On August 14, MANTRA, a dedicated layer-1 (L1) blockchain for real-world assets (RWAs), announced a partnership with Novus Aviation Capital. This partnership aims to tokenize assets within the $200 billion aviation finance market.

Doing this makes asset ownership more accessible and streamlines the process in aviation financing.

MANTRA and Novus to offer fractional ownership in aviation via tokenization

Founded in 1994, Novus Aviation Capital specializes in aircraft trading, leasing and financing. Moreover, it has a significant presence in Europe, Asia and the Middle East.

By partnering with MANTRA, Novus now aims to integrate blockchain technology into aviation asset management, improving transparency and efficiency. The partnership focuses on leveraging MANTRA’s blockchain infrastructure to tokenize aviation assets. This process also promises to increase liquidity, reduce risk by making fractional ownership and high-quality assets accessible to a wider range of investors.

Read more: Where to buy tokenized or fractionalized real estate and art

Mounir Kuzbari, co-CEO of Novus Aviation Capital, emphasized the strategic importance of the partnership. He mentioned that Novus Aviation Capital’s goal is to innovate and collaborate with its partners to deliver strong risk-adjusted returns within the aviation sector.

“By partnering with MANTRA, we are exploring the benefits of tokenization to broaden our investor base and simplify the process of purchasing, financing and trading aircraft,” Kuzbari said in a statement.

John Patrick Mullin, co-founder and CEO of MANTRA, also expressed his excitement about this collaboration. He acknowledged that the aviation financing market is recognized as a substantial asset class with significant potential benefits that could arise from tokenization.

“By tokenizing aviation assets, we are introducing a new asset class to the RWA sector, democratizing access to aviation financing. This partnership will unlock new opportunities for Web3 users and introduce a new flow of funding to the aviation industry. Tokenization of aviation assets also has the potential to reduce risk exposure for individual investors through fractionalization,” Mullin explained to BeInCrypto.

Read more: How to invest in real-world crypto assets (RWA)?

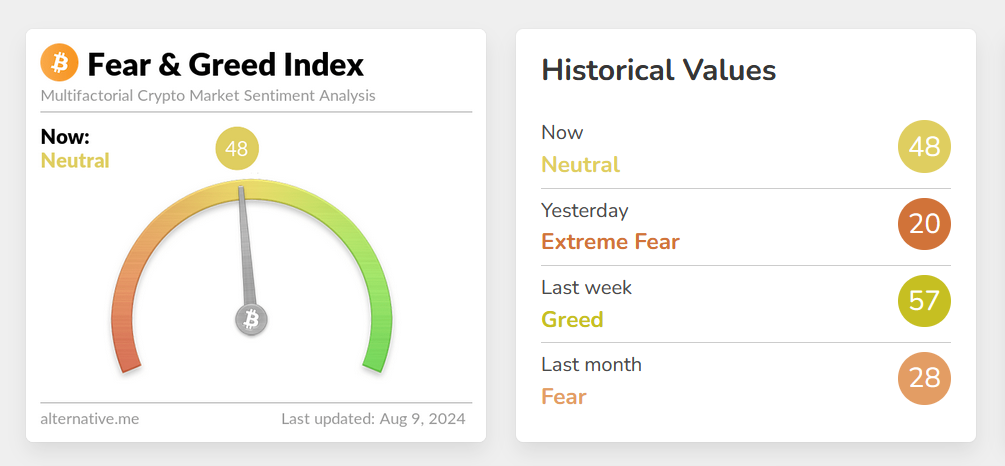

Market forecast for tokenized assets by 2030. Source: McKinsey

This collaboration also aligns with broader trends in the financial sector, where traditional financial players are increasingly exploring tokenization. A recent McKinsey report suggested that the market for tokenized financial assets could reach $2 trillion by 2030. The report highlighted the potential of tokenization to democratize investments by lowering barriers to entry and enabling more investors to participate in high-value assets.