- KAS is down 11.80% in the last 7 days.

- Despite the decline, the trend remains upward.

On June 30, KAS reported a 20% increase after days, as reported by AMBCrypto. However, a week later, KASPA fell by 11.80%, causing panic among long-term holders of KASPA.

Despite the decline, the market remains optimistic with positive market sentiment. Several analysts therefore predict an increase in market capitalization. KAS’s market capitalization has increased in 30 days, surpassing PEPE and ICP.

A crypto analyst @Sukie shared his projections on X (formerly Twitter) noting that:

“It’s no moon boy that $KAS can reach $100 billion+ MC. In 2017, bull $XRP reached $130 billion when there was MUCH less money in the market. The last bull run $BNB went from $3 billion to $108 billion MC. No other Crypto beats Kaspa’s fundamentals.”

Based on historical data, KAS is positioned to experience exponential market capitalization growth. Overall, market capitalization growth implies that KAS prices and user activity will continue to rise for the foreseeable future.

Market sentiment

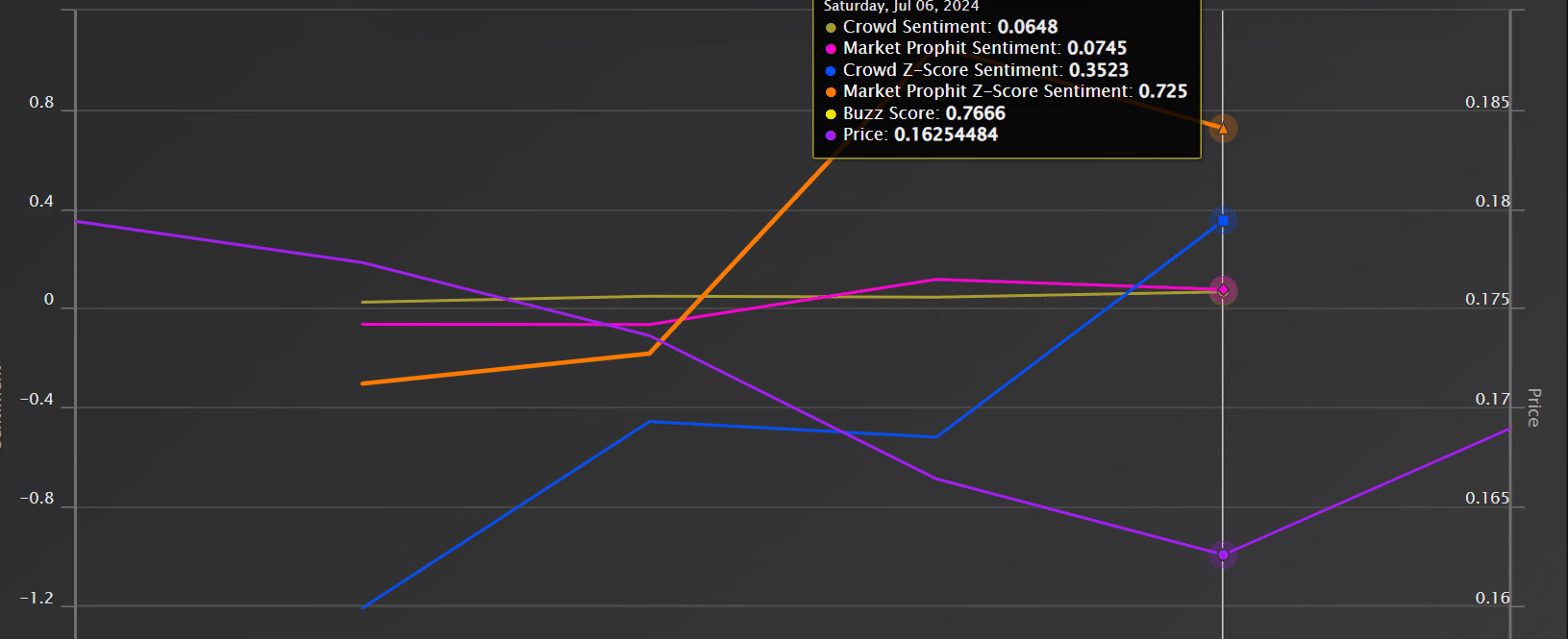

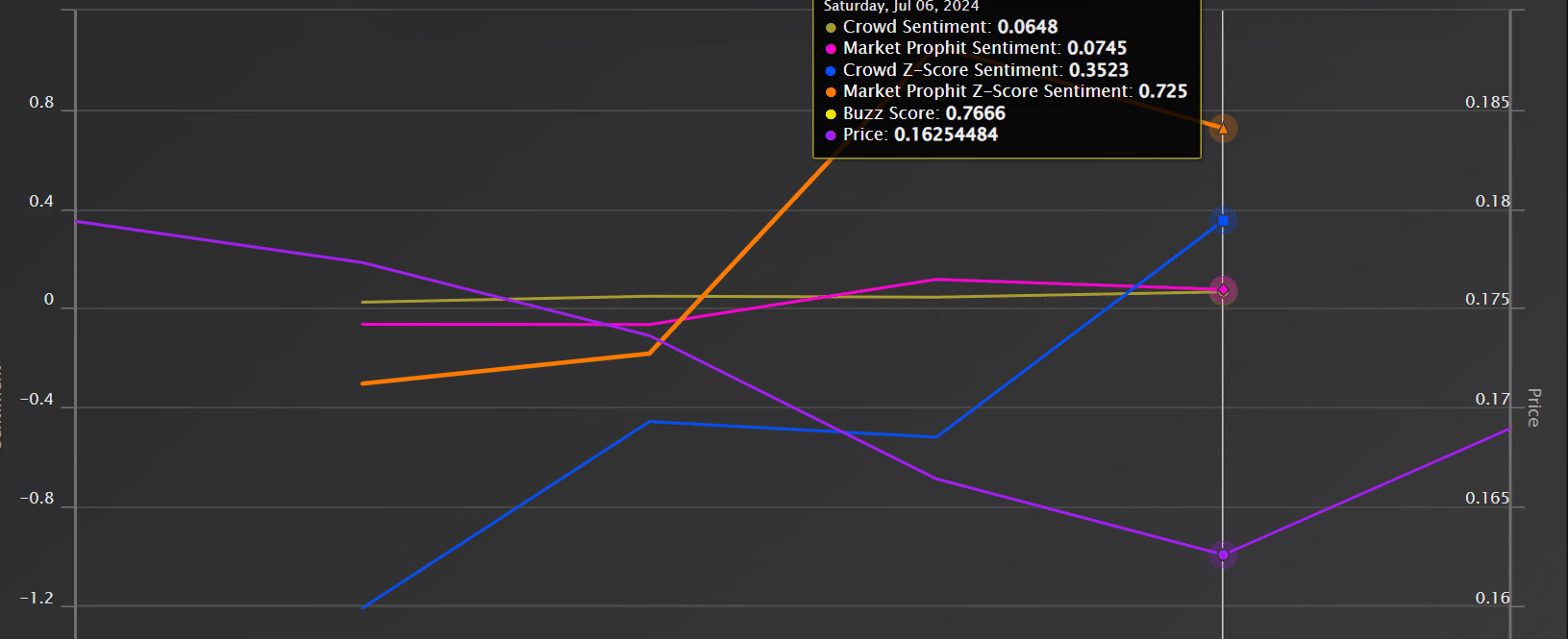

Source: Markt Profhit

According to Market Prophit, KASPA continues to enjoy positive market sentiment.

In fact, public sentiment is 0.06 with a Z-score of 0.35, while overall market sentiment is 0.07. The positive market sentiment shows that users and investors are optimistic about KASPA’s future potential.

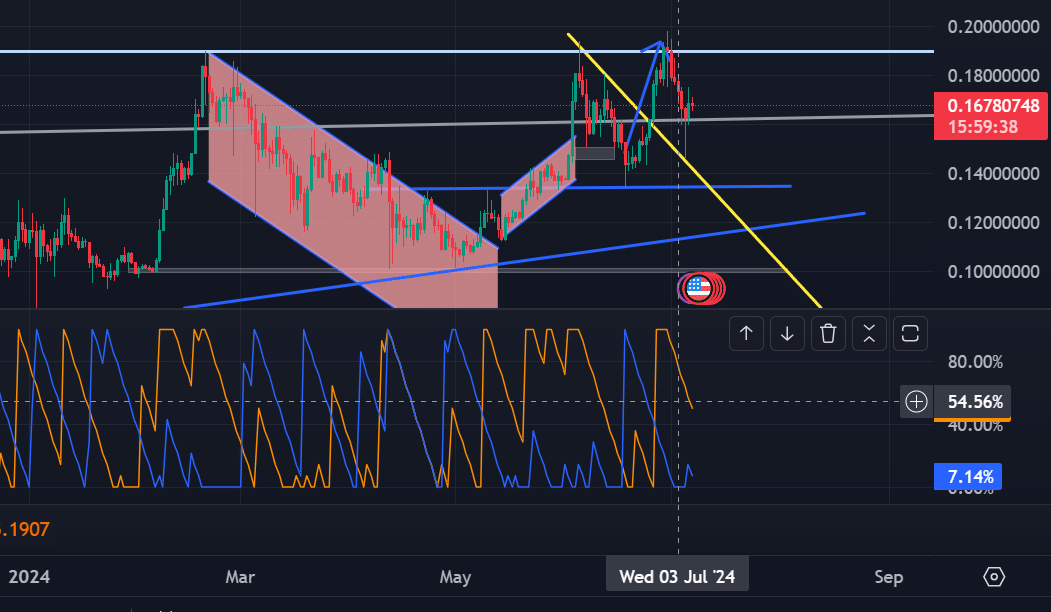

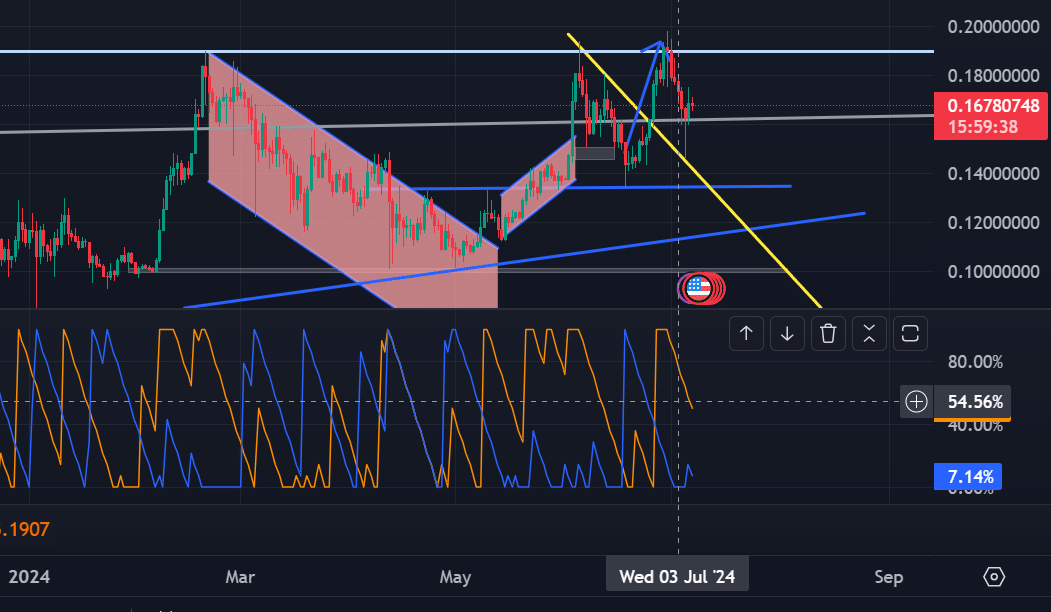

What the KAS price charts indicate

At the time of writing, KAS’s Aroon line is on a strong upward trend. In concrete terms, the aroon at 50 is above the aroon at 7.

When the Aroon line is set like this, it shows that the uptrend is strong and positioned to continue. Likewise, it shows that prices are within market value.

Source: Tradingview

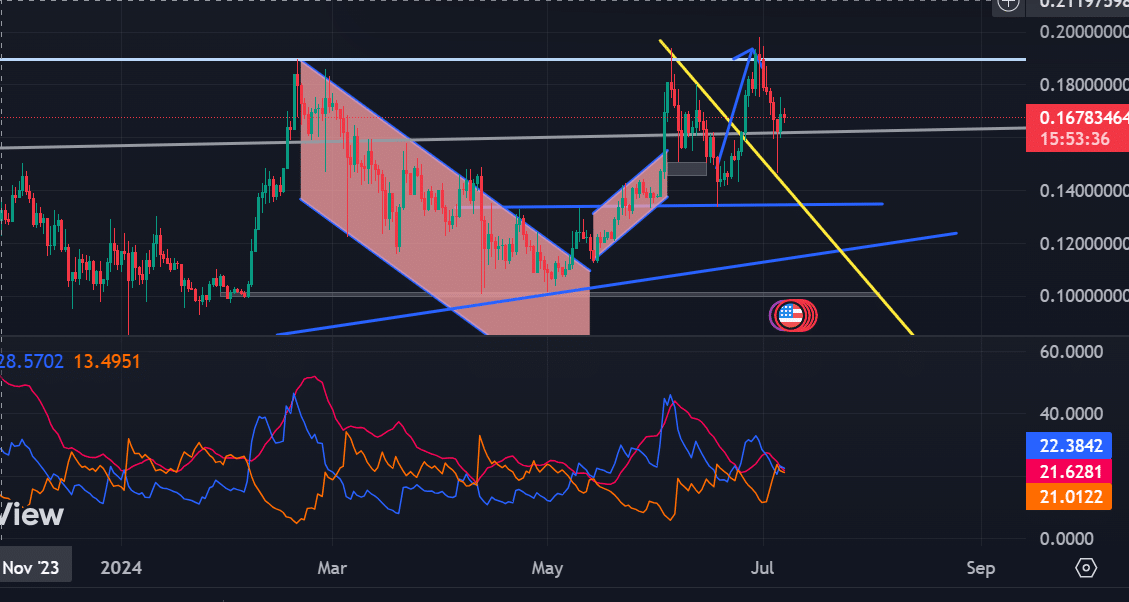

The Directional Movement Index further supports this. At the time of writing, the positive index at 22 (blue) is above the negative index (red) at 21.

This setup implies that KASPA is in a good position and continued positive market sentiment positions it for further upside.

Source: Tradingview

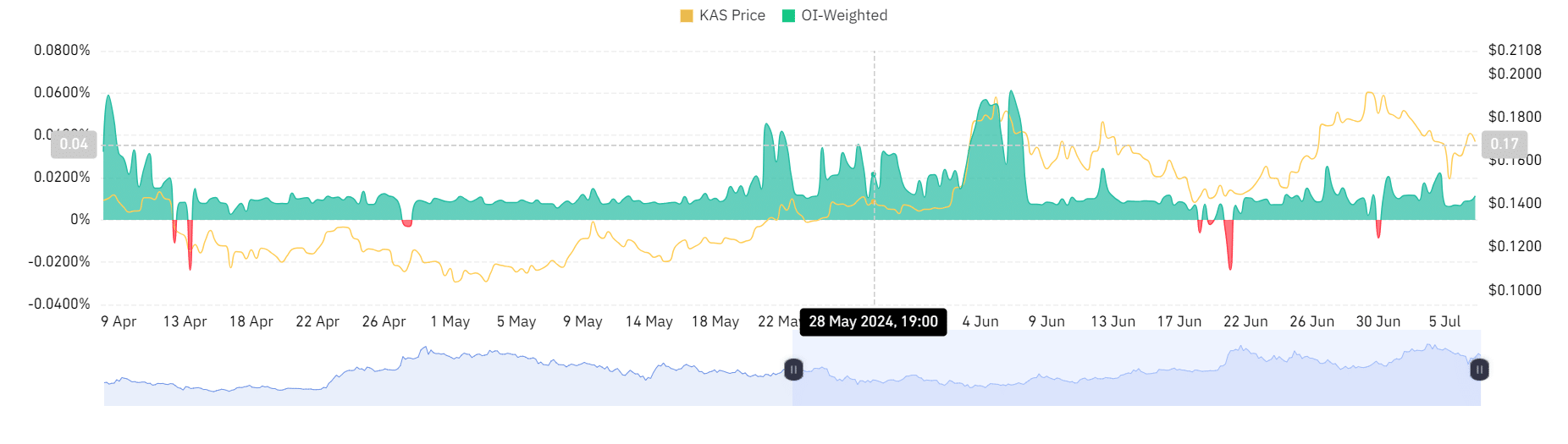

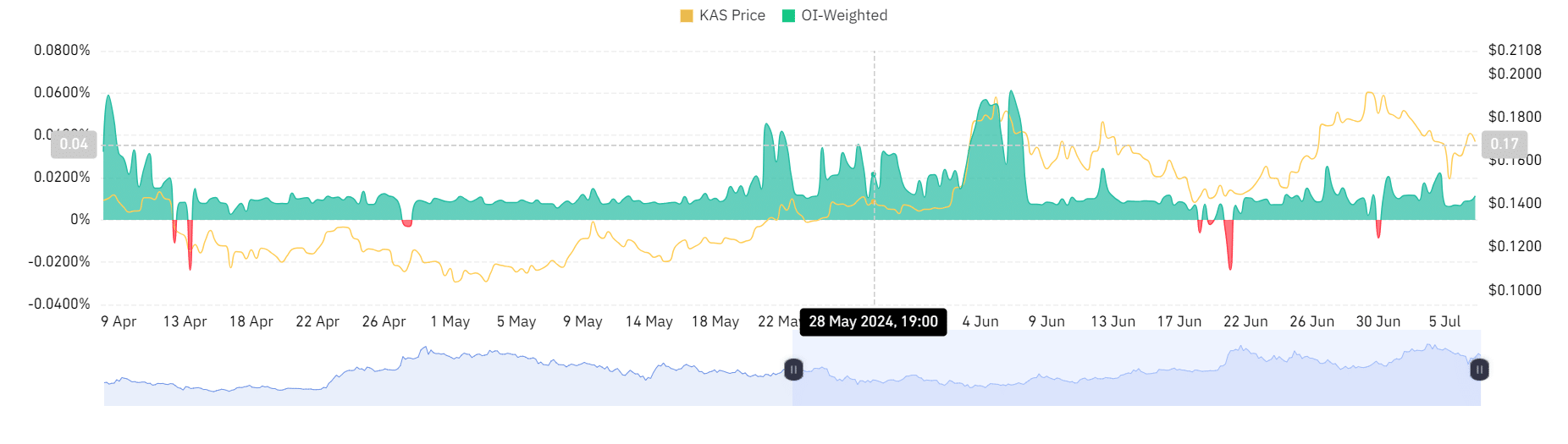

Looking at the OI-weighted funding rate, AMBCrypto’s analysis shows that this has been largely positive over the past seven days.

Positively weighted funding rates imply that demand for long positions is greater than for short positions. So traders pay a premium to hold their positions, which is bullish sentiment.

Source: Coinglass

Can KAS maintain its upward trend?

Kaspa’s analysis by AMBCrypto indicates that price movements remain largely in an uptrend. After reaching an all-time high of $0.194, KAS experienced a short-term price drop while the trend remained unchanged.

At the time of writing, KAS is trading at $0.1688, having risen 1.64% in 24 hours. After previously reaching the resistance level at $0.194, a breakout from the zone would send prices soaring to a new all-time high of $0.23.

Therefore, if the losses continue in the weekly charts, the price will fall towards the $0.15 support level.