- Bitcoin’s recent gains have been met with skepticism as foreign exchange inflows are surging, indicating profit-taking.

- Historically, Bitcoin’s performance in September has been poor, causing market turmoil.

Bitcoin [BTC] The price was trading at $56,864 at the time of writing, after gaining 3.6% in 24 hours. The gains followed a 31% increase in trading volumes per CoinMarketCap.

The renewed optimism comes despite September being one of the worst months for Bitcoin. However, despite the rebound, several signals have yet to turn bullish, raising concerns that BTC may not be out of the woods yet.

September haunts traders

Overall market sentiment is still bearish, with the Bitcoin fear and greed index at 33, indicating traders are bracing for a possible repeat of previous price declines in September.

This is evident from a recent report by the American fund manager NYDIG noted that the market could be,

“I’ll be stuck in seasonal work for the next month.”

The report also stated:

“On average, Bitcoin fell by 5.9% in September and the average return is -6.0%. That’s not much of a consolation, since September is just beginning.”

Sentiment is likely to change by the end of the month. According to Rekt CapitalBitcoin could be on its way to three straight months of positive upside potential in the final quarter of the year.

While previous price drops in September haunt traders, Bitcoin’s upside potential remains limited.

Currency inflows hit seven-day high

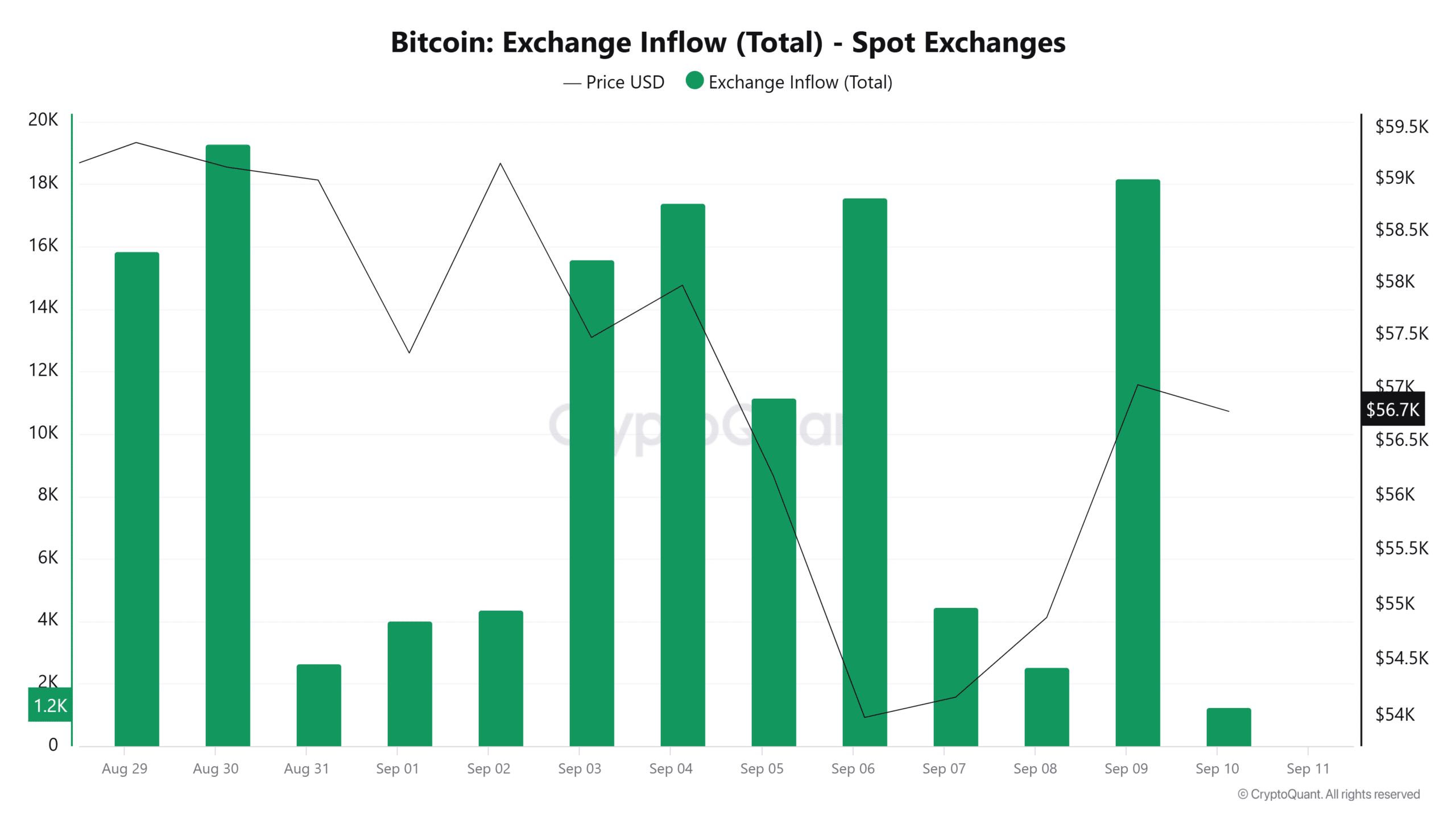

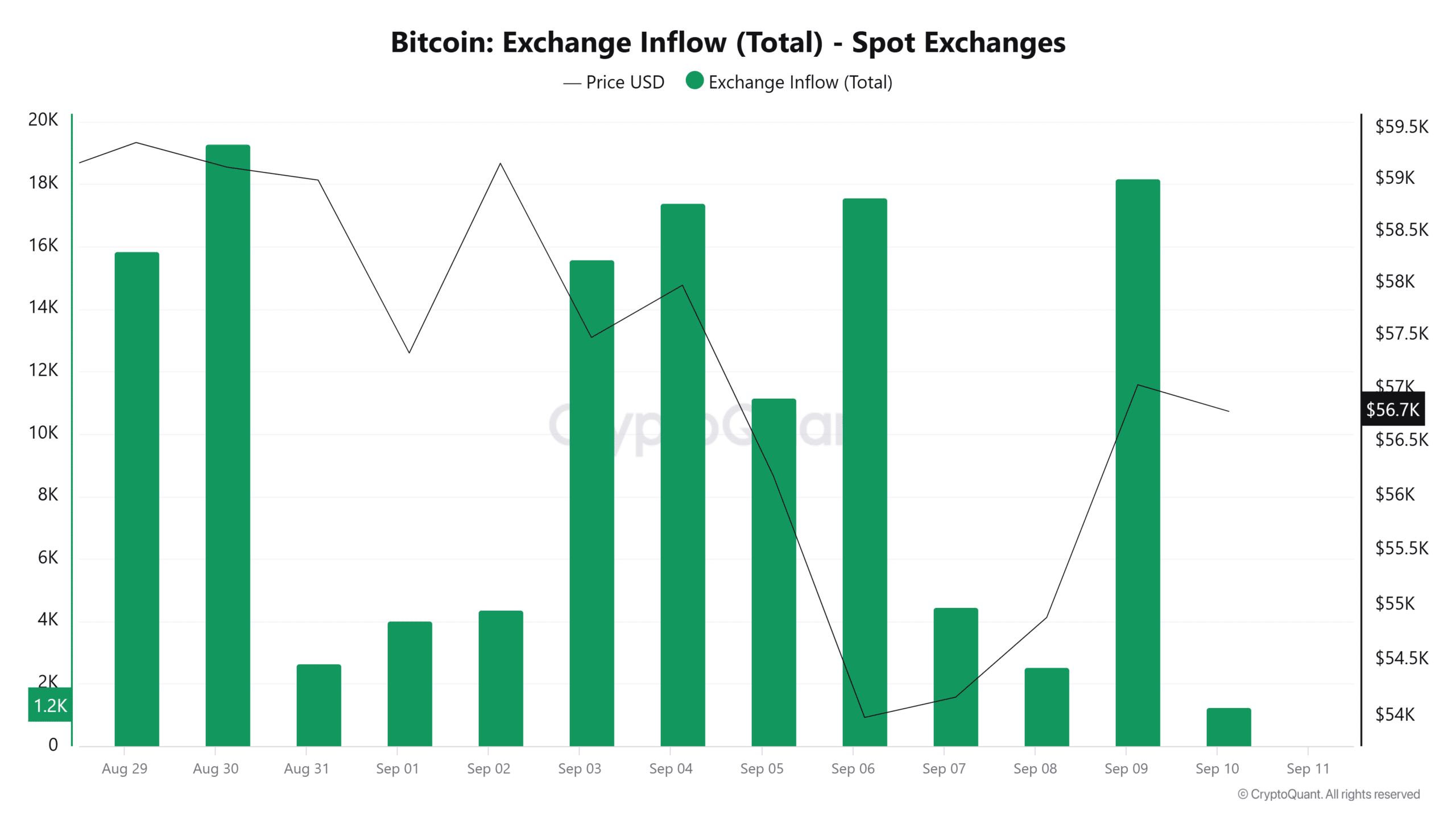

Another important signal that shows that a bearish trend is underway is currency inflows.

Data from CryptoQuant shows that Bitcoin inflows to spot exchanges reached 18,193 on September 9, a huge jump from the 2,535 BTC posted the day before. This was also the highest level of inflows in seven days.

Source: CryptoQuant

The surge in inflows coincided with a recovery in BTC prices, indicating profit-taking. It indicates that traders are anticipating a bearish trend as they choose to cut their losses.

Such selling activity indicates that traders are not expecting a major price breakout, and Bitcoin’s uptrend could continue to encounter resistance.

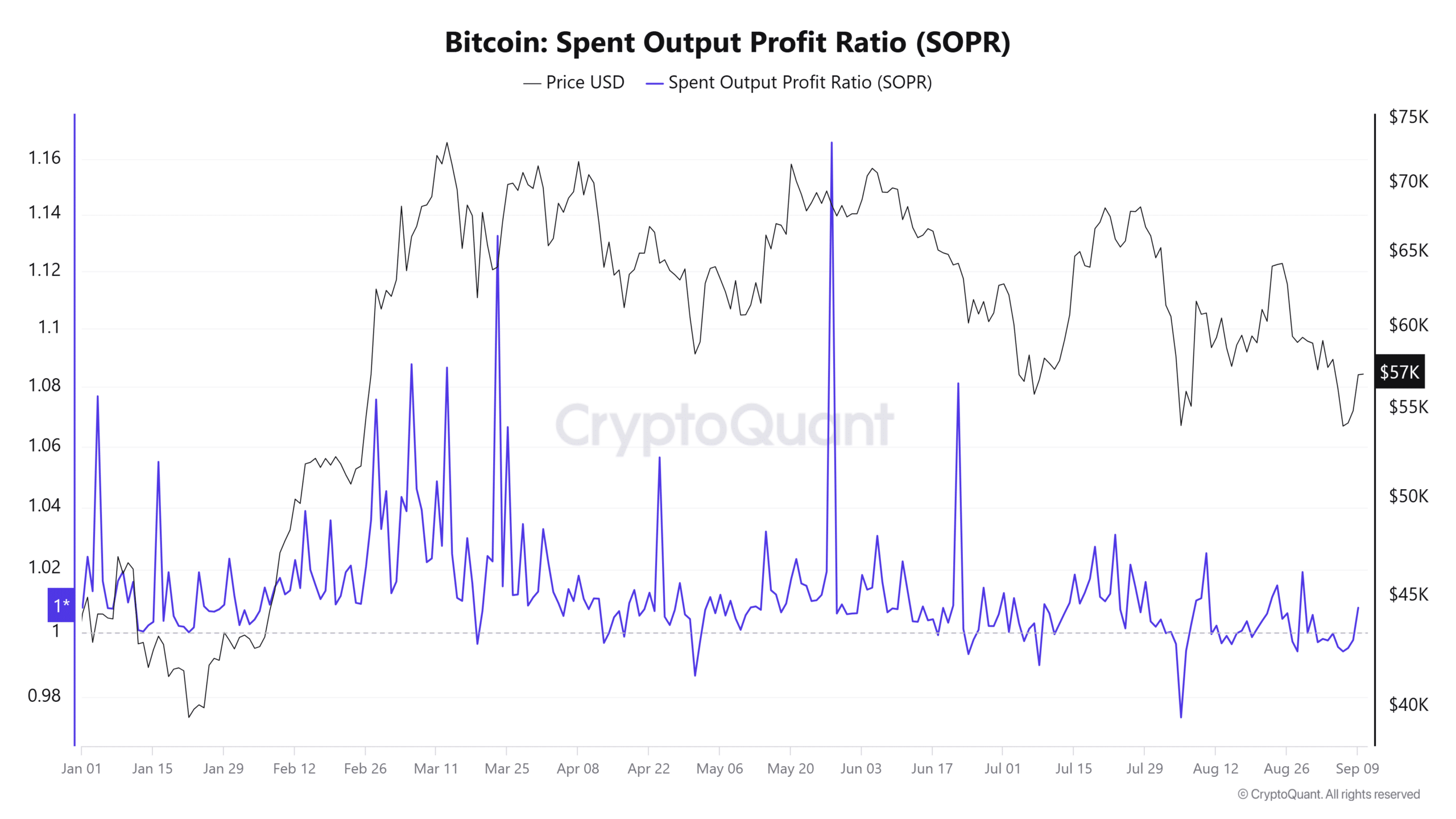

The profit-taking behavior is further reflected in the Spent Output Profit Ratio (SOPR) ratio on CryptoQuant, which has shifted above 1, suggesting that traders are selling to realize profits.

This could put a damper on Bitcoin’s gains.

Source: CryptoQuant

Buyers hold back

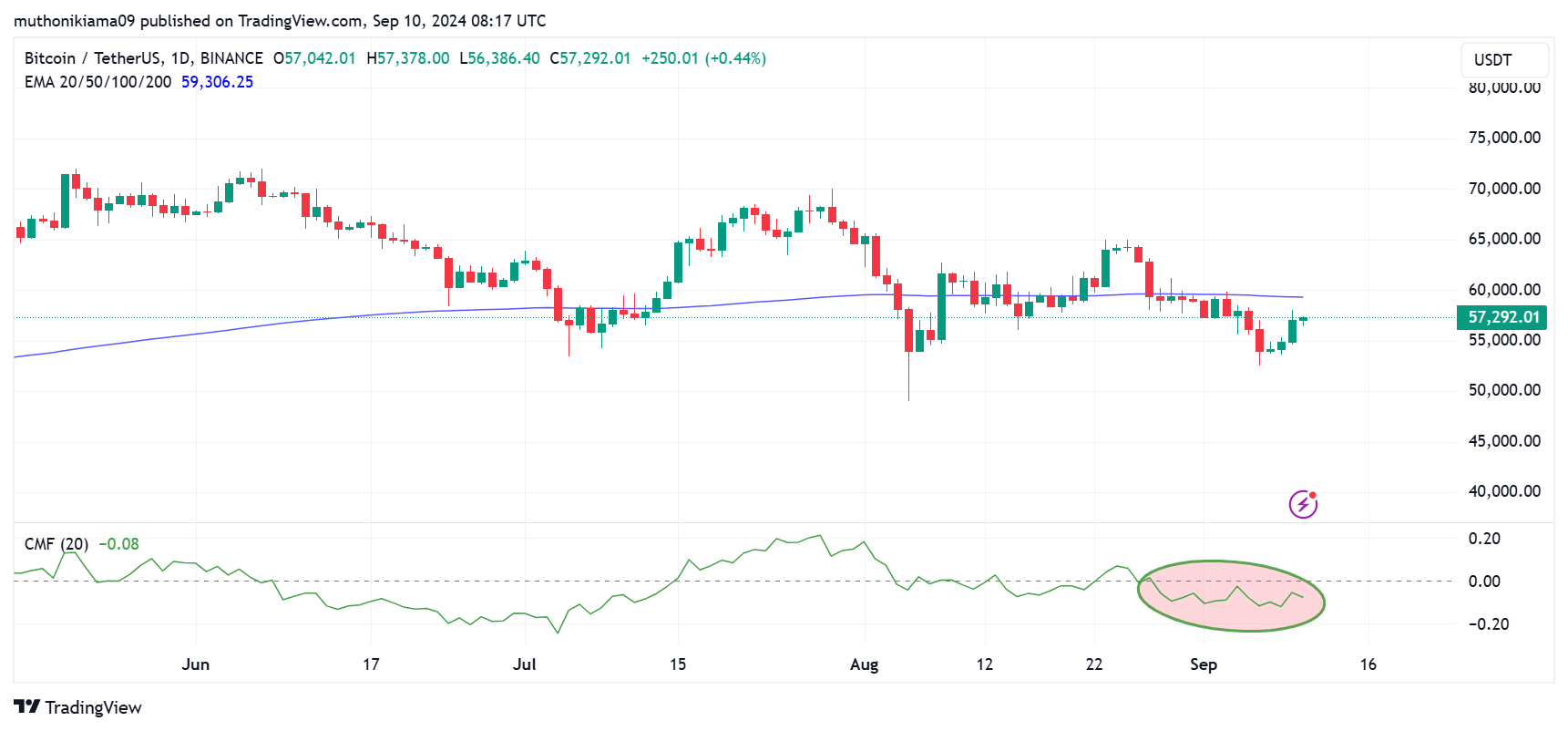

In a typical crypto bear market, buying activity remains relatively low. This trend has appeared on the daily Bitcoin chart.

The Chaikin money flow has been negative since August 27. Despite some periods of buying activity, this indicator has not turned positive for two weeks.

This shows that Bitcoin has experienced more sales than purchases during this period.

Source: TradingView

Furthermore, BTC has been trading below the 200-day exponential moving average for two weeks now. This shows that general market sentiment is negative.

BTC’s inability to reclaim the 200-day EMA also signals a lack of confidence among traders in a near-term price recovery.

Upcoming CPI data

Crypto traders are also turning their attention to the US Consumer Price Index (CPI) data set to be released on Wednesday.

According to Market watchInvestors expect August’s CPI to be 2.6%, down from the previous month’s 2.9%.

Positive inflation data will strengthen the case for a rate easing by the Federal Reserve next week.

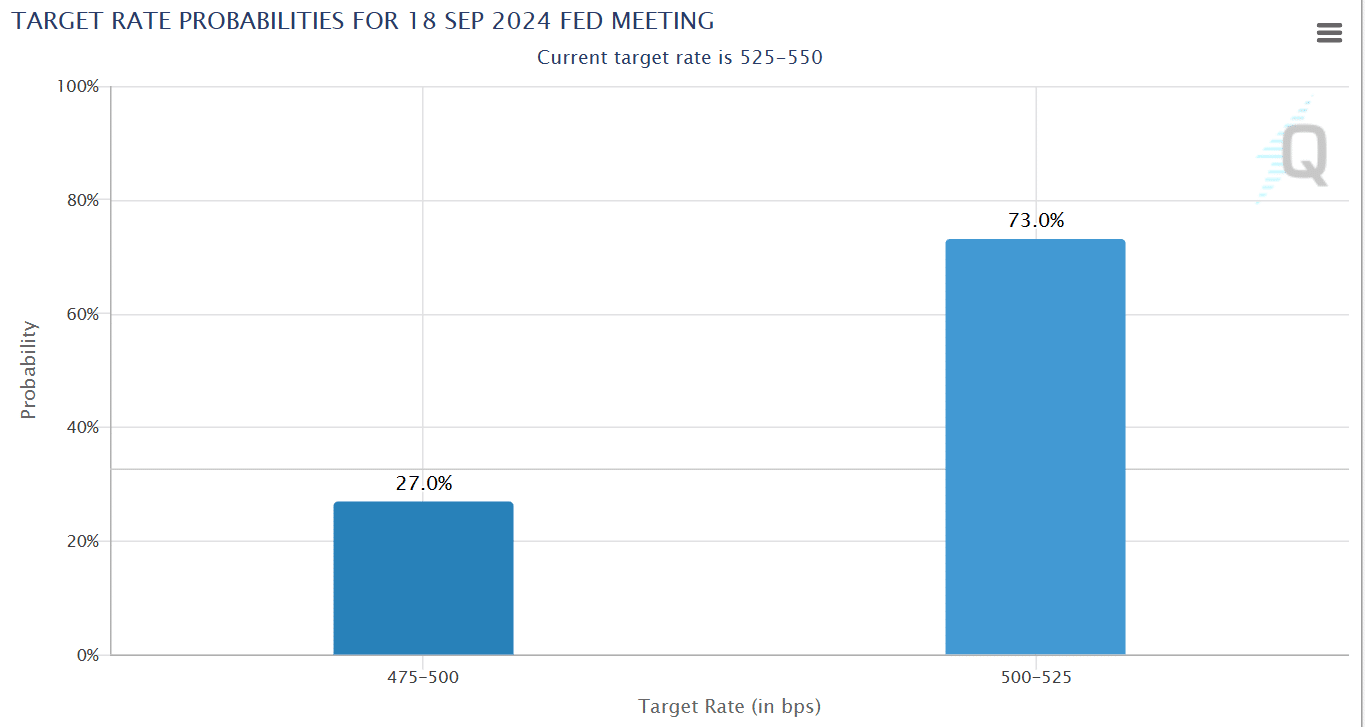

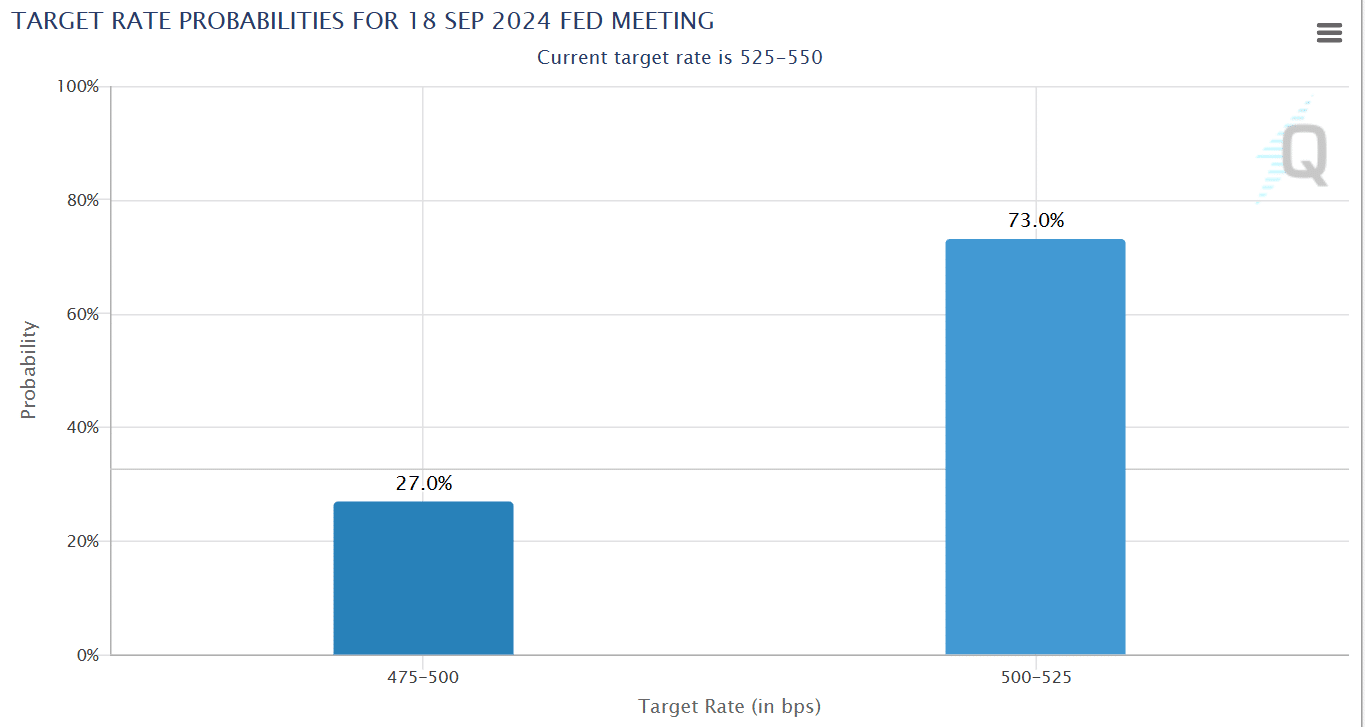

According to the CME FedWatch tool73% of investors price a rate cut of 25 basis points, while 27% of investors expect an even steeper cut of 50 basis points.

Source: CME FedWatch Tool

Last week, US Treasury Secretary Janet Yellen raised expectations for interest rate cuts next proverb the economy was healthy and on the road to recovery.

The Fed’s easing for the first time since 2020 will increase interest in risky assets like cryptocurrencies, which could reduce the likelihood of a crypto bear market.

A positive sign is created

While bearish signals dominate, a positive sign emerged as Bitcoin Exchange-Traded Funds (ETFs) turned positive for the first time since late August.

On September 9, inflows to spot Bitcoin ETFs amounted to $28 million per SoSoValue facts.

Read Bitcoin’s [BTC] Price forecast 2024–2025

However, the two largest Bitcoin ETFs by net assets experienced negative outflows. The BlackRock iShares Bitcoin Trust (IBIT) and the Grayscale Bitcoin Trust (GBTC) saw $9 million and $22 million in outflows, respectively.

If Bitcoin ETF data is positive for the rest of the week, it will renew optimism among crypto traders and allay fears of a bear market.