- Solana has been under selling pressure following the collapse of FTX, with concerns over a blocked bet and a recent sell-off by a major investor.

- Price drops, lower volumes and declining indicators create uncertainty for Solana.

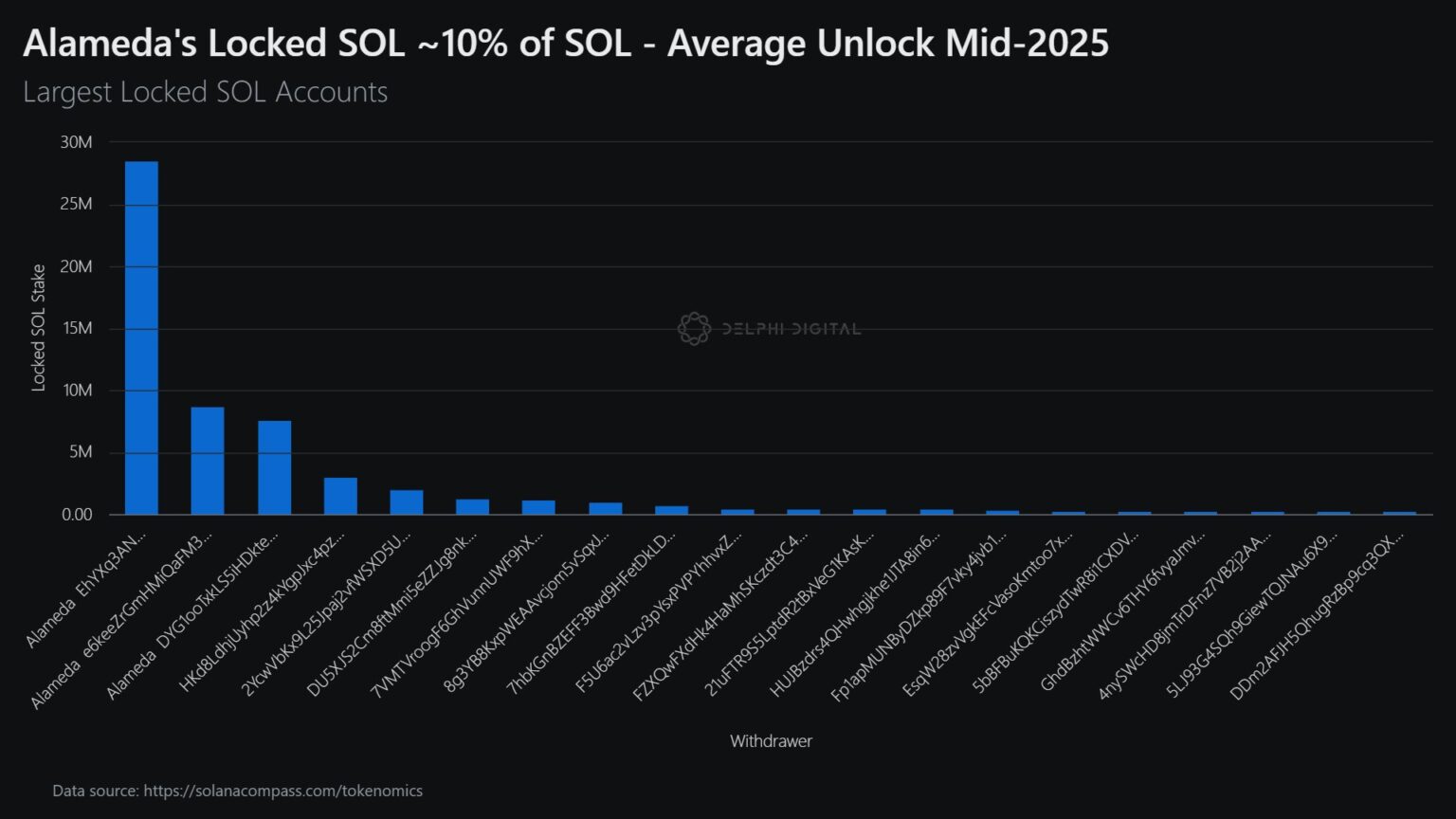

Solana was under major selling pressure following the collapse of FTX. This was largely attributed to Alameda Research, an FTX affiliated entity, which held a significant amount of SOL tokens. While initial indications suggested that Solana was recovering from the aftermath of FTX’s demise, new data suggests that may not be the case for SOL.

Realistic or not, here is the market cap of SOL in BTC terms

Problems for SOL

According to findings of Delphi digital, Alameda Research currently holds an 8.2% vested interest in the Solana cryptocurrency stock. This stake is SOL 45 million, valued at $45 million, and is currently in bankruptcy proceedings.

The expanded SOL can be unlocked in mid-2025. The presence of this locked stake raises concerns about the potential impact on SOL’s supply and liquidity over the next few years.

These conditions continue to cause FUD around SOL. In addition, Delphi Digital reported that a large whale had been sighted selling a significant portion of its holdings.

The whale could be an early investor in Solana. The account has been running time-weighted average price (TWAP) orders for the past few months.

Source: Delphi Digital

For context, TWAP orders involve executing trades gradually over a specific period of time to achieve an average price aligned with market conditions, minimizing market impact and price volatility.

The whale sold about 7 million SOL tokens. And that leaves about 10 million SOL. In addition, the sales activity increases the selling pressure on Solana and contributes to the downward price trend.

At the time of writing, Solana was trading at USD 13.20, down 44.70% since testing the USD 24.02 resistance level on April 30. The price drop, along with the significant drop in SOL’s RSI, points to a lack of positive momentum and potential weakness in the market for Solana.

In addition, the Chaikin Money Flow (CMF) indicator, which measures buying and selling pressure, also fell. This suggests a reduction in buying pressure and may indicate bearish sentiment in the market for Solana.

Source: Trade View

New developments can help Solana

In addition to the price drop, SOL’s trading volume also decreased. This can be seen as a reduction in market activity and liquidity.

Read Solana’s price forecast 2023-2024

However, despite these challenges, Solana’s development activity has continued to increase. The increasing development activity suggests that new updates and upgrades are in the pipeline for the Solana network. These improvements have the potential to attract new users to the protocol and improve the overall value and usability of the SOL token.

Source: Sentiment