- Litecoin found favor with Fidelity Digital after it was added to its portfolio

- Update could impact LTC’s price action in the near term

Litecoin has been overshadowed by more popular coins like Ethereum and Bitcoin and this is reflected in its recent performance. However, fortunes could soon change thanks to Fidelity Digital’s latest moves.

Litecoin on Friday confirmed that Fidelity Digital has added LTC to its portfolio of digital product offerings. This is a significant development that will allow Fidelity customers in the US to gain exposure to Litecoin. This also includes institutional investors. The company currently manages assets worth more than $12 trillion.

The addition of Litecoin to Fidelity Digital’s portfolio confirms optimism about the future of the cryptocurrency.

Paving the way for a Litecoin ETF?

Fidelity Digital’s addition of LTC to its portfolio raises speculation about the possibility of a Litecoin ETF in the future. Bitcoin ETFs have received billions in inflows and ETH ETFs have also recently been approved.

Litecoin meets the criteria of assets similar to BTC, such as scarcity and proof-of-work consensus algorithm. However, it’s worth pointing out that Fidelity Digital hasn’t hinted at the possibility of a Litecoin ETF anytime soon.

Either way, the cryptocurrency spotlight could be a stepping stone in that direction, if strong institutional demand makes a comeback.

Will Litecoin regain the $100 price level?

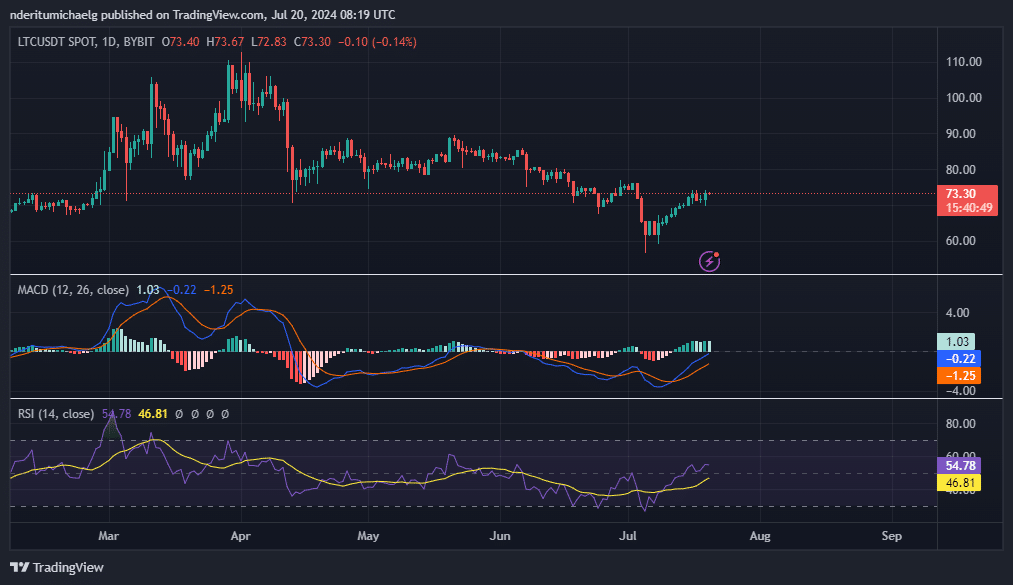

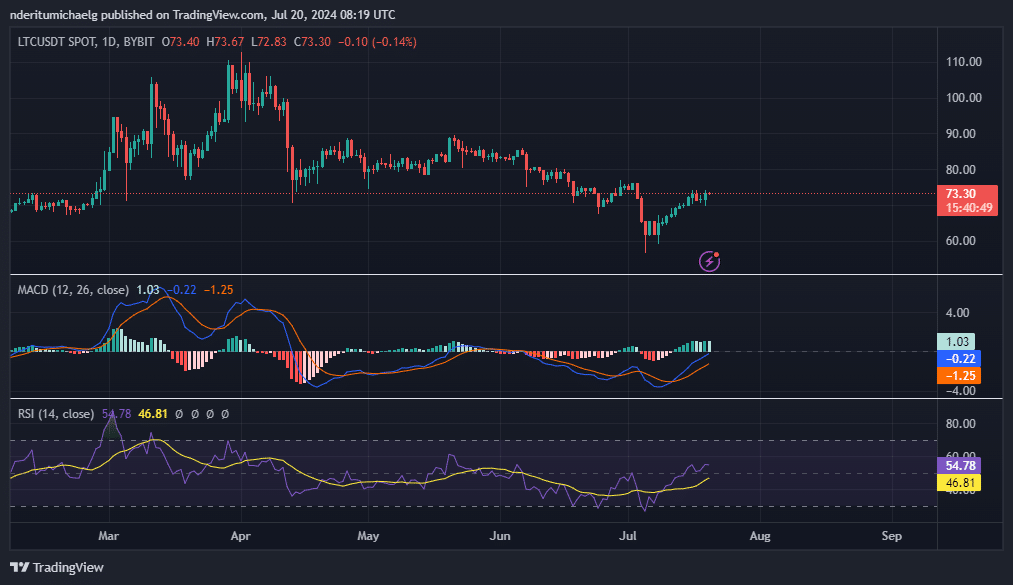

LTC managed to briefly rise above $100 in March 2024. In early April, it peaked at $112.83 before registering a 49% discount, hitting a low of $56.62.

The cryptocurrency was trading at $73.33 at the time of writing.

Source: TradingView

Simply put, LTC still has some ground to gain before it rises above the illusory $100 price level again.

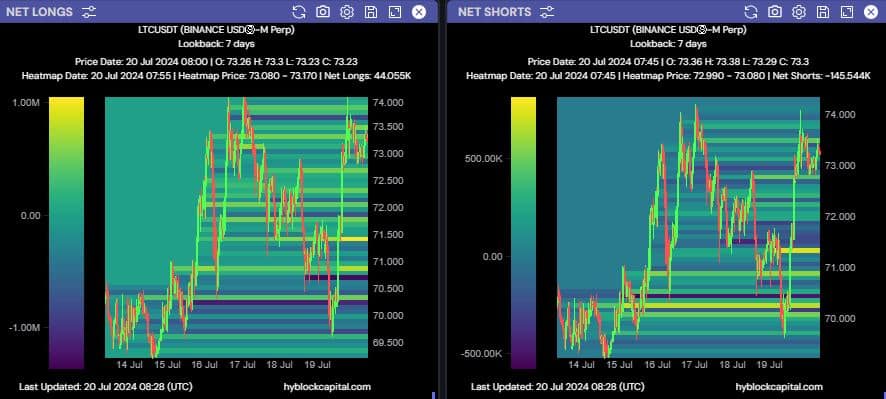

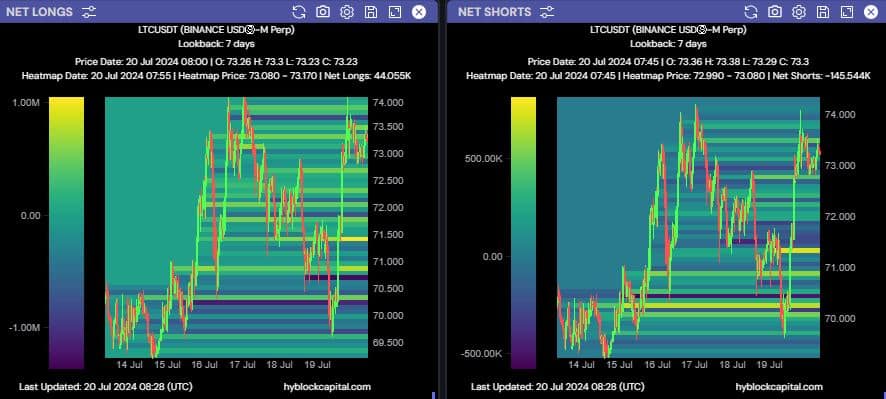

Still, both the RSI and MACD indicators confirmed the bullish momentum. However, can she maintain this momentum? The latest data on longs versus shorts shows that shorts are down 145,540, while the net number of longs was 44,055.

Source: HyblockCapital

The decline in the number of short positions indicates a change in sentiment. However, at press time it was not immediately clear whether this had anything to do with the announcement that Fidelity Digital would be adding LTC to its portfolio.

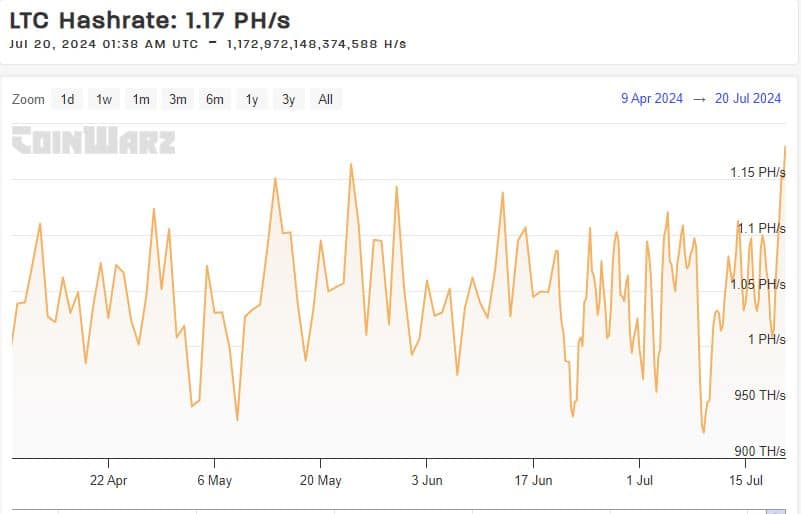

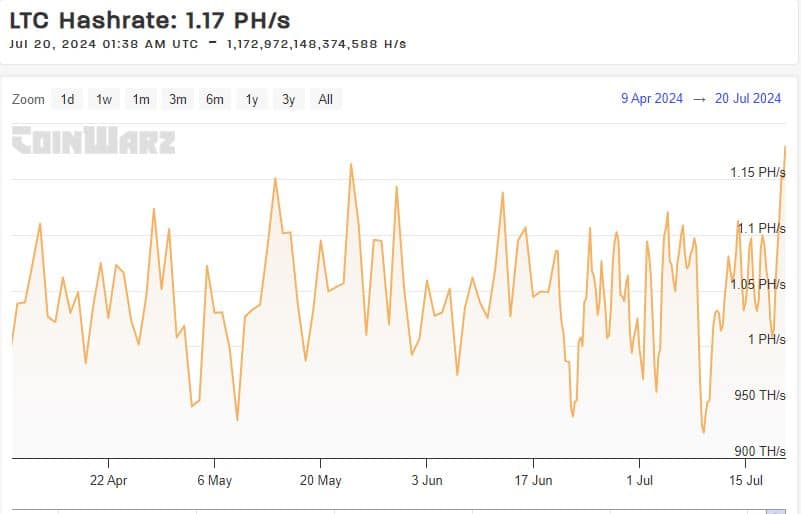

Hashrate rises to new three-month high

Litecoin’s hashrate also recorded a notable spike over the past two days, resulting in a surge to a new three-month high of 1,179 PH/s. This revival also brought it closer to a new six-month high on the charts.

Source: CoinWarz

The aforementioned spike corresponds to the observed shift in market sentiment and increase in the number of Litecoin transactions, especially when the market entered a bullish mood.

All these observations suggest that Litecoin has a chance of a bullish recovery. However, the ability to get back above the $100 level in the near term will depend on the level of market demand.