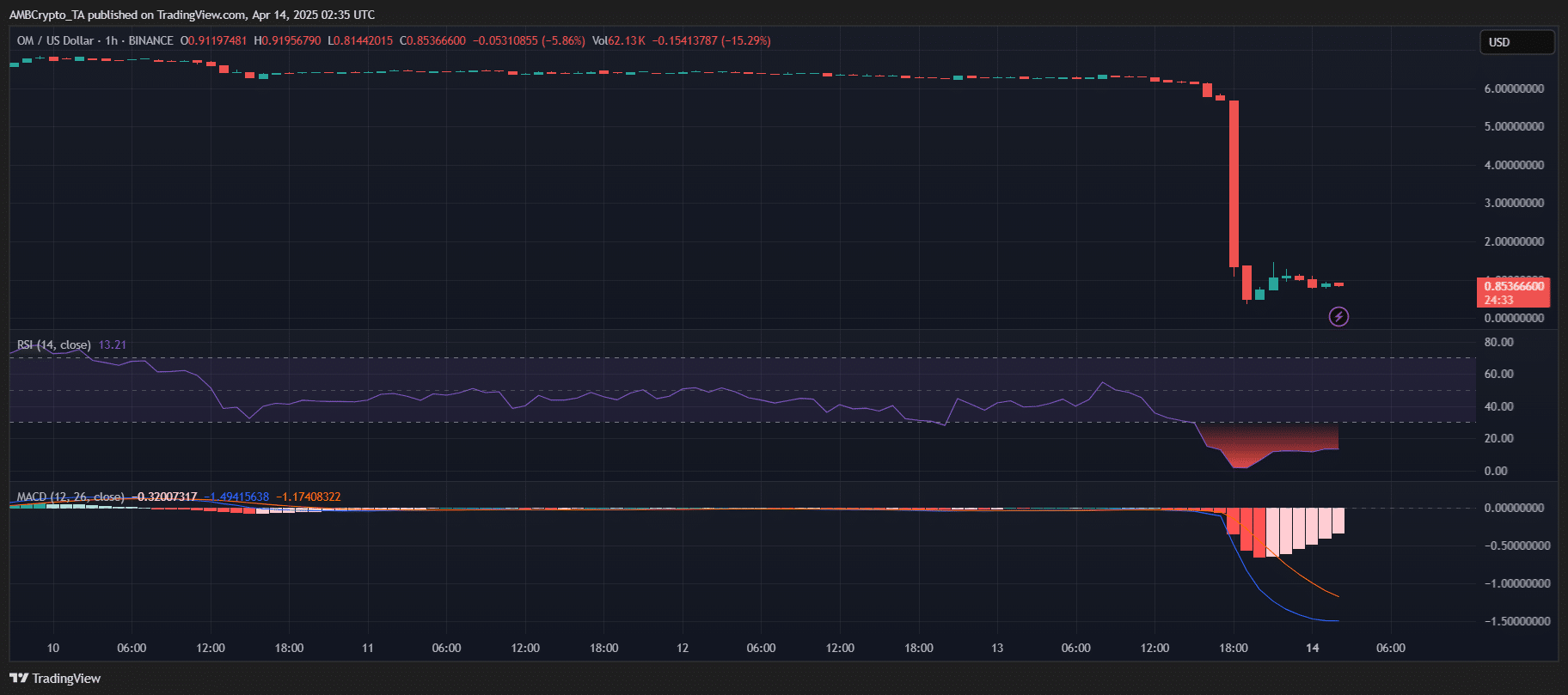

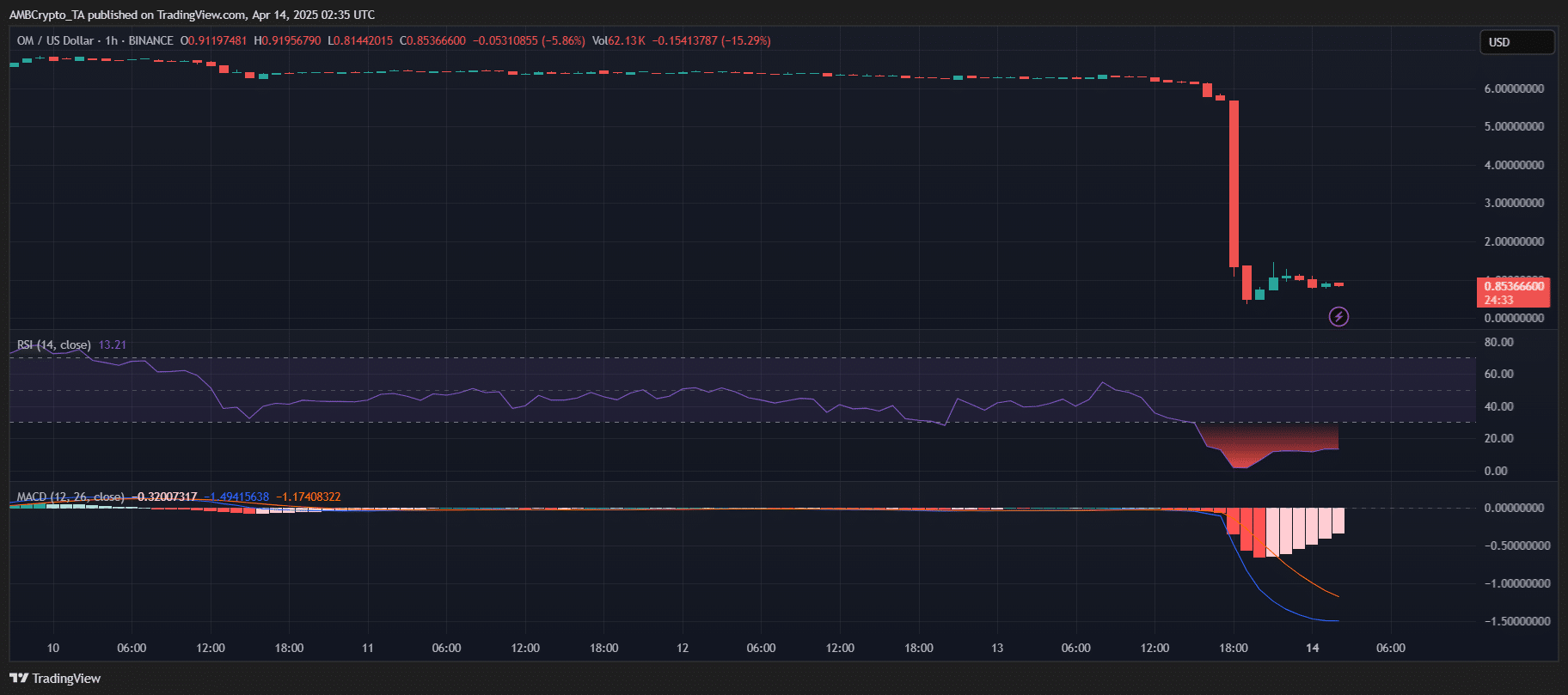

OM is in a deadly spiral

Source: TradingView

The dramatic crash of mantra-of about $ 6.30 to as low as $ 0.50 is activated on leverage-heavy crypto markets.

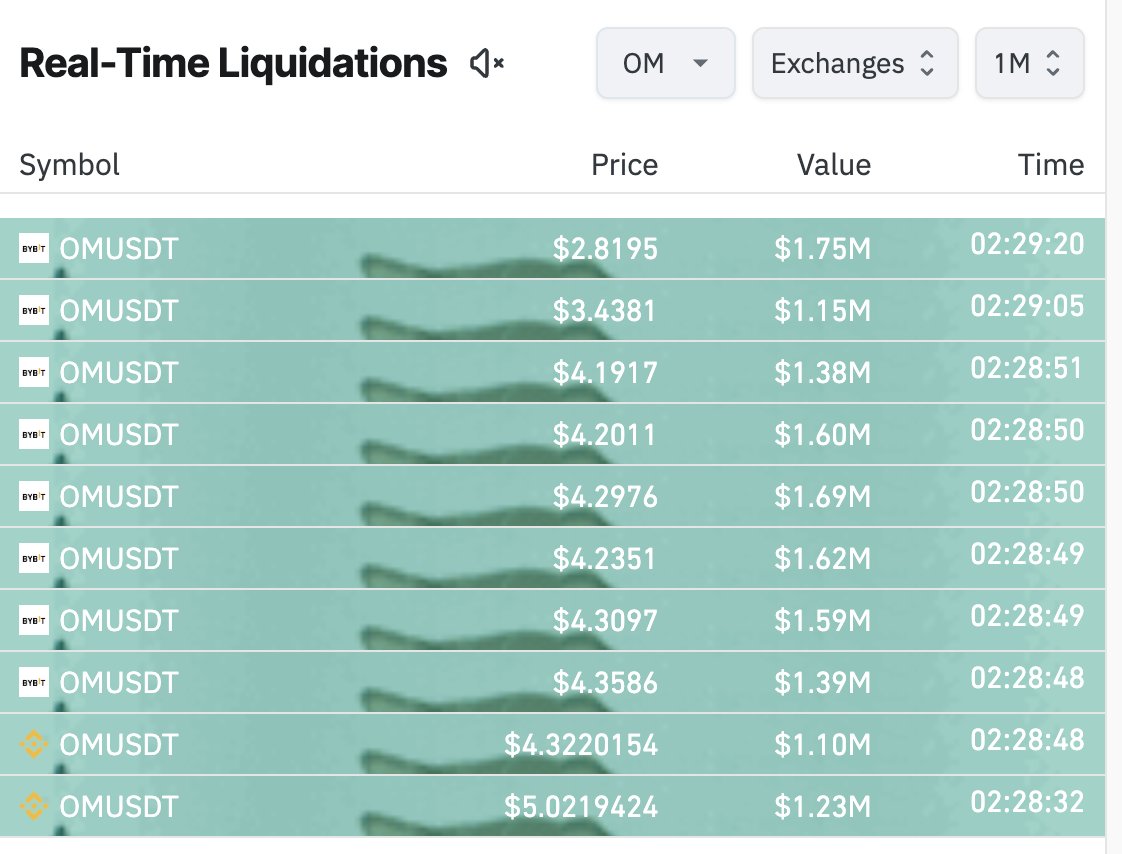

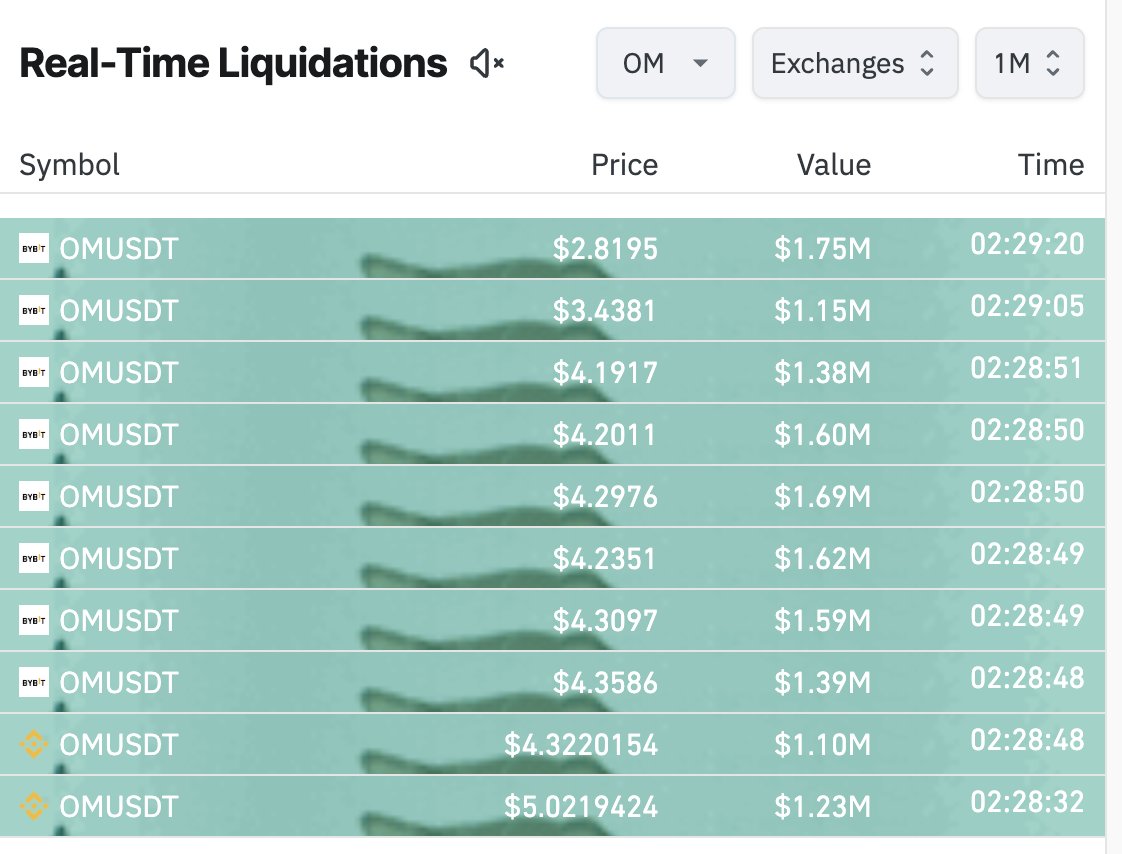

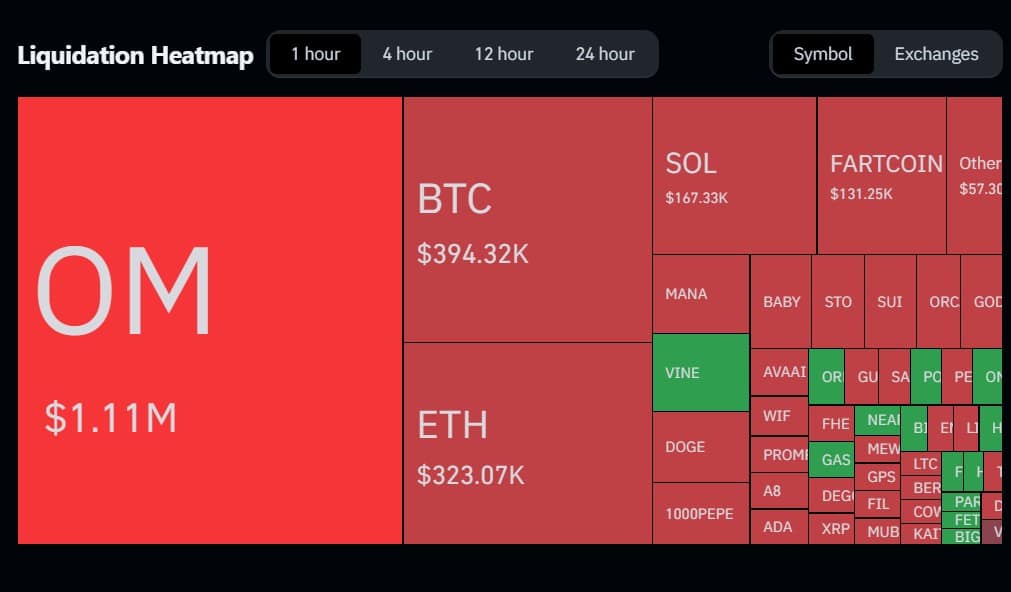

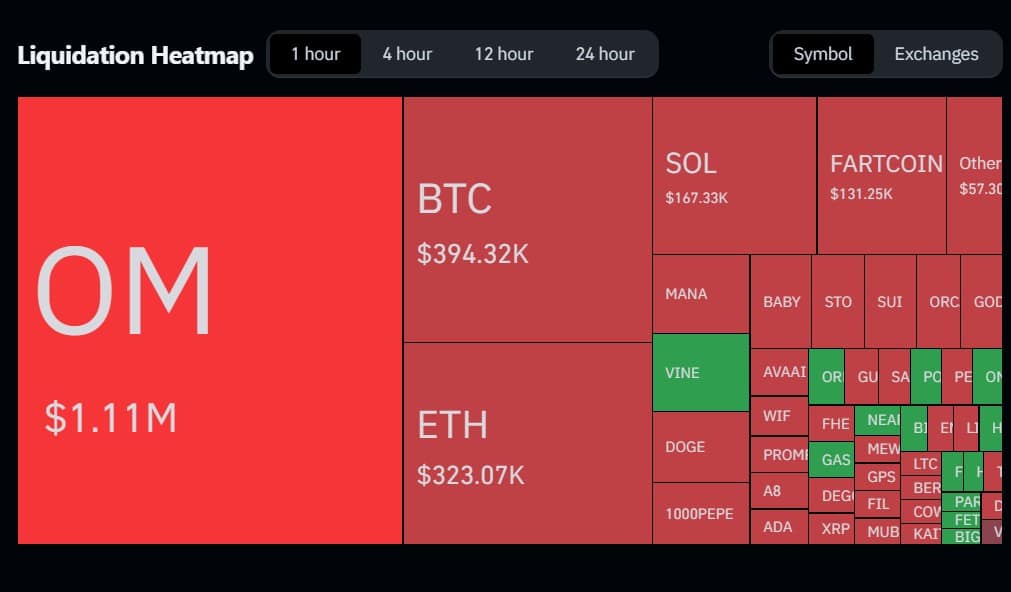

To suffer not only from the largest price fall, but also led the liquidation warmth. Within only 12 hours, traders liquidated More than $ 68 million in long positions, including more than 10 transactions of more than $ 1 million.

Source: X

In the last hour alone, $ 1.11 million were on for long positions Enormouslyeven surpass Bitcoin [BTC] and Ethereum [ETH] In liquidation volume.

Source: Coinglass

The rapid immersion caught the lift-delivered traders overwhelmed and led to a chain reaction of margin calls as omnoves through important support levels.

Other tokens such as Solana [SOL] and even the joke Munt Fartcoin [FARTCOIN] Saw liquidations – but nobody came close to Om’s scale. It is a rare face when BTC and ETH are relegated to supporting roles in the liquidation leader board.

Chaos Maybe started With a 3.9 million for payment of a possible team portionian to OKX.

With almost 90% of the offer reported by the team – and a history of market manipulation, delayed airdrops and OTC deals with a discount – escalated panic sale quickly.

As OTC buyers went under water, a wave of outputs causing stair -like liquidations may have caused.

Mantra blames CEXS, but the market is crying carpet trekking

JP Mullin, co-founder of Mantra Chain, defended The project after the liquidation crash of $ 1.11 million, blaming “reckless forced closures” by centralized fairs during hours with low liquidity. He insisted that the tokens remained under the fortress schedules and claimed that the team, investors and advisers were not sold.

But traders don’t buy it.

On X exploded accusations of manipulation. Prominent market keeper, altcoingordon, compared The collapse of earlier disasters:

“Largest rug Trek since Luna/FTX?”

Another user called “one of the greatest scams I’ve ever seen in Crypto”, accusative The OTC Dumpen and Requirements team “The team then belongs to prison.”

Screenshots Online claimed that 90% of the stock of OM was dumped and Mantra removed his telegram and fed the fears of the exit welder. A message went as far as It burns the situation: “Welcome to Terra Luna v.2.”

Market commentator Miles Deutscher called The OM crashes a handbook cabinet of inflated valuations. He emphasized that liquidity is more important than market capitalization.

“The graph hadn’t looked normal for a while,” he noticed, pointing to a broader problem of prices that deviate from Fundamentals. As a confidence in Fades, he sees the potential for capital to rotate in more credible RWA protocols.

The same script, different token

From Terra Luna’s catastrophic $ 60 billion crash in 2022 to the criminal downfall of FTX, crypto has had to deal with countless carpet trekkings.

Now, COmgaris for events from the past are on the rise because the OM is confronted with a liquidation of $ 1.1 million and accusations from Insider Dumpen.

Whether it is a deliberate scam or real market disk location, one thing remains clear: the cryptomarkt is ruthless and fast in its judgment.