- Bitcoin remains stable above $75,000 despite a 1.7% pullback.

- The increasing new address creation and increased open interest indicate strong market participation, but require careful observation.

Bitcoin [BTC] has shown remarkable resilience by maintaining its position above the $75,000 price level. This stability comes after the cryptocurrency hit a new all-time high of $76,872 on November 7.

Although Bitcoin has since undergone a slight correction, with prices falling 1.7% from the peak, the asset continued to show a strong base around $75,000.

Analysts attributed this development to a combination of greater market confidencenew liquidity and changing holder dynamics.

Amid this market performance, a CryptoQuant analyst identified as Mignolet provided insight into the evolving Bitcoin cycle. According to Mignolet, the conditions necessary for Bitcoin to enter a second phase of its current market cycle were aligned.

“After Phase 1, the Long-Term Holder (LTH) supply, which was on the rise again, started its distribution,” says Mignolet. explained.

Source: CryptoQuant

For Bitcoin to move into Phase 2, a notable increase in the supply of Short-Term Holders (STH) through the introduction of new capital was required. Mignolet pointed out that these new liquidity inflows were already happening, mirroring the patterns observed in the 2017 cycle.

The cyclical behavior implied that Bitcoin’s market dynamics were once again setting the stage for a potential uptrend, driven by increased activity and new entrants to the market.

Indicators point to growing momentum in Bitcoin metrics

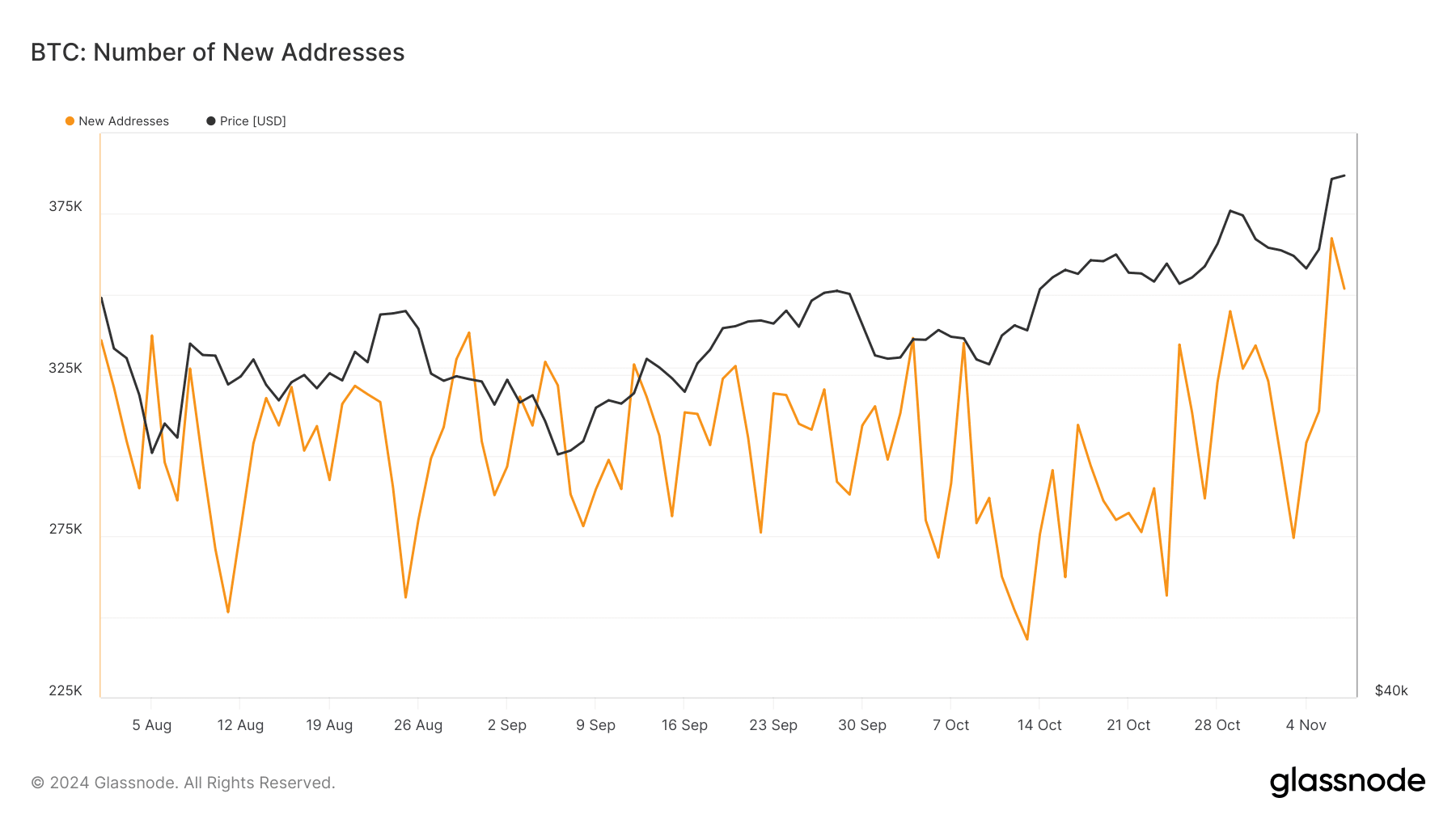

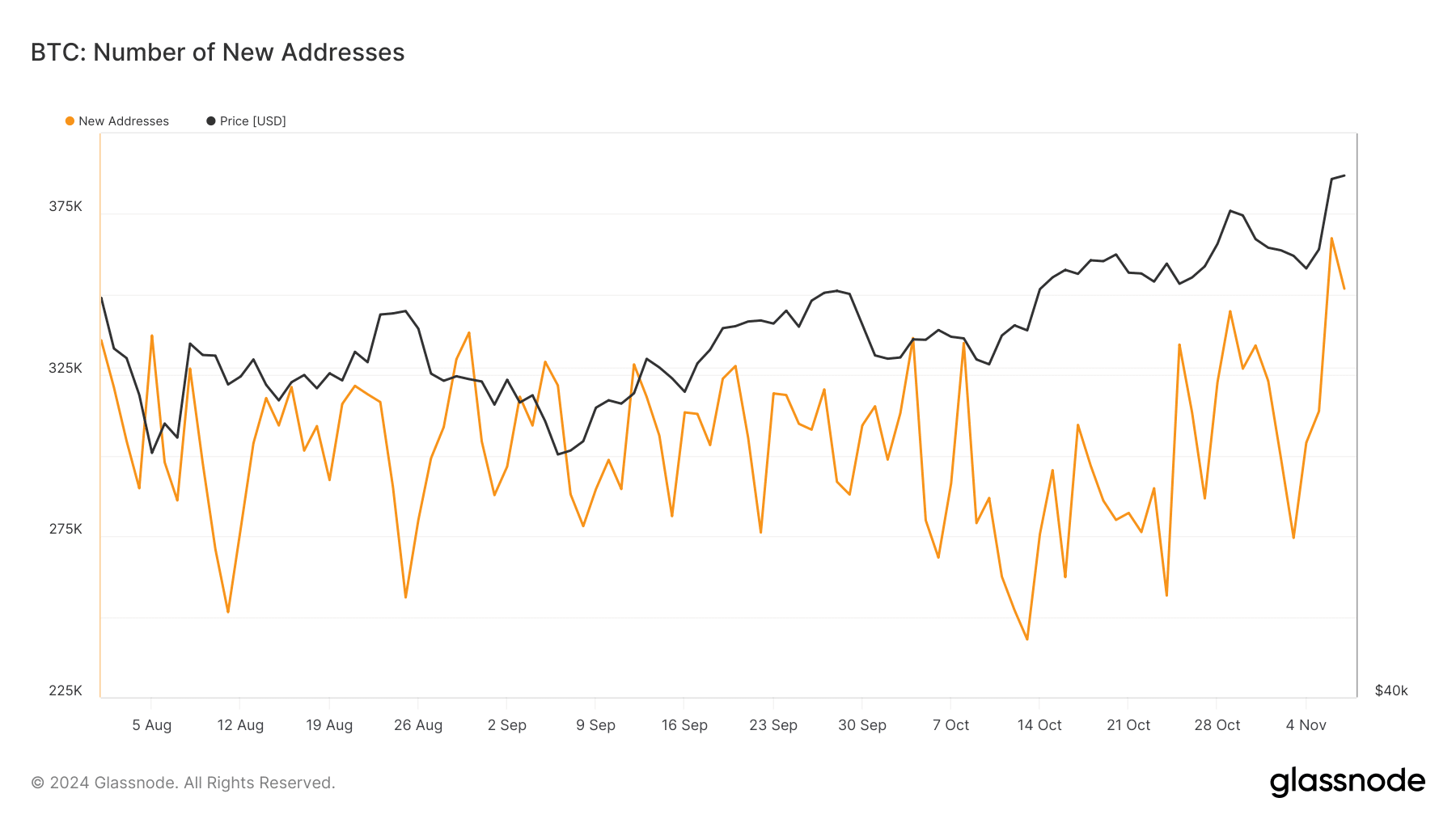

In addition to analyzing holder behavior, several key metrics provide further insight into Bitcoin’s market health. One of those indicators was the number of new Bitcoin addresses. According to Glassnode factsthis benchmark has been on an upward trend. After the low point of 242,000 new addresses in mid-October, this number has risen to more than 350,000 new addresses.

Source: Glassnode

This increase suggested that more participants are entering the market, which could strengthen demand and support Bitcoin’s price in the long term.

An increase in new addresses typically reflects growing interest and adoption, factors that could contribute to continued upward price momentum if maintained.

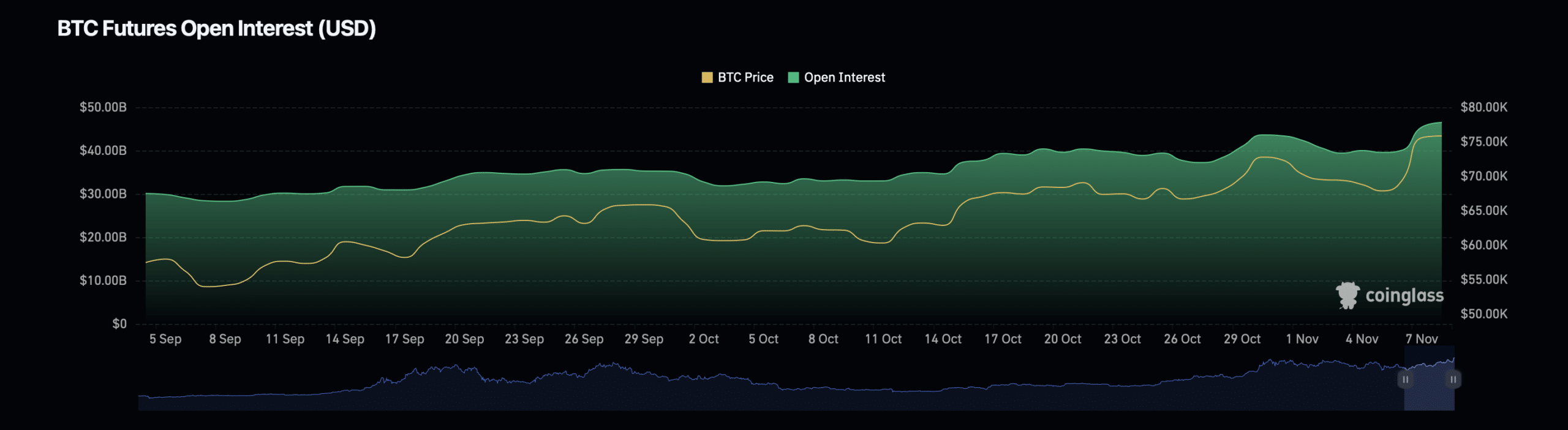

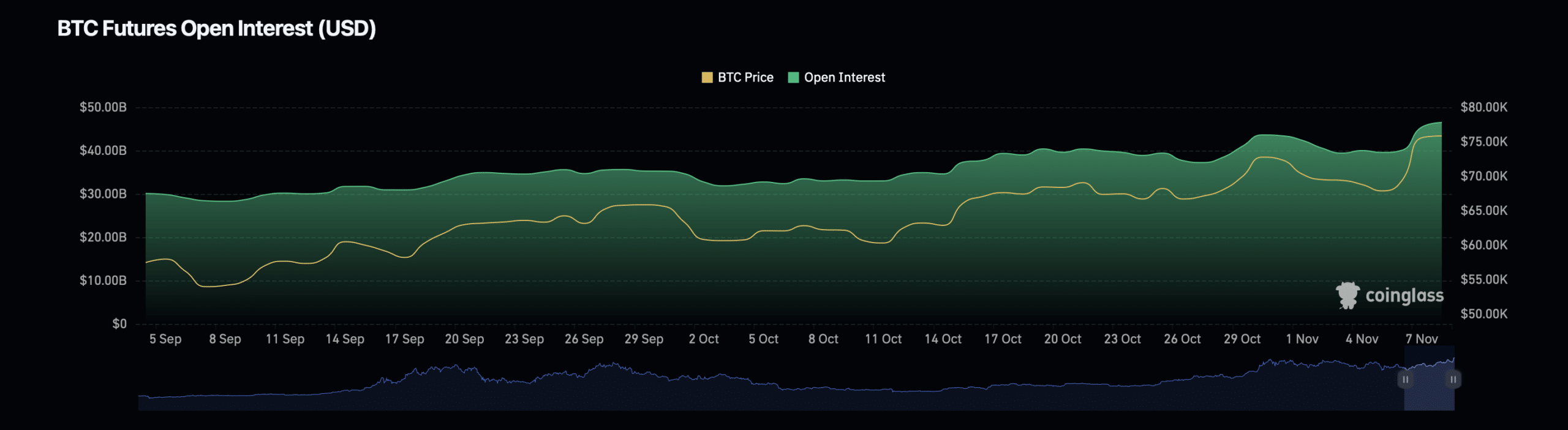

Another notable metric was Bitcoin’s open interest in futures contracts, which showed a moderate increase. Data from Mint glass indicated that open interest rose 1.32% to a current valuation of $46.59 billion.

Source: Coinglass

This increase indicated that more traders were taking positions in the market and possibly expecting further price movements.

Read Bitcoin’s [BTC] Price forecast 2024–2025

However, it is essential to note that Bitcoin’s open interest volume has experienced a notable decline, falling 41.01% to a current valuation of $69.81 billion.

The drop in open interest volume could indicate that some traders were closing their positions, possibly as a precaution amid the recent price correction.