- Tron’s ecosystem is considering a proposal to reduce the speed of TRX emissions by halving

- Justin Sun believes that, like Bitcoin, a TRX and Halving will benefit both validators and token

In the past few days, Tron Community has discussed the idea of a Bitcoin-like halving for TRX on a large scale. As expected, this discussion caused the founder of Tron Justin Sun To address the halving of the Altcoin.

According to Sun, TRX is already in a deflatory state of 1% per year, making it the only deflatoire active in large cryptocurrencies. However, as prices have risen, rewards for block -producing nodes in the network have risen considerably. That is why a moderate reduction can be beneficial for the network.

With reference to the path of Bitcoin, Sun stated that as the Bitcoin network grew, Block Rewards gradually fell. In the early days, higher rewards were needed to switch on the network. However, as the BTC prize rose, block senses were lowered and the Haltecycle played a role in the long -term sustainability in the long term.

That is why, just like Bitcoin, Tron could considerably benefit from reduced block rewards. As such, if the daily block rewards are reduced by 1 million TRX, the deflation percentage would increase by 50%, which reaches 1.5% per year.

Similarly, if it is lowered by 2 million TRX, the deflation percentage would rise by 2% annually. This would effectively double the deflation percentage with an impact on the price of TRX, a similar to Bitcoin’s halving.

According to Sun, even if the block release is reduced, the current stimuli for validators are very attractive and will still keep in profitable positions.

What would it mean for TRX?

As suggested by the founder of TRON, more deflatory measures would benefit TRX. That is why a halving event can positively influence the Altcoin in various ways. To start with, it would lead to market speculation in every half -half cycle, which stimulates the Altcoin’s demand in the process.

In addition, lower rewards will result in a reduced offer, which would lower inflation for the price of TRX. Lower supply results in higher prices, especially if demand remains high or constant.

Based on supply and demand, TRX will benefit extensively from its price charts. As such, TRX could grow and win his ATH back and climb to $ 1.

Latest market conditions

According to Ambitrypto’s analysis, TRX still stands for a number of strong bearish sentiments. Especially since investors are now missing the motivation to open new positions.

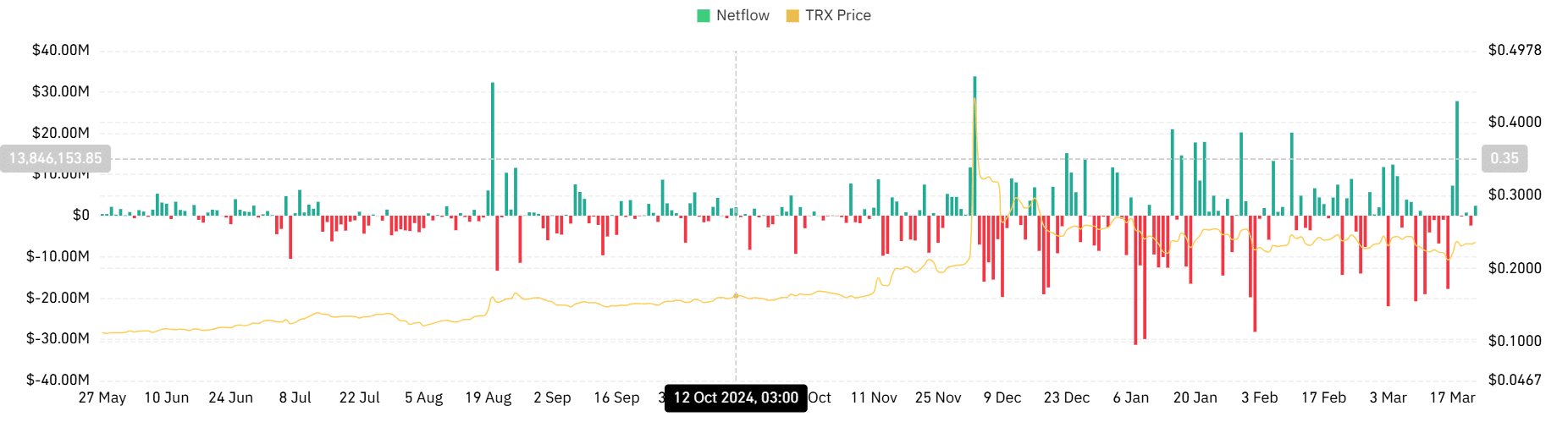

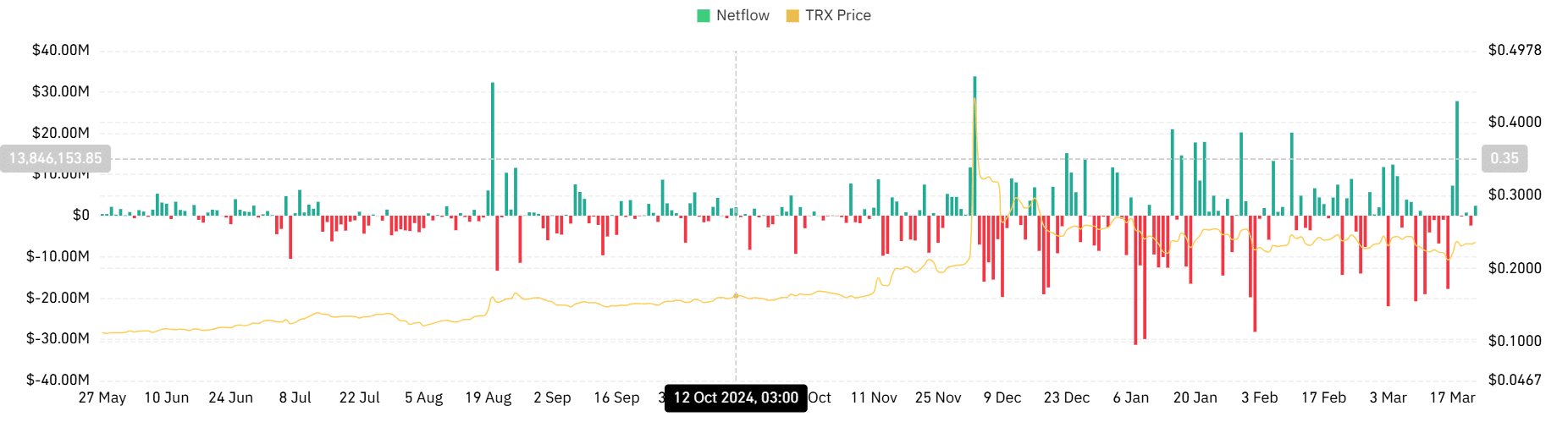

Source: Coinglass

In the past week, however, the Altcoin was won by 6.08% to act on the $ 0.235 press.

And yet, DSPITE This price pump, it is still confronted with considerable ariting. We can see this when the market is dominated by more sellers. The stain outflows of TRX became positive last day and reached $ 2.39 million. When exchange Netflows becomes positive, it means that there is more inflow.

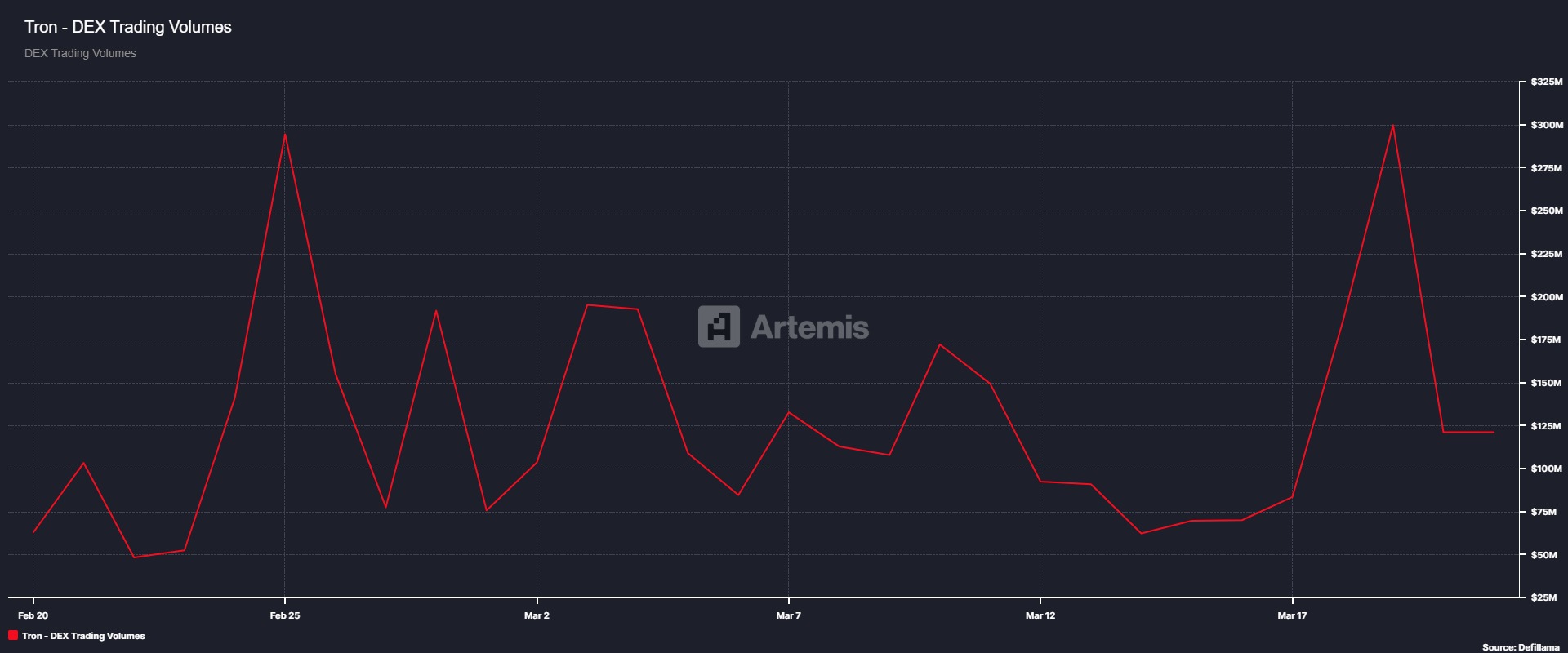

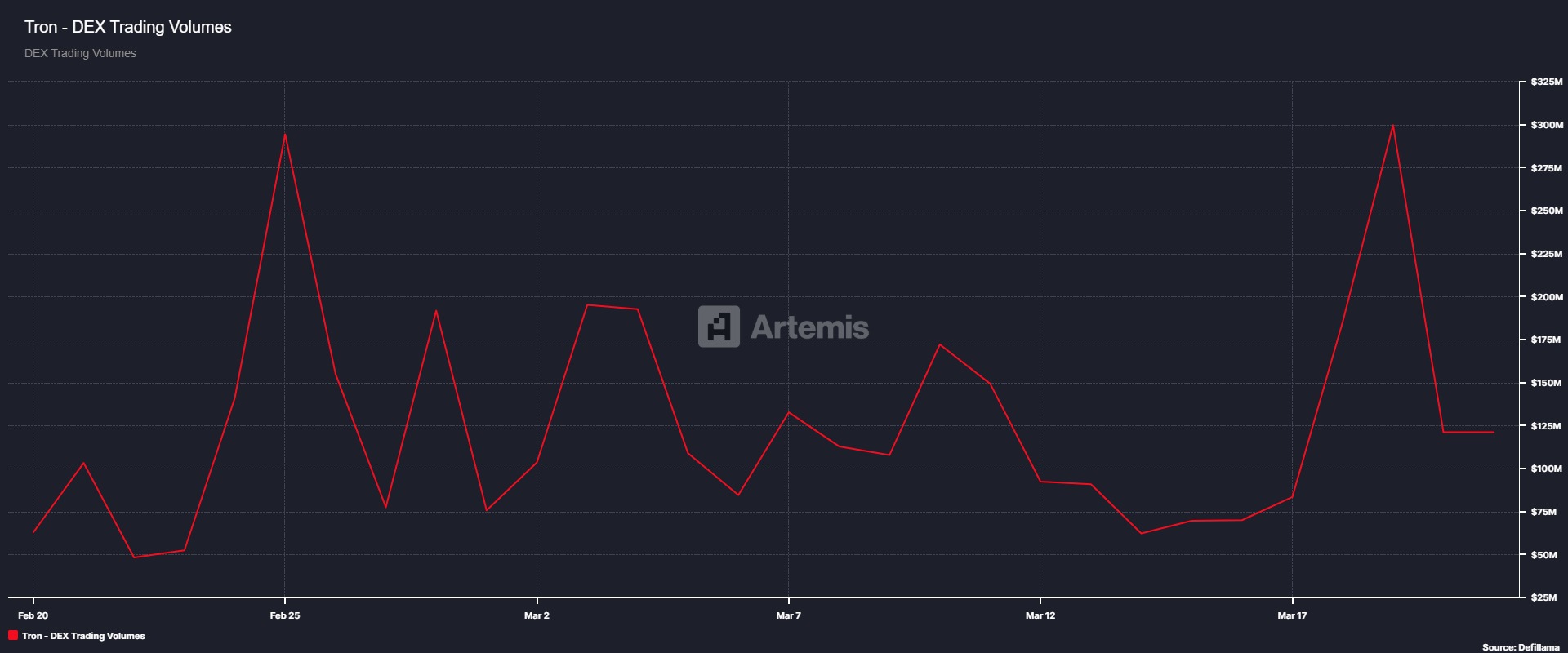

Source: Artemis

In addition, Tron’s DEX -Handelsvolume fell from $ 299 million to $ 121 million. When this falls, this means that the network sees a decrease in network activity as demand falls.

That is why there is less speculation among traders, which leads to lower swaps. Historically, a high DEX volume leads to higher prices. For example, when the price of TRX rose to $ 0.38 three days ago, it flashed a number of $ 299 million. A drop therefore means lower prices.

As it looks now, there are strong bearish sentiments in the market. If these prevailing sentiments persist, we can see a retracement up to $ 0.22. However, if investors consider the advocacy of Justin Sun as a bullish signal, the Altcoin can recover $ 0.35.