Volatility in the cryptocurrency landscape has skyrocketed in the run-up to the US elections. Amid this, Litecoin (LTC) has reached a make-or-break level that could potentially lead to the liquidation of millions of dollars in traders’ positions.

Litecoin (LTC) Technical Analysis and Upcoming Level

According to expert technical analysis, Litcoin (LTC) is trading within a bullish channel pattern and is currently at the lower boundary, which acts as a support level. Historically, whenever the LTC price reaches this level, it experiences buying pressure and an upward rally. This time, however, traders and investors expect a similar upward move.

Based on the recent price action, there is a high chance that the asset could rise 16% to reach the $77 level in the coming days if LTC sustains itself above the $64.5 level.

On the other hand, some believe that LTC may not be able to hold this support level due to the strong volatility in the cryptocurrency market. If this happens, the asset could experience a 15% price drop and reach the $55 level in the coming days.

As of now, LTC is trading below the 200 Exponential Moving Average (EMA) daily, indicating a downtrend. Meanwhile, the Relative Strength Index (RSI) suggests a potential upward rally in the coming days as the index is currently in the oversold zone.

Statistics in the chain

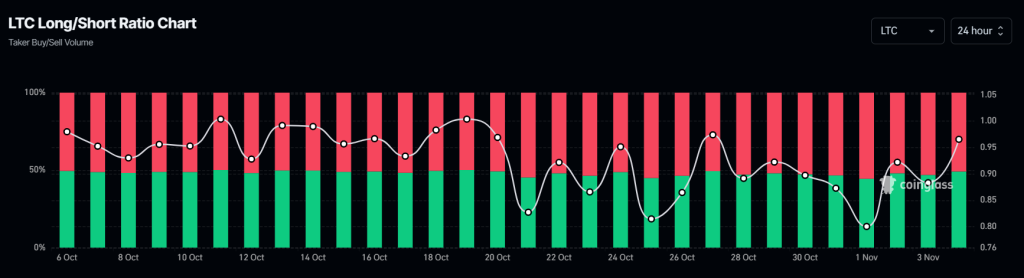

LTC’s mixed sentiment is further supported by on-chain metrics. According to the on-chain analytics company Mint glassLTC’s Long/Short ratio currently stands at 1.001, indicating equal participation from both bulls and bears over the past 24 hours.

Moreover, LTC’s open interest has remained unchanged over the past 24 hours, indicating that traders’ positions are still safe as the price hovers at a critical level. Currently, 50.01% of top traders have long positions, while 49.95% have short positions.

Current price momentum

At the time of writing, LTC is trading around $66 and has experienced a modest price increase of 0.55% over the past 24 hours. During the same period, trading volume fell by 10%, indicating lower participation from traders and investors compared to the day before.