- The market capitalization of altcoins increased while the market capitalization of Bitcoin decreased.

- The launch of spot Ethereum ETFs could further reduce Bitcoin’s dominance.

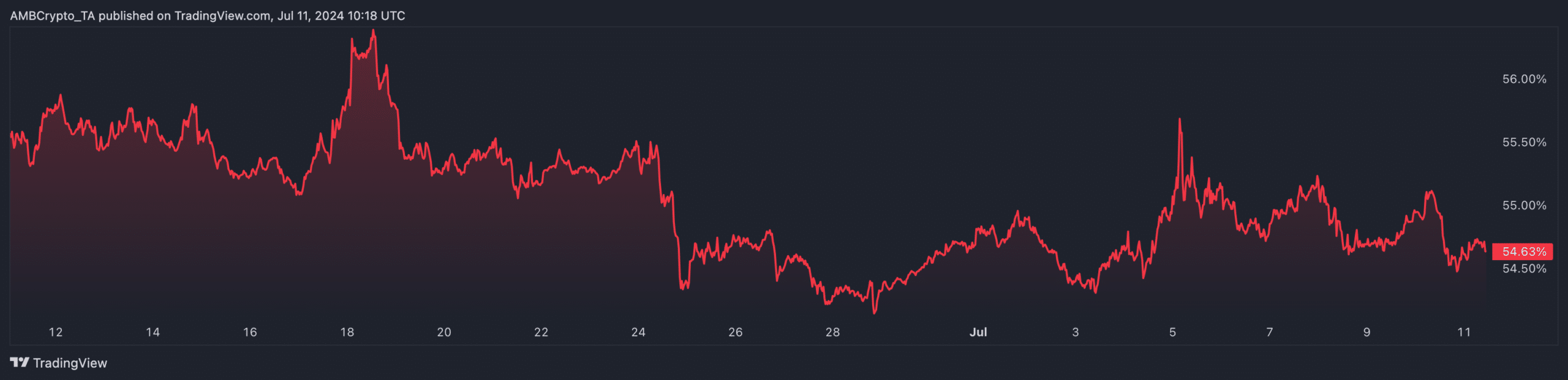

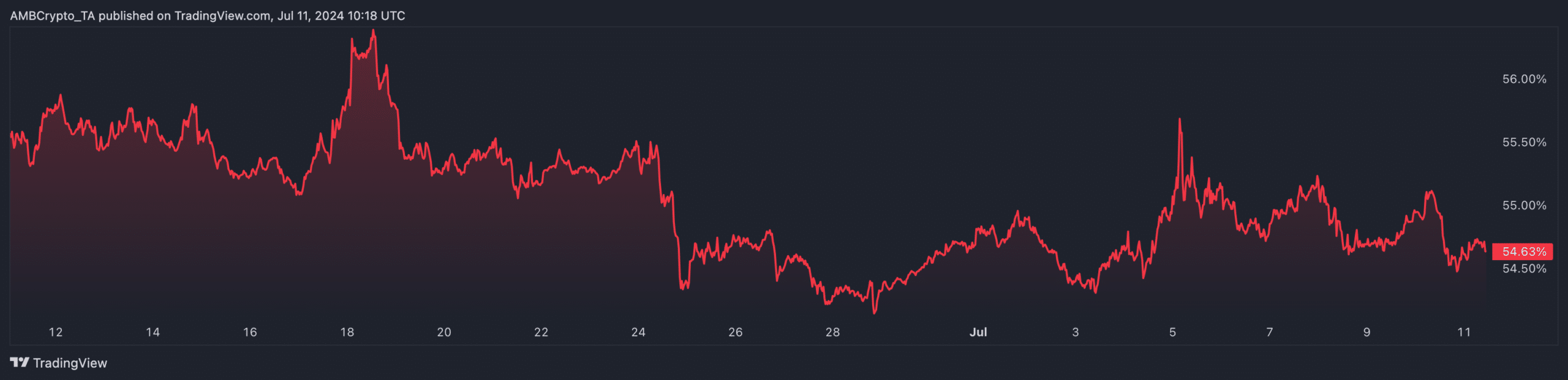

AMBCrypto’s analysis showed that Bitcoin [BTC] dominance graph has decreased. On July 10, dominance was 55.10%. However, at the time of writing this had fallen to 54.62%.

Bitcoin’s dominance is an important indicator for the price of BTC. This is because it shows how the coin’s market cap compares to the market cap of other cryptocurrencies.

Can BTC’s dominance continue?

If Bitcoin’s dominance increases, it means the coin is outperforming the average altcoin. However, when it decreases, it indicates that BTC is losing momentum and altcoins are outperforming.

On a Year-To-Date (YTD) basis, the coins have performed better. But over the past month and lately, the opposite has been the case. If this continues, Bitcoin could fall further despite the correction it has undergone.

Source: TradingView

At the time of writing, BTC changed hands at $58,257. This represented an increase of 1.37% over the past seven days. An indicator to check if Bitcoin is starting to lose its superiority is the TOTAL2.

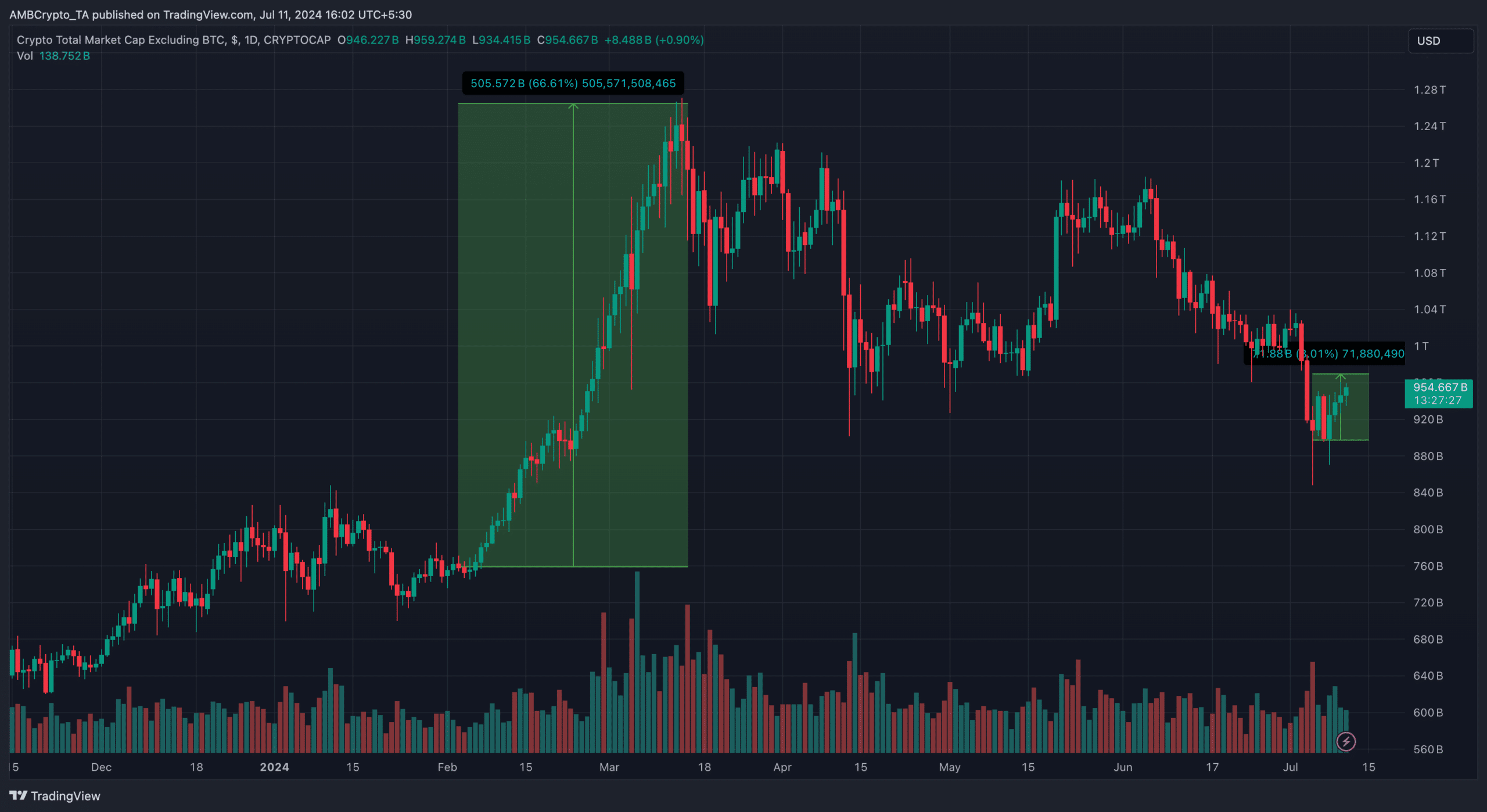

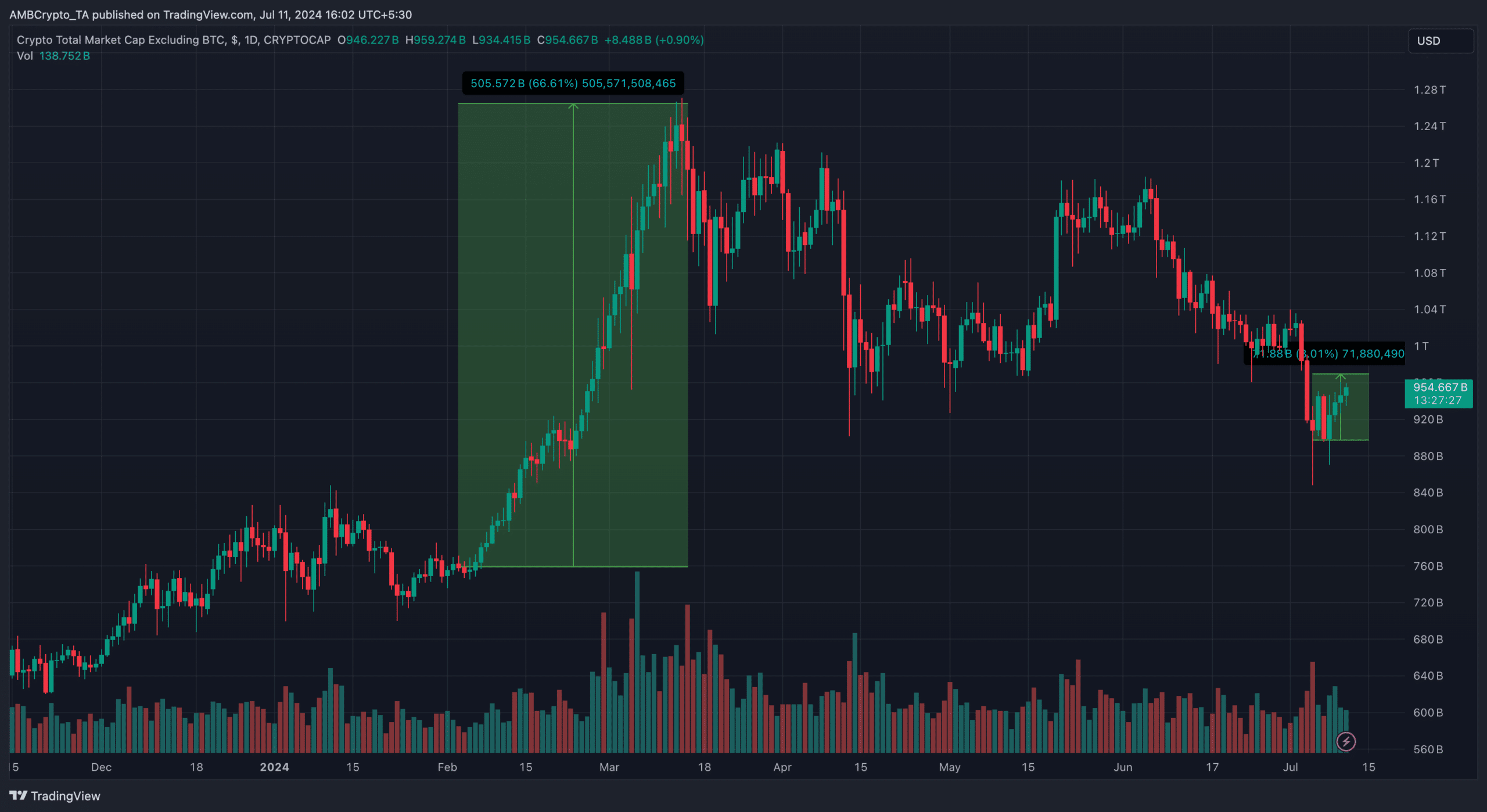

The TOTAL2 is also known as the total market capitalization of the crypto market excluding BTC. If it rises, it means altcoins are outperforming Bitcoin.

But when it falls, it implies that BTC is leading the market revival.

Between July 5 and the time of writing, TOTAL2 has risen 8.01%, indicating that the prices of the average altcoins have outperformed Bitcoin’s dominance.

Altcoins are willing to give the king a fight

The last time the indicator made such moves, the market cap rose 66.61% between February and March, while the market cap also exceeded $1.20 trillion. At the time of writing, its market capitalization was $953.68 billion.

If this continues to rise, it could reach $1 trillion, potentially bringing us a step closer to the highly anticipated altcoin season. If this happens, BTC’s correction would continue.

Source: TradingView

One factor that could cause an increase in dominance is Ethereum [ETH]. Historically, when ETH’s price performance is better than BTC, it gives strength to other altcoins.

In turn, it reduces Bitcoin’s dominance. One catalyst that market participants are looking forward to is the launch of spot Ethereum ETFs.

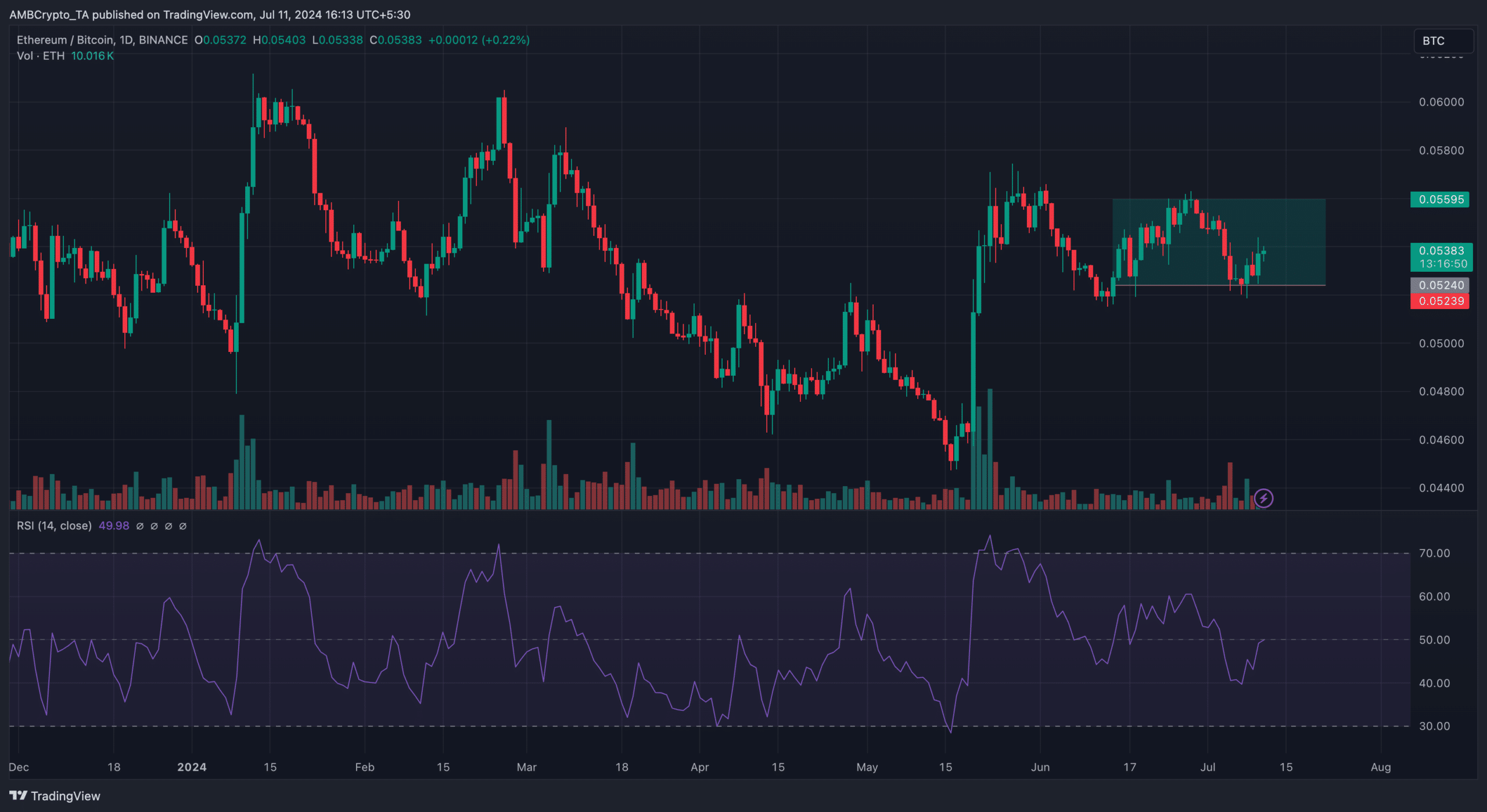

However, it is also important to look at the ETH/BTC chart to see if the altcoin would take over Bitcoin dominance in the coming weeks.

When ETH/BTC rises, it means Ethereum is outperforming Bitcoin. But a decline suggests otherwise. Previously, the ETH/BTC ratio was 0.051.

Source: TradingView

Realistic or not, here is the market cap of BTC in ETH terms

But at the time of writing that has increased to 0.053, meaning 1 ETH was equal to 0.053 BTC. Furthermore, the Relative Strength Index (RSI) revealed that ETH was gathering good momentum.

If this continues, it could push the ratio to 0.056, potentially reducing Bitcoin dominance.

![Like Bitcoin [BTC] dominance drops below 55%, is altcoin season here?](https://bitcoinplatform.com/wp-content/uploads/2024/07/bitcoin-dominance-price-news-1-1000x600.webp)