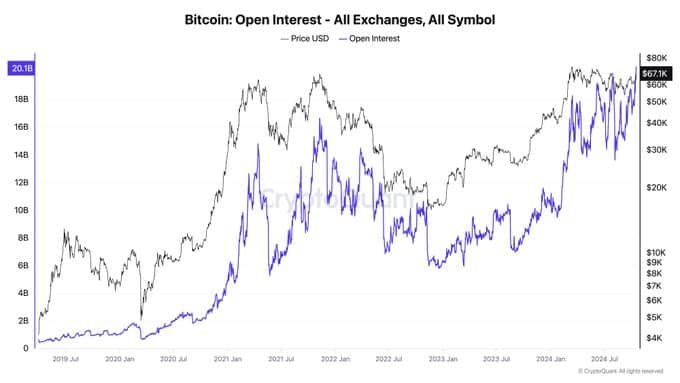

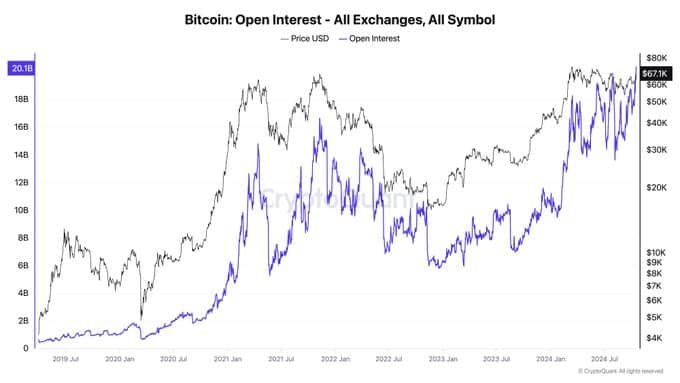

- Bitcoin open interest hits a record $20 billion, just 8% below its ATH, indicating potential price volatility.

- Whales are accumulating Bitcoin, with net outflows from exchanges soaring over the past seven days.

Bitcoin [BTC] open interest across all exchanges has reached a record-breaking $20 billion noted by Ki Young Ju, CEO of CryptoQuant.

Meanwhile, this rise in open interest comes at a time when Bitcoin is hovering just 8% below its previous all-time high (ATH), indicating that a major price move is being anticipated. The growing participation in futures markets is a key indicator of the increasing interest in Bitcoin, especially among institutional investors.

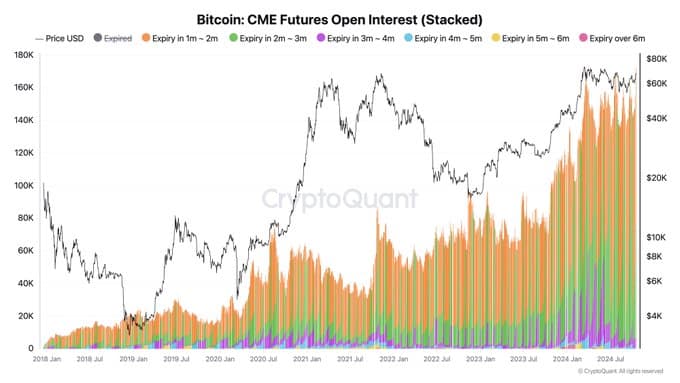

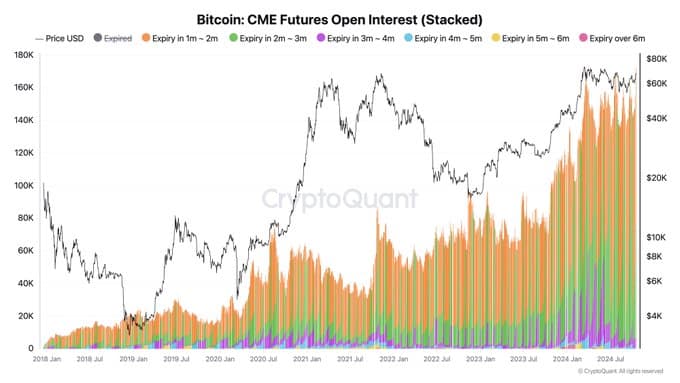

At the same time, CME Bitcoin Futures has open interest also reached an all-time high. This simultaneous increase in both price and futures positions indicates that traders are preparing for a period of increased market activity.

Source:

Bitcoin open interest will rise in 2024

The relationship between Bitcoin price and open interest has historically been strong, especially during bull runs. During the previous rally from mid-2020 to late 2021, open interest and price rose together, driven by increased speculation and leveraged trading.

Open interest peaked alongside Bitcoin’s ATH in late 2021, reflecting traders’ confidence in the rising market.

Source:

However, during the 2022 bear market, both open interest and price fell significantly, with traders exiting or reducing their positions.

As Bitcoin recovered from its lows, open interest began to rise again, eventually reaching new highs in 2024. Despite Bitcoin still being slightly below its ATH, rising open interest suggests that market participants are expecting a large price move in the near term.

Whale accumulation and network activity

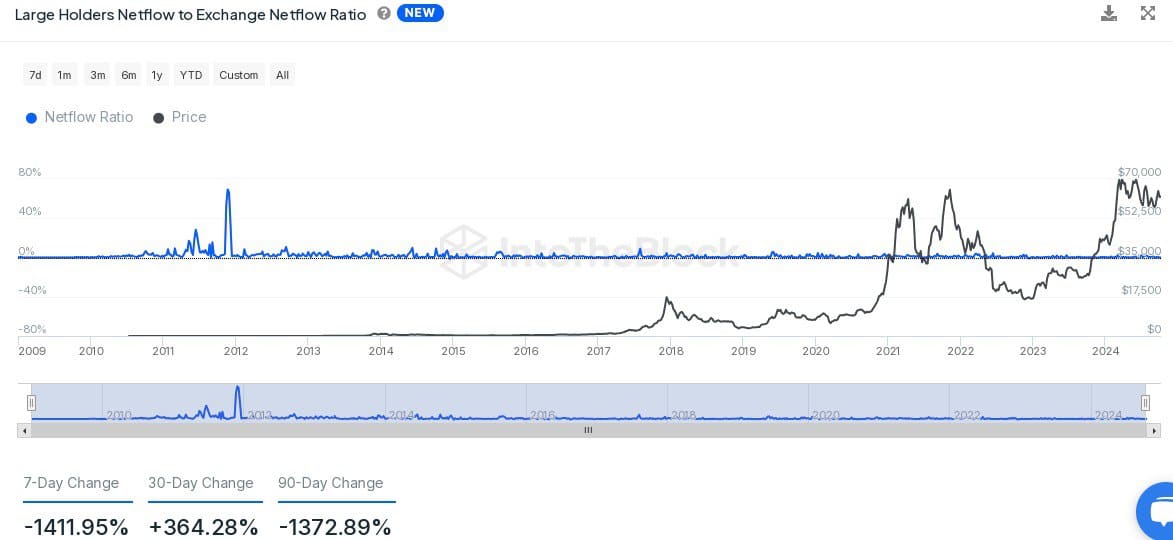

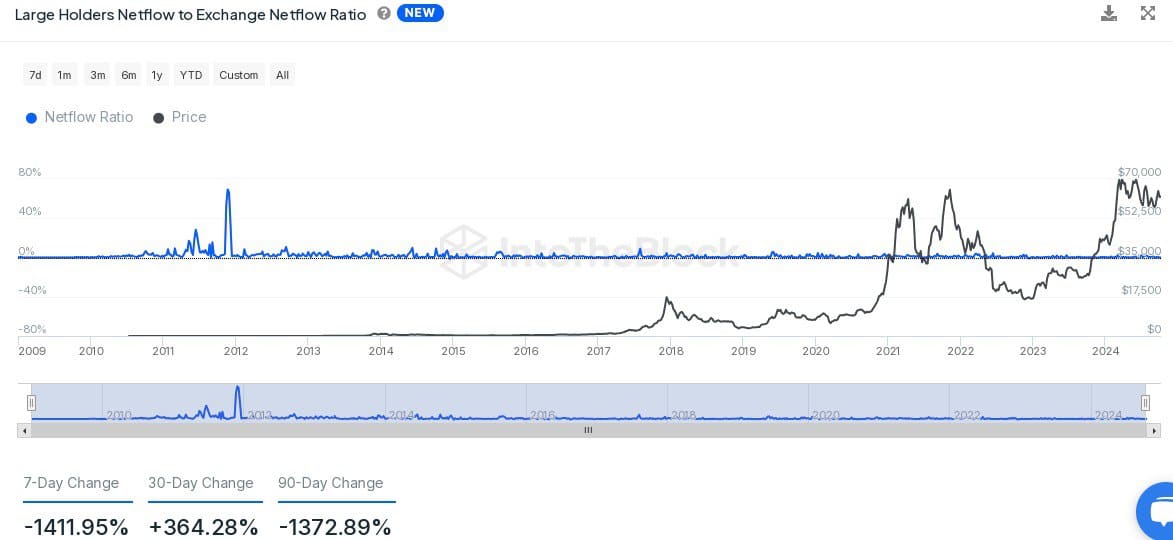

Data from InTheBlok shows that large Bitcoin holders have consistently taken their holdings off the exchanges, which is often a sign of accumulation.

Over the past seven days there has been a -1411.95% change in net flows to exchanges, indicating that whales are likely preparing to hold onto their Bitcoin for the long term.

Source: IntoTheBlock

Statistics about the chain also reflect the growing interest. The number of new addresses increased by 9.59% in the past week and active addresses increased by 8.20%.

This increase in network activity, coupled with the rising price of Bitcoin, suggests that user engagement is growing, contributing to the positive sentiment around the market.

Source: IntoTheBlock

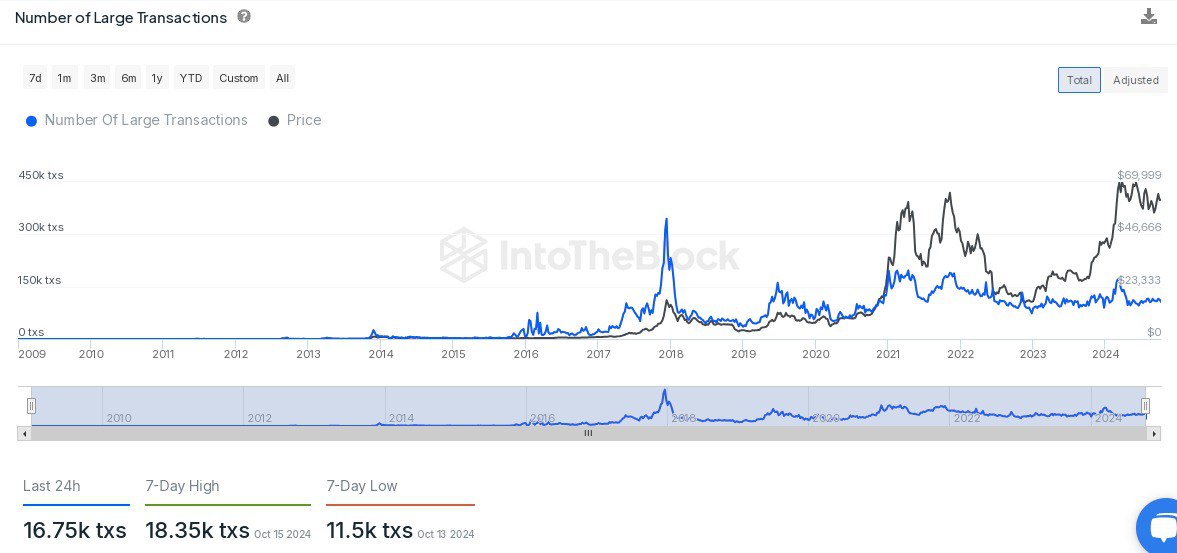

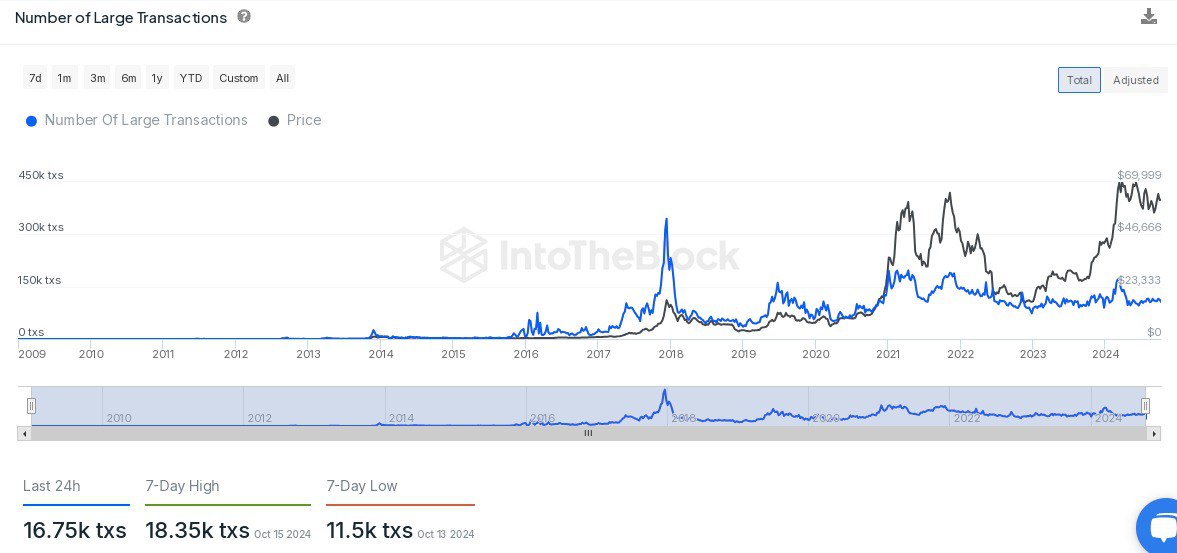

Whale trades and short-term price prospects

Whale activity was also notable in the last 24 hours with 16,75,000 major transactions recorded. While slightly below the seven-day high of 18.35k transactions, current volume is still well above the recent low of 11.5k transactions.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price forecast 2024–2025

This steady stream of large trades indicates that whales are actively trading, which could contribute to potential price movements in the coming days.

As BTC approaches its ATH, the combination of rising futures open interest, whale accumulation, and increased network activity points to the possibility of significant price movement.