- Chainlink fell 38% this week, breaking major support zones.

- Potential further declines could target the $5 support level, with a recovery possible if resistance is met.

Now that the cryptocurrency market is facing a challenging phase, Chainlink [LINK] has not been spared and has experienced significant downturns that align with broader market trends.

Over the past week, LINK’s value has fallen 38%, with a sharp 25% decline only seen in the past day.

In addition to the recent Chainlink price action against the backdrop of the recent LINK rose above $21 in Marchthe decline is influenced by technical patterns observed on the price chart.

Technical view of Chainlink

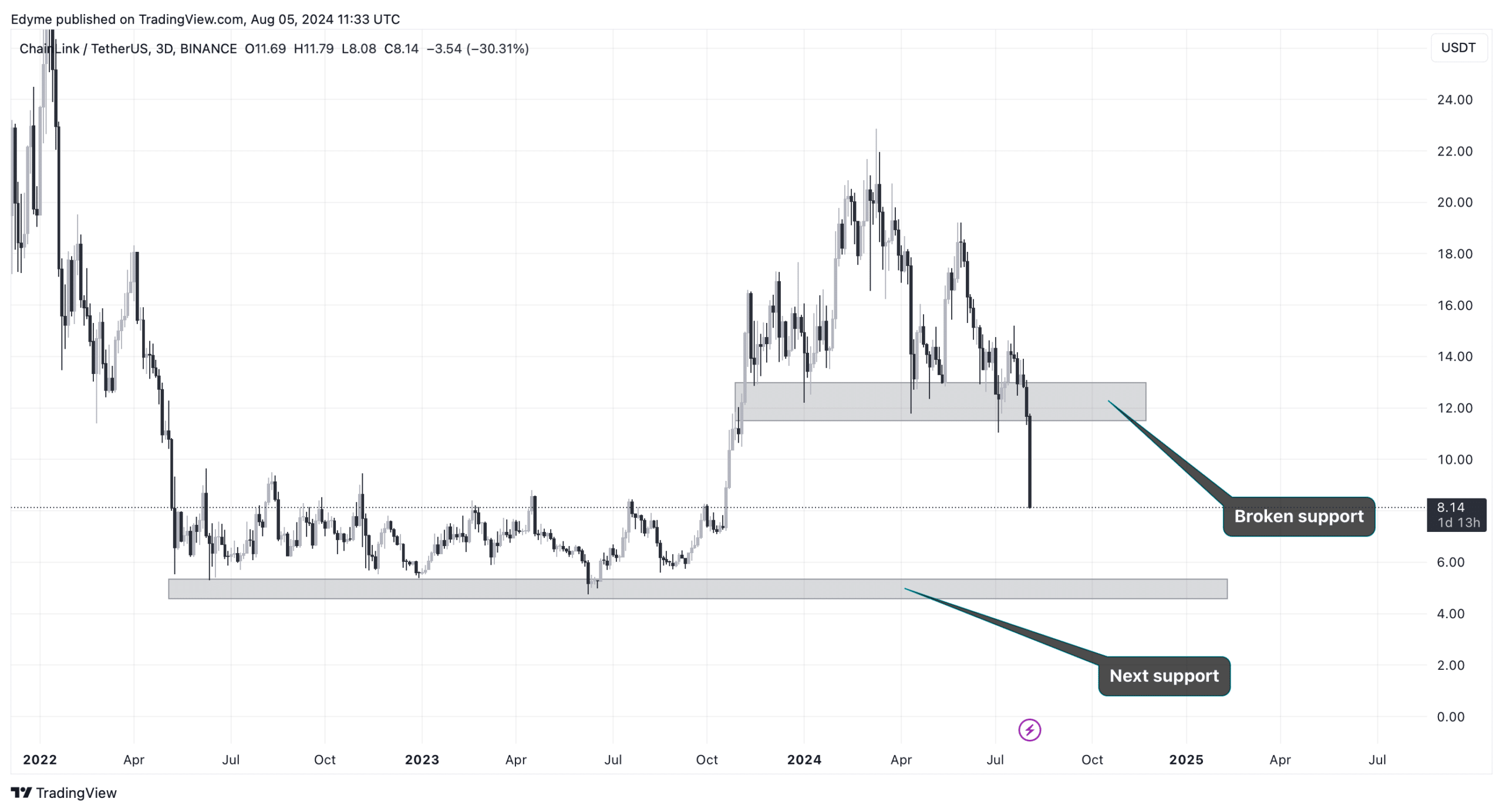

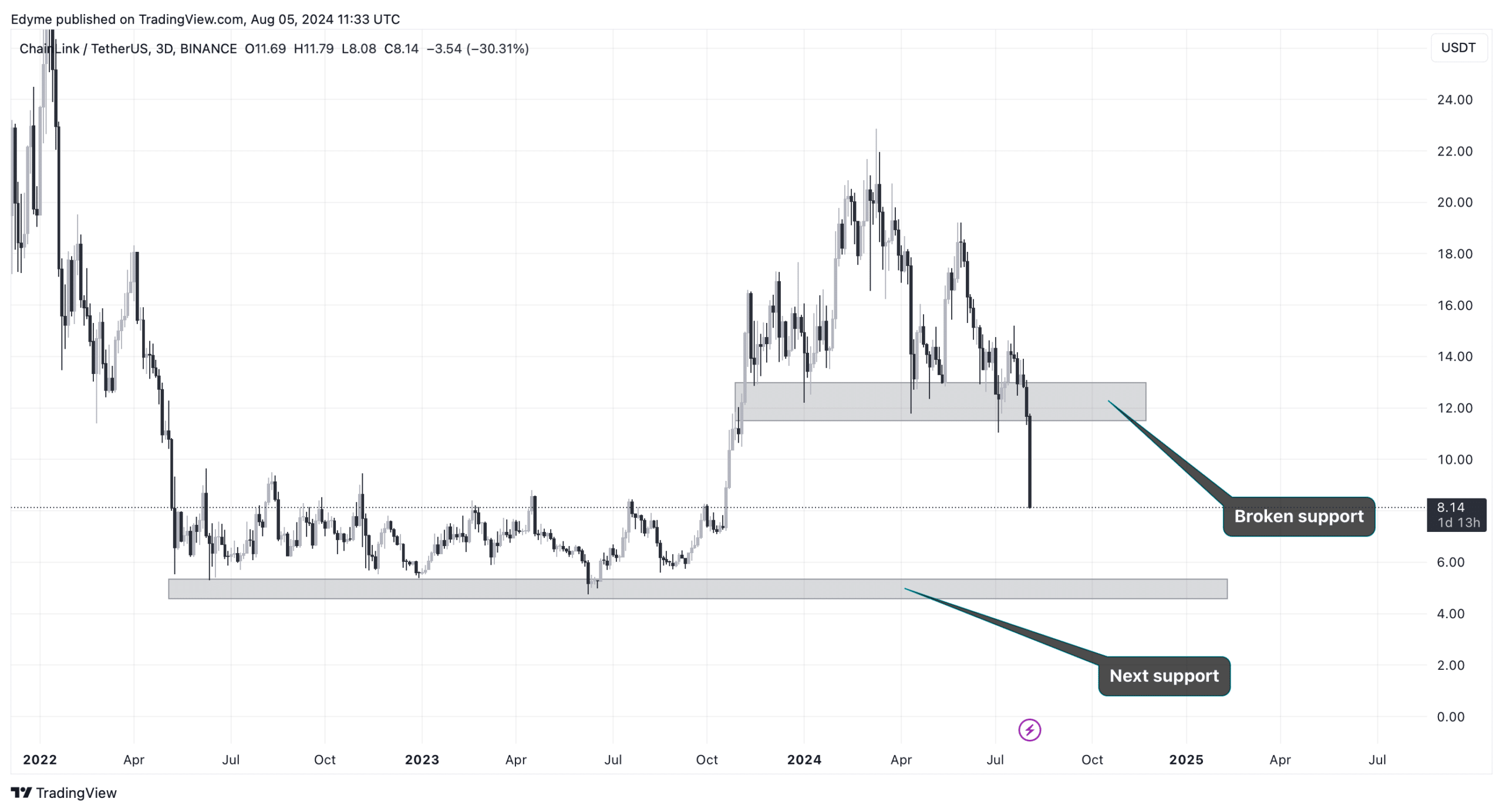

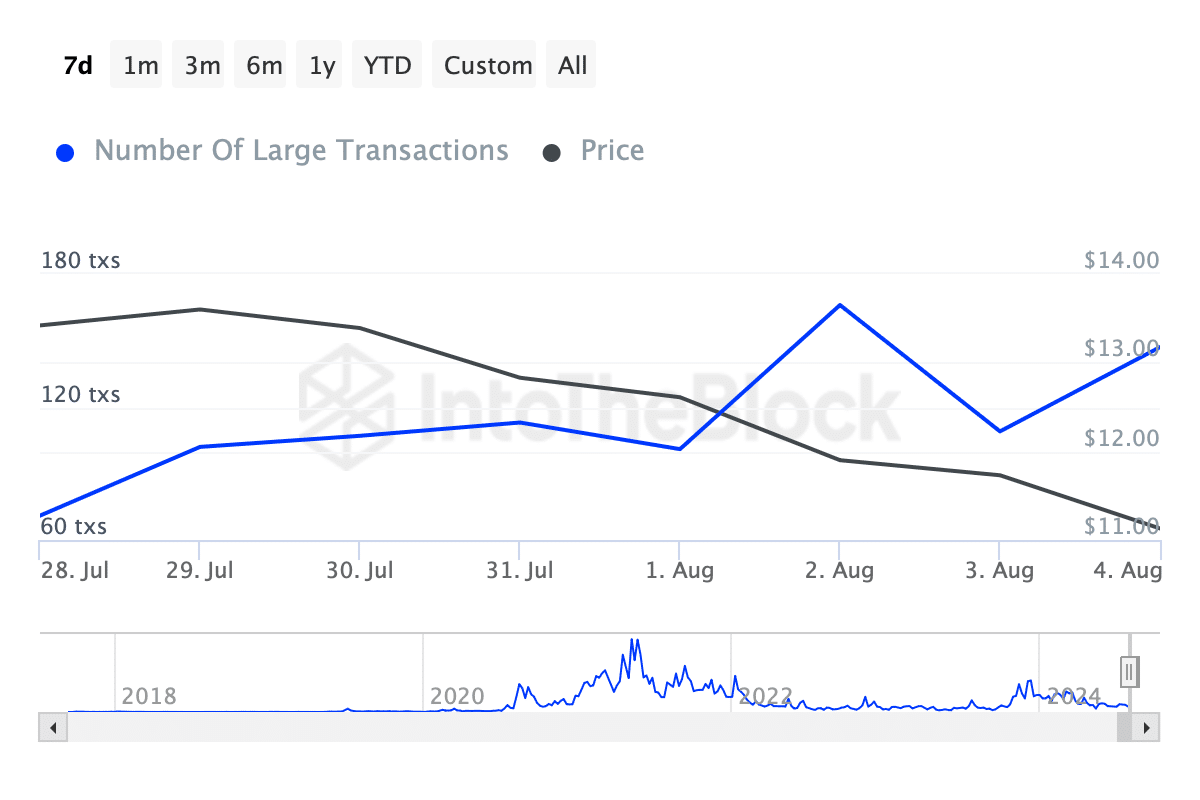

Analysis of the 3-day chart shows that LINK has broken through a crucial support level, indicating potential for further downside.

In trading, a “support level” refers to a price point that an asset typically does not fall below because buying interest is strong enough to counteract selling pressure.

Since LINK broke the support between $13 and $11.40, the asset has continued to fall year to date, indicating that buyer enthusiasm has waned.

Source: TradingView

Looking at the chart, it is likely that LINK will continue to decline until it reaches another key support currently found in the $5 region.

Should LINK reach this support and break through again, we could see increased selling pressure. Conversely, if the price stabilizes or rebounds at this point, it could indicate a potential rebound and restoration of investor confidence in LINK.

Who sees this as an opportunity?

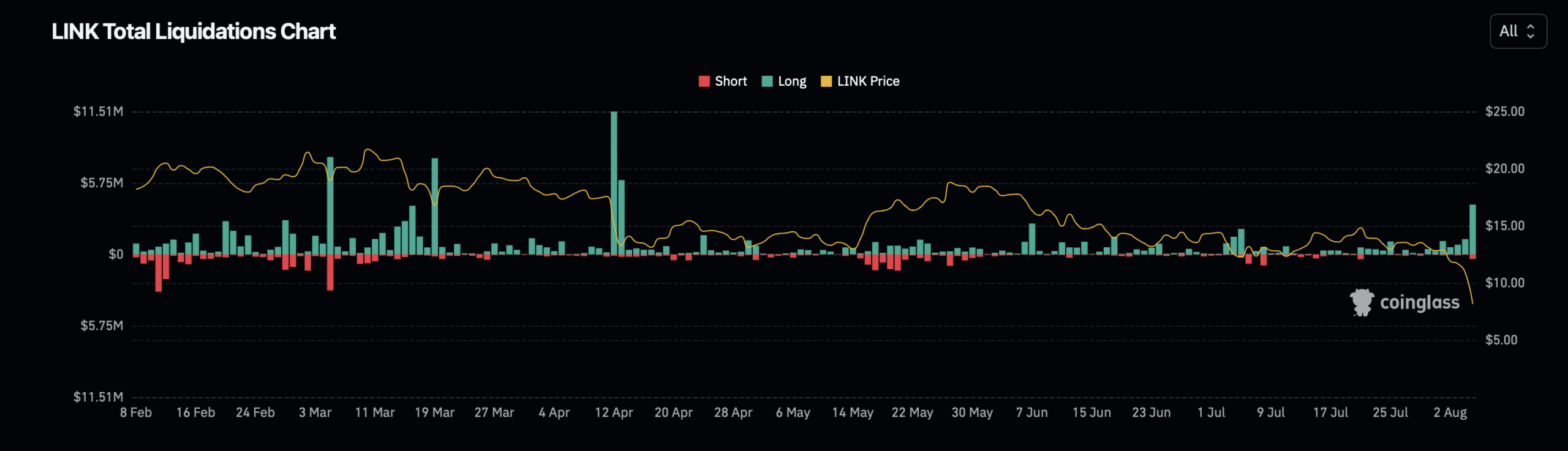

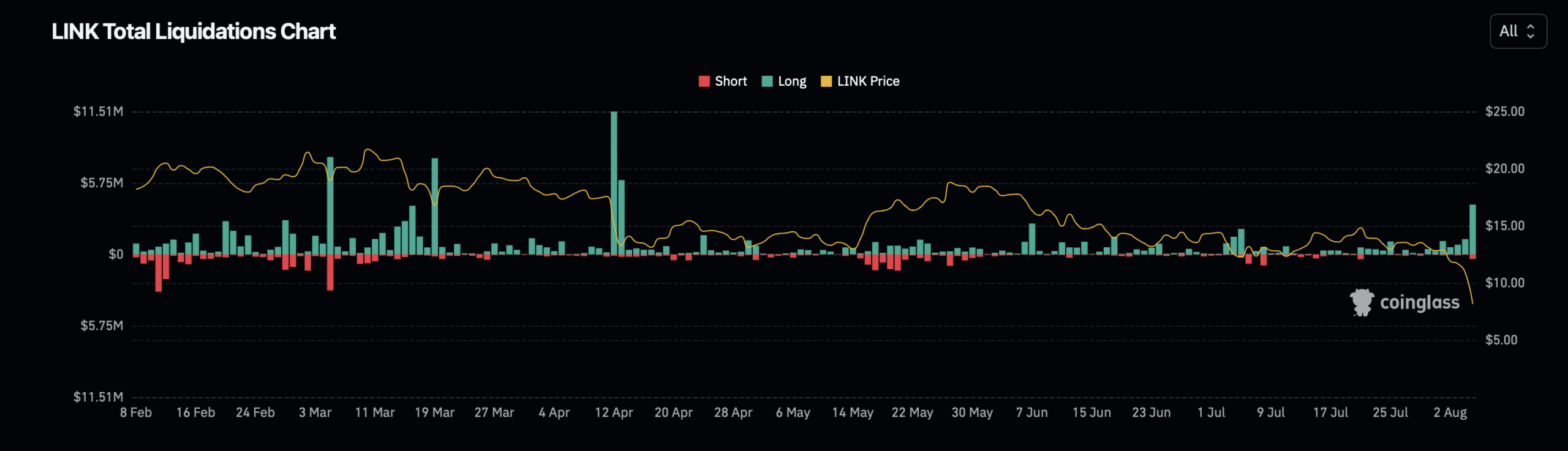

The market reaction to these moves has been mixed. Facts from Coinglass highlights that the broader crypto market liquidated more than 290,799 traders in the past 24 hours, with a total liquidation count of $1.11 billion.

Source: Coinglass

Within these figures, LINK-specific liquidations contributed over $6 million, dominated by long position liquidations of $5.11 million, compared to $384.43k from short positions.

Interestingly, despite the recession, some large-scale investors, or “whales,” appear to be seeing the lower prices as a buying opportunity.

Read Chainlink’s [LINK] Price forecast 2024-25

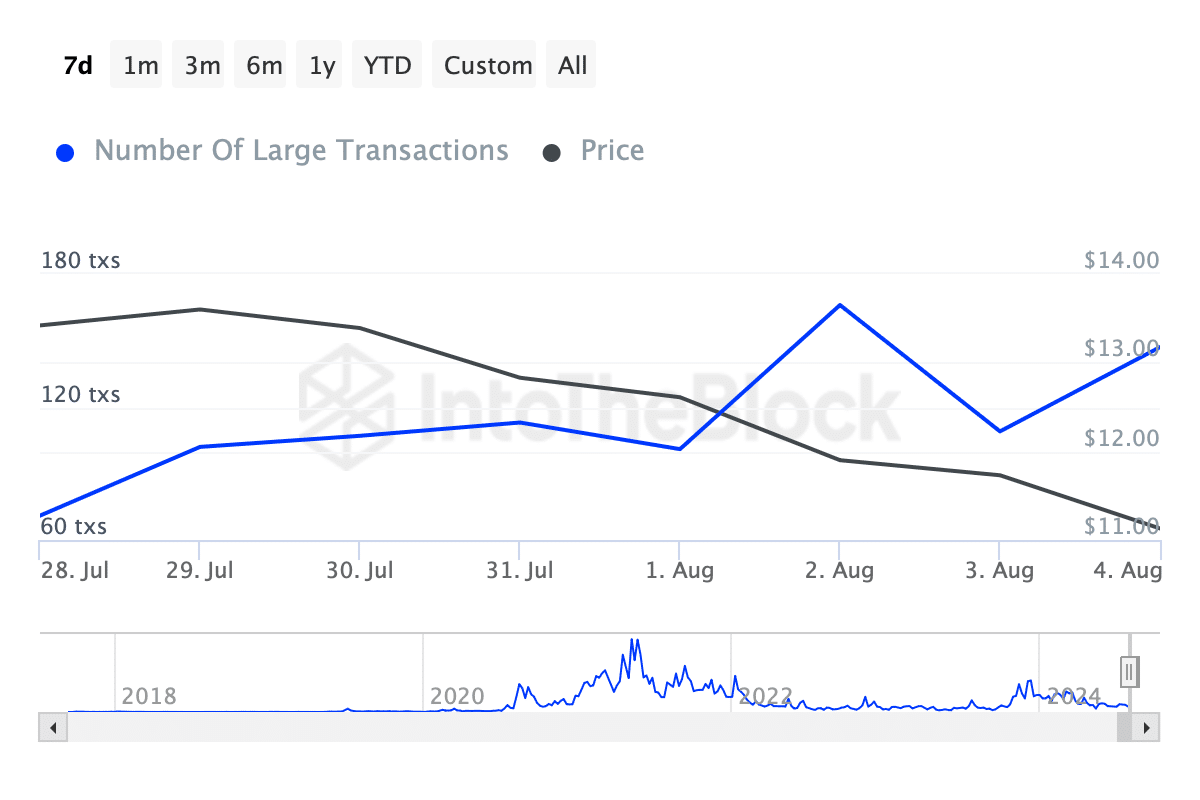

Facts from IntoTheBlock indicate a significant increase in the number of large transactions (over $100,000), from 71 transactions last week to 147 today.

Source: IntoTheBlock

This uptick suggests that while the short-term outlook may appear bearish, some investors are positioning themselves for what they believe could be a favorable long-term trajectory.