- PEPE reaches $2.6 billion in trading volume as technical signals point to potential bullish breakout opportunities.

- 73.6% of PEPE holders are in profit, with key resistance at $0.000022 and strong support at $0.000013.

The crypto market has experienced mixed trends over the past two weeks, with a sharp shift from bullish sentiment to bearish caution. Among the affected assets are meme coins such as Pepe [PEPE] have seen reduced trading interest as attention returns to Bitcoin [BTC].

Nevertheless, technical indicators suggest that PEPE could be poised for a recovery as trading volume reaches $2.6 billion.

The TD sequential buy signal indicates a potential rebound

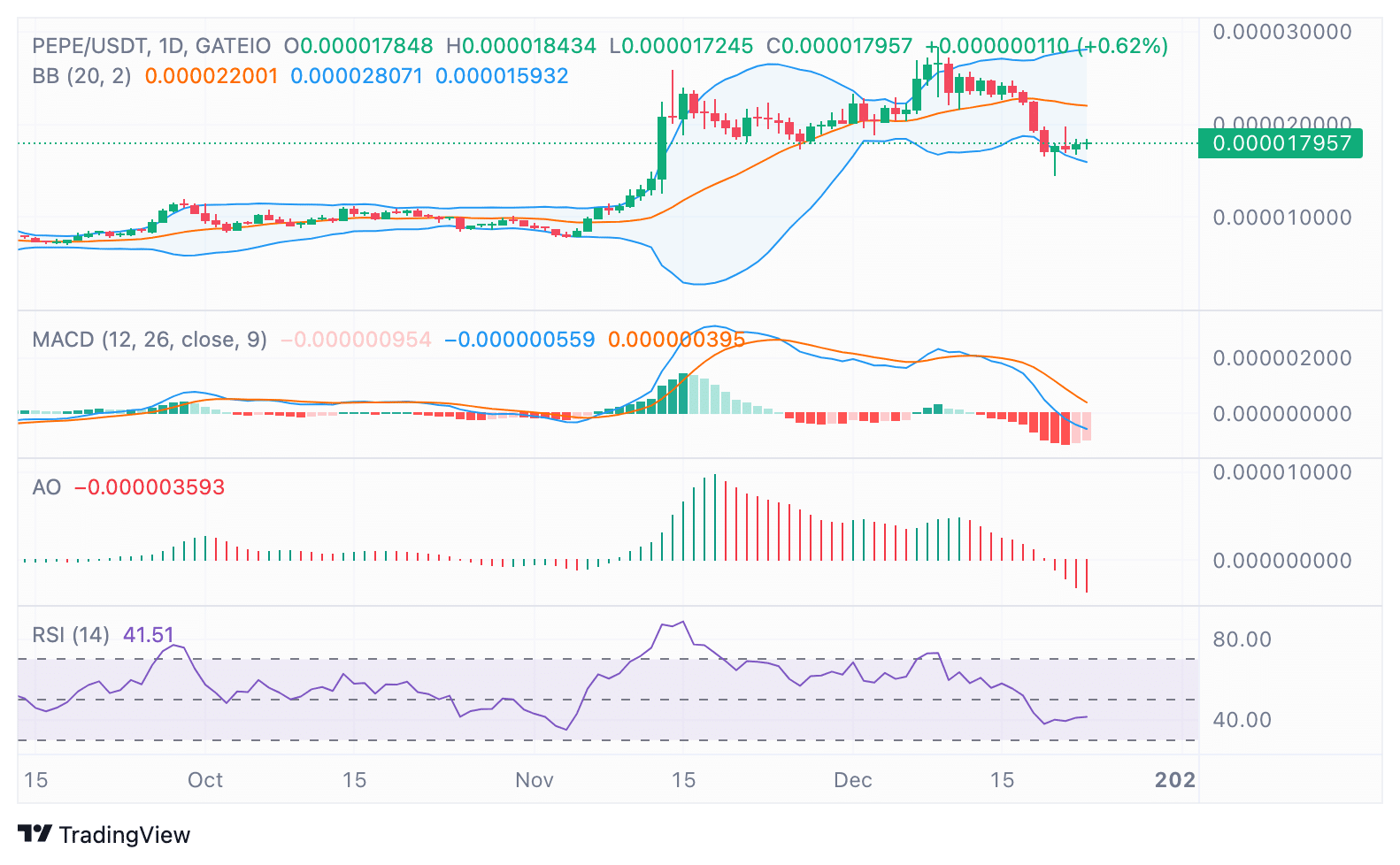

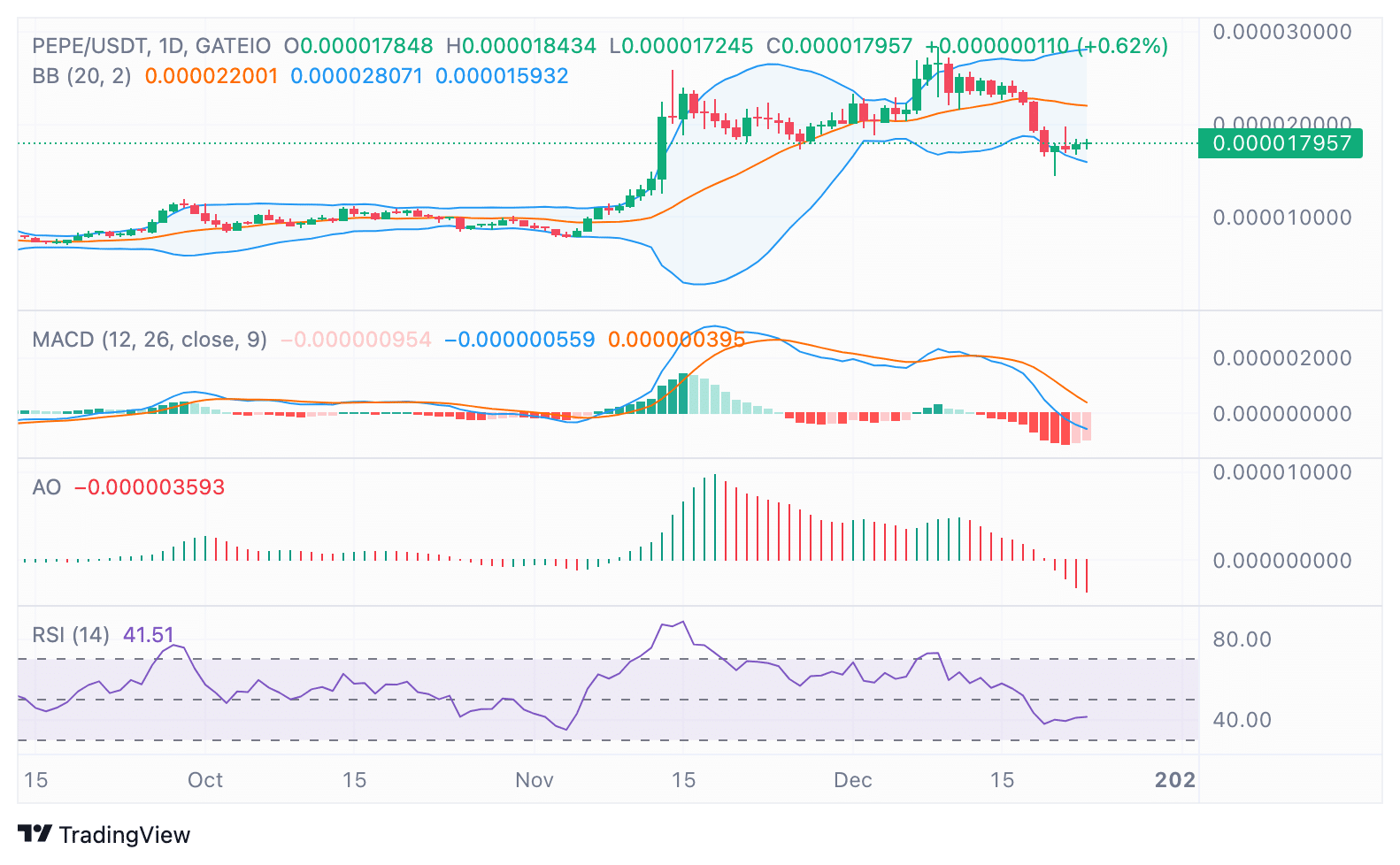

Technical analysis tools indicate a potential turnaround for PEPE. The TD Sequential indicator has presented a buy signal on the daily chart, which is usually interpreted as a sign of an impending price reversal.

Such signals have often preceded upward price movements in the past, making them a point of interest for traders anticipating a recovery.

Source:

PEPE was trading at $0.00001791 at the time of writing, showing a 2% price increase in the last 24 hours, but still down 25.97% over the last seven days.

As the price range has fluctuated between $0.00001455 and $0.0000242 over the past week, traders are keeping a close eye on resistance near $0.00002201, where Bollinger Bands also signal key levels that need to break for a sustained rally.

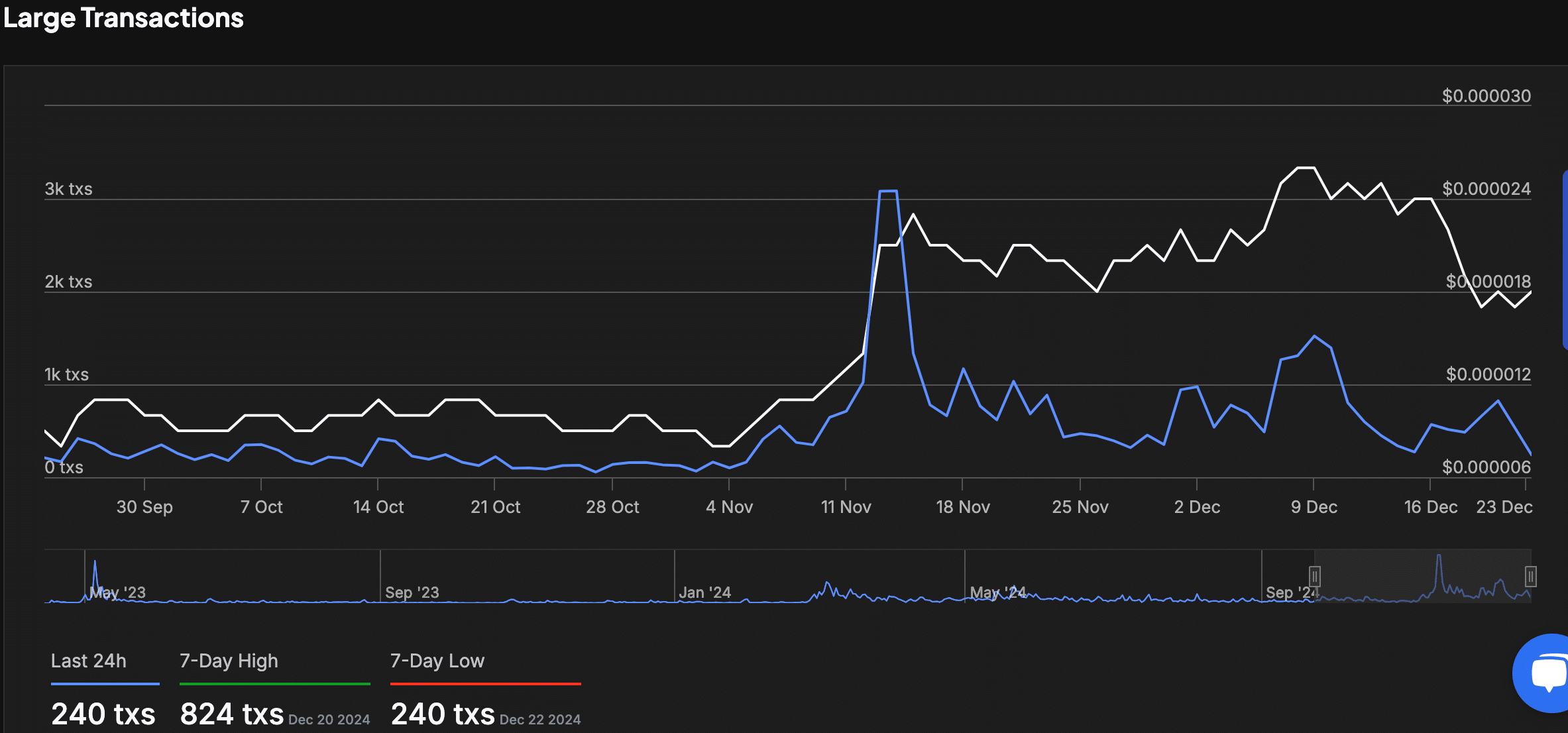

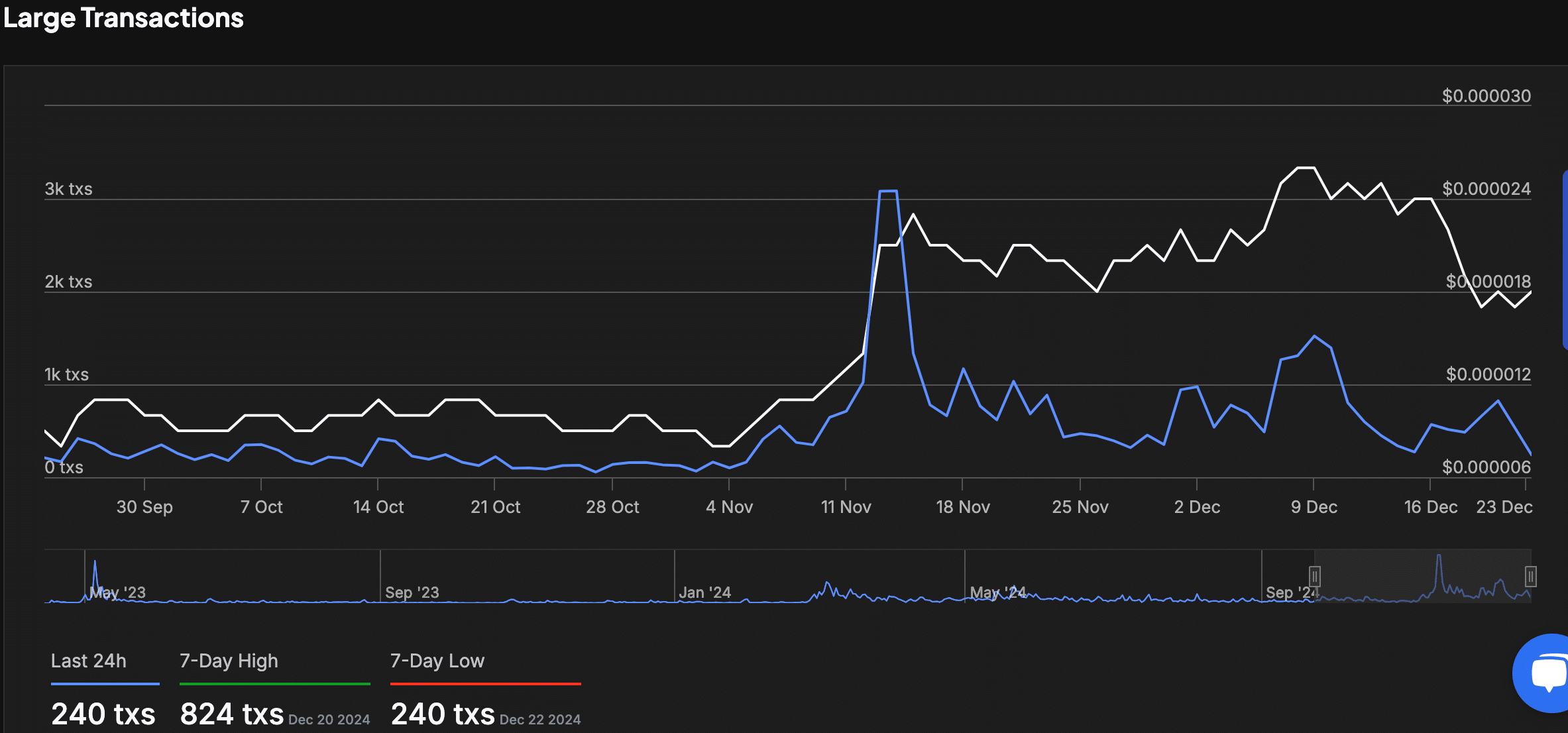

Whale activity is slowing after its peak in November

Data from IntoTheBlock reveals a clear decline in large transaction activities for PEPE. There was a spike in large trades in mid-November when the price reached $0.000024, indicating whale or institutional activity.

Since then, transactions have fallen, with just 240 major transactions in the past 24 hours, the lowest in the past week.

Source: IntoTheBlock

The reduced activity corresponds to the consolidation of the price around $0.00001791, indicating that accumulation or reduced trading interest is taking place.

Analysts indicate that monitoring large transaction activity could provide insight into a possible breakout or further downward movement.

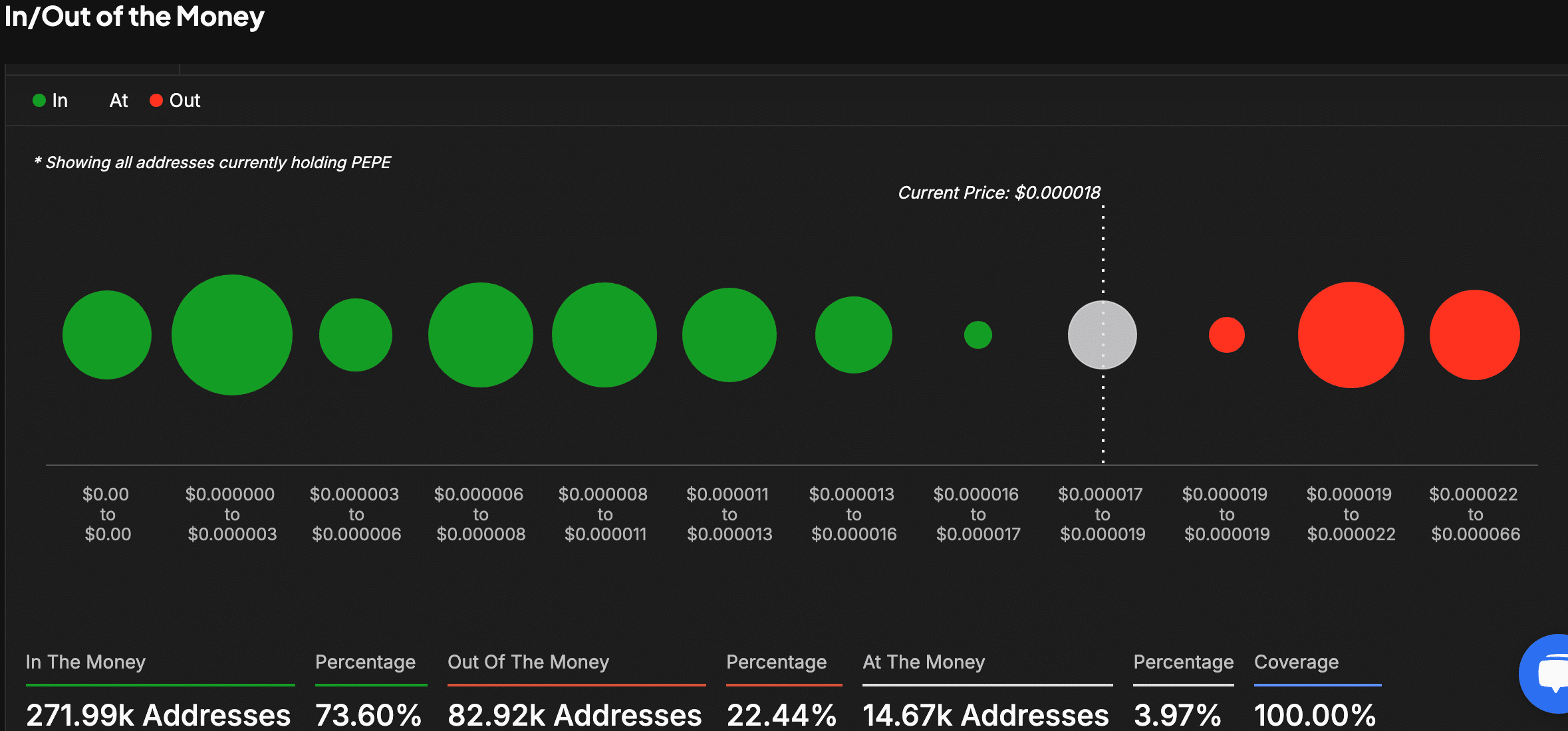

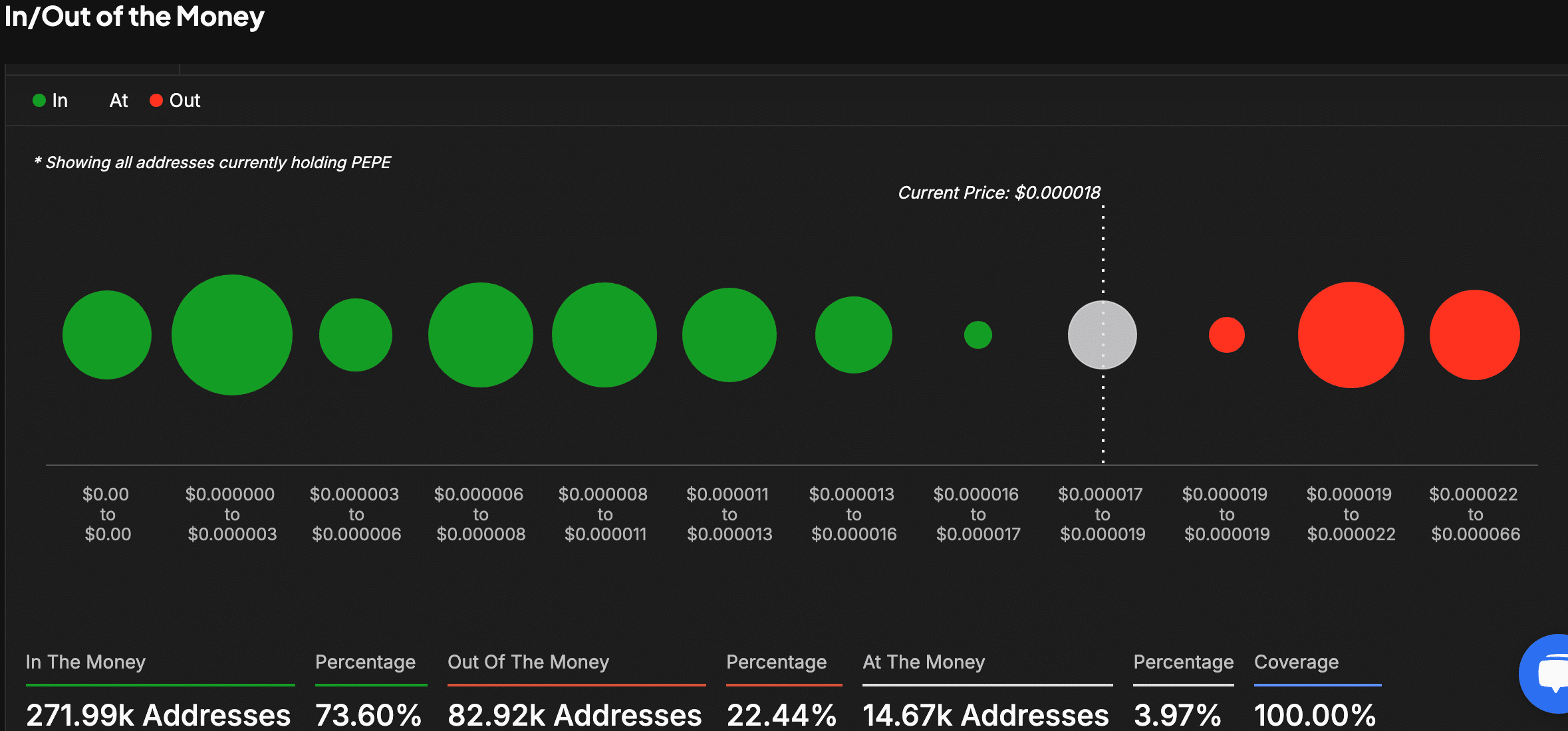

On-chain metrics indicate critical price zones

On-chain analysis shows that 73.60% of PEPE wallets are profitable, with strong support between $0.000011 and $0.000013, where most holders have accumulated the token.

However, around 22.44% of wallets remain unprofitable, with potential resistance expected between $0.000019 and $0.000022 as these holders may sell to recoup their losses.

Source: IntoTheBlock

Bollinger Bands further highlight critical levels, with the lower band at $0.00001593 acting as a support zone and the upper band at $0.00002201 as a signal for resistance.

A break above the upper band could catalyze upward momentum, while a decline below the lower band could lead to further price corrections.

Indicators point to weakening bearish momentum

Momentum indicators indicate that the downtrend is weakening. The MACD histogram shows a contraction, indicating a potential bullish crossover.

Read Pepe’s [PEPE] Price forecast 2024–2025

Meanwhile, the RSI currently stands at 41.51, below the neutral 50 level, but not in oversold territory. A move above 50 could indicate renewed buying interest.

Source: Trading view

As the market stabilizes, the combination of a TD Sequential buy signal, on-chain metrics and technical indicators suggests that PEPE may be preparing for its next move.