- Kaspa rose 5.4% on the daily charts and 5.37% in the past seven days.

- The recovery comes amid reduced liquidations and increased interest in buying.

Over the past month, the crypto market has experienced increased volatility. The market fluctuations have hit altcoins the most as their market cap has fallen by 60% from ATH.

Although Bitcoin [BTC] has also witnessed a sustained decline, trying to recover and remain above $60,000 on average.

Momoa crypto analyst, noticed this altcoin trend and stated that:

“Not just Solana, but the broader crypto market is showing similar signs of uncertainty. The recent rallies in Bitcoin and Ethereum have not generated the expected momentum. Many altcoins are struggling for stability as market sentiment remains cautious.”

Since the recent market crash, most altcoins have struggled to recover and report sustained gains. However, after nearly two weeks of decline, KAS has reported significant upward trends.

KAS is recovering from the downturn

Two weeks ago, KAS attempted to reach a new ATH high after hitting an all-time high of $0.20. However, the market crash and the preceding market decline hit Kaspa hard, causing the company to fall into decline for a long period.

After the market crash, KAS fell from a high of $0.183 to a low of $0.125. Since the crash, KAS has recovered 5.37% over the past seven days.

Likewise, the market cap has reported significant gains up 4.06% to $4.1 billion.

While it’s a gain, in terms of market cap it’s down from the record high of $5 billion two weeks ago. Despite that decline, there has been a remarkable recovery from the crash, which brought the market capitalization below $4 billion.

What price charts suggest

At the time of writing, KAS was trading at $0.170, after rising 5.4% on the daily charts. However, trading volume is down 11% to $89 million.

Essentially, AMBCrypto’s analysis of Kaspa’s price action showed that the altcoin was experiencing strong upward moves.

Source: TradingView

The Advance Decline Ratio (ADR) was above 1 at 3.57 at the time of writing, indicating that the recent highs have outweighed the lows. This suggested that the market was positive, indicating strength in the market.

A persistently positive ADR showed a strong increase, indicating increased purchasing interest.

Similarly, the Relative Strength Index has risen from a low of 35 in the past seven days to 48 at the time of writing.

This showed rising buying interest as demand began to outweigh the selling pressure, which has overwhelmed the altcoin over the past two weeks.

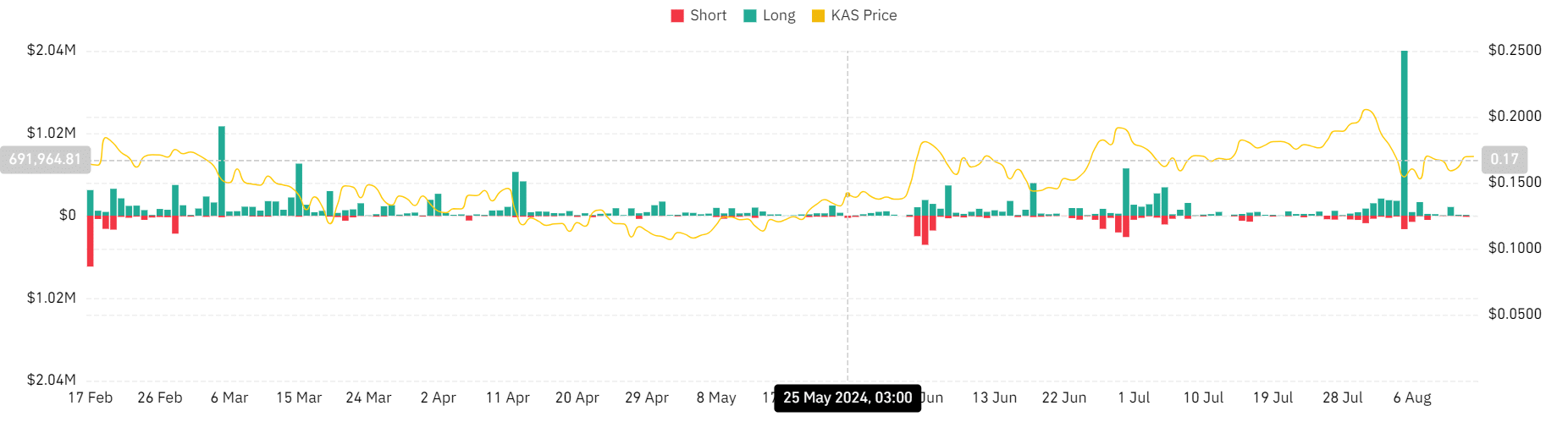

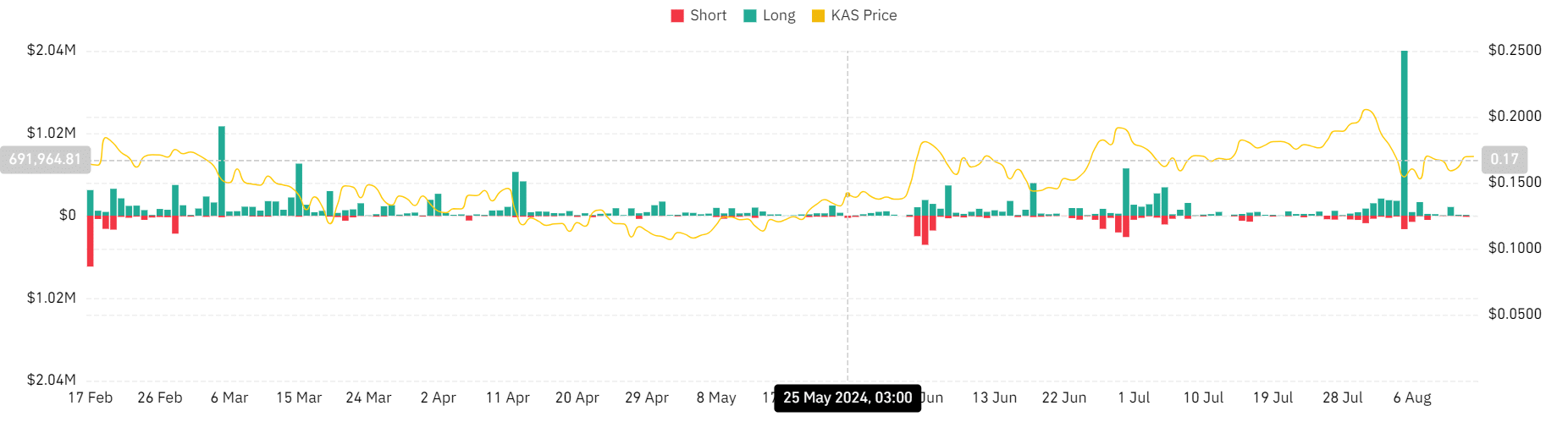

Source: Coinglass

Looking further, AMBCrypto’s analysis of Coinglass shows that liquidation of long positions has declined over the past week. Liquidation for long positions has fallen from $2 million to $592 at the time of writing.

The decreased liquidation showed that investors were paying premiums to hold their positions, and those who bet against the market were running out of money.

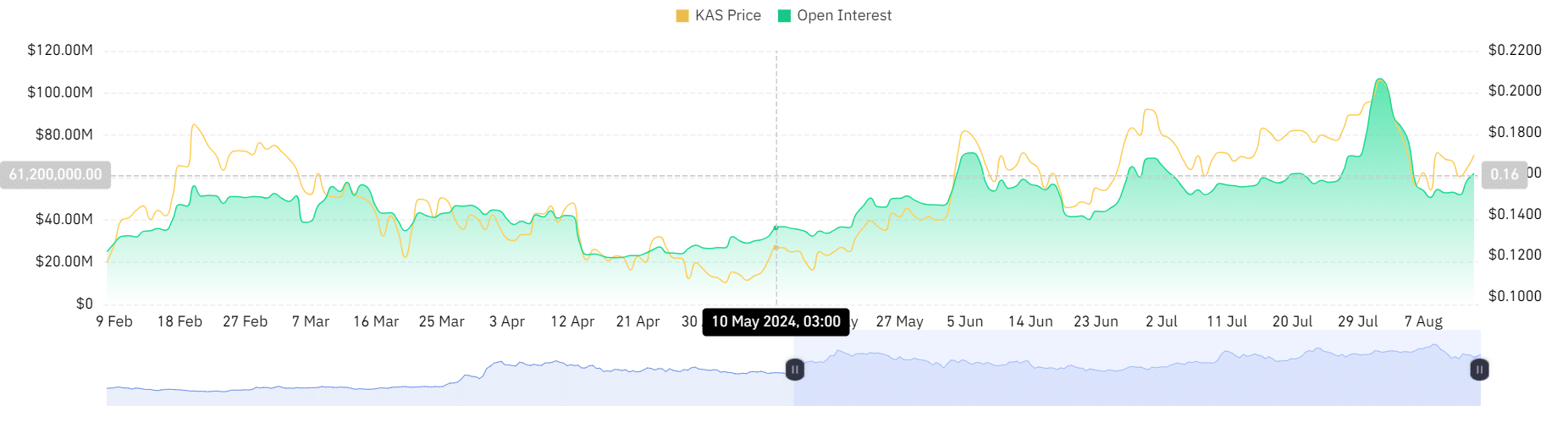

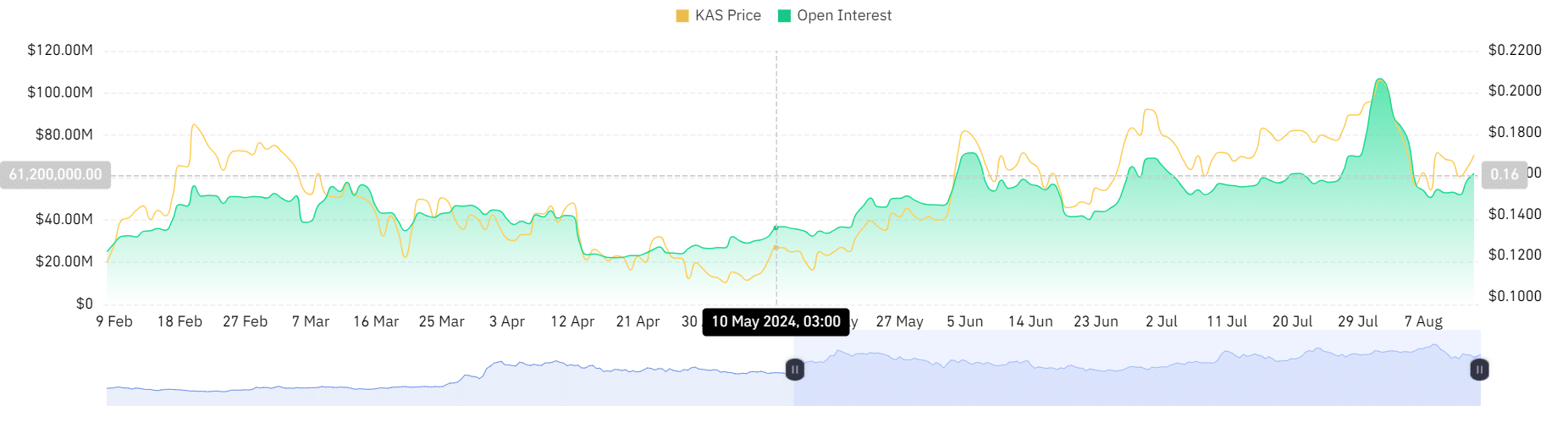

Source: Coinglass

Finally, KAS has seen a continued increase in Open Interest over the past week. The altcoin’s Open Interest has increased from $50 million to $61.97 in the past week.

So investors kept their positions while opening new ones.

Read Kaspa’s [KAS] Price forecast 2024-25

KAS is recovering strongly from the recent market downturn, with increased interest in purchasing. If the current trend continues, Kaspa will attempt the previous resistance level around $0.185 and $0.195.

However, a market correction will see Kaspa drop to $0.161.