- The LDO is up 5.67% in the past 24 hours.

- The Lido DAO whale has won 2.72 million LDO tokens worth $4.9 million.

The past three days Lido DAO [LDO] has made significant gains on its price charts. During this period, the price has risen from a low of $1.55 to a high of $2.00.

Since reaching $2, Lido DAO has made a slight pullback. At the time of writing, the stock is trading at $1.84. This represents an increase of 5.67% on the daily charts. It is also up 2.45% on the weekly charts and 8.49% on the monthly charts.

With continued gains on the charts, investors have become optimistic. This positive perception is more common among whales, which have begun to gather.

Lido DAO’s whale activity peaks

According to SpotOnChain, a sleeping Lido DAO whale has woken up after a year and spent $5 million. This whale has collected 2.72 million LDO tokens worth $4.9 million in the past day.

When a whale decides to add to its assets, it indicates market confidence and bullish sentiments.

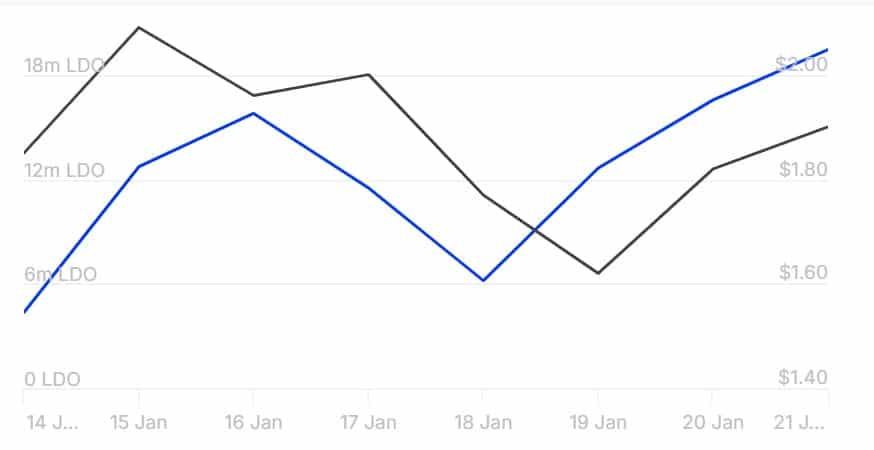

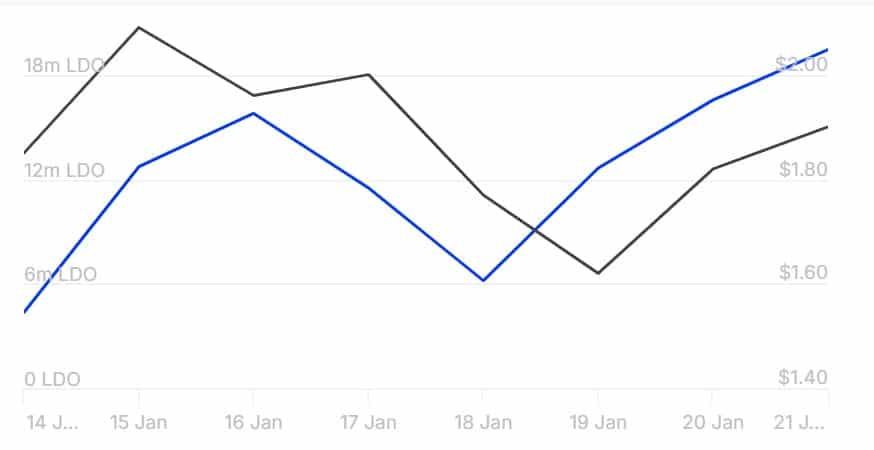

Source: IntoTheBlock

Whale activity increased in the broader LDO market, evidenced by a strong increase in large keeper inflows. These inflows have increased from 12 million tokens to 19 million, with more capital inflows than outflows.

As a result, net flows from large bond investors have remained positive over the past seven days. This market trend implies that large owners have confidence in the market and take advantage of the opportunity to accumulate.

Any impact on LDO charts?

As expected, increased whale activity has had a positive impact on the LDO. This demand from whales has created increased purchasing pressure, causing prices to rise.

Source: Tradingview

The rising demand is confirmed by a bullish crossover on LDO’s Stoch RSI. A bullish crossover here suggests that buyers have taken control of the market while sellers are losing momentum.

This implies that investors are buying, which reflects bullish sentiment.

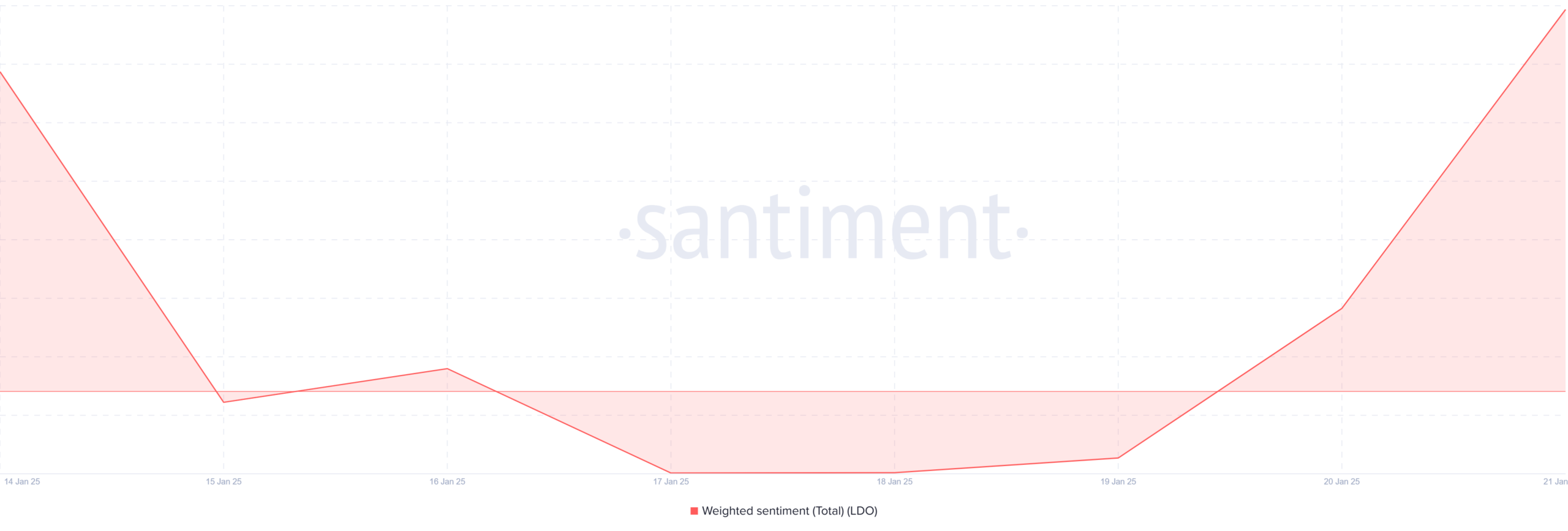

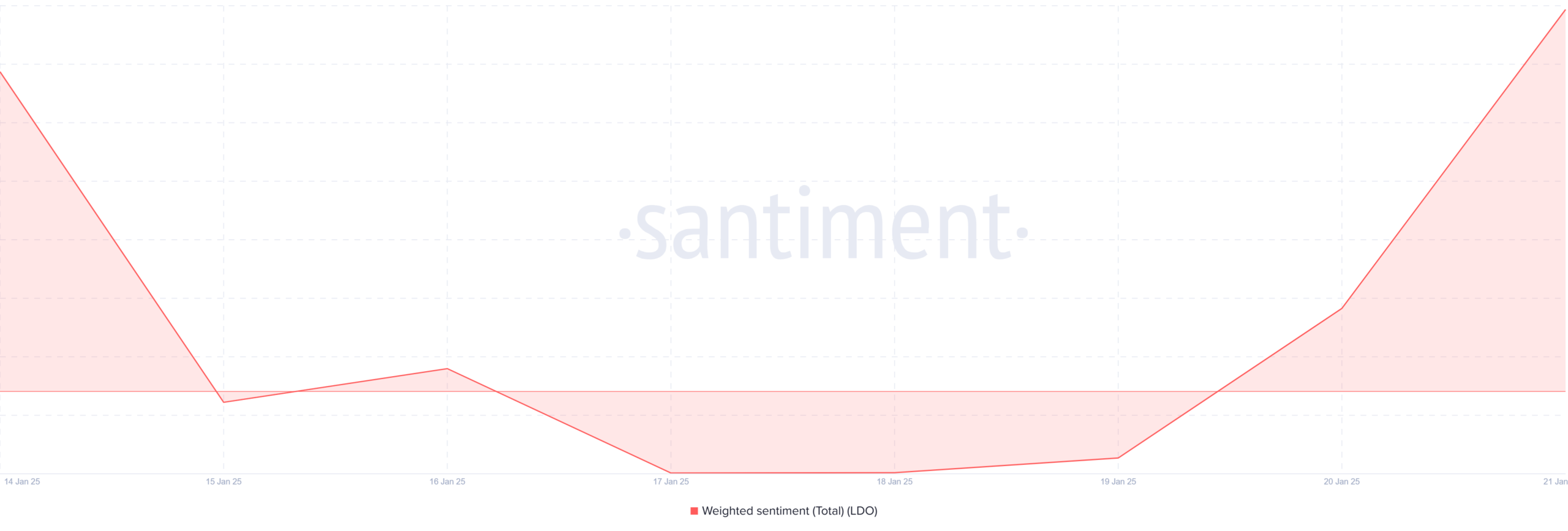

Source: Santiment

As such, all market participants turned bullish; This shift in market sentiment is reflected in the LDO weighted sentiment turning positive two days ago after remaining negative for most of the week.

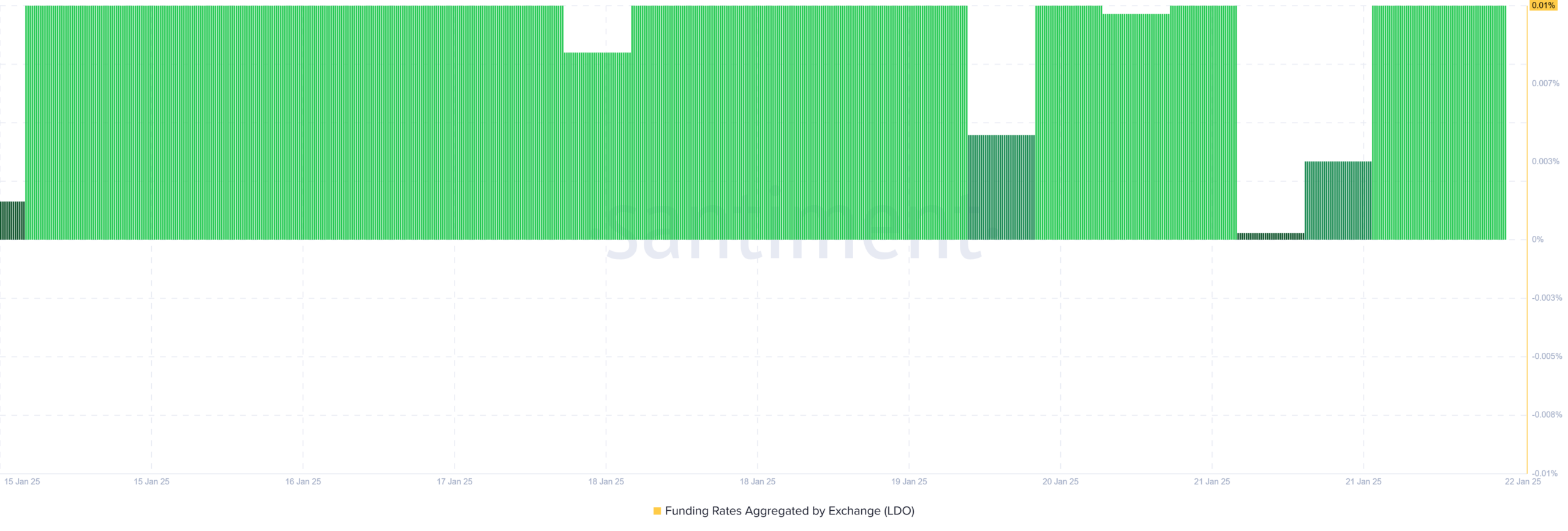

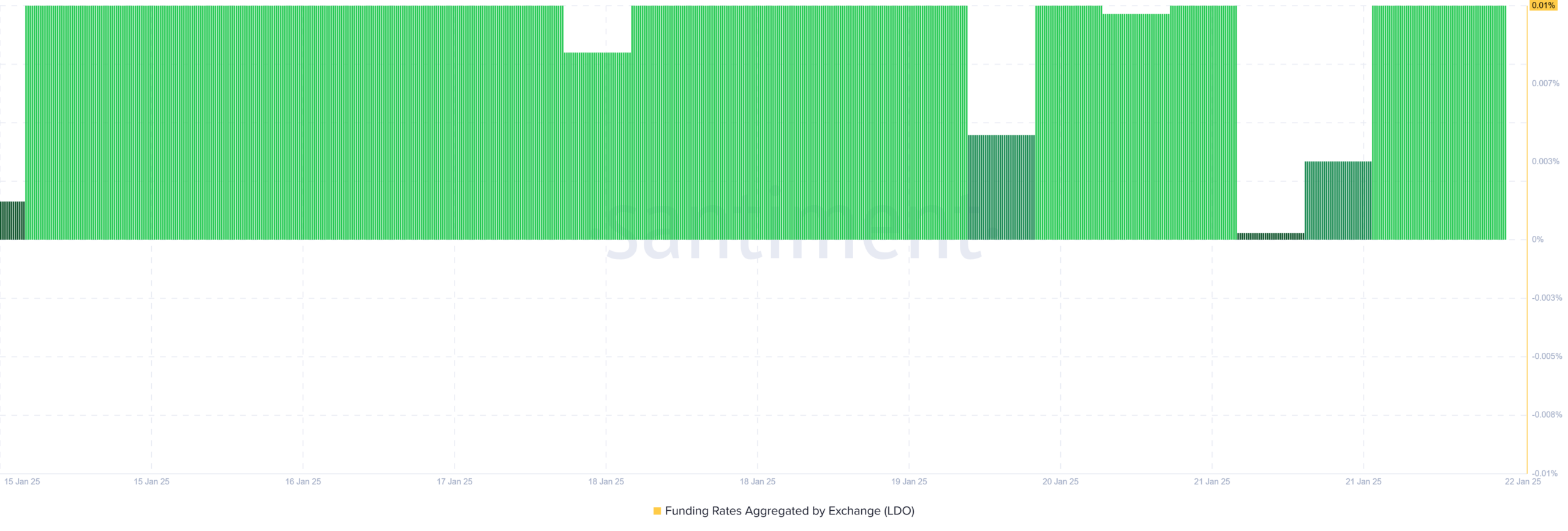

Source: Santiment

This bullish market is further supported by increasing demand for long positions. This is reflected in a positive financing percentage on all fairs.

LDO funding rates have remained positive over the past week, indicating strong demand for long positions.

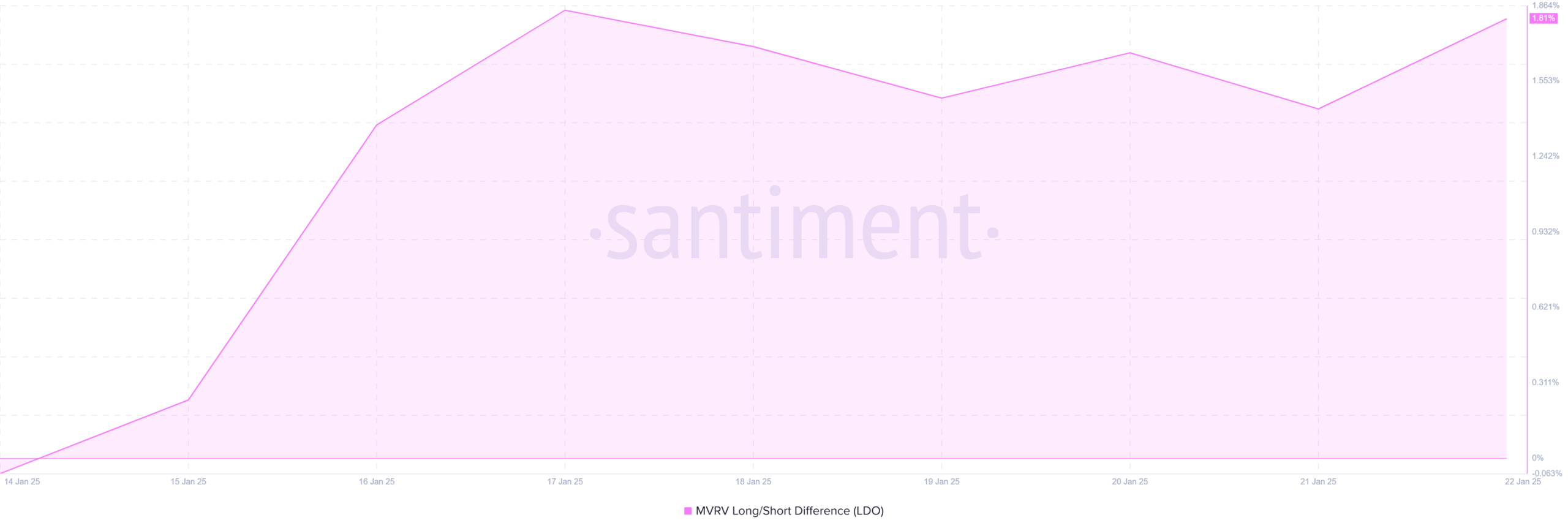

Source: Santiment

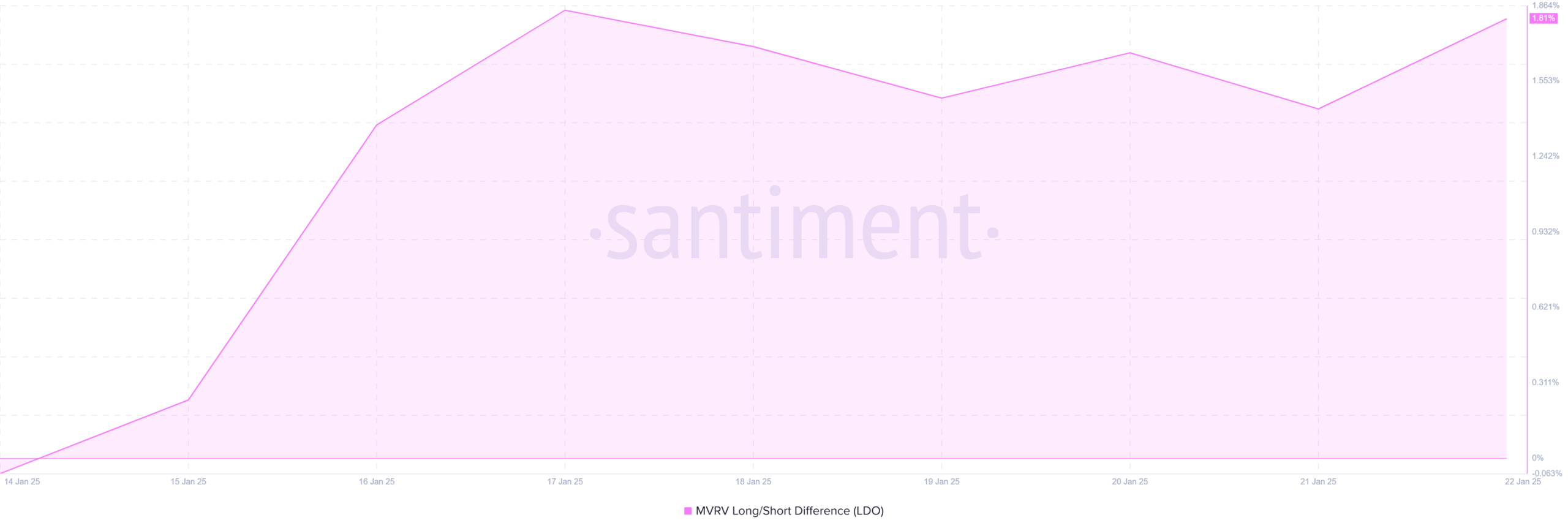

The Lido DAO’s MVRV Long/Short Difference has turned positive after turning negative earlier this week.

A rising MVRV long/short difference indicates that long-term holders’ profit margins are increasing as they continue to hold their shares. This behavior reflects the market’s confidence as they expect profits to continue to rise.

Read Lido DAOs [LDO] Price forecast 2025–2026

Whales are actively accumulating LDO, while retailers remain optimistic. With all market participants showing optimism, Lido DAO could make more profits on the price charts.

If the current trend continues, LDO will regain $2 and attempt the $2.1 resistance level. If the trend fails, a correction will follow, sending the altcoin down to $1.65.