- Litecoin now processes $2.85 billion in transactions over $100,000 per day

- The price of Altcoin rose by more than 13% in seven days, but the trend could change

Litecoin [LTC] has seen a big increase in its networking activity lately, a rise that clearly reflects its popularity and high usage. In the meantime, the crypto’s price action also turned bullish as it registered double-digit growth. Let’s take a closer look at the Litecoin ecosystem.

A look at Litecoin’s network activity

Int0TheBlock recently released a tweet which reveals an interesting development regarding the Litecoin ecosystem. According to the same, Litecoin processes $2.85 billion in transactions above the daily average of $100,000. This accounts for more than 50% of the cryptos’ market capitalization.

This figure is more than the figures of most Tier 1s. For example, Dogecoin sees $590 million in large transactions, despite having roughly three times the market cap of Litecoin.

All these developments suggest that whale activity on Litecoin’s network has been significantly high.

AMBCrypto then checked Glassnode’s facts for more information about LTC’s network activities. We found that active addresses peaked on July 9, reaching 478k. Thanks to the same, the daily transactions of the blockchain also increased during the same period.

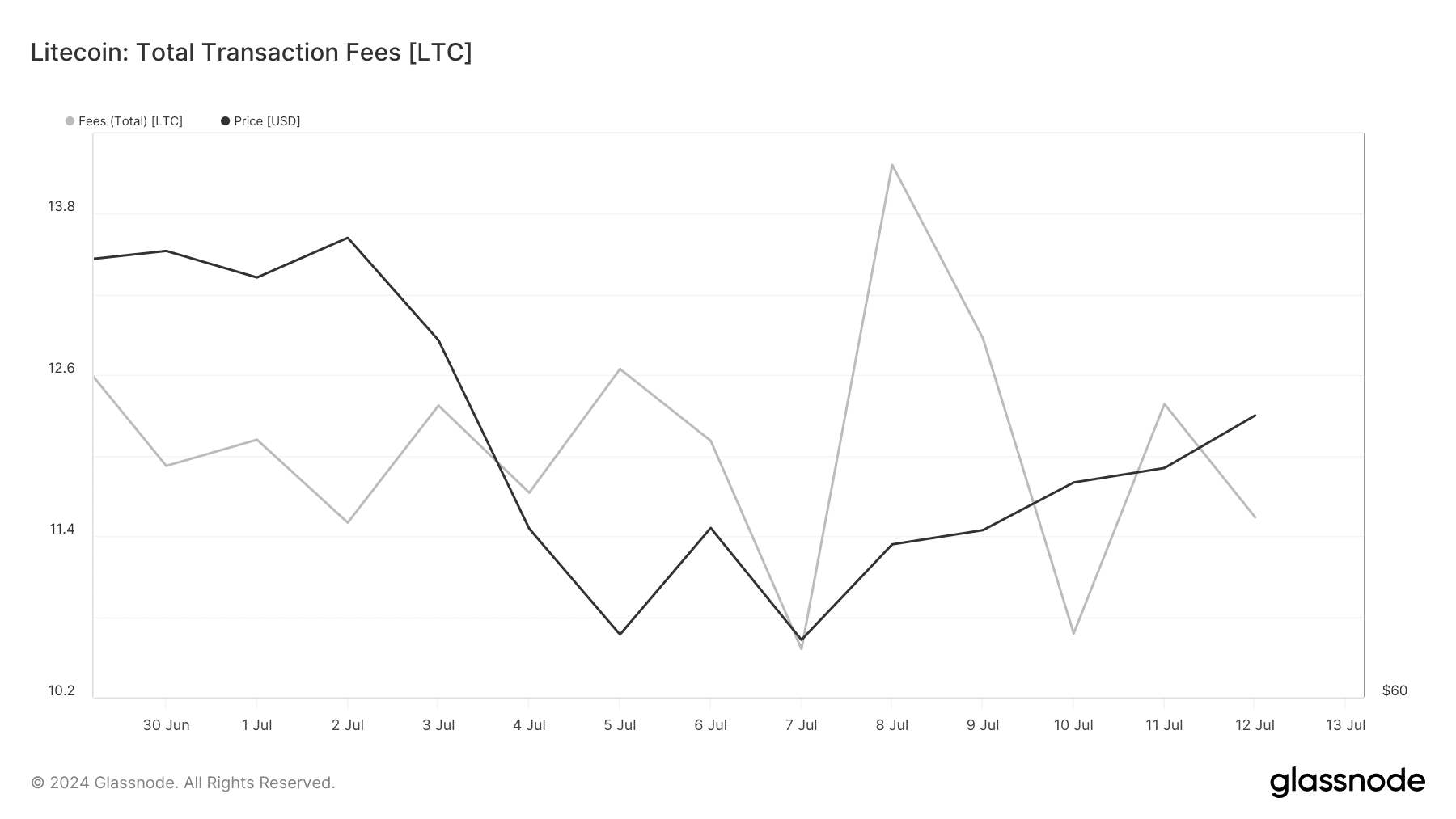

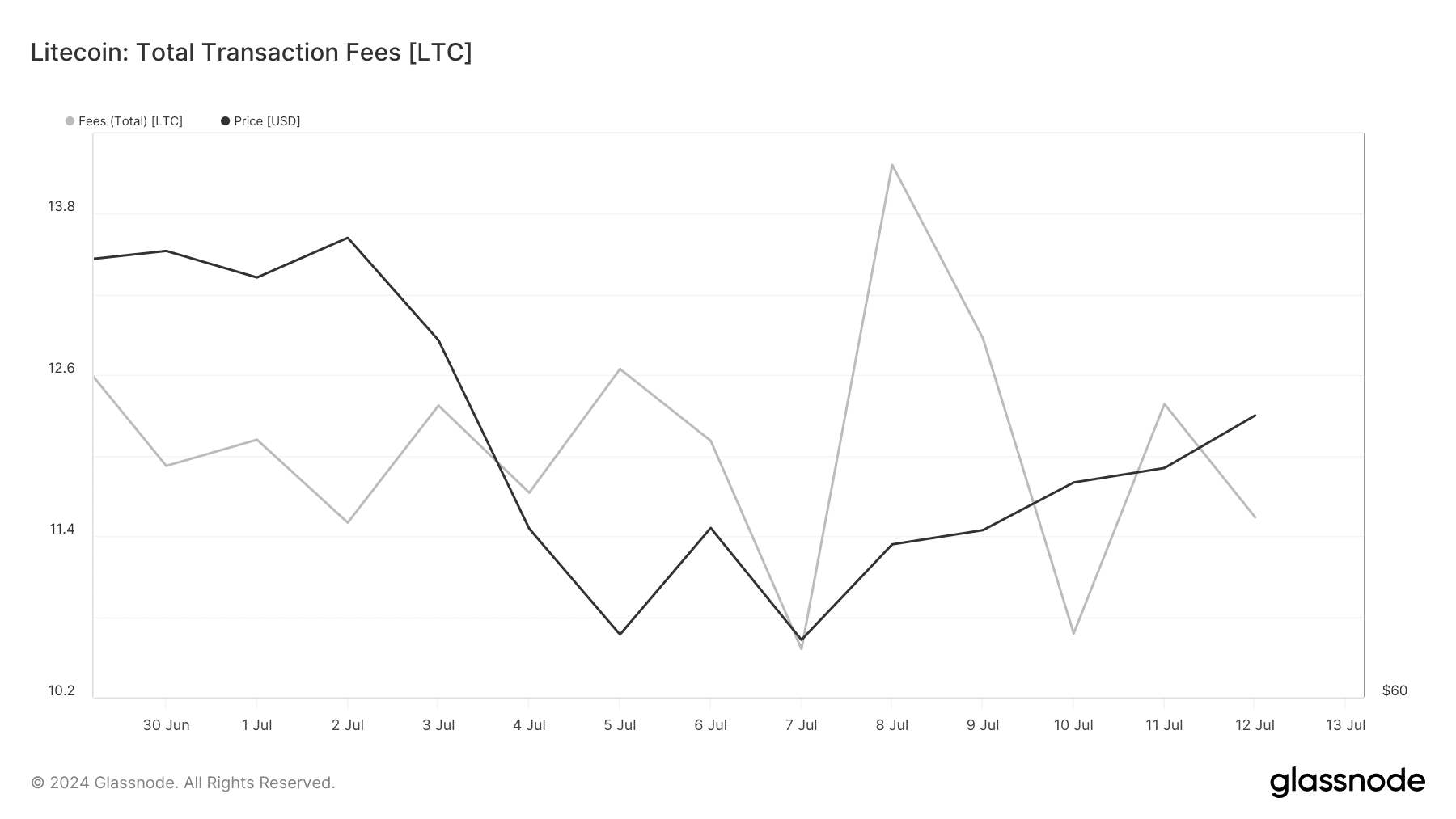

Everything in terms of captured value also seemed quite optimistic for the blockchain. This was the case as fees registered an increase in the charts.

Source: Glassnode

Litecoin bulls are back in action

As blockchain network activity increased, reflecting increased use and adoption, LTC’s price action also turned bullish. In fact, the price of the altcoin rose by more than 13% in the last 7 days. In the last 24 hours alone, the value has risen by more than 2%.

At the time of writing, Litecoin was trading at $70.17 with a market cap of over $5.24 billion, making it the 20th largest crypto.

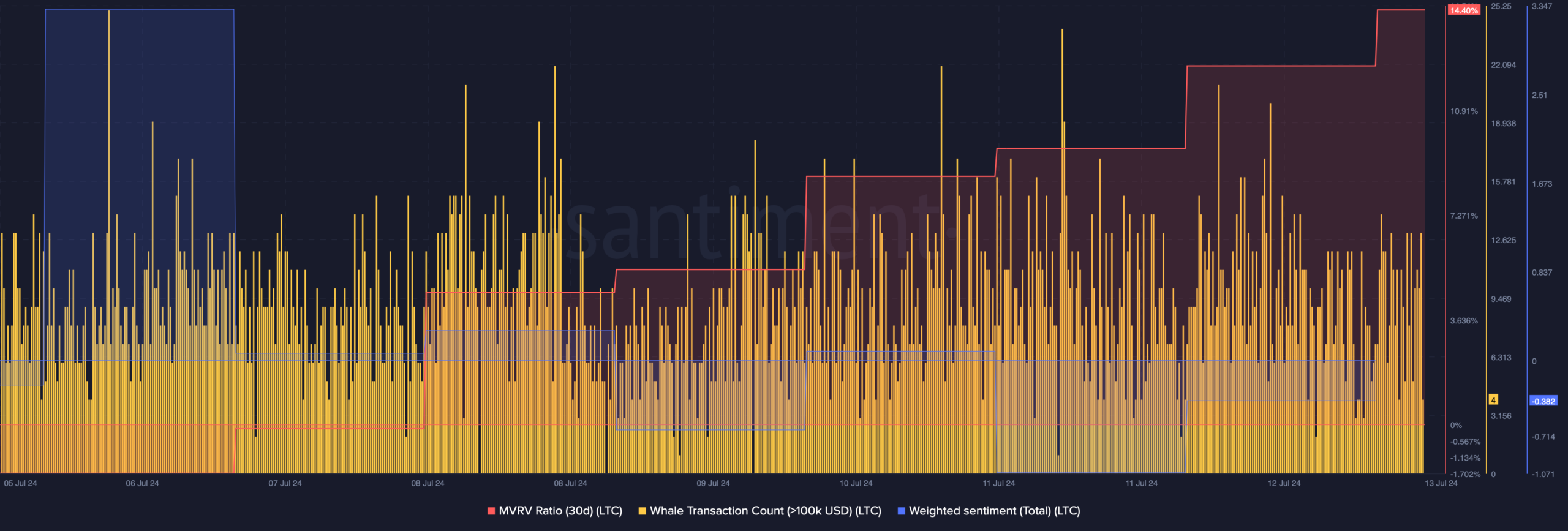

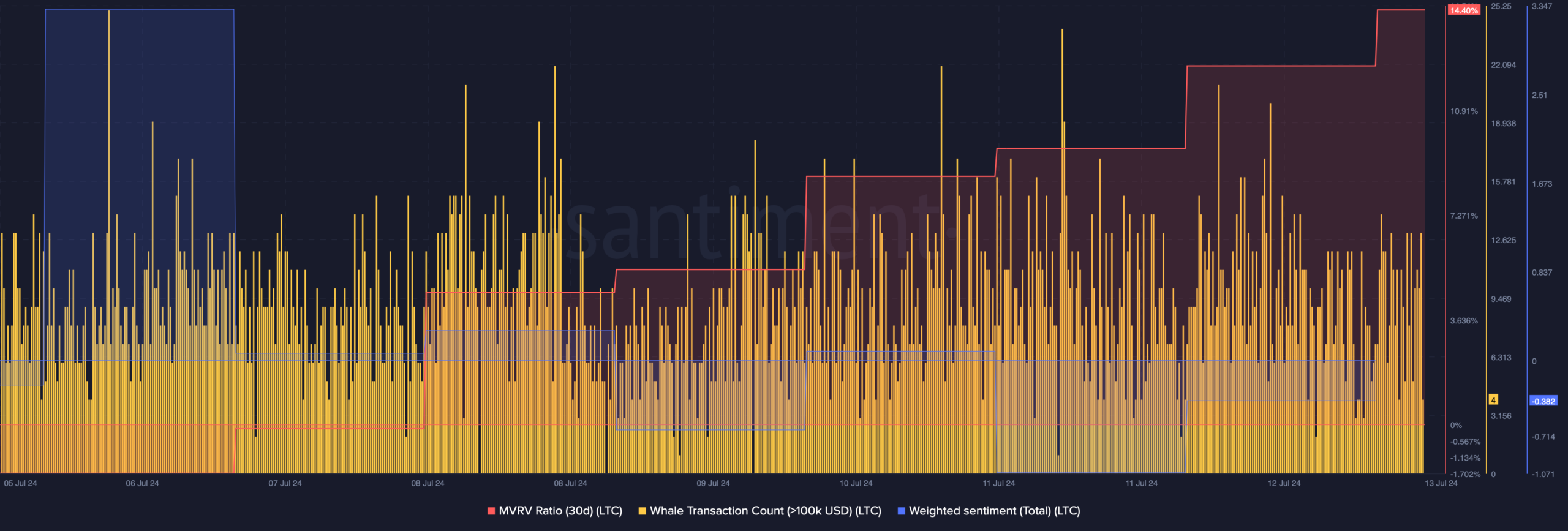

We then analyzed Santiment’s data to see if the numbers indicated continued price growth. According to our analysis, LTC’s MVRV ratio rose sharply last week, which can be inferred as a bullish signal.

In addition, the number of whale transactions also increased, reflecting high whale activity. However, it was surprising to see that despite the recent price increase, market sentiment surrounding the coin remained bearish. This was evident from the decline in weighted sentiment.

Source: Santiment

Additionally, LTCs fear and greed index was at 72% at the time of writing, meaning the market was in a “greed” phase. When the statistic reaches this level, it indicates a possible price correction.

Is your portfolio green? Check the Litecoin profit calculator

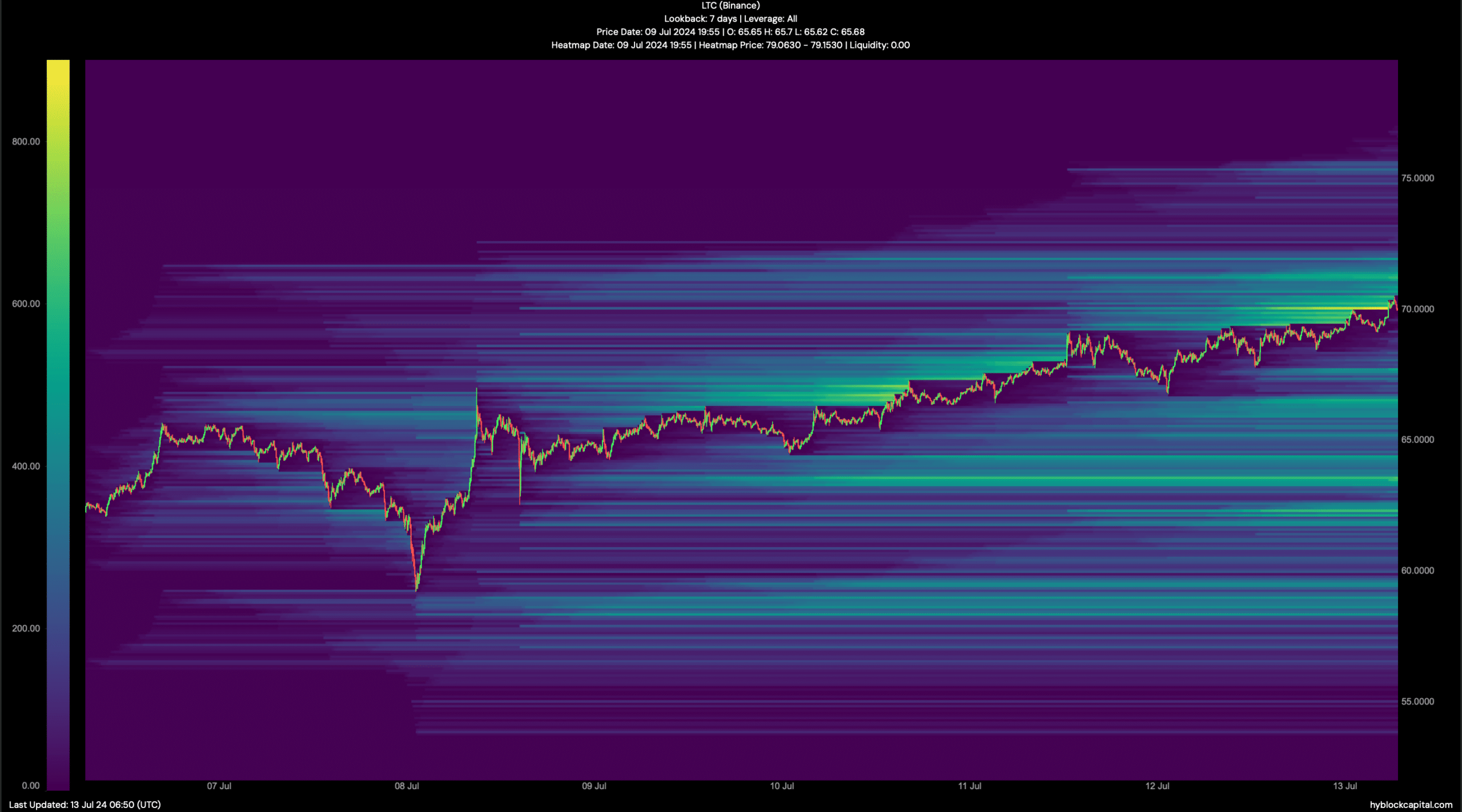

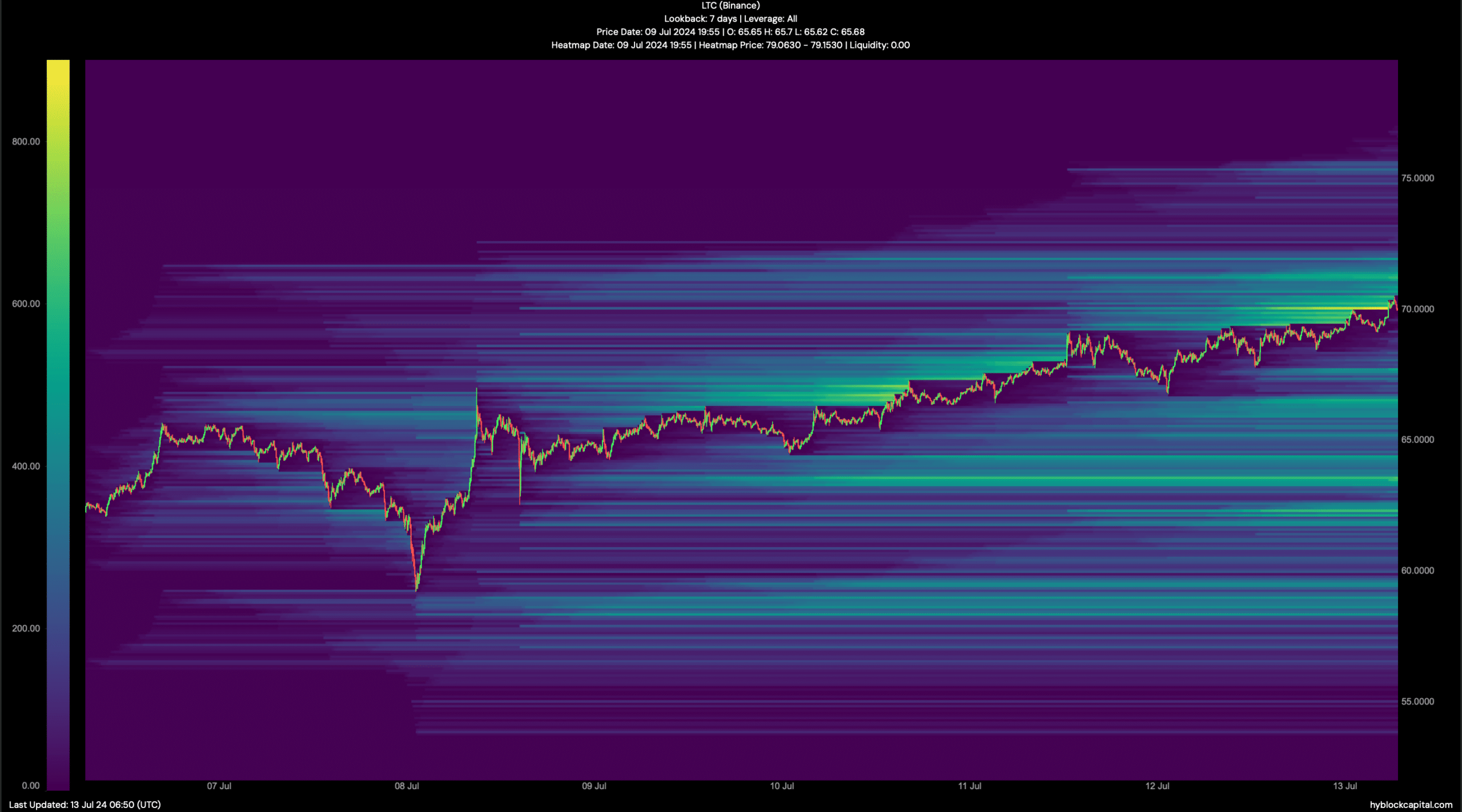

Finally, AMBCrypto took a look at Litecoin’s liquidation heatmap to look for possible support and resistance levels.

According to our analysis, if the bull rally continues, LTC could soon reach $71.8. However, if the trend changes, as some statistics show, investors could see LTC drop to $68.

Source: Hyblock Capital