- LTC has notably deviated from Bitcoin’s recent plunge, with an upward move of 8%.

- Will it continue this trend or succumb to Bitcoin’s volatility?

Litecoin [LTC]amid broader market swings led by Bitcoin [BTC] Failing to hold the crucial support at $57,000, it has risen around 3% over the past seven days and was trading at $66.37 at the time of writing.

Historically, September has been bullish for LTC, as quoted by analysts. However, AMBCrypto noticed that Bitcoin This time of year the price often turns bearish.

That said, is Bitcoin’s September slump the driving force behind Litecoin’s rally? Will investors choose LTC as a safer bet, or will it become a standout alternative? AMBCrypto investigates.

Bitcoin’s influence on LTC remains strong

Source: TradingView

Interestingly, LTC has risen more than 17% since the beginning of August, from $56 to $66. Bitcoin’s significant rally, which tested its $64,000 value during this period, likely fueled this rise.

However, while Bitcoin started September bearishly, falling below $57,000, LTC bulls have avoided a similar decline.

According to AMBCrypto’s analysis, despite BTC’s bearish dominance, LTC has maintained an 8% upward move since August 28.

While Bitcoin’s influence on altcoins is well known, this level of divergence is unusual.

AMBCrypto examined historical price charts to determine if this anomaly is a temporary glitch or reveals a deeper pattern.

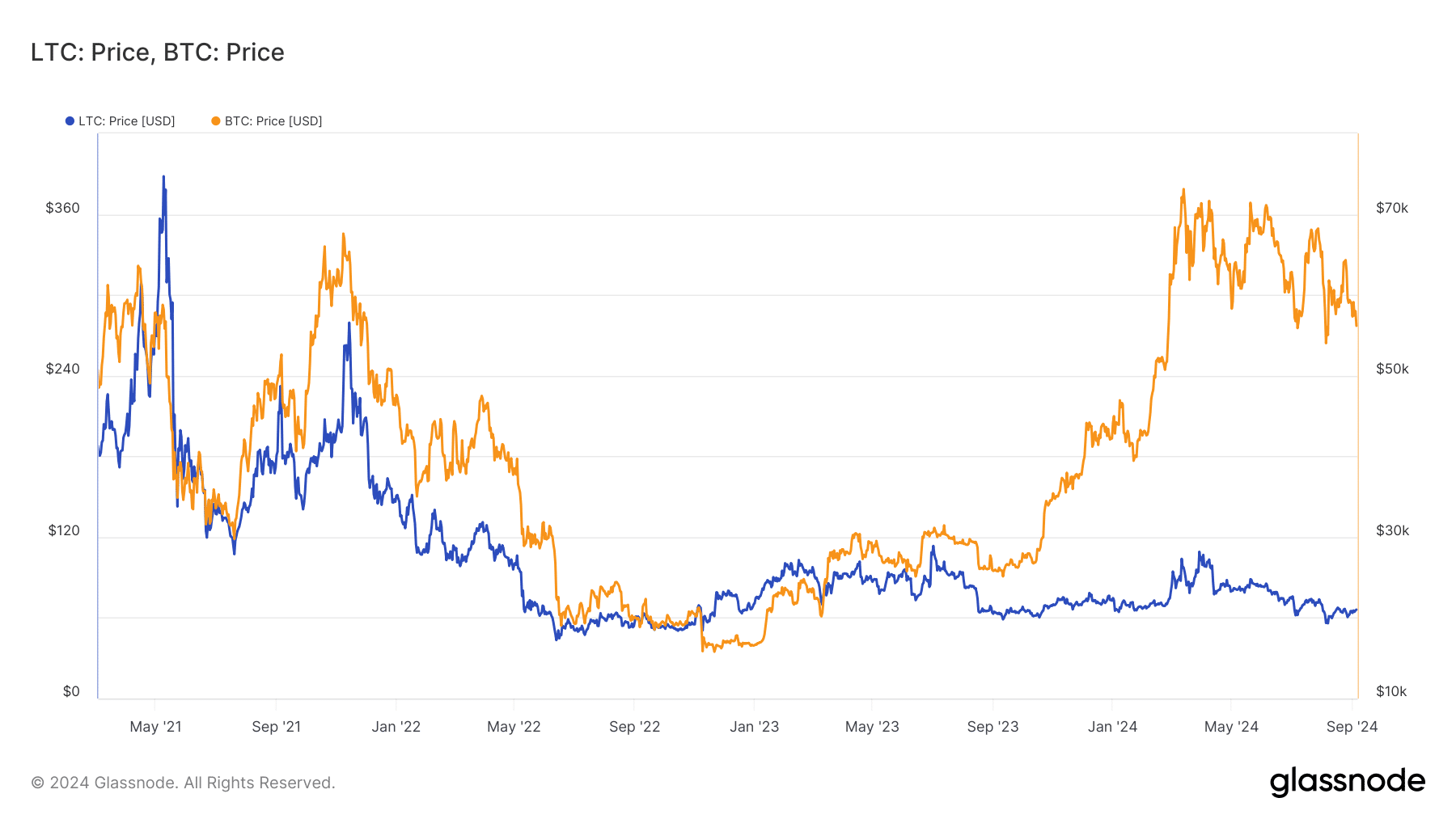

Source: Glassnode

The above chart revealed a striking correlation between the two coins. Three years ago, during a rally in early September, LTC tested the $200 mark, while BTC broke through the $50,000 resistance level.

Following this, LTC fell as BTC returned to the $40,000 support line. Moreover, every time Litecoin approached its high, Bitcoin’s bullish momentum strengthened it.

In short, this trend underlines Bitcoin’s dominance over Litecoin, suggesting that the recent anomaly could only be a temporary problem. This begs the question: what caused the difference?

Behind the strong rise of Litecoin lies a tactical development

In a recent X (formerly Twitter) afterLitecoin developers announced a historic achievement: Litecoin now leads Bitcoin in transaction volume by more than 10%.

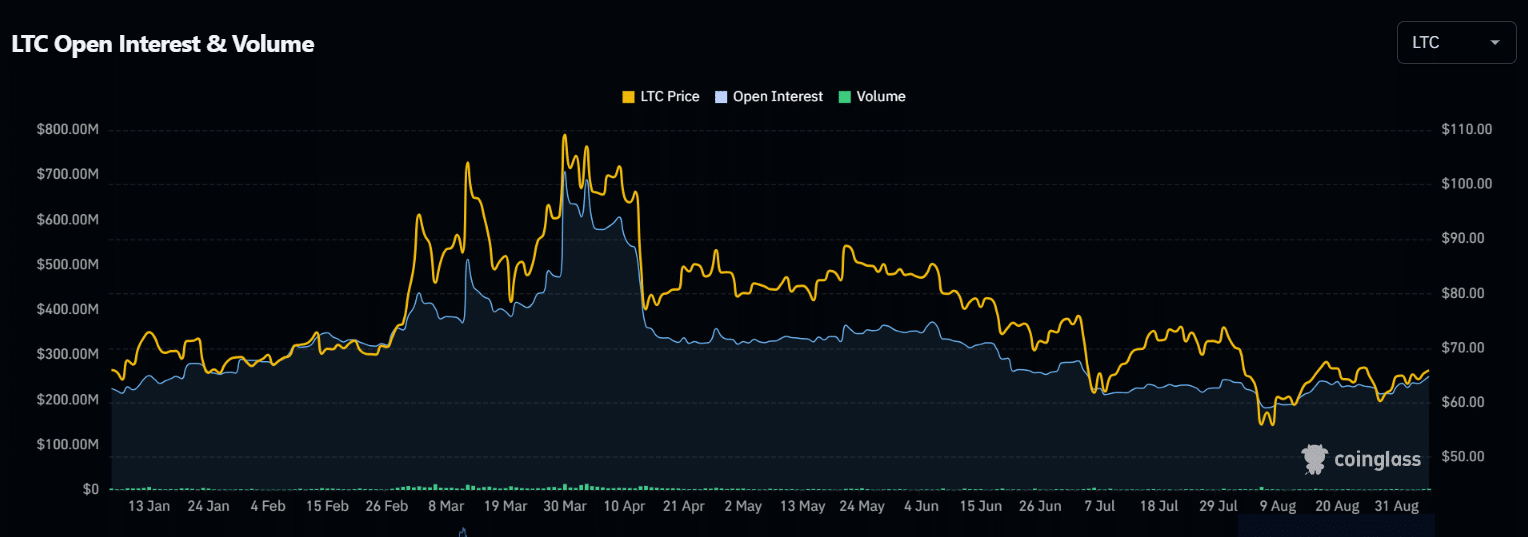

Furthermore, Bitcoin’s continued volatility has clearly captured the attention of prospective traders, as evidenced by the high open interest shown below.

Source: Coinglass

After the day, Bitcoin bears jeopardized a long-awaited rebound; Litecoin Open Interest rose from $213 million to $252 million, an increase of 18.3%, while volume rose from $277 million to $482 million, reflecting a 74% increase.

Conversely, Bitcoin’s OI fell from $31 billion to $29.07 billion, a decline of 6.2%, while volume fell from $78 billion to $68 billion, reflecting a decline of 12.8%.

This increase in user activity aligned with LTC’s recent upward trend and highlights Litecoin’s strategy to surpass Bitcoin through faster transactions and lower fees – a tactic that has clearly paid off.

However, caution is warranted given the trend from earlier in September where LTC mirrored BTC’s decline.

Read Litecoins [LTC] Price forecast 2024–2025

Overall, if Litecoin continues to attract trader interest, it could approach its previous rejection point at $76.

Conversely, if Bitcoin’s volatility overwhelms LTC’s gains, the price could return to $50.