- BTC’s net unrealized gains and losses confirmed the ongoing bullish rally.

- At the current price, BTC could be overvalued and experience a pullback.

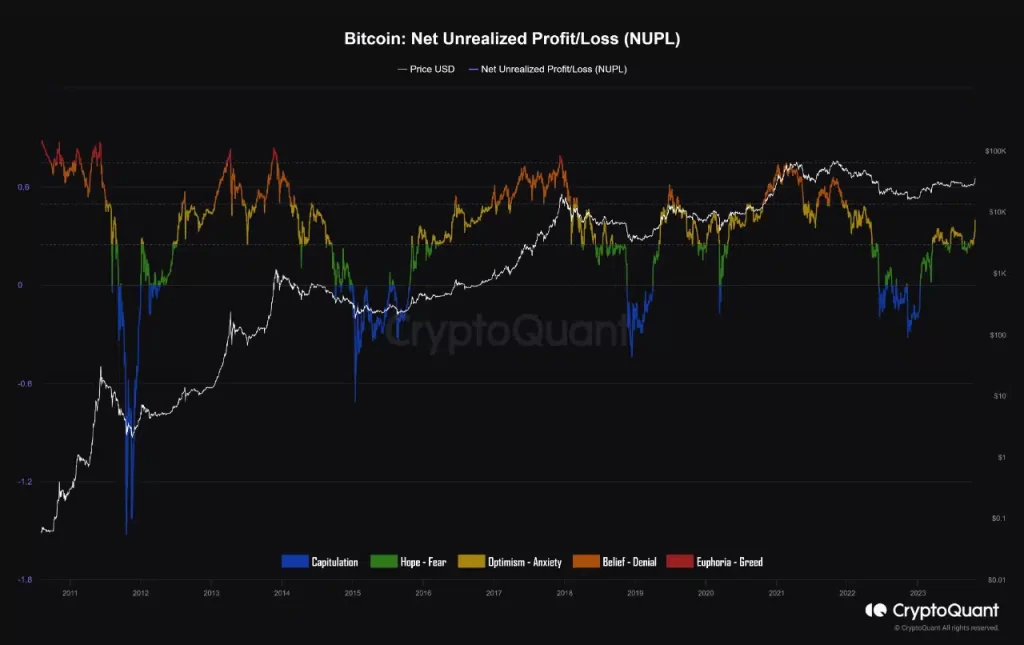

Bitcoins [BTC] The Net Unrealized Profit and Loss (NUPL) has reached its bullish phase, indicating that the prevailing sentiment is more bullish, pseudonymous CryptoQuant analyst Gaah noted in a recent publication. report.

Read BTC price forecast for 2023-2024

BTC’s NUPL metric functions as a good gauge of market sentiment as it measures the overall profitability of coin holders. When the NUPL value is above zero, it indicates that BTC holders are making a profit. Conversely, a value below zero indicates that most holders are making a loss.

At 0.399 at the time of writing, the leading coin’s NUPL rose above the zero line on October 15, as BTC began its uptrend. Since then, the value of the coin has risen by 31%, data from CoinMarketCap showed.

With growing bullish sentiments, Gaah noted:

“The indicator is now approaching 0.5+ (Belief – Denial phase). [Orange]), a level that has historically indicated market tops.”

Source: CryptoQuant

The analyst added that the euphoria could emerge once the US Securities and Exchange Commission (SEC) approves BTC spot exchange-traded funds (ETFs). “If this happens later this year, the price could once again reach its last historical high,” Gaah said.

The coin’s last historical high was $68,789.63, which was reached on November 10, 2021.

A retrace in sight?

At the time of writing, the leading crypto was exchanging hands at $34,063. Price movements assessed on a daily chart indicated the possibility of a slight retracement in the coming days.

First, the coin’s key momentum indicators were at overbought highs at the time of writing. The Relative Strength Index (RSI) and Money Flow Index (MFI), which track the coin’s trading momentum, were 82.63 and 84.36 respectively at the time of writing.

At these values there is a high chance of a relapse or reversal in the near future. Moreso, an assessment of the spent output profit ratio for both short- and long-term BTC holders found that both cohorts of investors are currently making profits. They could be incentivized to sell their assets to cash in on those profits. This may result in a price disadvantage.

Is your portfolio green? Check out the BTC profit calculator

Likewise, at the time of writing, the price of BTC was above the upper band of the Bollinger Bands indicator.

When the price of an asset trades this way, it means that the asset is trading above its average price and volatility is high. It often indicates that the currency is overvalued and a pullback is likely.

Source: BTC/USDT on TradingView