- LINK has risen by more than 5% in 24 hours.

- Buying pressure was high and most indicators looked bullish.

The year 2024 started well for several cryptos, and Chain link [LINK] was one of them. Notably, a bullish pattern formed on Chainlink’s chart, indicating a higher chance of a bull rally.

Are the Chainlink bulls here?

In the last 24 hours, Link’s price has increased by more than 5%. According to CoinMarketCapAt the time of writing, LINK was trading at $15.83 with a market cap of over $8.9 billion.

In the midst of this, Ali, a popular crypto analyst, pointed out that a bullish pennant pattern was formed on Chainlink’s chart.

#Chain link shows signs of bull pennant formation. A decisive close above $17.2 could be the catalyst for a breakout, potentially providing momentum $LINK towards $34.

However, keep an eye on the $14.2 level – a decline below could negate the current bullish outlook for the dollar #CLUTCH. pic.twitter.com/N9e6peREPn

— Ali (@ali_charts) January 1, 2024

If LINK were to manage to get above the USD 17.2 resistance level, the price could reach USD 34 soon. However, if that doesn’t happen, investors should also keep an eye on the $14.2 level because if LINK falls below that, its value could fall further.

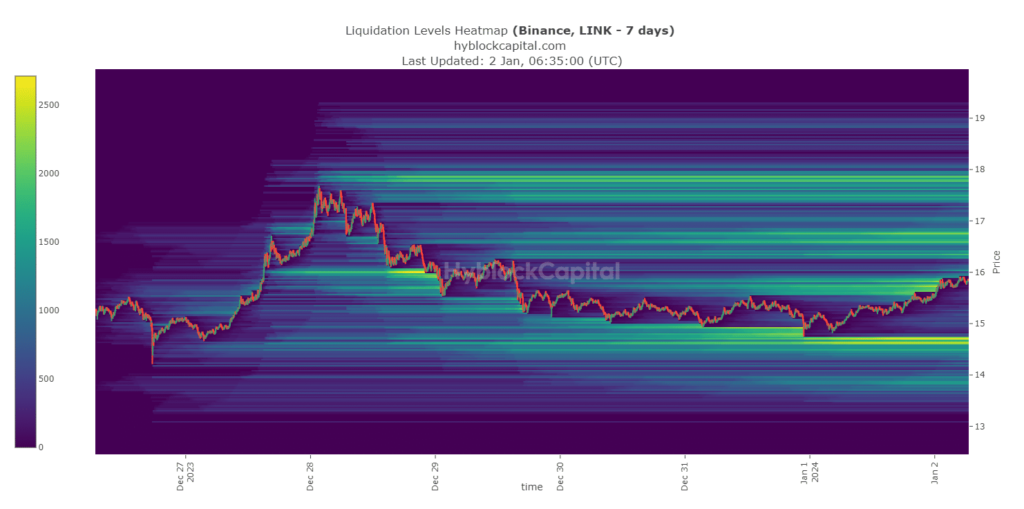

To check if this was true, AMBCrypto took a look at LINK’s liquidation heatmap. Our analysis showed that CLUTCH is facing a key resistance zone around $17.

Apart from that, two other levels of whether LINK could witness high liquidations again were near USD 15.7 and USD 15.

Source: Hyblock Capital

What you can expect from LINK in 2024

Although some resistance levels had to be overcome, buying pressure on the token remained high. This was evident from the fact that the supply of Chainlink exchanges decreased last week.

This happened as off-exchange supply surged, indicating high buying pressure. Nevertheless, there wasn’t much whale activity around the token as supply in the top address chart remained flat last week.

Source: Santiment

To better understand whether Chainlink will be able to break above the $17.2 resistance zone, AMBCrypto checked LINK’s daily chart. We found that CLUTCH‘s Relative Strength Index (RSI) registered an increase from the neutral mark at the time of writing.

Realistic or not, here it is LINK market cap in terms of BTC

The Money Flow Index (MFI) also followed a similar route, increasing the likelihood of a sustained price move north in the coming days.

However, the Chaikin Money Flow (CMF) flashed worrying signals as it fell during this period. Considering the aforementioned metrics and indicators, it will be interesting to see if Chainlink will reach $34 soon.

Source: TradingView