- An unprecedented move by the BOJ causes a market shift.

- Bitcoin’s bearish sentiment supports the crypto market’s overall decline, but it’s still not time to sell.

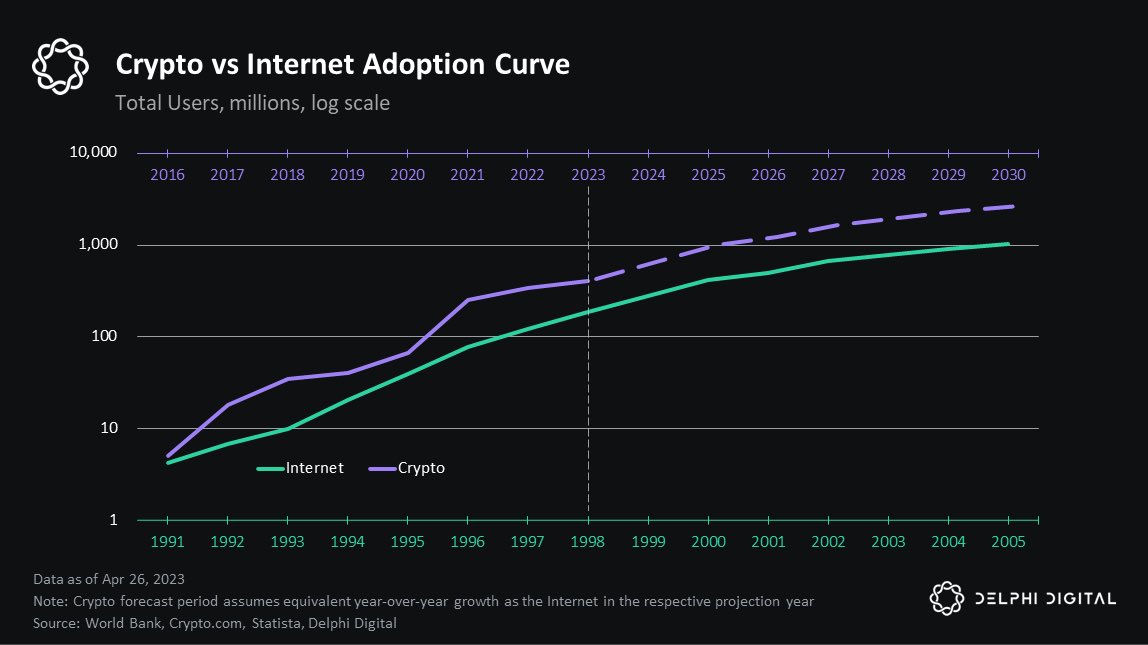

Crypto is growing faster than the internet and heralds the arrival of Web 3. Unlike the Internet, whose value took some time to recognize, the value of cryptocurrency is immediately apparent, as Crypto vs. Internet Adoption Curve indicates.

As crypto becomes more and more popular, understanding its complexities will keep you informed and ready for the next big change.

The future trend of cryptocurrency will undoubtedly outpace any investment, despite inevitable short-term market declines due to interest rate increases.

Source: Delphi Digital

Why are crypto markets not immune to interest rate increases?

After thirty years of 0% interest rates, Japan’s rate hike caused investors to lose $4 trillion in trades, impacting global markets, as popular analyst Nicholas Mugalli said. notedand crypto is not immune to the impact.

This unprecedented move by the BOJ causes a market shift as Japanese investors, who previously used cheap bank money for global investments such as crypto, began selling assets to repay loans, triggering a sell-off that impacted global markets.

The historical context shows that similar scenarios led to market declines in 2001 and 2008. While global tensions and Federal Reserve policy play a role, Japan’s rate hike is a major catalyst for the recent market decline.

This unexpected move caused widespread asset liquidation, causing ripple effects across international markets and contributing to the current downturn.

What Happens to Bitcoin?

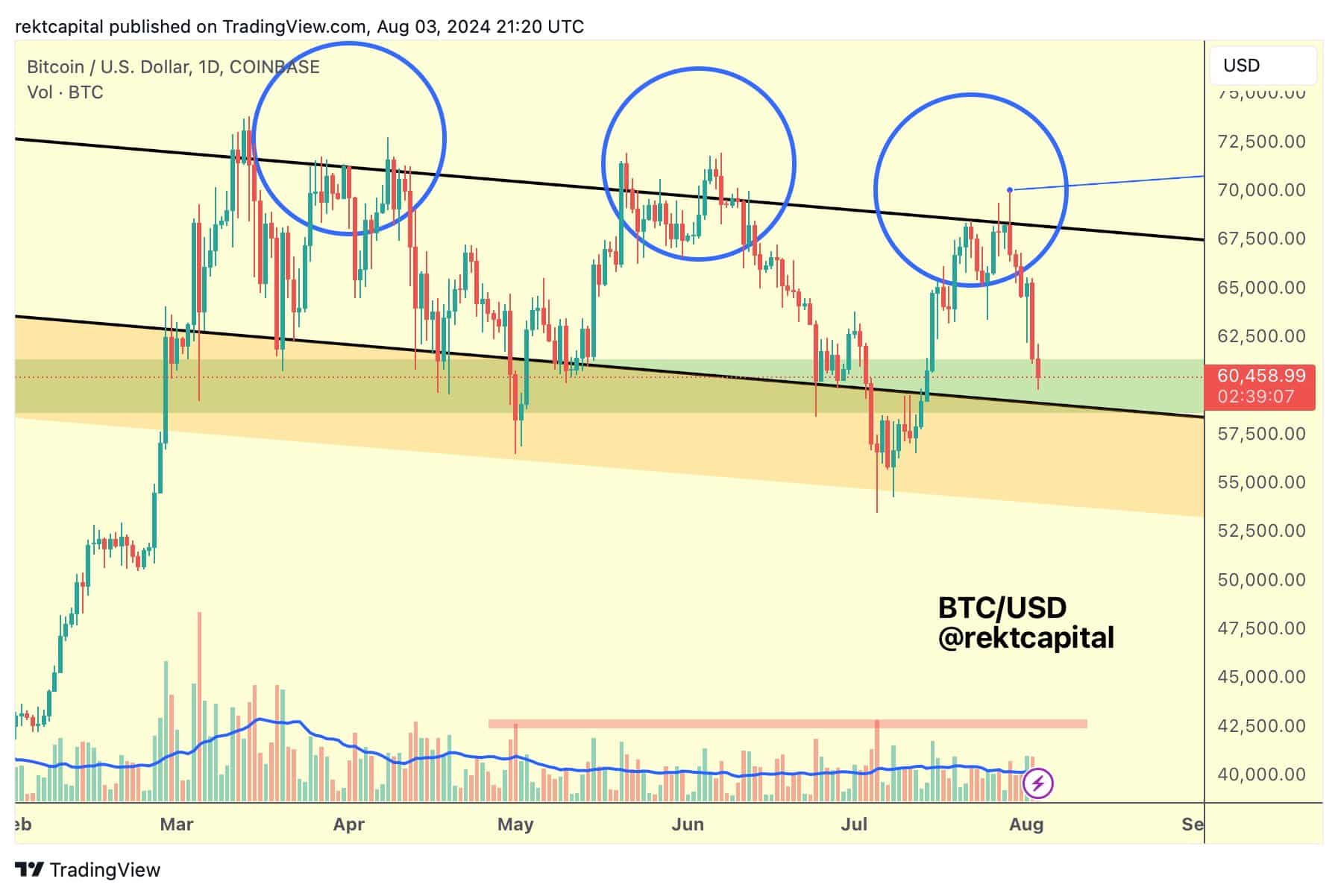

The previous two lows in Bitcoin price action occurred when above-average selling volume occurred, indicating seller exhaustion.

This pattern, highlighted by red boxes on the volume chart, suggests that a similar trend is necessary before a price drop can occur. Bitcoin has not yet reached this level of selling volume, implying that more selling pressure needs to come first.

The three tops in price action, combined with bearish sentiment, provide further insight into the expected sell-off in Bitcoin and other crypto assets.

This bearish pattern highlights the need for increased selling volume before the market can see a rapid price drop, confirming a deeper bearish trend.

Source: TradingView