- Bitcoin is expected to soar after the summer halving.

- Some anomalies suggest that this time could be very different.

Bitcoin [BTC] has been in a strong uptrend since the end of October 2023. While this was evident from the price action, it is unclear what could follow. AMBCrypto used one CryptoQuant Insights post to understand what the dynamics of this cycle might be.

There was a pertinent but uncomfortable question as to whether the Bitcoin bull run was different this time. An argument can be made that it was different, but should investors be concerned?

Has the current bull run been around since March 2023?

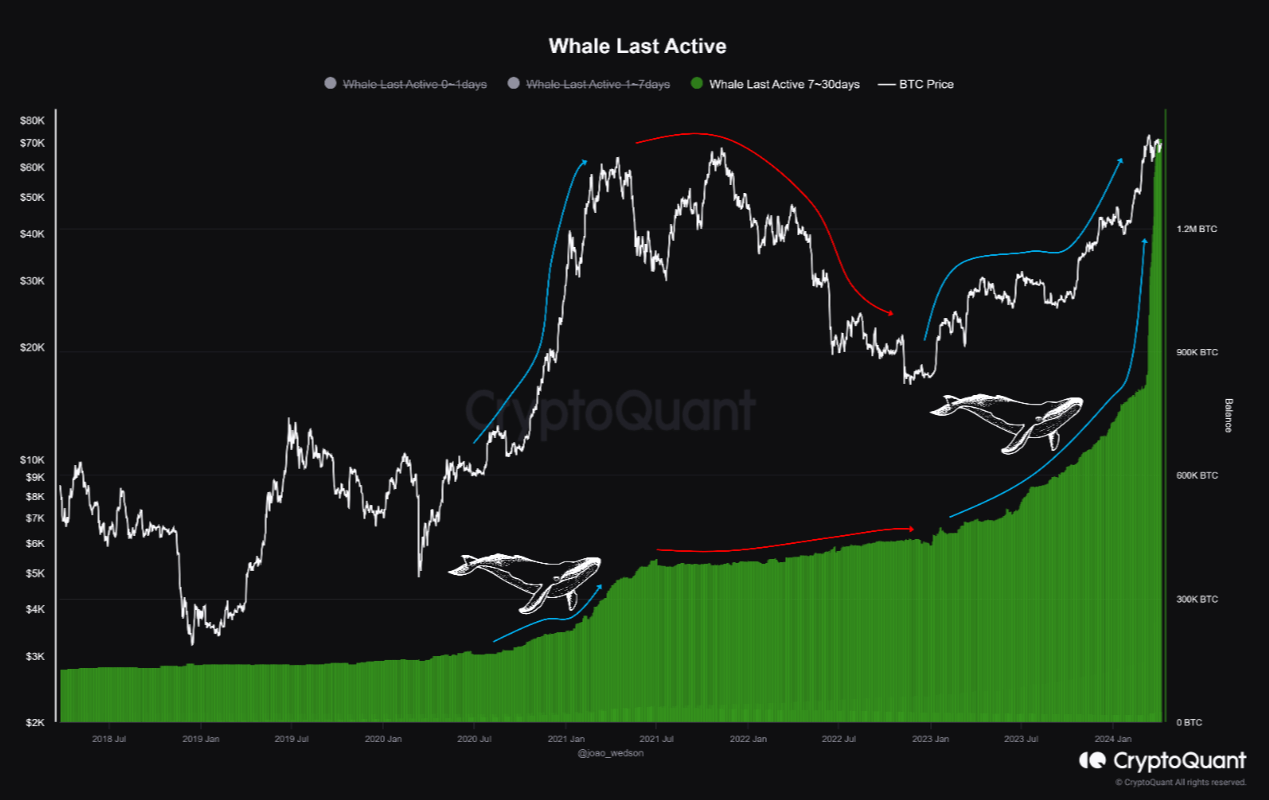

CryptoQuant user joaowedson pointed out that the Whale Last Active 7-30 days indicator started showing an upward trend since March 2023. During the previous bull run, the increase in whale activity in mid-2020 was accompanied by a rapid Bitcoin rally.

A similar situation occurred over the past six to eight months, when the indicator began to rise noticeably higher.

In addition to the price action, the whale indicator was another sign that the current uptrend was a long-term bull run that started at $30,000.

Investigating the behavior of miners

The halving event is the talk of the town (after Bitcoin ETFs and their absurd inflows) and the miners were at the crux. Their block rewards would drop from 6.25 BTC to 3.125 BTC, which could force many of them to shut up if they don’t hold out until BTC prices move higher.

Alternatively, a drop in the network hash rate and a decrease in difficulty could result, but this was extremely unlikely.

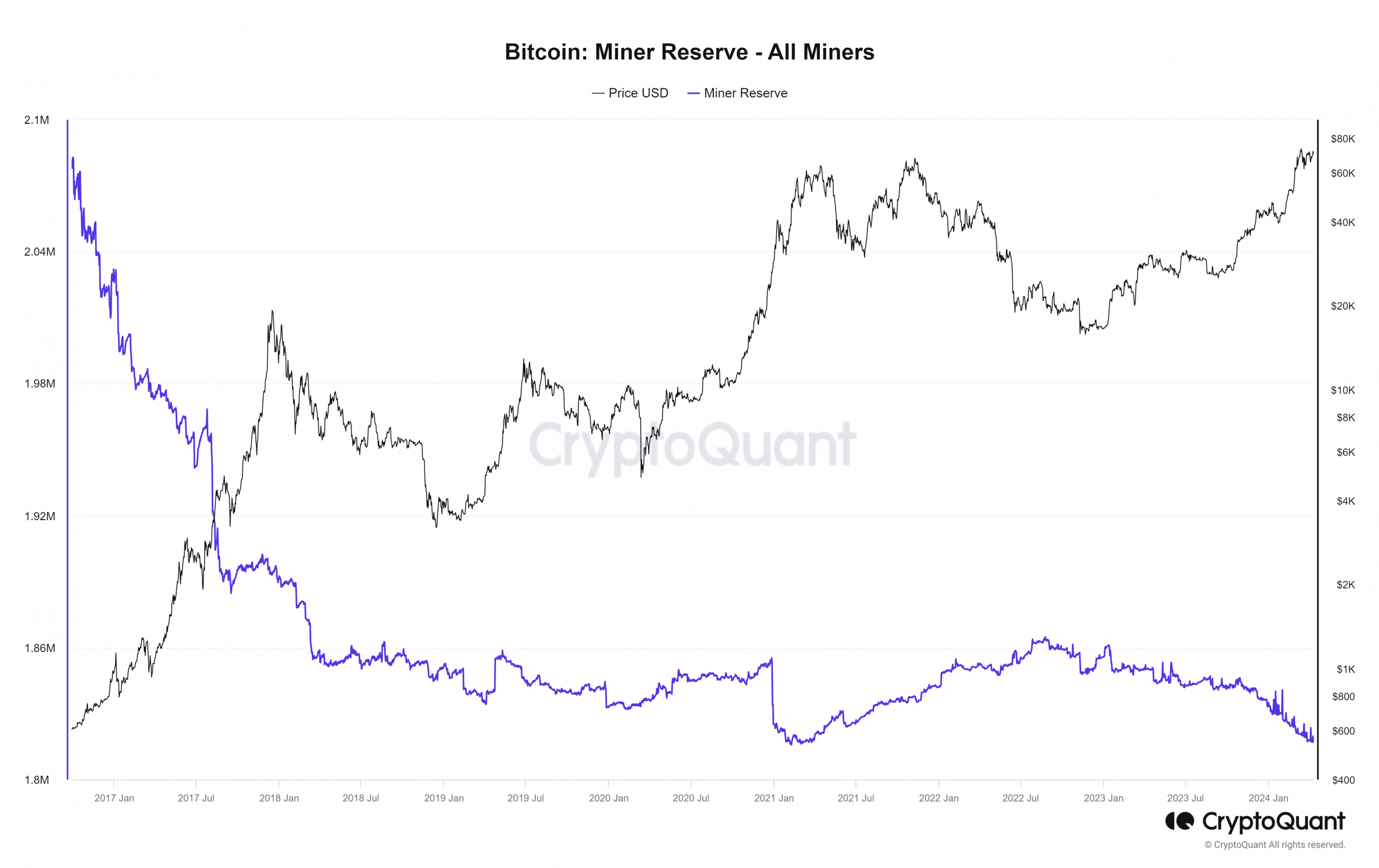

CryptoQuant’s miner reserve chart has shown a decline since November 2023. In the past two cycles, a noticeable decline in BTC’s miner reserve has gone hand in hand with a bull run.

Therefore, it was another metric that confirmed the idea that Bitcoin started trending upward well before the halving event. Bitcoin also made an ATH before the halving, which has not happened in previous cycles.

The importance of miners’ Bitcoin transactions has also been something that has decreased with successive cycles. This trend was likely to continue as the whales and institutional investors became the dominant players.

In that case, the halving event could become a ‘sell the news’ event.

Read Bitcoin’s [BTC] Price forecast 2024-25

Since the numbers on whale activity and miner reserves, combined with the price action, support the idea of an existing bull run, the question becomes “when will the cycle end”?

Previous cycle tops reached 526 and 547 days after the halving. Can the duration of this run be seriously shortened because we have already been running for the past six to eight months? Time will tell.