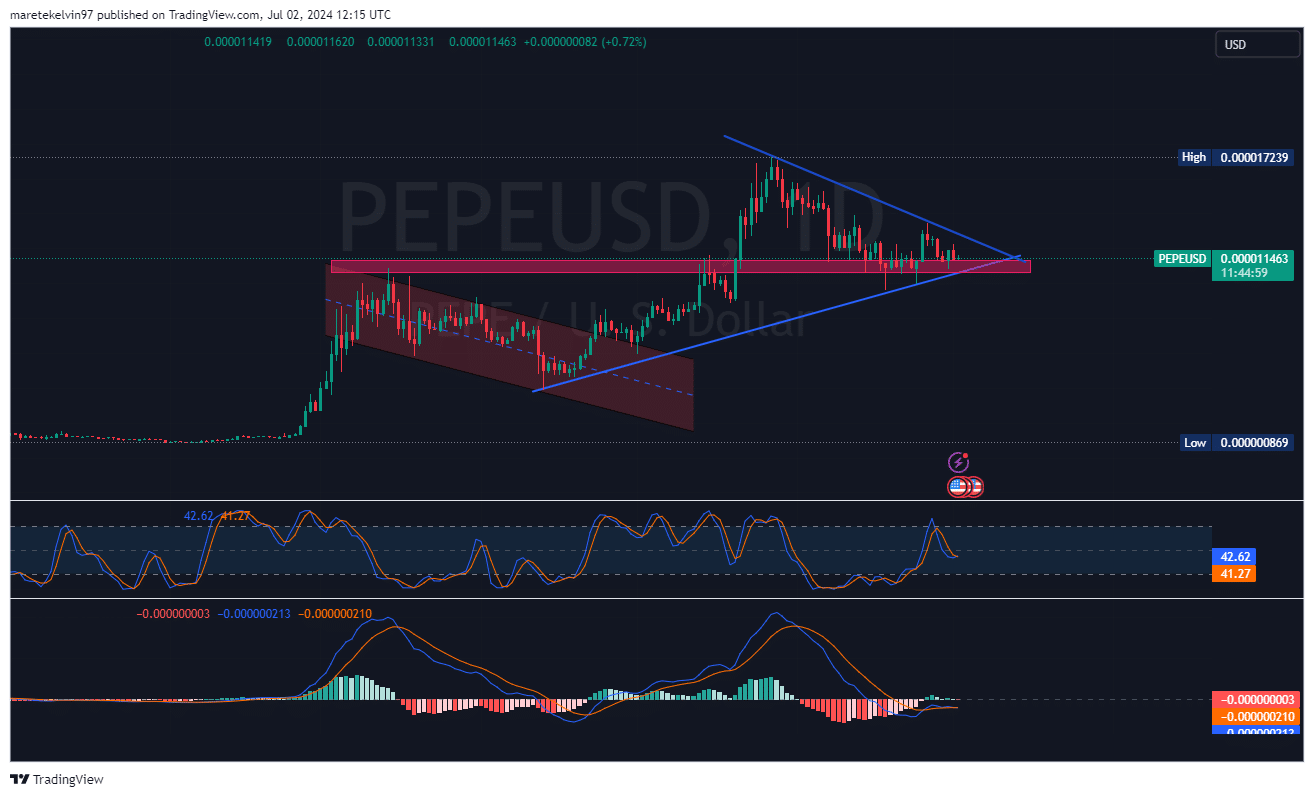

- The price of PEPE consolidated into a symmetrical triangle, with a potential breakout in sight.

- Statistics pointed to a possible outbreak.

PEPE has been in a narrowing price range for the past four weeks while forming a symmetrical triangle pattern.

The memecoin’s price has fallen 13% since the symmetrical triangle resistance level at $0.00001348 was also tested last week. This consolidation phase often precedes significant price movements.

According to CoinMarketCapAt the time of writing, PEPE was trading at $0.00001152, up 0.02% over the past 24 hours. These small gains suggested that the token maintained stability despite broader market swings.

PEPE’s market capitalization was $4.84 million, making it the 23rd largest cryptocurrency. However, trading volume has dropped significantly by 19.79%, with $413.8 worth of PEPE changing hands in the last 24 hours.

Source: TradingView

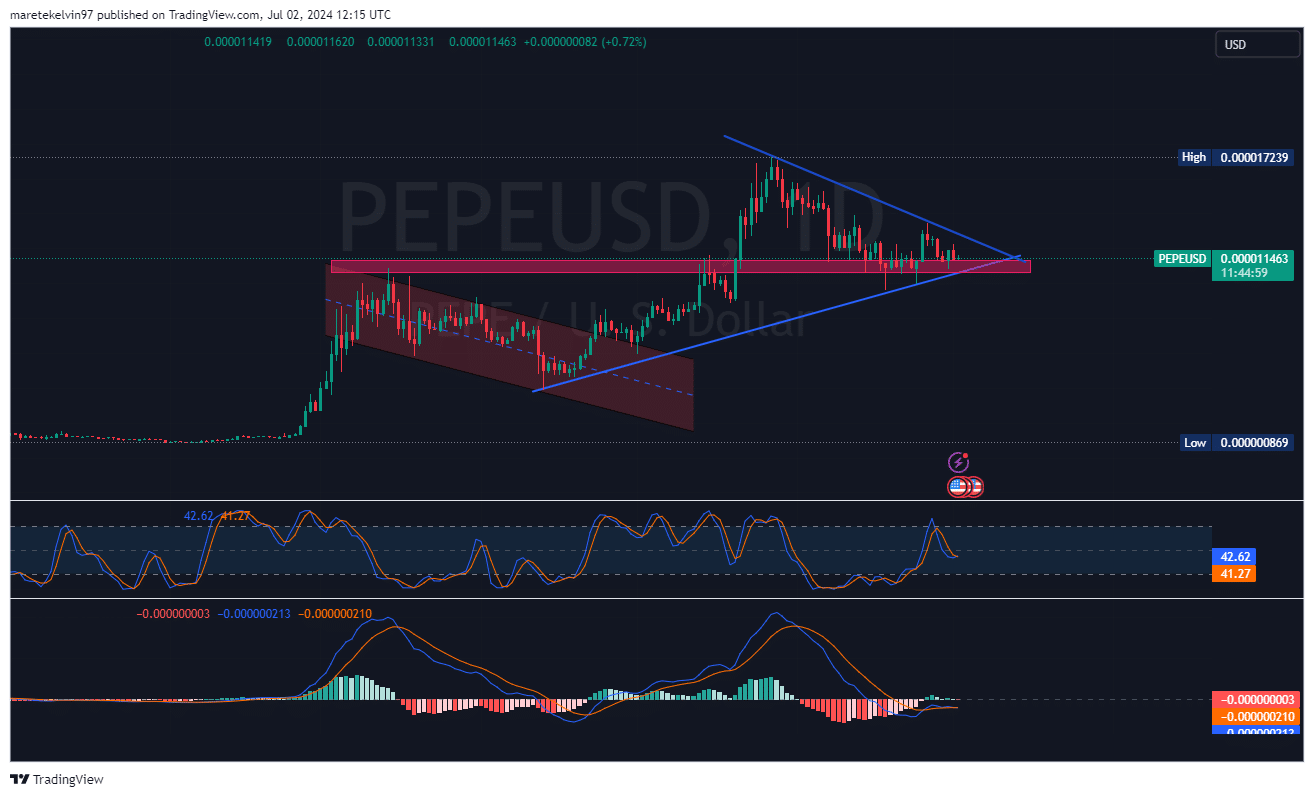

PEPE holders’ sentiment remains bullish

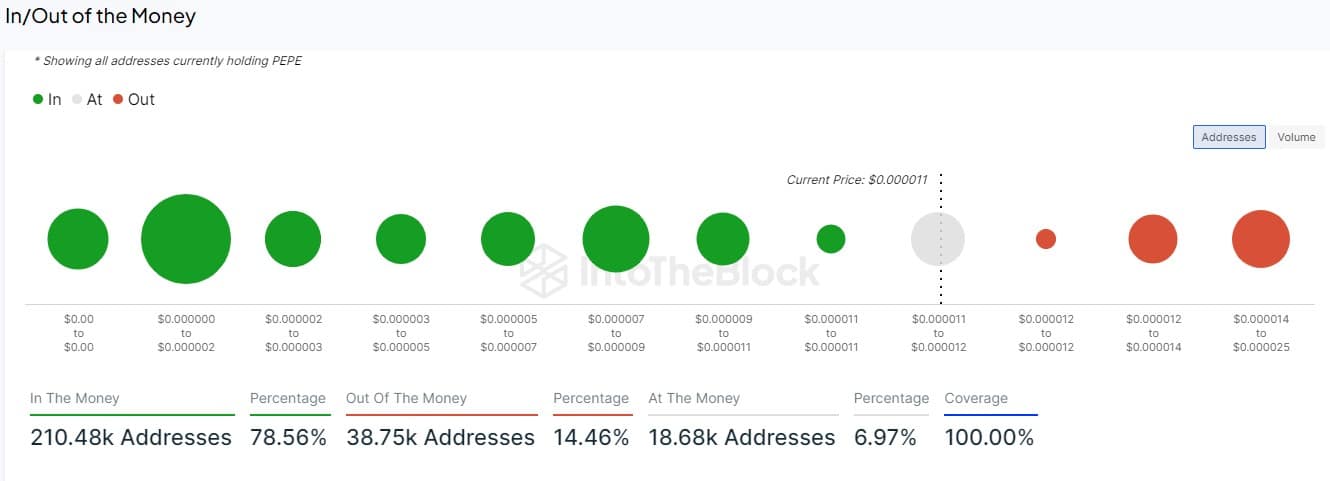

AMBCrypto’s look at IntoTheBlock’s ‘In/Out of the Money’ data painted an optimistic picture of a possible breakout. Strikingly, 78.56% of PEPE holders were in the money at the time of writing.

Only 14.46% of addresses were out of the money, indicating limited selling pressure from underwater positions.

Source: IntoTheBlock

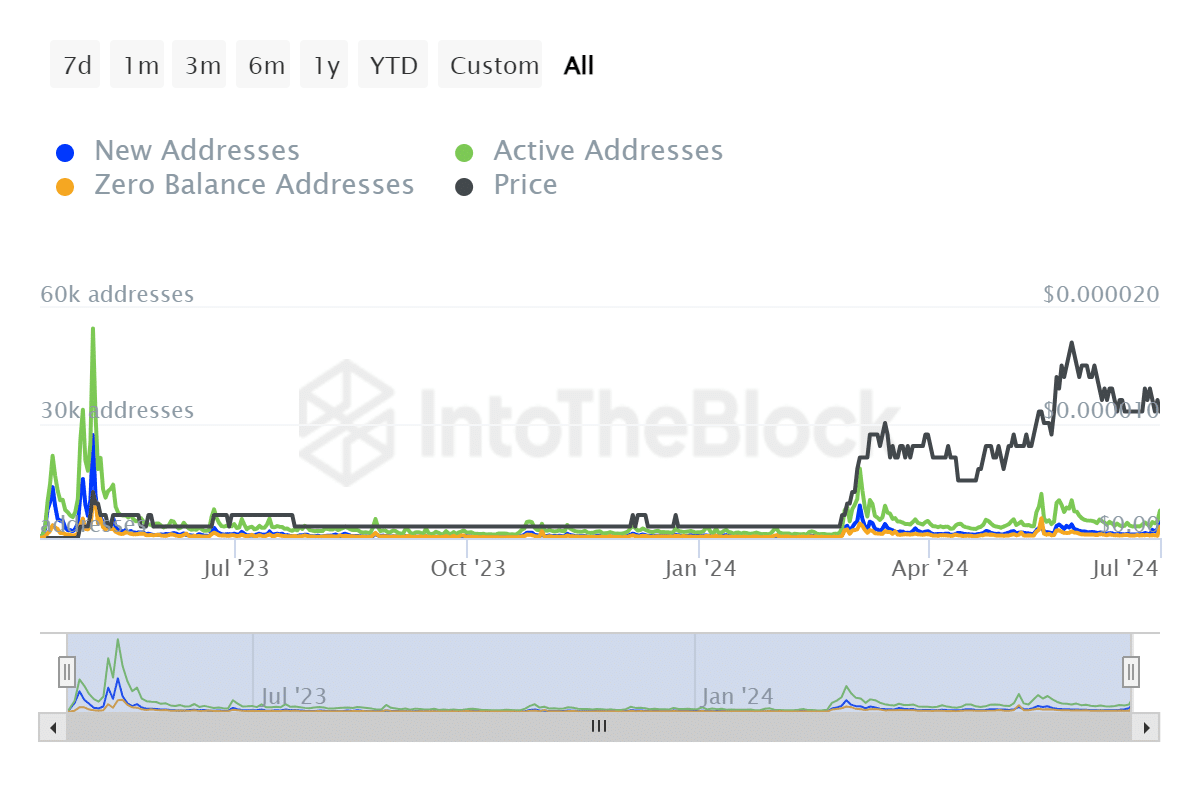

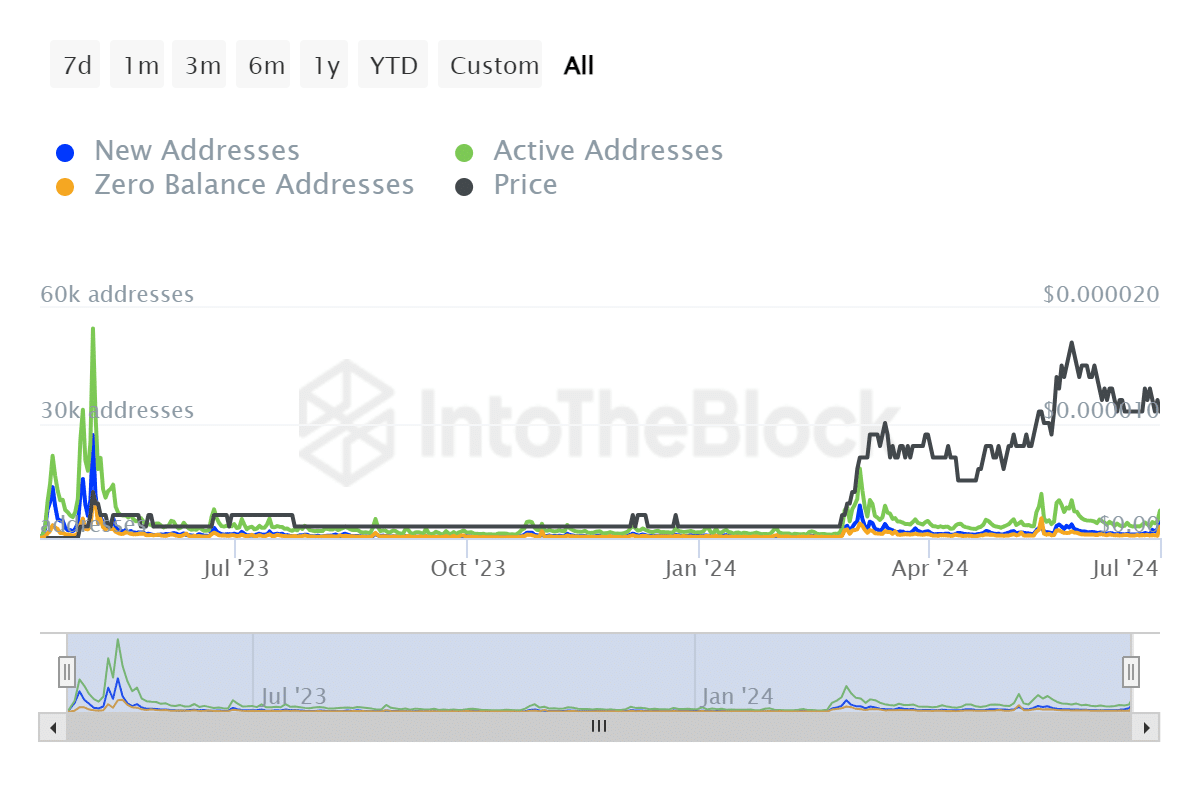

AMBCrypto’s analysis of IntoTheBlock address activity data showed spikes in new and active addresses.

This increased number of active addresses is often associated with growing interest and potential price volatility.

The increase in the number of active addresses was notable as it reached new highs not seen since April 2024.

Source: IntoTheBlock

What story do liquidations tell?

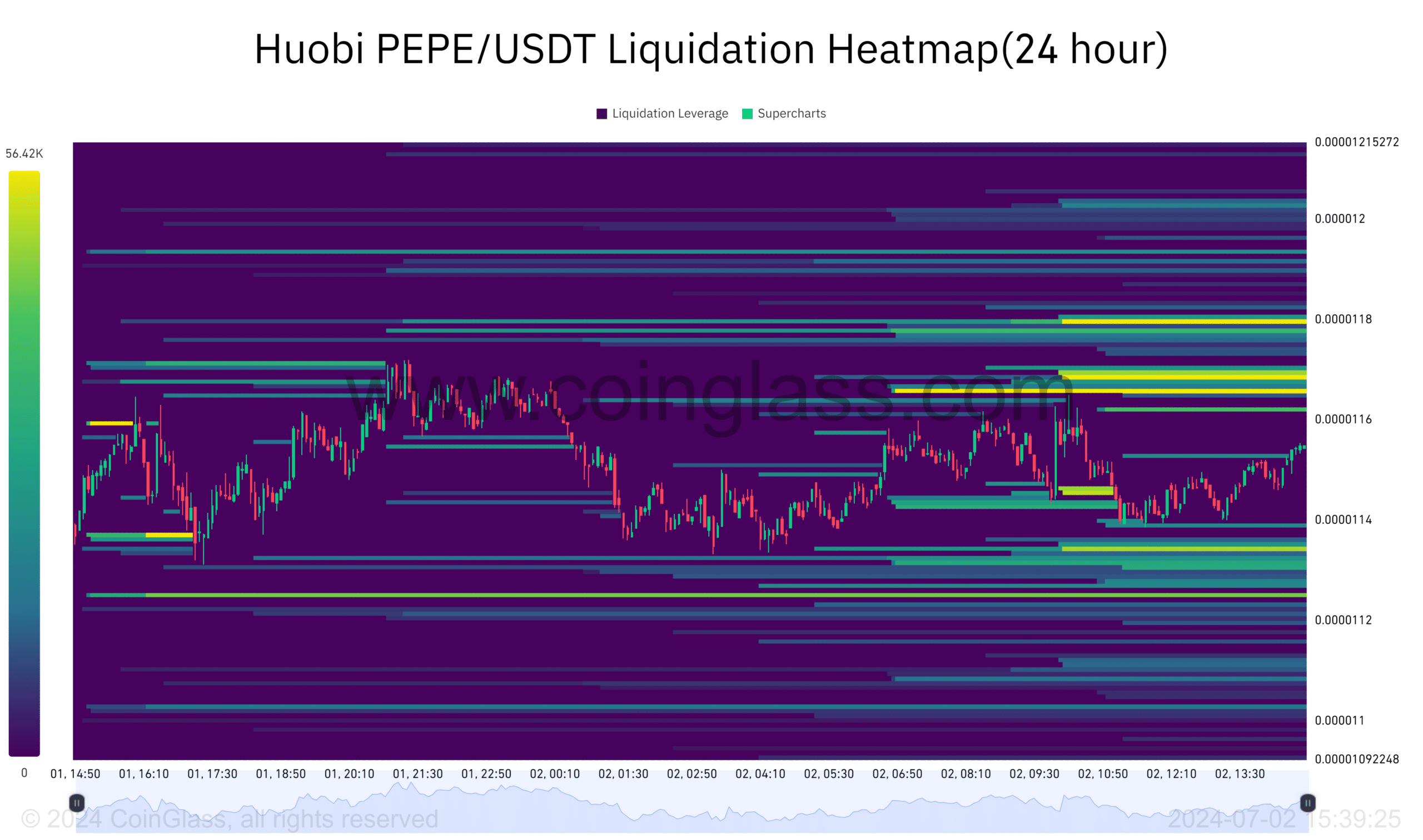

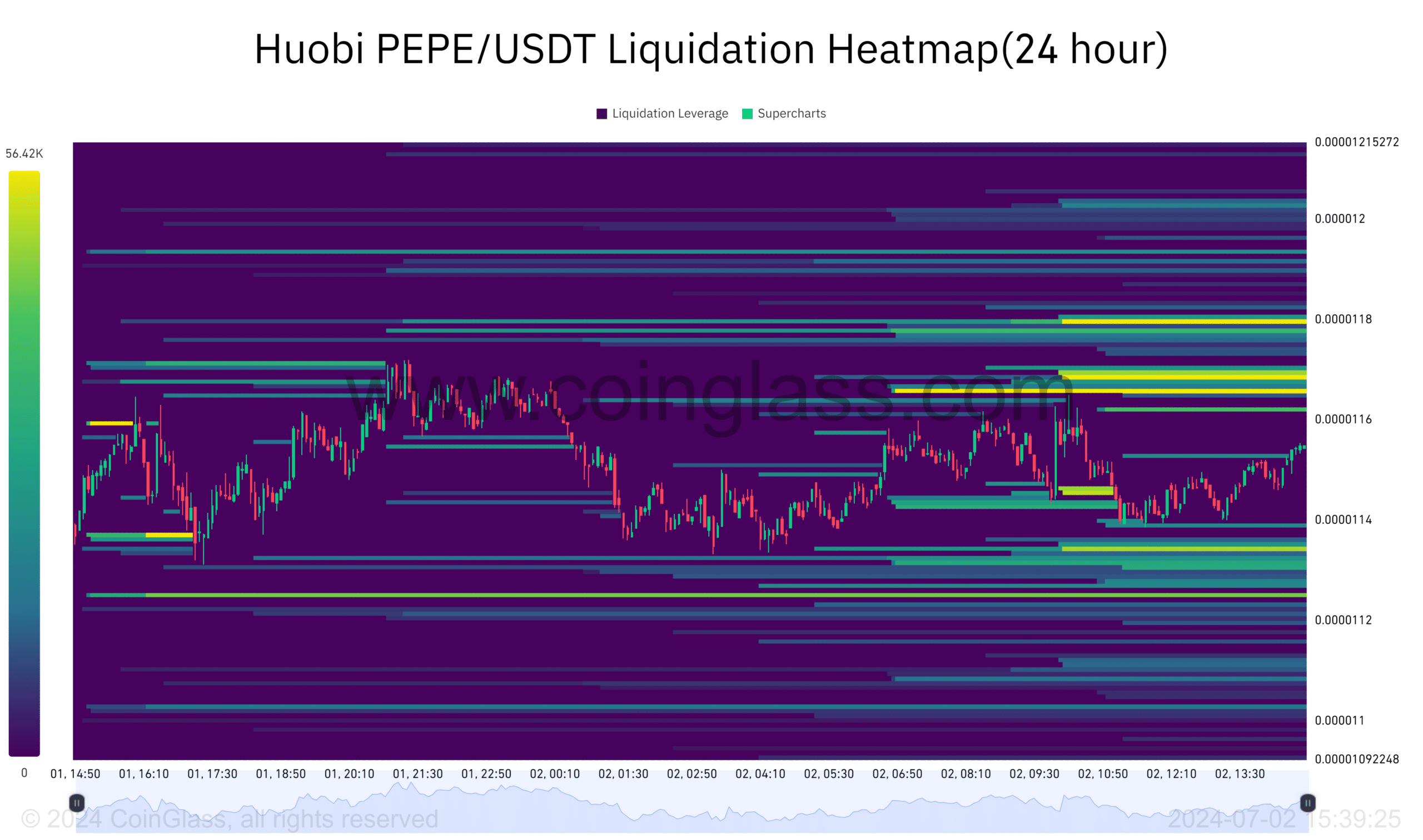

Complementing the increasing active addresses, AMBCrypto further analyzed the Coinglass liquidation heatmap, which showed concentrated liquidation levels between $0.00001164 and $0.00001180 over the past 24 hours.

This concentration suggested that investors were actively engaging with this price corridor, which in turn could trigger a breakout.

Despite minimal price movements, liquidation data points to underlying market tensions. Investors appear to be positioning for potential price action, with leverage positions clustered around key levels.

Source: Coinglass

Read Pepe’s [PEPE] Price forecast 2024-25

The technical patterns and statistics suggested that a breakout was imminent, but only if PEPE builds enough momentum.

However, if the price distribution occurs below the key support level, there are even more disadvantages associated with the cards.