- Litecoin performed better than Bitcoin, powered by liquidations, but risks remain due to market volatility

- Analysts insist on caution, because LTC is confronted with important support challenges and continuous price fluctuations

Litecoin [LTC] recently showed a slight lead over Bitcoin [BTC] In the short term, with some Bearish positions that are liquidated during the process. This increase in the price of LTC has led to optimism among traders, but analysts insist on caution.

Despite the rally, the market remains volatile, making risk management essential.

LTC’s short-term performance liquidations of fuel De Rally, but caution is required

Litecoin has seen a decrease of 5.54% in the last 24 hours and traded at $ 119.74 in the charts after a high point of $ 127.30. Despite this withdrawal, however, LTC performed better than Bitcoin in the short term. The liquidation of Beerarish positions probably contributed to a temporary price increase before the retracement.

Source: TradingView

Data indicated that although LTC registered a strong meeting in mid-February, rejection on important resistance hinted on profit and market uncertainty.

In the meantime, BTC saw a decrease of 20.51%before he recovered, which reflects a wider market weakness. Analysts have therefore emphasized the importance of Stop-Loss levels, because the volatility remains high with important LTC support for $ 114 and $ 110.

Litecoin Market Analysis

Recent analysis also emphasized a dynamic market landscape.

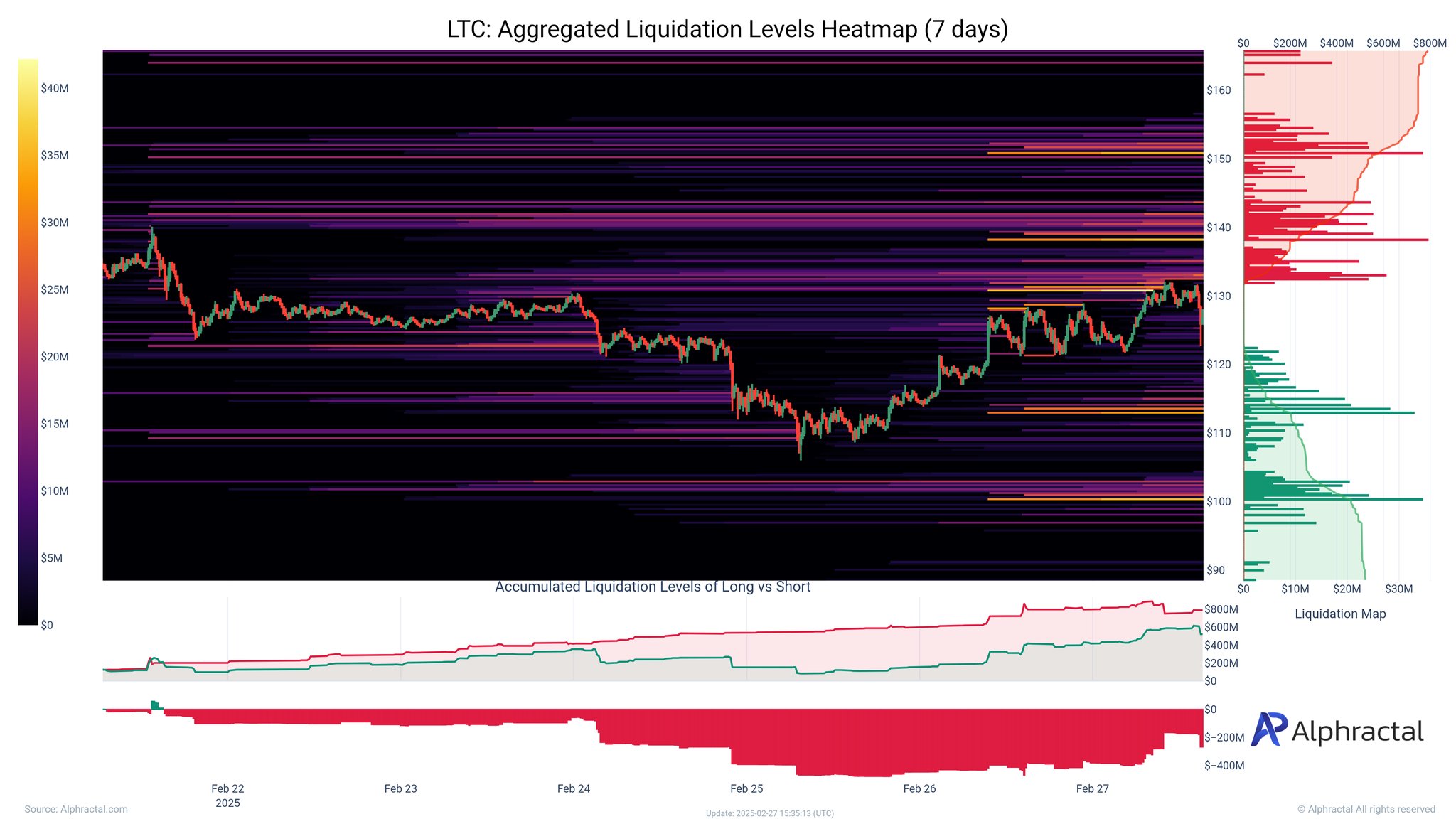

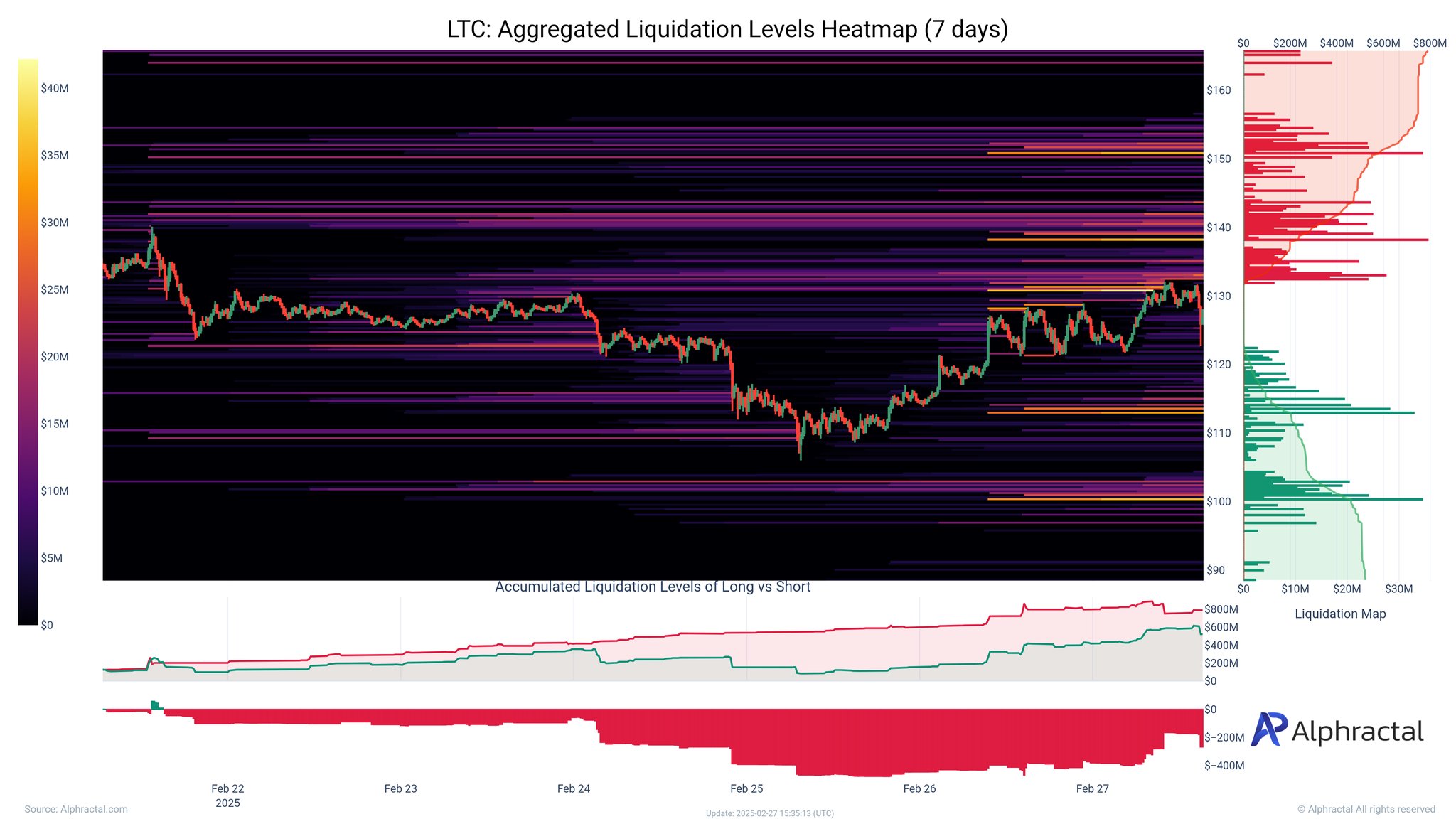

A seven-day liquidation heat revealed a significant activity on key levels-strong liquidations near $ 130 resistance and long liquidations near $ 110 support. The cluster of short liquidations above $ 130 suggested that Beerarish positions were pressed when LTC tried to gather in the charts.

Source: Alfractaal

This rally was largely powered by short liquidations.

However, as LTC approaches the $ 110 level, long liquidations will be pronounced more, so that potentially downward risk is demonstrated if the sales pressure increases. The overall trend also emphasized more short liquidations than longs – reinforcement that bears were forced during the upward movement.

Source: Alfractaal

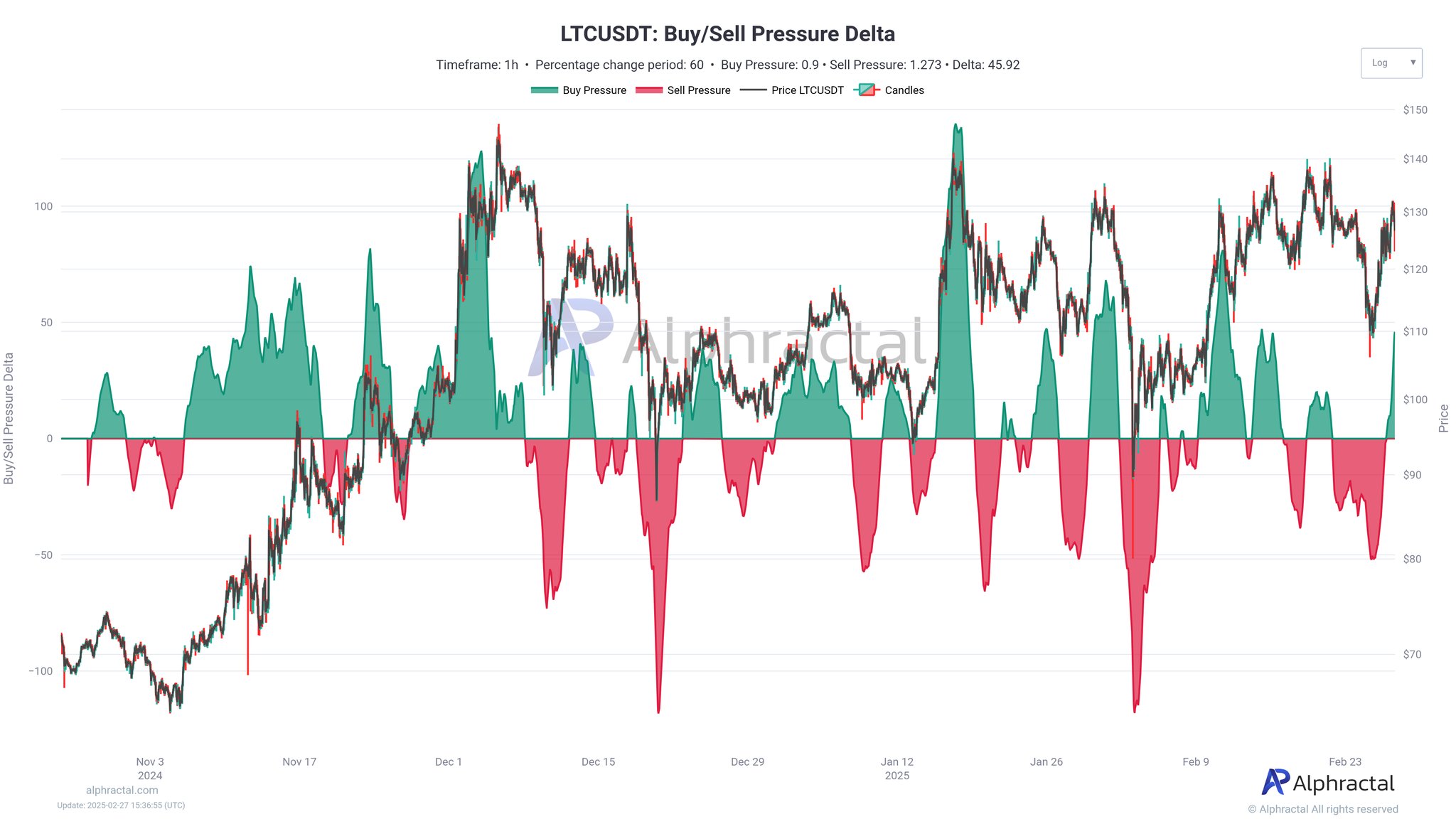

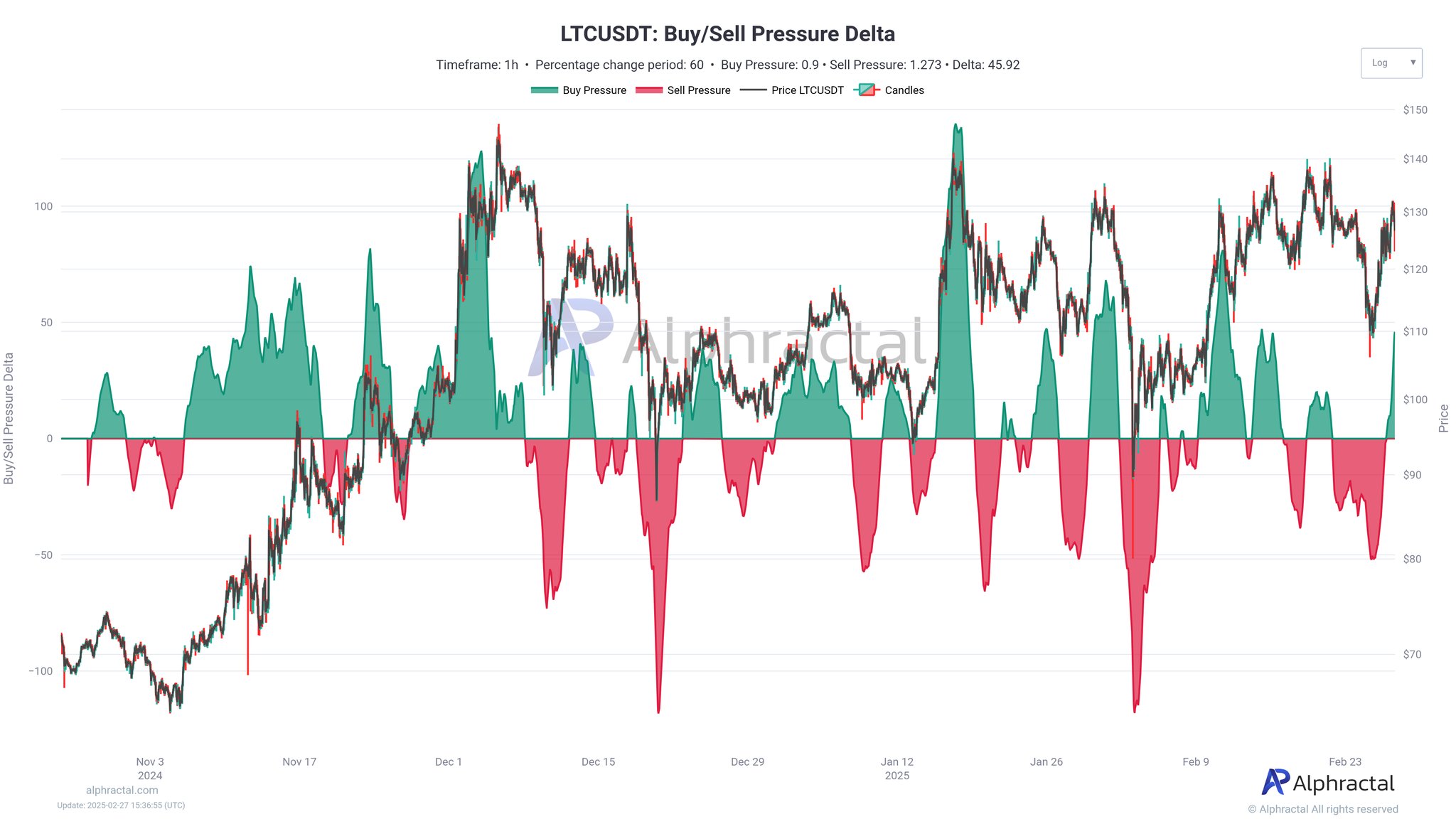

The Buy and Sell pressure graph underlined important moments of accumulation and distribution.

During the Rally of LTC, the dominance of the buy-side pushed the price higher. As the momentum delayed, the sales pressure increased, which indicates taking a profit or a shift in sentiment. Nevertheless, the demand has remained strong in the vicinity of the support, by pointing a potential rebound when LTC stabilizes.

Source: Alfractaal

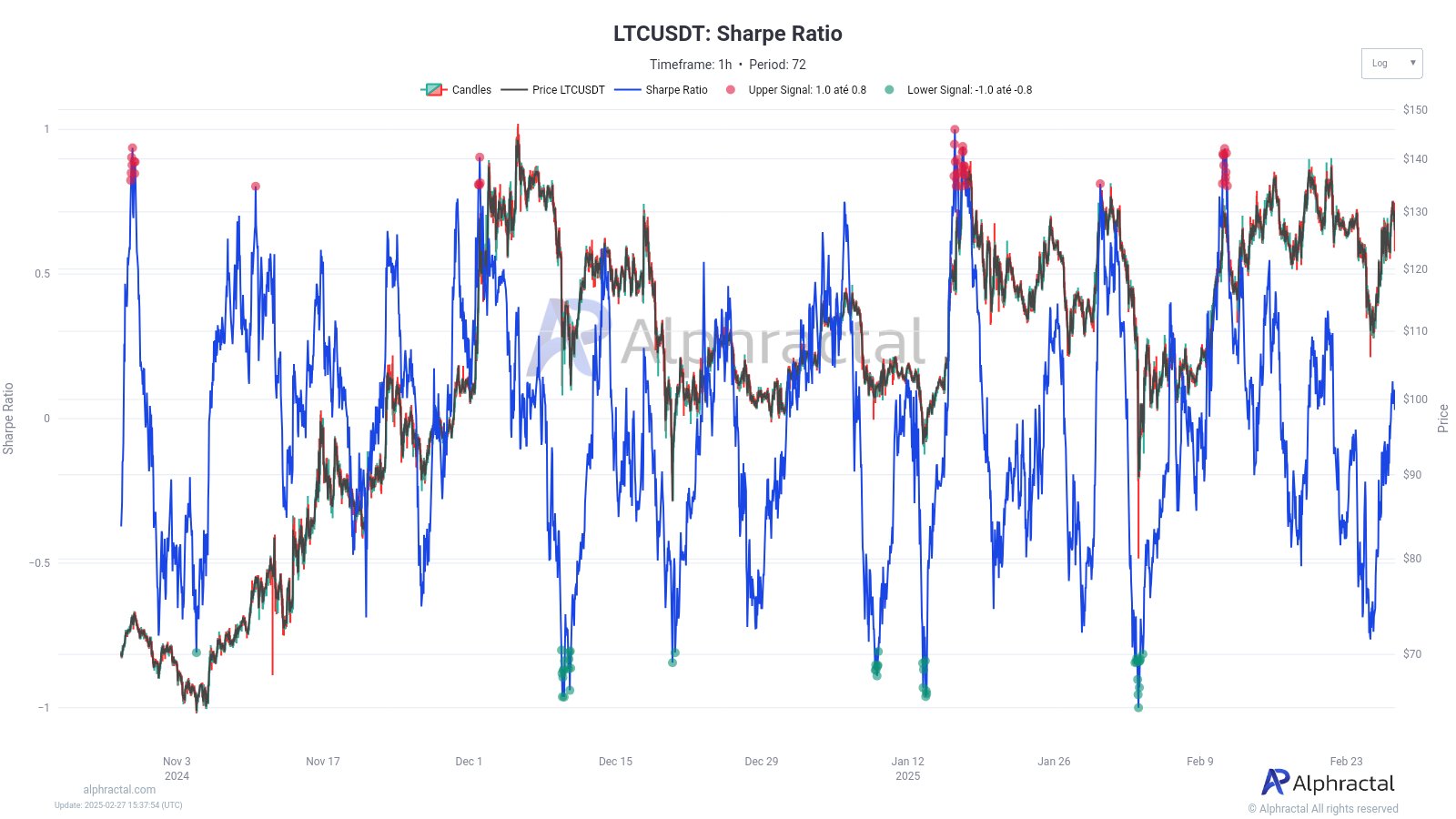

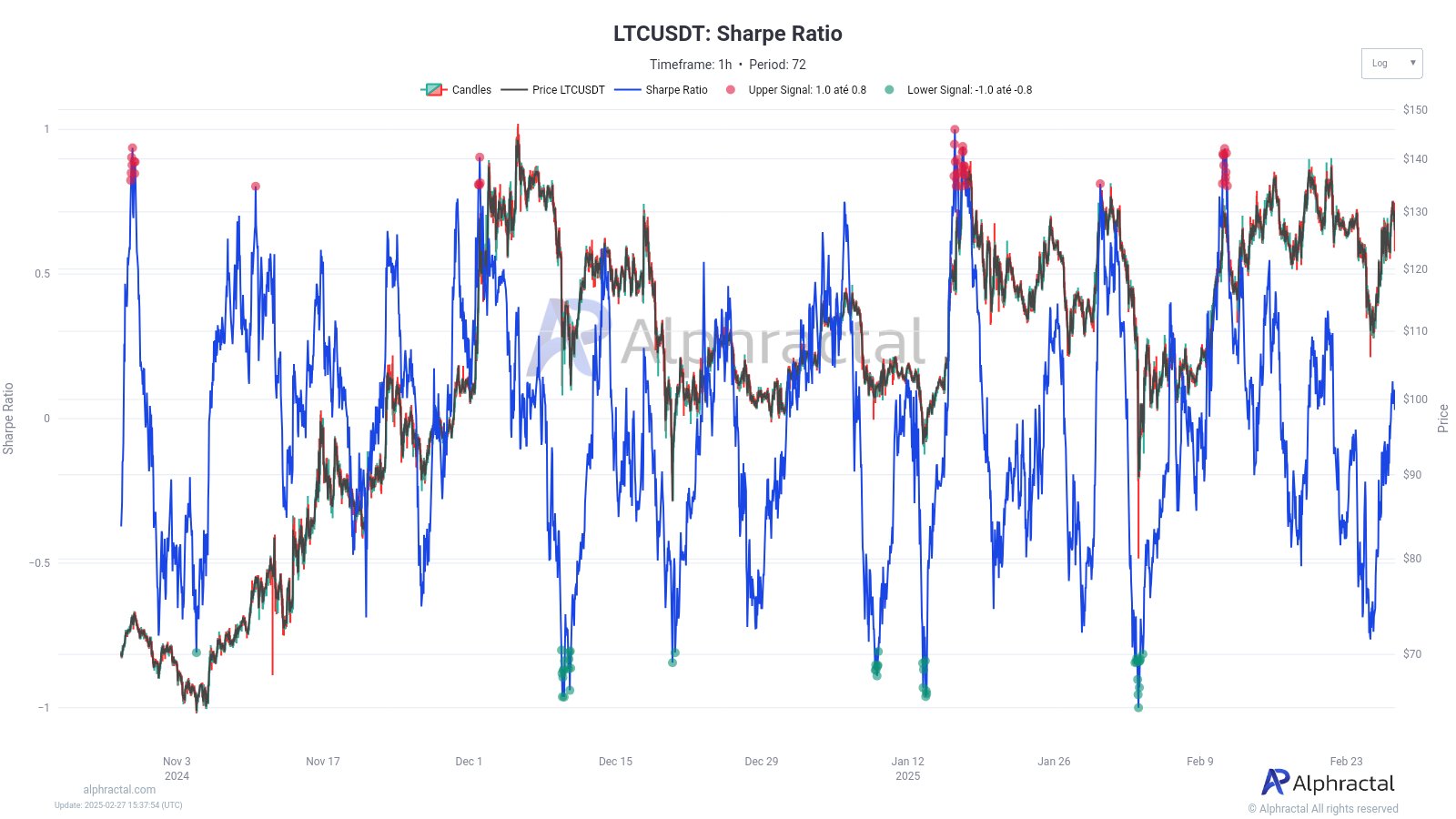

Finally, the Sharpe ratio, with spikes above 0.8, indicates conditions in which the return risk, often leads to corrections. Conversely, dips below -0.8 indicate undervaluation, with the risk outweighing the potential return.

At the time of writing, the Sharpe ratio of LTC seemed to return from a recent low point and a sign that although volatility persists, risk-corrected returns can improve in the near future.