- Solana surpassed Ethereum in terms of DEX volumes.

- The price of SOL has fallen significantly in recent days.

Solanas [SOL] Performance since the beginning of the year has been extremely positive. Thanks to this momentum, Solana managed to outperform Ethereum[ETH] in terms of DEX (Decentralized Exchange) volumes.

Solana DEX volumes increase

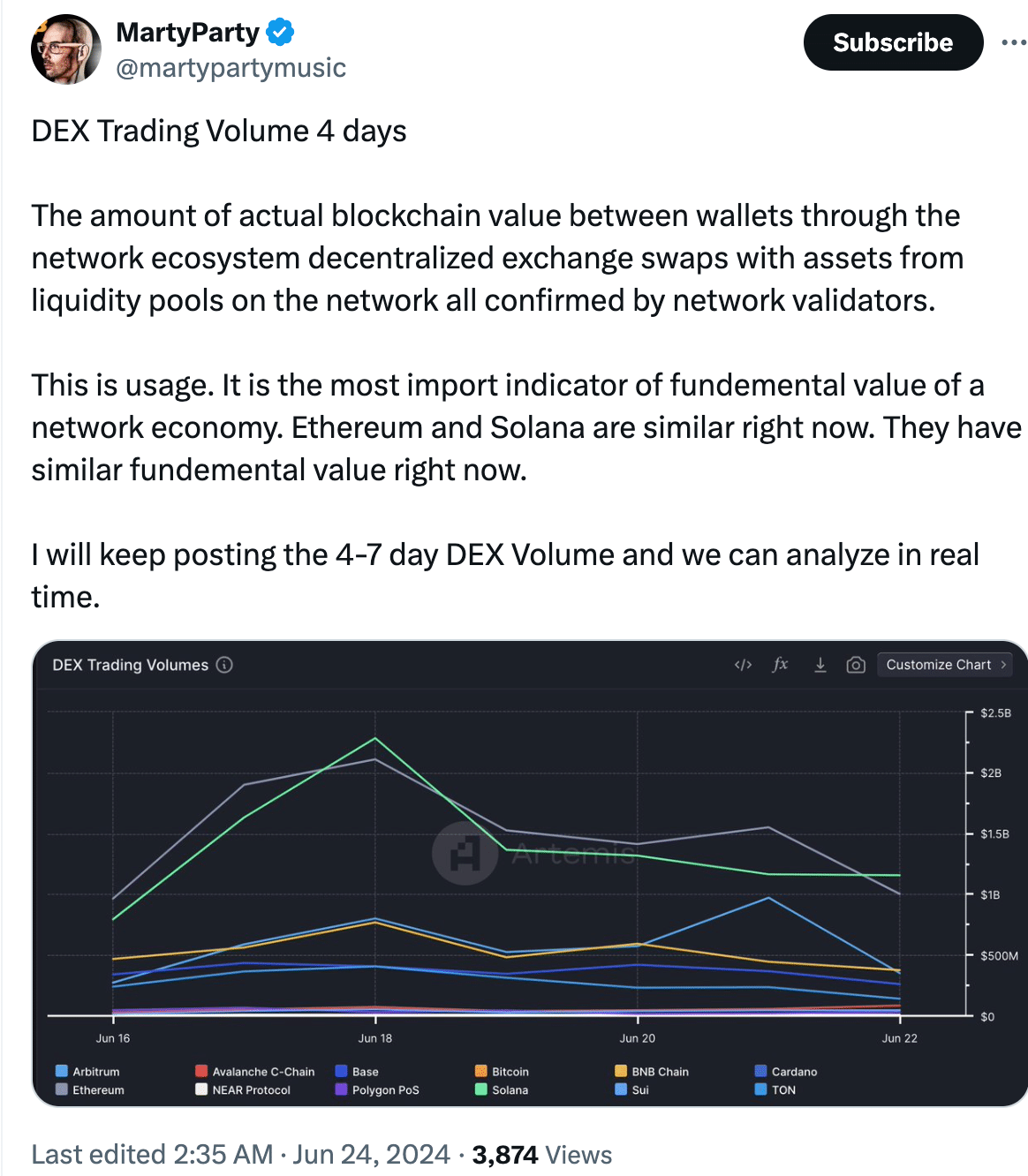

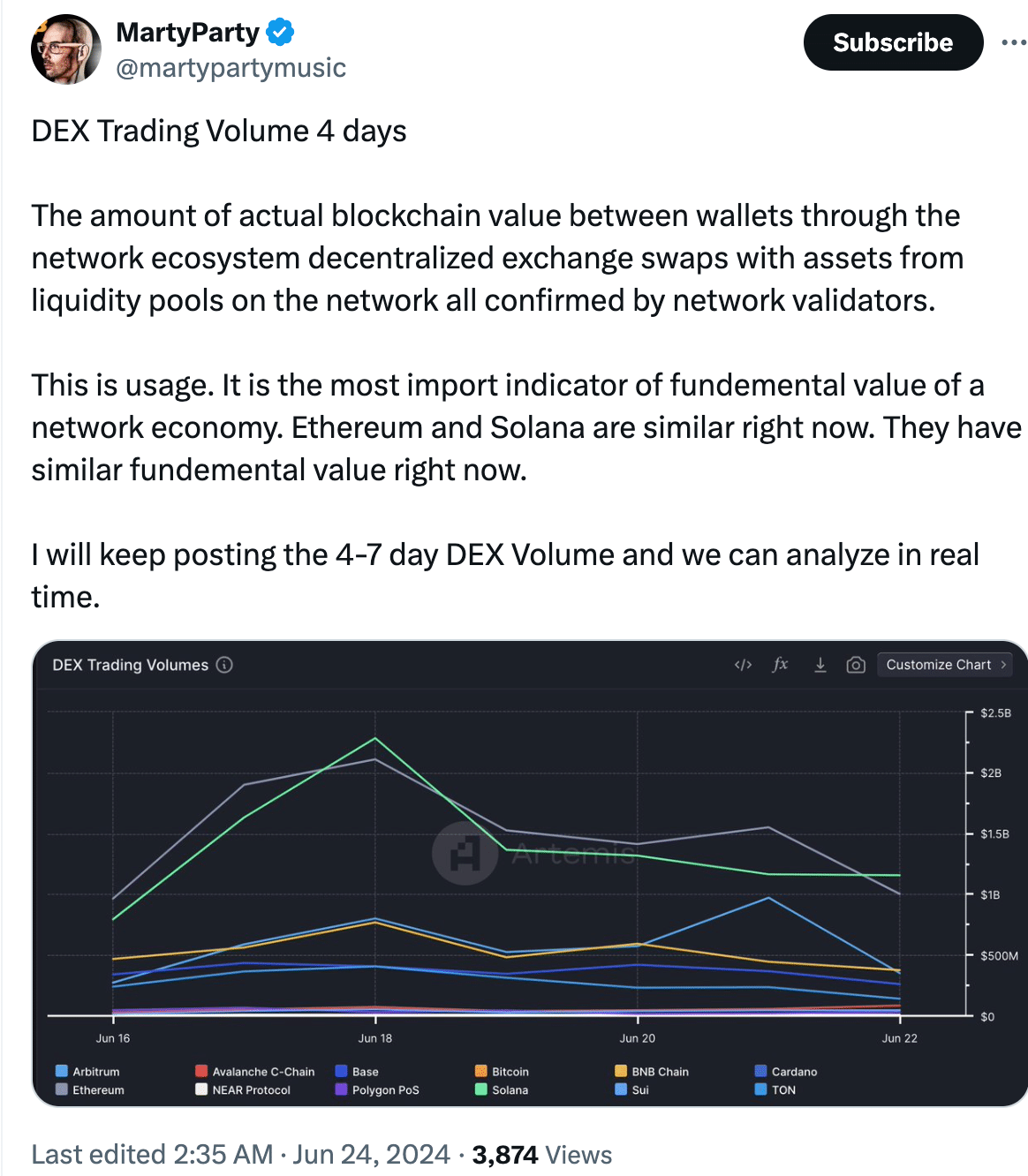

This DEX volume refers to the total value of cryptocurrency actually transferred between wallets on the Solana network. These transfers are done via swaps on DEXs, which use liquidity pools on the network and are all verified by Solana’s validators.

This DEX volume metric is considered a crucial indicator of the fundamental value of a blockchain network. It reflects actual usage within the network’s ecosystem, as opposed to just speculation about the price of the token.

By this metric, Solana’s strong DEX volume suggests that it is currently outperforming Ethereum in terms of real-world usage. This could be a sign of increasing acceptance and potential for future growth for Solana.

Source:

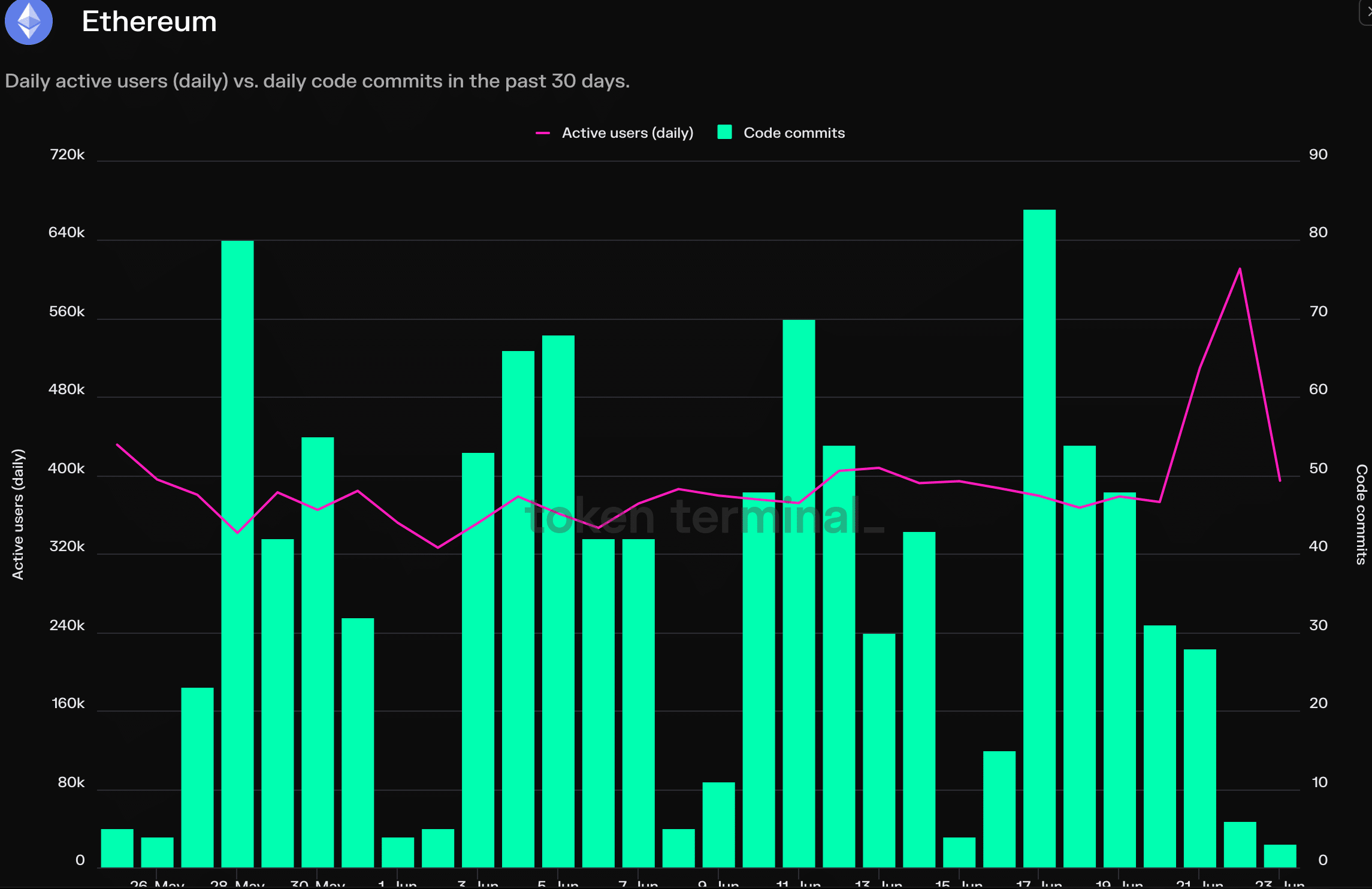

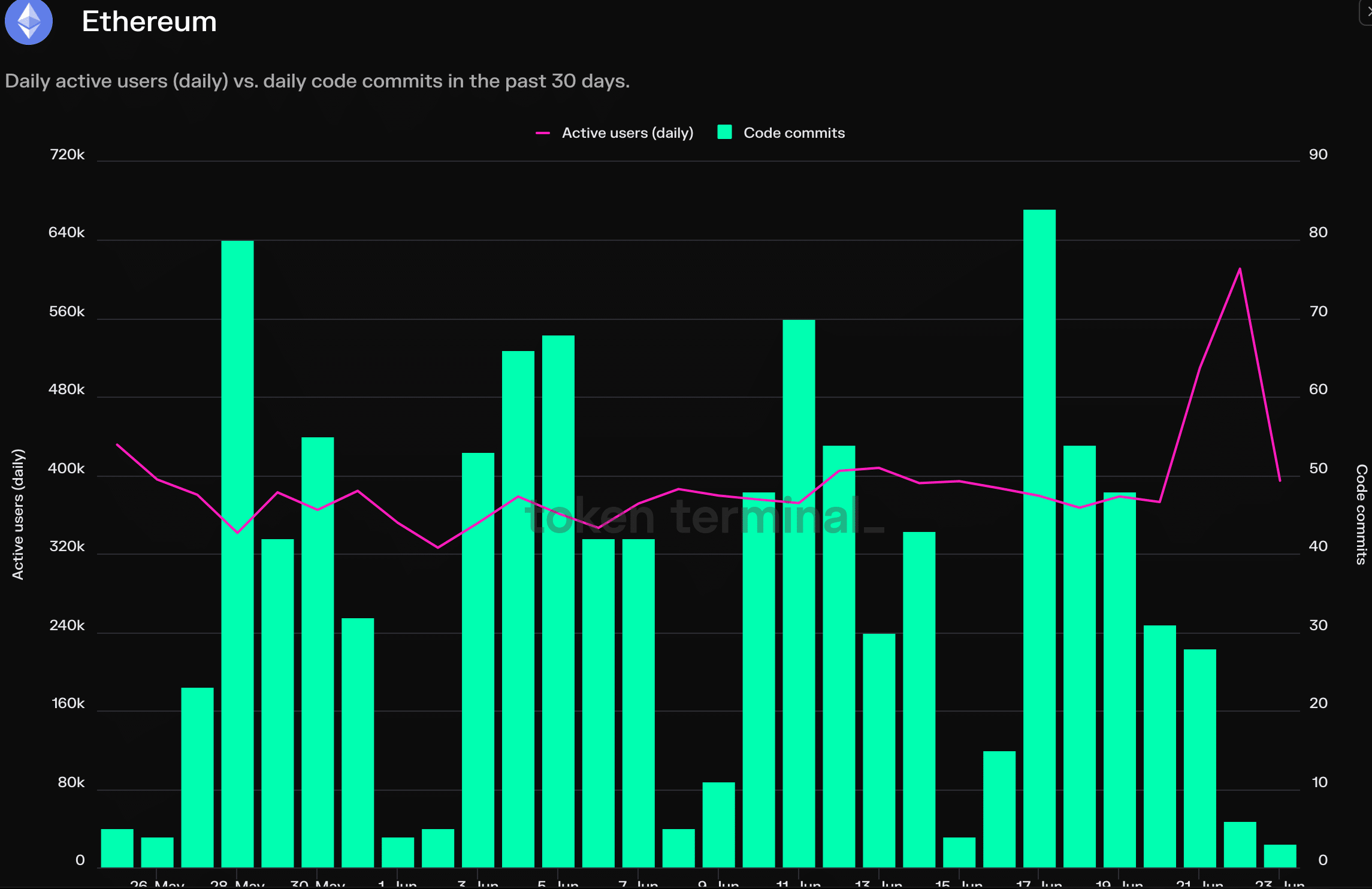

Although DEX volumes for Solana were up, overall activity on the network was down significantly over the past month, down 10.7%.

Additionally, the number of code commits on the network was also down 20%, indicating a decline in development activity.

Ethereum, on the other hand, showed growth on both fronts. The total number of active users on the network grew by 2.2% last month and the number of code commits increased by 10% over the same period.

Source: token terminal

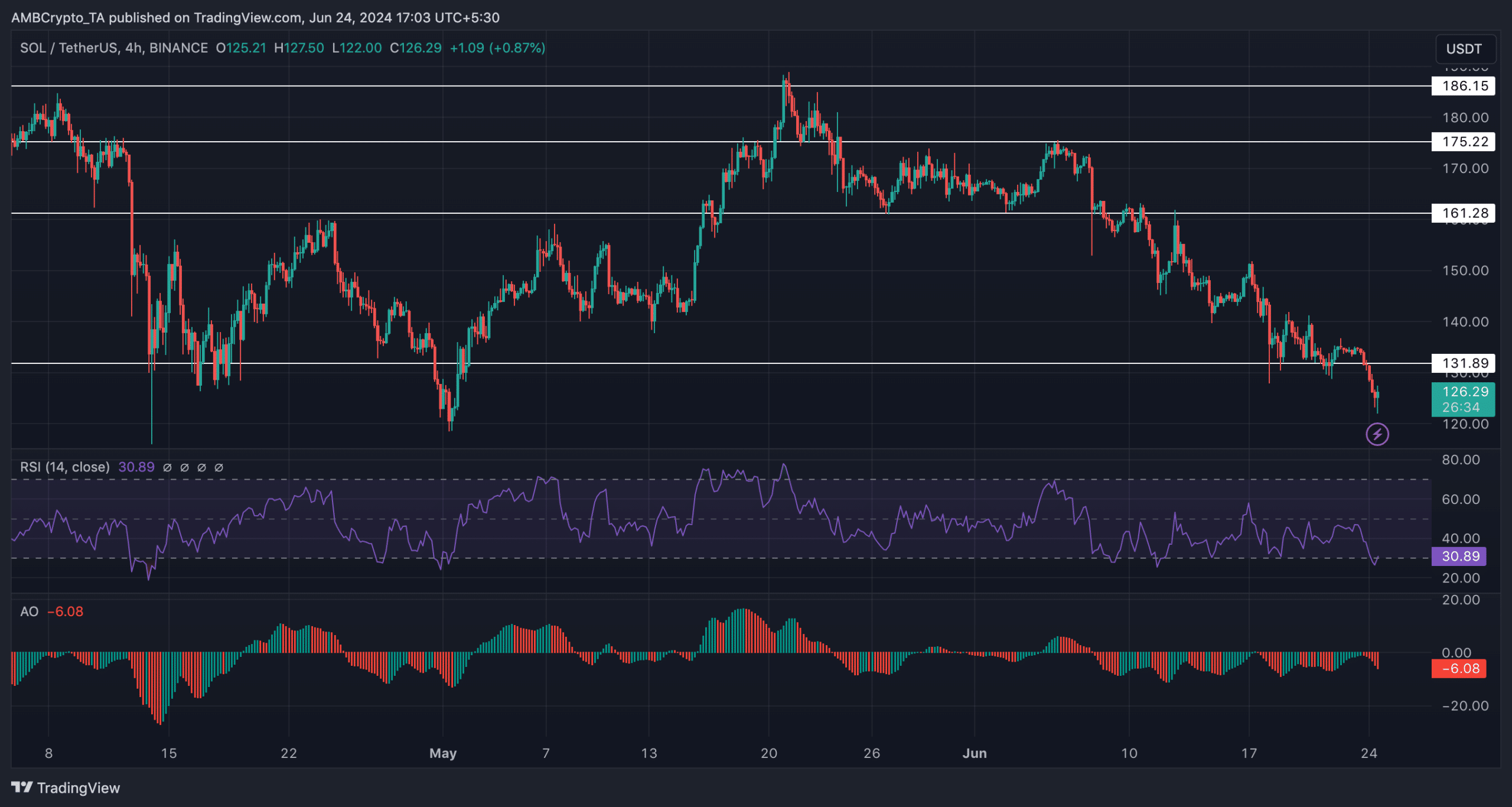

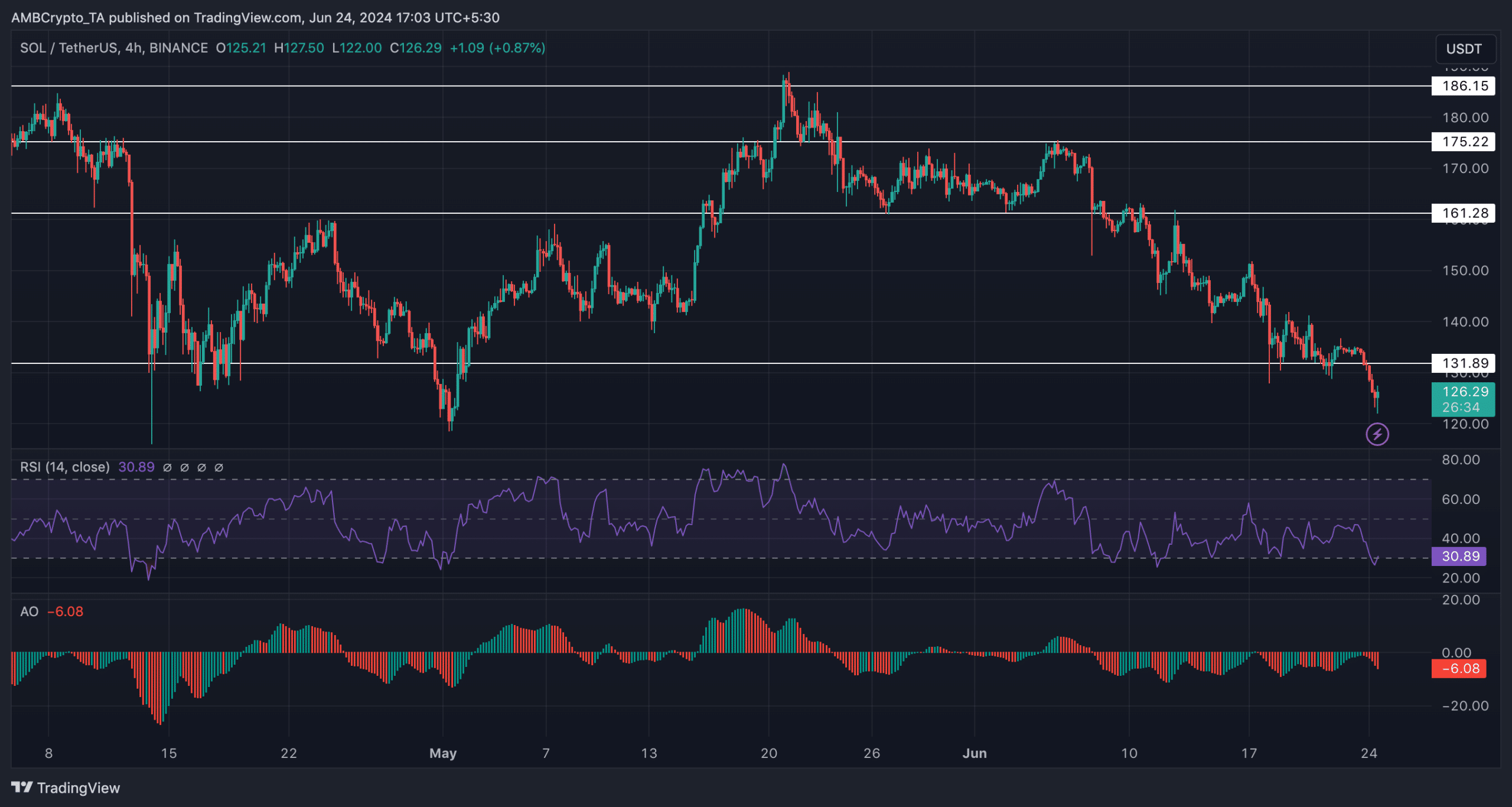

At the time of writing, SOL was trading at $126.47 and the price had fallen 5.21% in the last 24 hours due to the recent market correction. Since May 21, the price of SOL has fallen significantly.

During this period, the price of SOL showed multiple lower lows and lower highs, indicative of a bearish trend.

The RSI (Relative Strength Index) for SOL has also fallen significantly in recent days. It was below 40, indicating that SOL may be slightly oversold at the time of writing and could see a reversal soon.

Read Ethereum’s [ETH] Price forecast 2024-25

The Awesome Oscillator (AO) for SOL was down, indicating that buying pressure has decreased and selling pressure may have increased.

However, the volume on which SOL traded was up a significant 212% in the last 24 hours.

Source: trading view