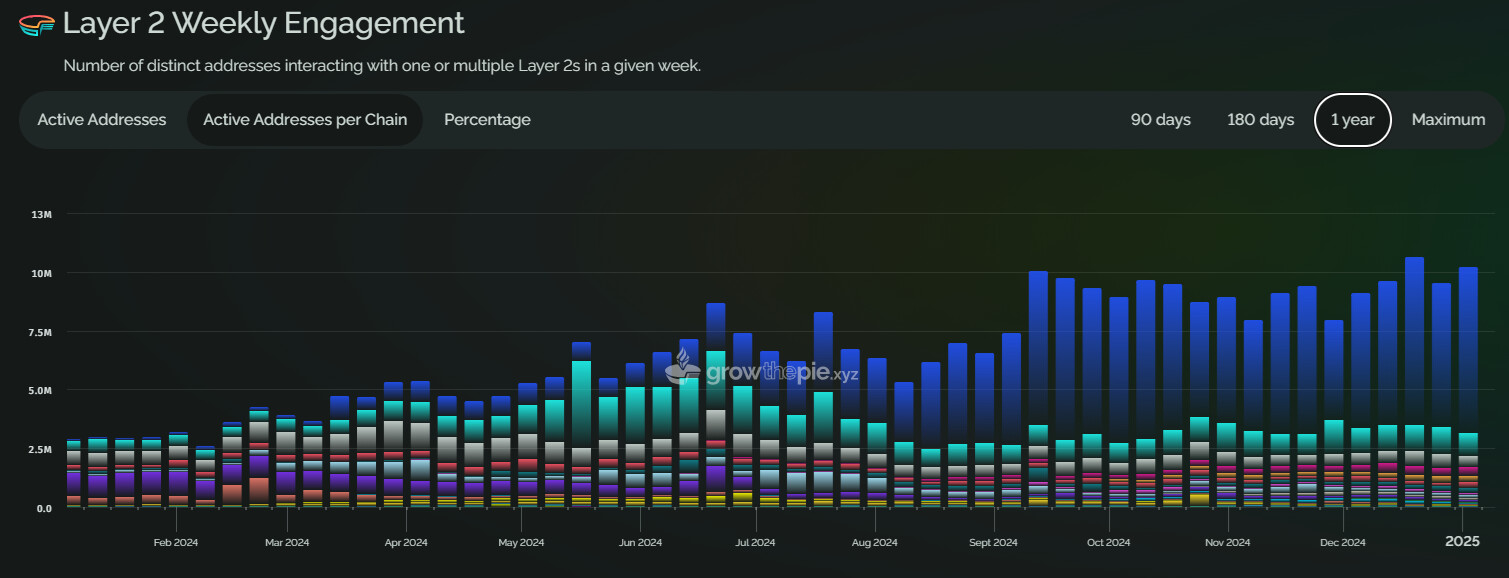

Activity on rollups and other L2 networks reached new all-time highs. Traffic on L2 is more than 4.5 times higher than that of Ethereum transactions, indicating a permanent shift to scalable chains.

L2 chains, led by Base, Arbitrum and Optimism, invite over 4.5 times as much traffic as Ethereum (ETH). On the main L1 chain, transactions stabilized at around 1.16 million, shifting to high-value stablecoin transfers, ETH movements and less swaps or NFT activity.

The growth in L2 activity was mainly driven by Base’s impact, but other top chains provided a robust base level of transactions. | Source: GrowThePie

More complex transactions have shifted to L2, where each chain has a specific profile. DeFi activity and stablecoin liquidity has piled up on Arbitrum and a handful of top chains, drawing users in for easier DEX swaps.

As a result, L2 activity has been setting new records for months. On a weekly basis, L2 activity passed the 10 million user milestone, with only 1.96 million for Ethereum on a weekly basis.

Users are active in the Ethereum Ecosystem – Last week’s statistics:

More than 10,000,000 addresses have interacted with 1 or more layers 2.

More than 1,960,000 addresses interacted with Ethereum Layer 1. pic.twitter.com/eMXlz3Yyk2

— growthepie.xyz 🥧📏 (@growthepie_eth) January 6, 2025

While Base remains the leader in fast transactions, some of its traffic remains tied to organic DEX trading and DeFi lending on L2’s other top chains. The base also gets a boost from CbBTC traffic as it stacks up as well $3.49 billion locked in value.

Stablecoins are also one of the driving forces behind L2 adoption. In the early days of 2025, L2 owned more than $11 billion in bridged or native stablecoins, with Arbitrum being the leader with $6.35 billion. Base was in second place, with $3.5 billion in stablecoins.

The upward trend reflects Arbitrum’s strong baseline, but most of the expansion still comes from Base. The chain is among the top providers of DeFi, through the high liquidity version of Uniswap and the Aerodrome DEX. Arbitrum follows closely based on DeFi activity and reaches out $33.6 million on a daily time frame.

Most L2 chains slowed down significantly after the end of their airdrop mining operations. Returning to organic traffic has been a struggle for several chains. The base is still not officially preparing for an airdrop, although there are still expectations for a native token in the future.

L2 chains grow based on specialized activities

While Linea is carrying less traffic, it continues to play an important role in L2 activity in NFT swaps and decentralized social media. Optimism serves as a universal utility chain, while ZKSync Era has the largest share of simple token transfers.

Arbitrum is the largest hub for cross-chain operations, with more than $15 million generated daily. In general, L2 does not communicate between chains, but relies on bridging and flows to and from Ethereum.

In addition, dozens of smaller networks focus on specialized tasks, such as gaming or a specific DEX. However, newer networks may lack liquidity, and older networks may be unwilling to become interoperable.

Growing L2 traffic is driving fee competition and blockages in the space

The growing traffic also makes L2 more expensive, with regular spikes in the rent paid to Ethereum. While the rental fee is small compared to Ethereum’s block production incentives, there is a shift from previous months of near-zero payments. By comparison, Base was paying no more than $3,000 for its activity at one point, while a recent spike resulted in $93,000 in daily rent paid to Ethereum.

The increased on-chain activity means on-chain operators can choose how they post on Ethereum. Data shows Arbitrum switches between blobs and call data, depending on which is cheaper at the moment. However, this L2 activity actually takes up block space on Ethereum, making regular transactions more expensive.

Ethereum transactions are still more expensive at $1.10, with regular price spikes for specialized tasks. Arbitrum keeps $0.09 per transaction, although even L2 doesn’t offer virtually free transfers. However, arbitrage swaps can be as low as $0.27, while Ethereum DEX deals $21.38 without special priority or extra payments for block builders.

L2 chains maintain real economic activity and the top chains show robust demand. However, the L2 story remained submissive. A total of 127 high-profile chains were launched, each competing for niche or mass business.