- DAI supply fell to the lowest level this year.

- MKR’s MVRV ratio showed that most holders were making profits at the time of writing.

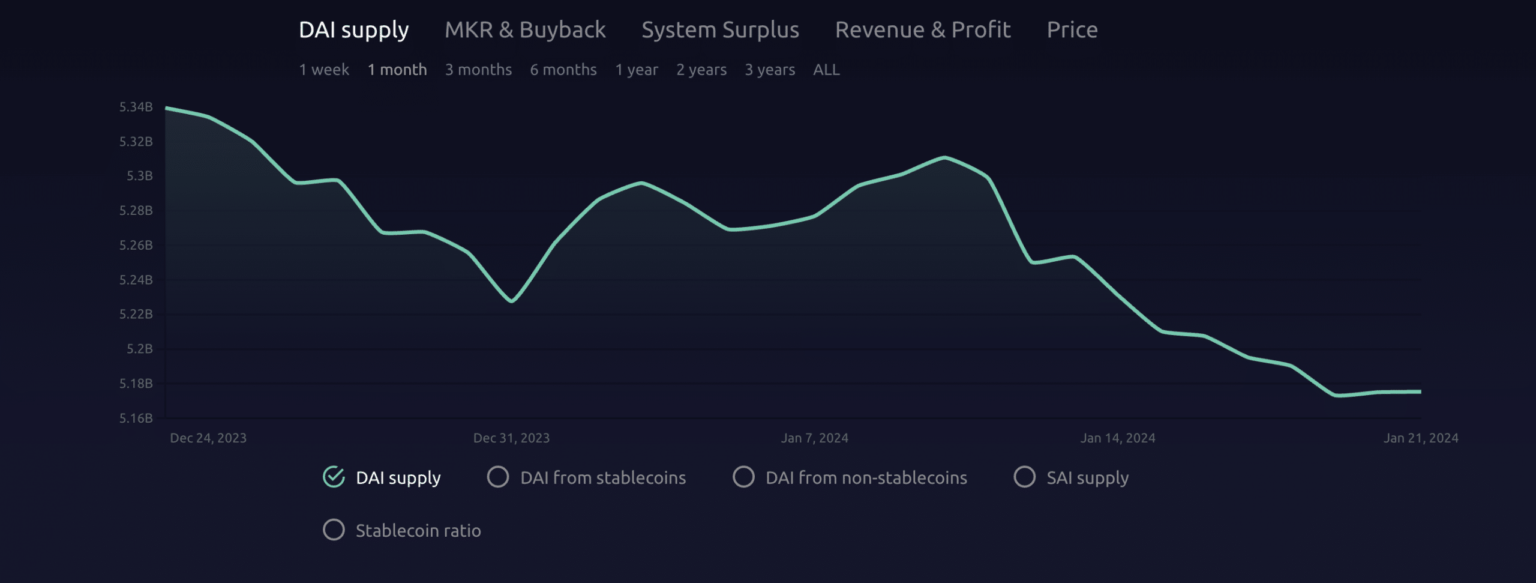

The complete range of MakerDAOs [MKR] decentralized stablecoin, DAI, has fallen to its lowest level since the start of the year, according to data from MakerBurn.

AMBCrypto reported previously that the stablecoin’s supply recovered in the first two weeks of the year after hitting a four-month low on December 31, 2023.

However, due to the decline in prices of some of DAI’s underlying assets, supply has steadily declined since January 11.

Source: MakerBurn

The decline in DAI supply is due to the protocol’s Collateralized Debt Position (CDP) model. The CDP system acts as a self-regulating market. When the prices of assets that support DAI fall, interest rates on loans automatically rise.

Therefore, borrowing becomes more expensive as new borrowers avoid taking out loans, and existing borrowers pay back their loans to avoid high costs, which discourages the creation of new DAI.

Maker user activity review

So far this year, the number of active monthly users on MakerDAO has reached 2,000, according to data from Token terminal.

While this represents a 40% drop from the 2,800 active users registered in December, these users’ transaction fees have surpassed December’s total.

Data from Token a Terminal shows that transaction fees on MakerDAO have totaled $16.5 million over the past 20 days, marking a 9% increase from the $15.1 million recorded in December.

AMBCrypto found that MakerDAO fees and the revenue generated from them have been steadily increasing over the past year. Over the past twelve months, these have each grown by 35%. In the past six months they are up more than 400%.

Realistic or not, here is MKR’s market cap in BTC terms

MKR holders are all smiles

At the time of writing, MakerDAO’s native token MKR was trading at $1,990. While the values of many crypto assets have fallen or risen within a narrow range over the past month, MKR’s value has risen 53%, according to data from CoinMarketCap.

Source: CoinMarketCap

As a result of the price increase, MKR trades were mostly profitable last month. An assessment of the token’s daily transaction volume profit-to-loss ratio yielded a value of 2.21. This meant that for every MKR trade that ended in a loss, 2.21 trades produced a profit.

Source: Santiment

Similarly, a market value to realized value (MVRV) ratio of 40.94% at the time of writing meant that the token’s market value was 40.94% higher than the average price at which holders acquired the asset. That’s why they kept profits.