Este Artículo También Está Disponible and Español.

In a new research report that is shared on X, Joe Consorti, head of growth at HEA, driven out on current rumors, claiming that the Bitcoin price is artificially retained. Consorti explains an extensive investigation of data on chains, indicating the normal cyclical behavior of long -term holders (LTHs) and their profit maker patterns as important factors of the current trade dynamics of Bitcoin.

Has the Bitcoin price currently been manipulated?

One of the core arguments Consorti addresses is the suspicion that “the boring period of consolidation” can be designed through hidden market forces. In his words: “Claims of artificial price suppression is an argument from the Golden Age that does not work in Bitcoin, whose ledger is auditable in real -time, which means that we can see exactly who buys and sells through their own junction on the network. “

Consorti emphasizes that every joint efforts to artificially capt Bitcoin artificial cap too artificial, visible to observers in chains. Instead, the data point to a well-affected pattern: after collecting BTC in the lower price range between $ 15,000 to $ 25,000 sales, the parts of their interests in higher prices, so that coins are redistributed to new market participants who remain Bitcoin up bid. “This is normal. Those who hold for years start loading as the price goes higher and transfer coins to new buyers who intervene to offer the price to even higher highlights. “

Related lecture

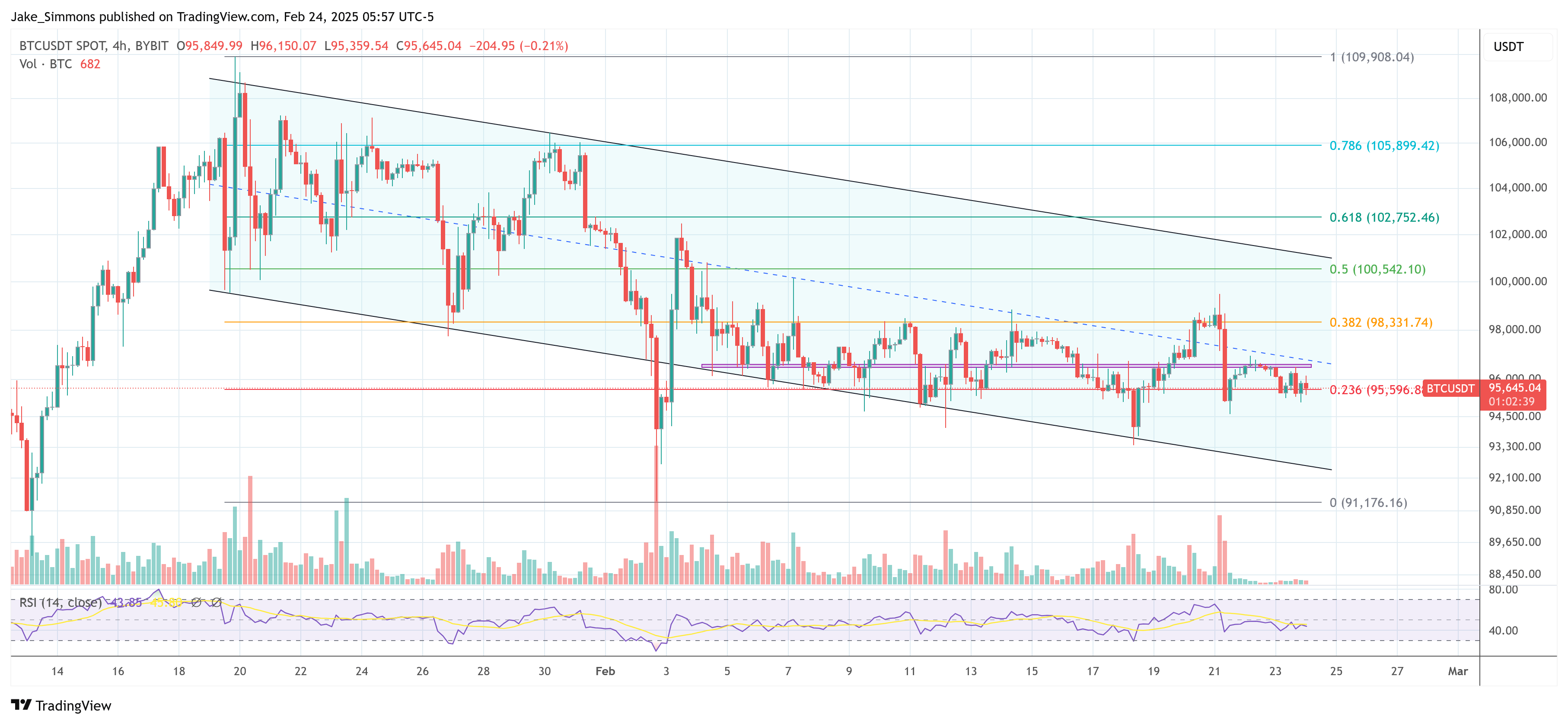

According to Consorti, Bitcoin has now introduced its 100+ day consolidation range around $ 95,000 that he compares with previous consolidation phases of several months that were ultimately resolved in large price extensions.

The research offers a retrospective view of how LTHS behaved in earlier price climbing: “LTHS has built up BTC from $ 15k to $ 25k, before sold to new market input (short -term holders) who offer the price to the next ‘step’. They did the same from $ 25k to $ 40k, from $ 40k to $ 65k, and from $ 65k to the ~ $ 95,000 range in which we now find ourselves. “

Consorti notes that LTHS has recently changed back into net accumulators. Although the shift is low, he argues that this behavior usually marks the end of the tail of the tail before a new outbreak.

The researcher also points to a recent ethereum -hack of $ 1.4 billion on Bybit – ranging the largest in the history of Crypto – because a factor temporarily Bitcoin of an attempt to break out of his falling wig pattern. Despite the disruption of the market, Bitcoin fell only 1.75%on the day, of which Consorti says it is proof of the leading BTCs “outright force” and decreasing correlation with wider crypto assets.

In general, Consorti expects the falling wedge to “solve itself in the first week of March”, apart from extra Black Swan events. He also notes that the current Bitcoin consolidation zone can then extend for 101 days, warning that “maximum pain in the market” could see it up to 236 days, with the long -term consolidation period reflecting last summer.

Consorti also refers to the possible impact of President Trump’s working group on Bitcoin, who will decide on the viability of a strategic Bitcoin reserve at the end of June. If there is earlier a final decision, he suggests that it can offer a big spark for the market – Bullish or Bearish, depending on the outcome.

Spot ETF inflow, once seen as a most important propeller of Bitcoin’s price, have been taken since the beginning of January. Although they still show 7-8 Figure daily intake, they have fallen considerably compared to the 9-10 figures that took place during the past spring and autumn, which means that other market forces, such as institutional and on-ket then dynamics, can show the price movement of This cycle.

Another subject is the dislocation of Bitcoin by the global M2 money amount, which had followed the price for almost 18 months with creepy accuracy. That correlation broke a deeper decline for Bitcoin when Global M2 broke, but BTC continued to float around $ 95,000. Now that M2 is rising again on a weaker American dollar, the research suggests the possibility that Bitcoin tunes up on his next leg higher.

Comparing Bitcoin with gold with a 50-day lead also implies that the recent Gold process “can indicate an upward resolution”, albeit less precisely than M2 correlations. If this applies, a push to $ 120,000 seems plausible.

Related lecture

Consorti decides by switching to the developing landscape of the question of US Treasury (UST). Large foreign holders such as China and Japan have gradually reduced or crushed their positions – the interests of China have reached a lowest point of $ 759 billion in 2009, while Russia has been completely abandoned, and Japan remains 13 years at $ 1.06 trillion. “It’s not just China. Russia has completely left USTs. Japan, the largest foreign holder, has been flat at $ 1.06 trillion for 13 years. “

In the meantime, the share of the US Federal Reserve in the marketable USTs has risen from 22% in 2008 to 47.3% in 2025, taking the foreign demand. But a new player participates in the market in the form of Stablecoins, who jointly have around $ 200 billion in treasuries to support their dollar-Pegkens. According to Consorti, this Stablecoin question can: “Long-term interest rates. The proliferation of stablecoins and their use of treasury as a reserve resistant means that they function as a completely new foreign central bank. “

He argues that Stablecoins effectively ensure a new demand for treasuries, which compensates for the US government by reducing foreign involvement and maintaining its loan needs. White House AI & Crypto Tsar David Sacks has publicly reflected this perspective and says that Stablecoins help maintain the liquidity for our debts.

At the time of the press, BTC traded $ 95,645.

Featured image made with dall.e, graph of tradingview.com