A widely followed crypto trader thinks improving macroeconomic conditions and easing selling pressure bode well for Bitcoin (BTC).

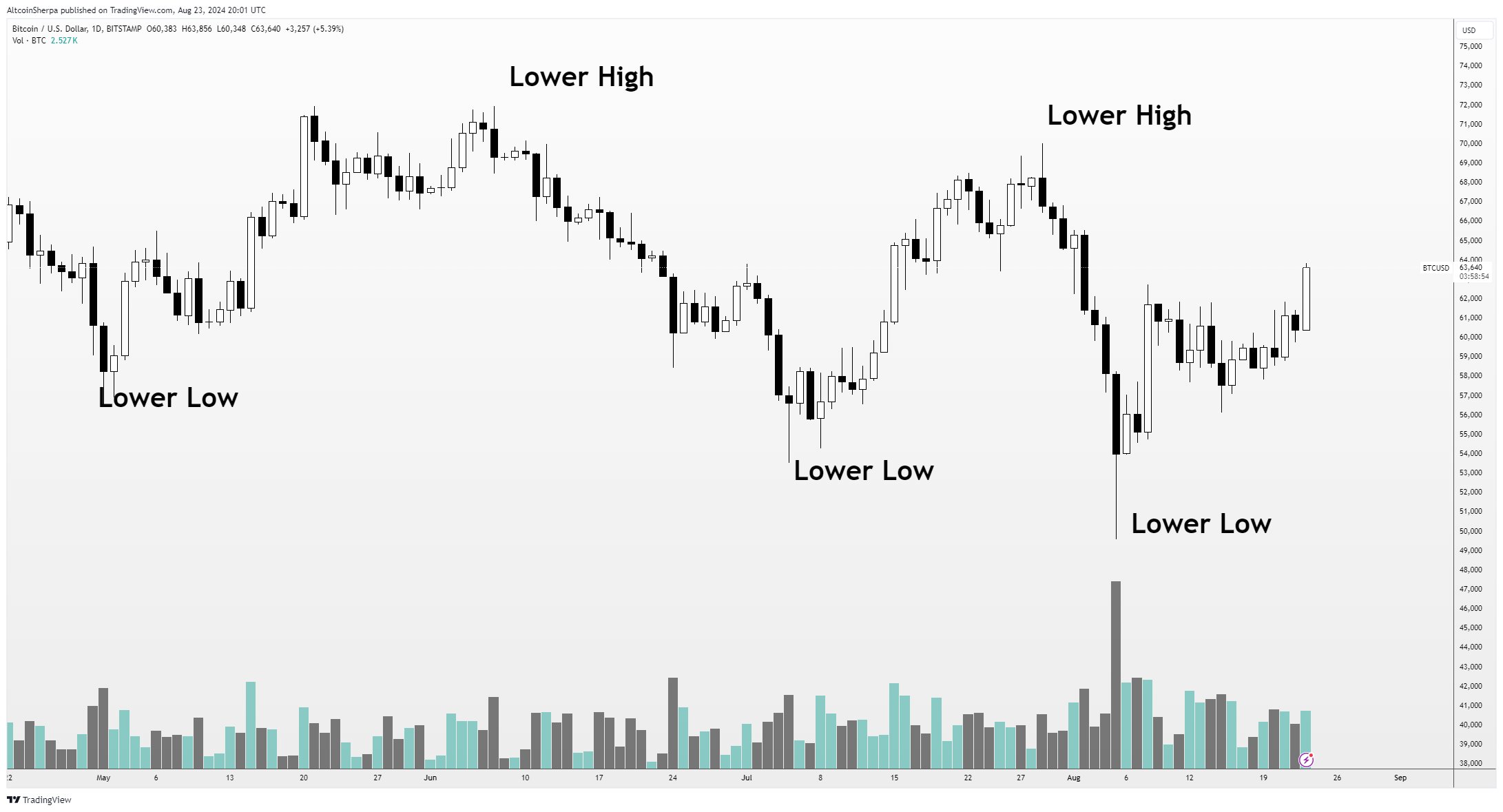

Pseudonymous analyst Altcoin Sherpa tells his 220,300 followers on social media platform X that he is bullish on Bitcoin, even as BTC’s market structure on the daily chart remains bearish.

“Personally, I’m not that scared. Macro conditions and massive supply glut look largely stable/bullish for us as we enter the third/fourth quarter.

I hope we break the recent high at $70,000 and form a higher low. Bullish in the short term.”

Last week, Fed Chairman Jerome Powell hinted at coming rate cuts in a speech at the Jackson Hole Symposium.

According to the CME’s FedWatch tool, investors and traders can now to see a 61.5% chance that the Fed will cut rates by 25 basis points at the September Federal Open Market Committee (FOMC) meeting and a 38.5% chance that the Fed will cut rates by 50 basis points.

Meanwhile, the German government has finished offloading billions of dollars worth of Bitcoin and the defunct crypto exchange Mt. Gox has until October to repay creditors approximately 142,000 BTC.

Looking at Bitcoin’s final hurdle, Altcoin Sherpa believes BTC’s resistance around $71,000 has been exhausted after multiple tests.

“The resistance becomes weaker the more times it is tested. We’ll be back for more.”

Zooming in, the analyst predicts a new Bitcoin peak as BTC forms a bull flag on the one-hour chart.

“Expansion coming soon BTC.”

A bull flag is seen as a continuation pattern, indicating that an asset is consolidating and gearing up for another rally.

At the time of writing, Bitcoin is trading at $64,104.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: DALLE3