- Litecoin gained 9.5% last week, defying the broader crypto market downturn.

- Technical analysis indicated a potential breakout to $100, supported by rising Open Interest and SOPR trends.

Litecoin [LTC]one of the top cryptocurrencies by market capitalization, has broken the general bearish trend seen in the crypto market in recent weeks.

While many major assets have been hit hard and fallen by at least 5% or more, Litecoin has managed to hold on and even post gains.

Over the past two weeks, Litecoin has risen 3.5%, and in the past week alone its value has increased by 9.5%.

However, a slight retracement has occurred over the past 24 hours, with LTC now down 0.5% and trading at $65.88 at the time of writing.

Litecoin ready for further growth?

This bullish price action of LTC has caught the attention of traders and analysts. One of these prominent crypto analysts, ZAYK Charts, shared a technical look at Litecoin on X (formerly Twitter).

According to ZAYK Charts, Litecoin was trading within a descending channel formation on the 1-day chart, which could indicate a potential breakout on the horizon.

Source: ZAYK charts/X

For context, a descending channel formation in trading is a technical pattern that occurs when the price of an asset moves within a downward parallel trendline.

This formation indicates that even though the price is trending lower, there could be a potential breakout when the price reaches the lower limit of the channel.

A breakout occurs when the price moves outside the upper limit of the channel, signaling the end of the downtrend and possibly a reversal to the upside.

According to ZAYK Charts, if Litecoin manages to break out of this declining channel, the next target for the asset could reach $100.

Tits projection is based on previous technical patterns observed in the market.

However, this breakout will largely depend on market momentum and whether Litecoin can gather enough bullish support to break through its resistance levels.

Fundamental view of LTC

To support this potential breakout, there has been an interesting move in Litecoin’s fundamentals.

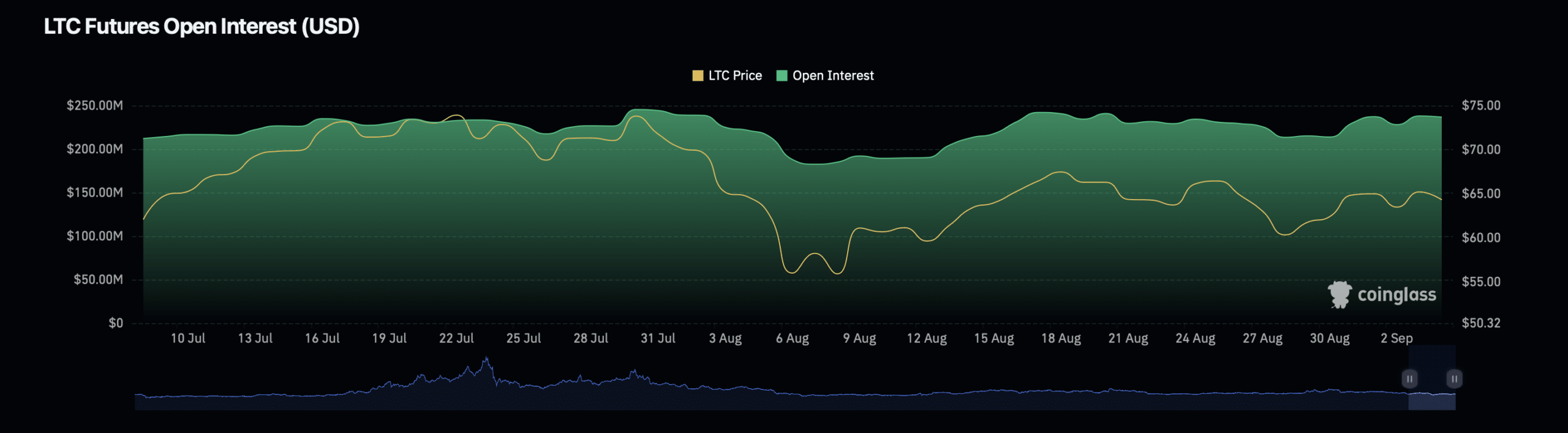

According to facts from Coinglass, Litecoin Open Interest has been on an upward trend, rising 1% to reach a current valuation of $243.96 million.

Source: Coinglass

Open Interest refers to the total number of outstanding derivative contracts (such as futures and options) that have not yet been settled.

The increase in Open Interest suggests that more traders are taking positions in Litecoin, which could indicate increasing interest and confidence in a potential price increase.

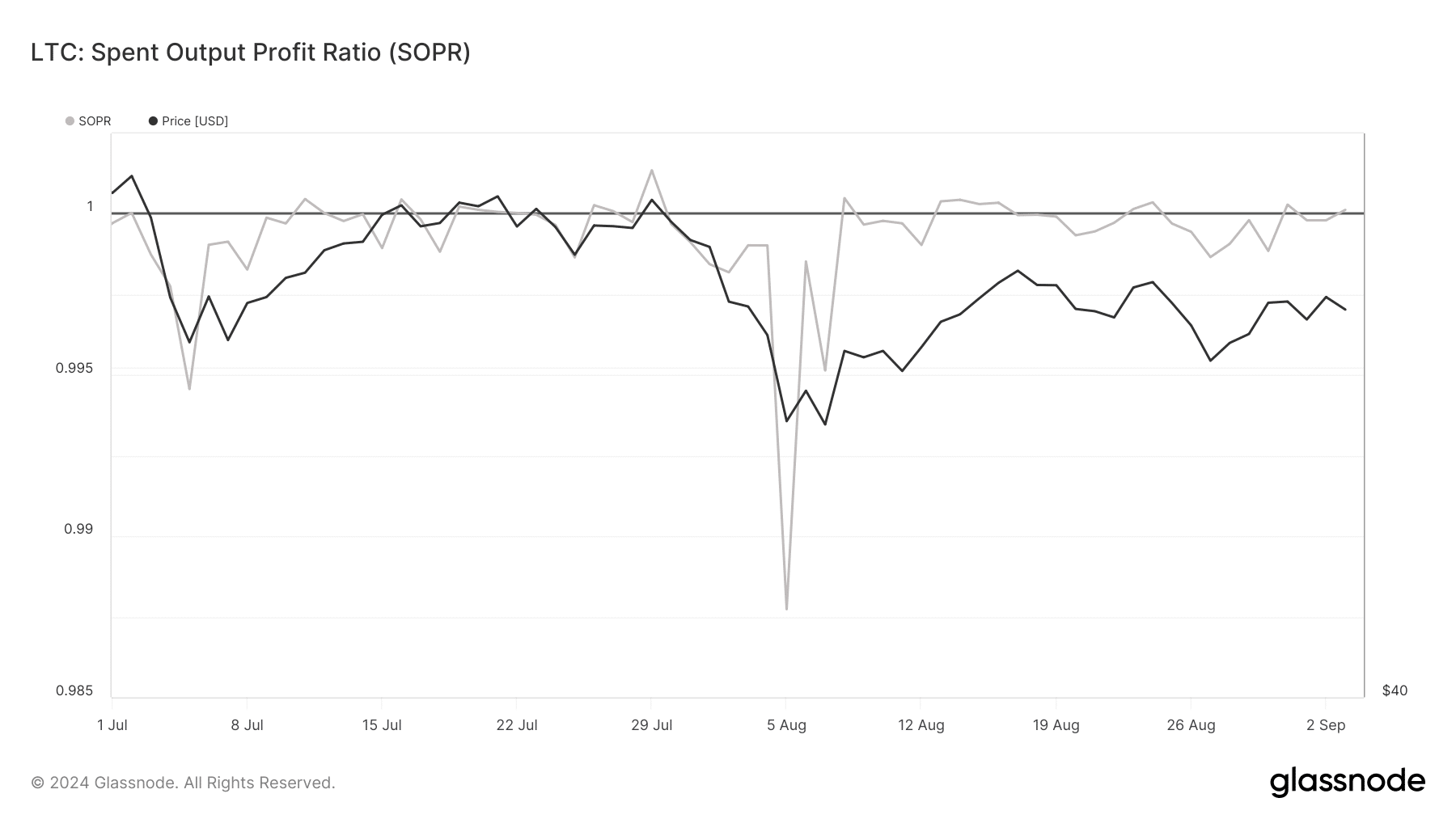

Another important metric to monitor for Litecoin is the spent output profit ratio (SOPR), which measures whether holders sell their assets at a profit or loss.

A SOPR value of 1.0 indicates that coins are selling at their original purchase price, while a value above 1.0 means the holders are selling at a profit, and a value below 1.0 indicates they are selling at a loss.

According to facts from Glassnode, Litecoin’s SOPR has recently shown a slight uptick. After falling below 1.0 early last month, the metric has now returned to 1.0.

Source: Glassnode

Read Litecoins [LTC] Price forecast 2024–2025

This indicates that LTC holders are now, on average, breaking even on their sales, which could indicate a stabilizing market.

A rising SOPR could be a positive sign for the price of LTC, as it could indicate that selling pressure is easing and buyers are becoming more confident.