- Justin Sun announces $1 billion for the crypto industry amid market crash

- However, TRX remains bearish despite positive developments.

Over the past 48 hours, crypto markets have experienced an extreme sell-off amid a global stock market crash. The crypto industry experienced a liquidation of over $1 billion, resulting in a drop of over $300 billion in the crypto market.

Amid the market uncertainty, Justin Sun, the founder of Tron Network (TRX), has emerged as a savior, announcing $1 billion as a bailout plan for crypto.

Justin Sun announces emergency response plan amid market crash

As the market collapsed, traders and analysts looked for a lifeline. Because of this unrest, Justin Sun announced its $1 billion initiative for the crypto market. Via his official X page (formerly Twitter) he announced:

“Don’t worry! The industry has grown significantly over the past year and these market swings are not due to negative news. We must reject FUD and keep building. That’s why we’re creating a $1 billion fund to fight FUD, invest more and provide liquidity.”

His investment is a certainty for crypto traders and investors as the market has experienced high liquidation over the past two days.

Crypto market decline and ETH liquidation

Due to the cryptocurrency downturn and the decline in the global stock market, ETH suffered the most. In the midst of the downturn, ETH experienced increasing liquidation, liquidating more than $355 million within 24 hours.

This increased liquidation brought rumors that many investors, including Justin Sun, were victims. Several reports claimed that he was forced to liquidate his positions as ETH crashed and most of the long positions were liquidated.

However, while announcing his crypto relief plan, Sun stated that such rumors were false. He explained it in detail, arguing that he rarely deals with leveraged trading, but is mainly concerned with staking and supporting various crypto projects.

Such a strategy has seen his ETH holdings increase over time to 377,590 ETH spread across several wallets.

Potential implications for TRX price charts?

Since Justin Sun is the founder of TRX, his comments and investments will likely influence the price action. While TRX has been on a continued downward trend, the $1 billion relief plan has given the altcoin a boost on the daily charts.

The crypto has gained 0.56% on the daily charts and is trading at $0.124.

Source: Tradingview

AMBCrypto analysis showed that TRX has experienced a strong bearish market. As indicated by the Directional Movement Index, downward momentum continues.

The DMI showed that the negative index of 25.3 is above the positive index of 14.6. This suggested that the downward movement is strong.

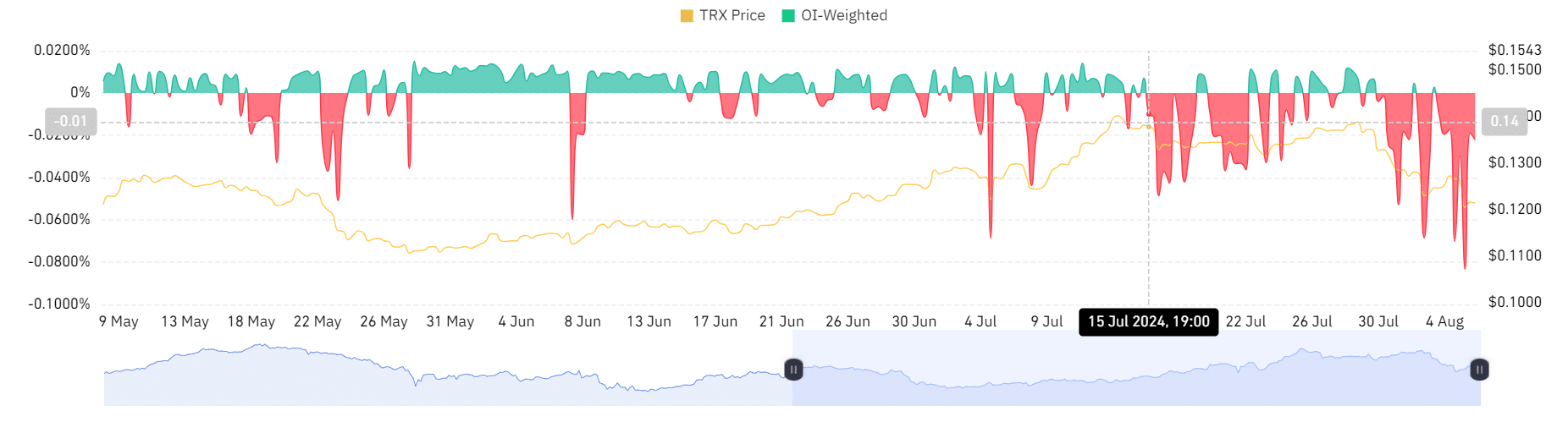

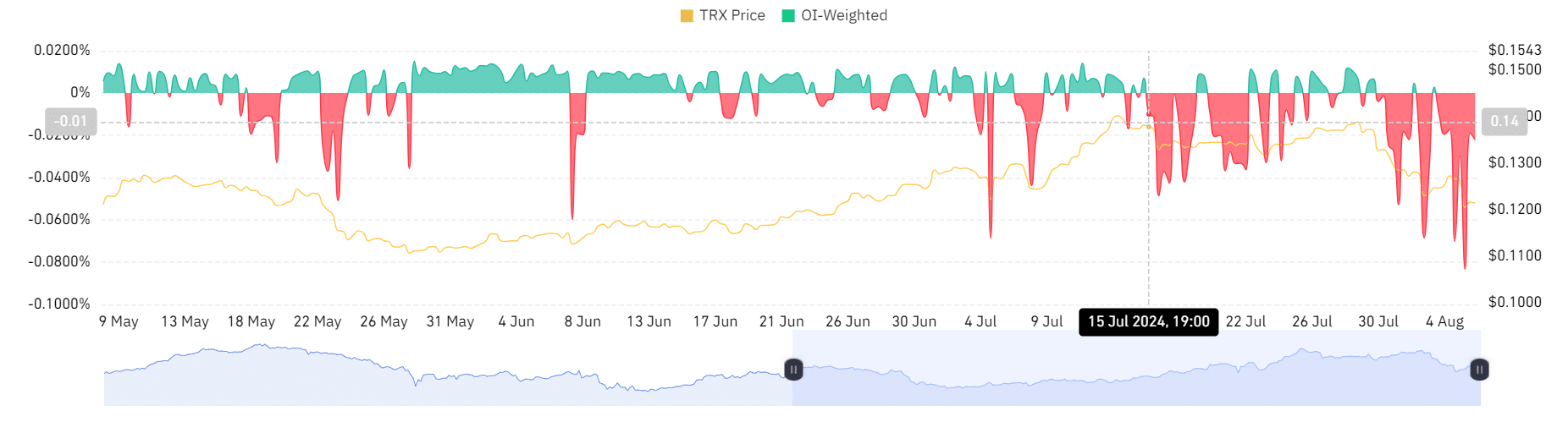

Source: Coinglass

Looking further, the TRX OI-weighted funding rate has been negative for the past four days, according to Coinglass.

This meant that short positions pay for long positions, which usually happens when perpetual futures prices are lower than the spot price. This indicates bearish market sentiment.

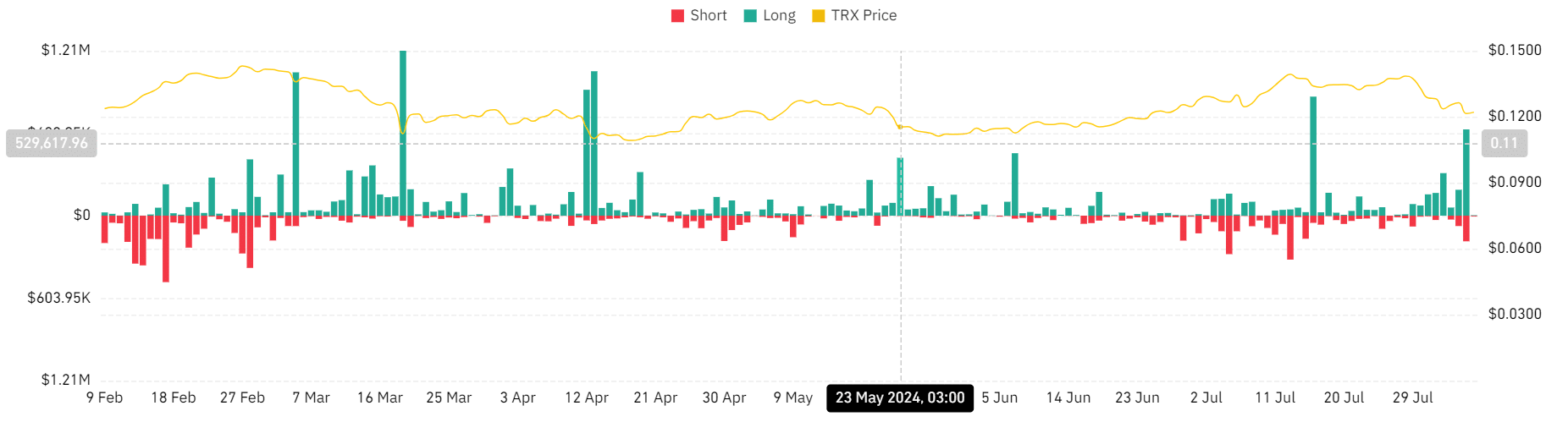

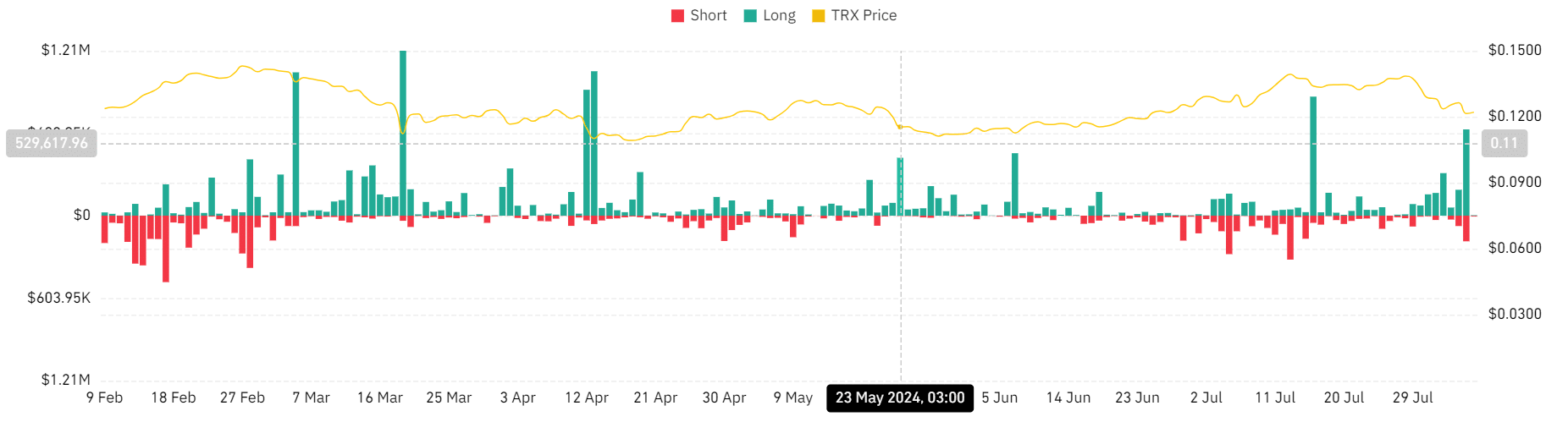

Source: Coinglass

Even after Justin announced the $1 billion initiative, TRX has experienced massive liquidation for long positions over the past 24 hours.

According to Coinglass, TRX liquidation for the long positions reached $631.69k on July 5. This suggests that long position holders were forced out of their positions because they were unconvinced of the altcoin’s current direction.

Although Justin Sun announced a $1 billion relief initiative to support the crypto market, the TRX market remains bearish even on the daily charts.