- Metaplanet’s increased Bitcoin holdings reflect MicroStrategy’s successful institutional adoption strategy.

- Despite the volatility, Metaplanet shares are rising in sync with Bitcoin’s upward trajectory through 2024.

Like Bitcoin [BTC] and the broader crypto market was in the red for days, Metaplanet, a publicly traded investment and advisory firm based in Japan, has decided to increase its BTC holdings.

The move underlines the strategy known as ‘buying the dip’, where investors buy assets at discounted prices with the expectation of future appreciation.

For those unfamiliar with the term, “buying the dip” reflects a belief in the long-term potential of the asset, despite short-term market fluctuations.

Metaplanet’s Bitcoin holdings

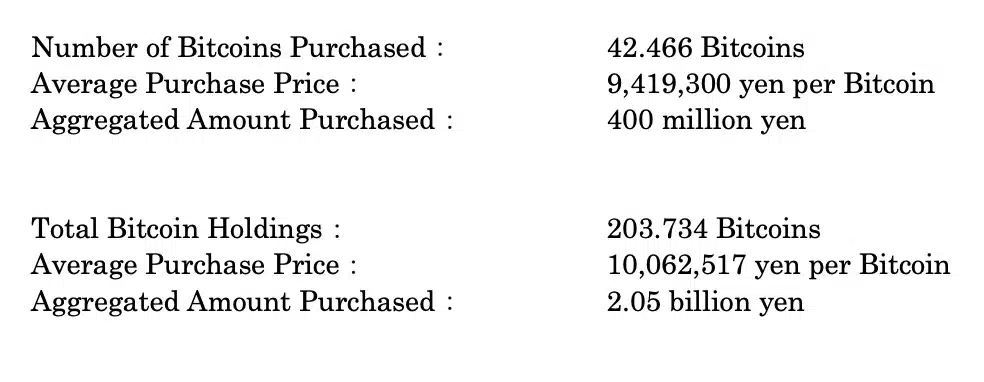

According to the rack released by Metaplanet Inc.,

“We hereby announce that we have purchased an additional 400 million yen worth of Bitcoin.”

The statement was further elaborated,

Source: Metaplanet Inc.

This step by Metaplanet is closely related Michael Saylors MicroStrategy BTC holdings. As of June 20, Saylor emphasized:

“$MSTR acquired 226,331 $BTC for ~$8.33 billion at an average price of $36,798 per bitcoin.”

Follow the steps of MicroStrategy

In fact, MicroStrategy’s BTC shares contributed to a 380% increase in the MSTR stock price. According to The recent report from CCData titled ‘2024 H2 Outlook’,

“MicroStrategy led with a 380% share price increase, driven by its 214,000 Bitcoin holdings now worth $13.3 billion, purchased at an average cost of $35,158. These holdings have earned the company approximately $6.54 billion since 2020.”

Following in the footsteps of MicroStrategy, Metaplanet is often hailed as “Asia’s MicroStrategy,” highlighting the increasing adoption of BTC among institutions.

Needless to say, the launch of Bitcoin ETFs has been a catalyst that has shifted the perspective of millions of people, including Wall Street, from seeing BTC as a threat to now seeing it as an opportunity.

Furthermore, there has been a notable shift in political interest, especially under former President Donald Trump, who once mocked cryptocurrencies but now sees crypto and Bitcoin as potentially crucial in winning the upcoming election.

Impact of Bitcoin on Metaplanet’s stock price

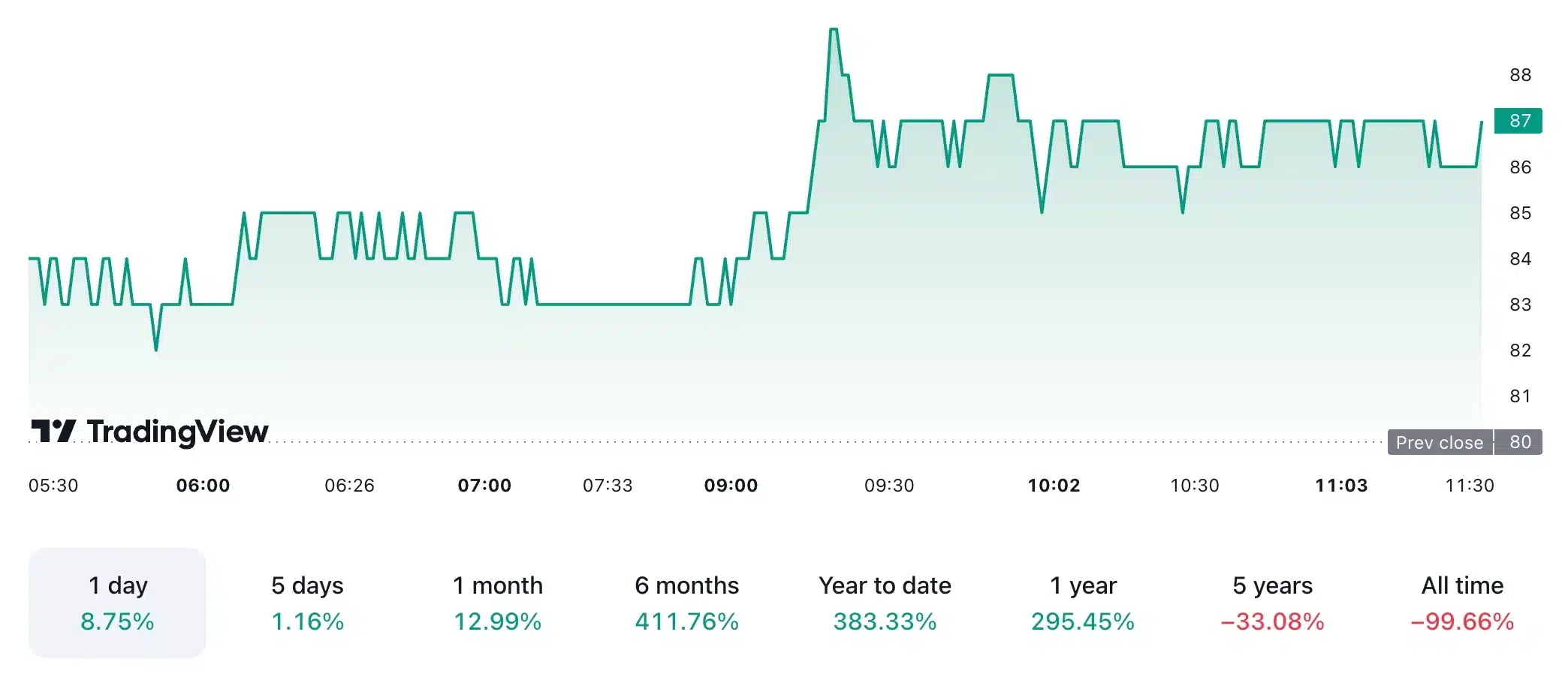

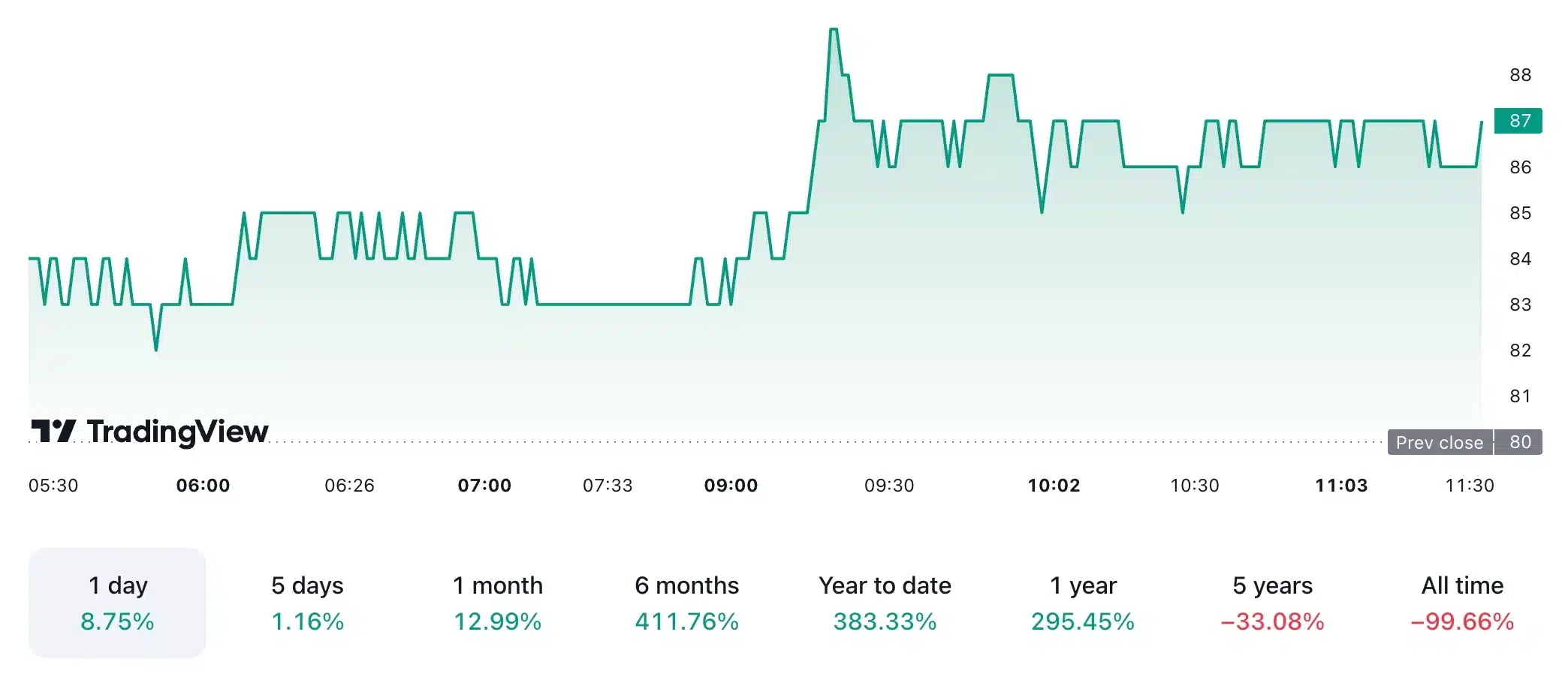

However, similar to Bitcoin’s recent downturn, there has been a direct negative impact on Metaplanet’s share price.

After peaking at 107 yen on June 11, Metaplanet shares fell 25%, while BTC fell from around $70,000 to less than $60,000.

However, as of the last update, the stock was trading at 87 yen, reflecting an increase of 8.75% in the past 24 hours, with the share price up 383.33% since the beginning of the year.

Source: TradingView

Meanwhile, Bitcoin was trading at $57,705 at the time of writing, having risen 2.29% in the past 24 hours, and a gain of 36.55% since the start of the year.