- The accumulation of whales highlighted strong confidence as ONDO traded within key support and resistance levels.

- Technical indicators pointed to oversold conditions, with large trades signaling potential bullish momentum.

A single entity has re-entered the country Ondo [ONDO] market with a whopping $7.87 million across five portfolios just a week after the sale.

The largest purchase saw $2.46 million USDT spent to acquire 1.64 million ONDO, signaling renewed confidence in the token.

At the time of writing, ONDO was trading at $1.43, down 2.15% in the past 24 hours, as traders assess their next move.

This strategic accumulation raises questions about whether the token is preparing for a significant rally or remains sensitive to further price swings.

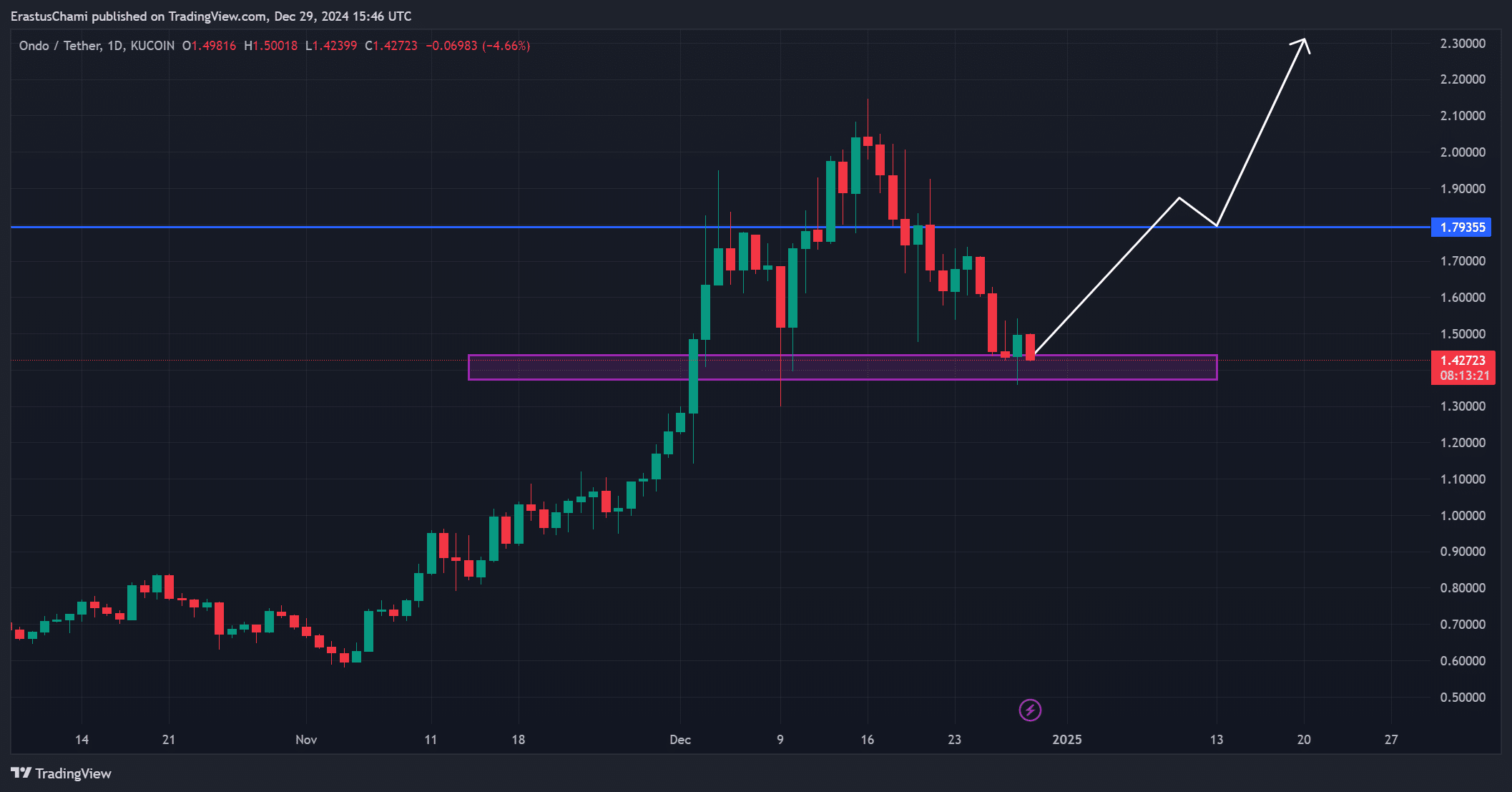

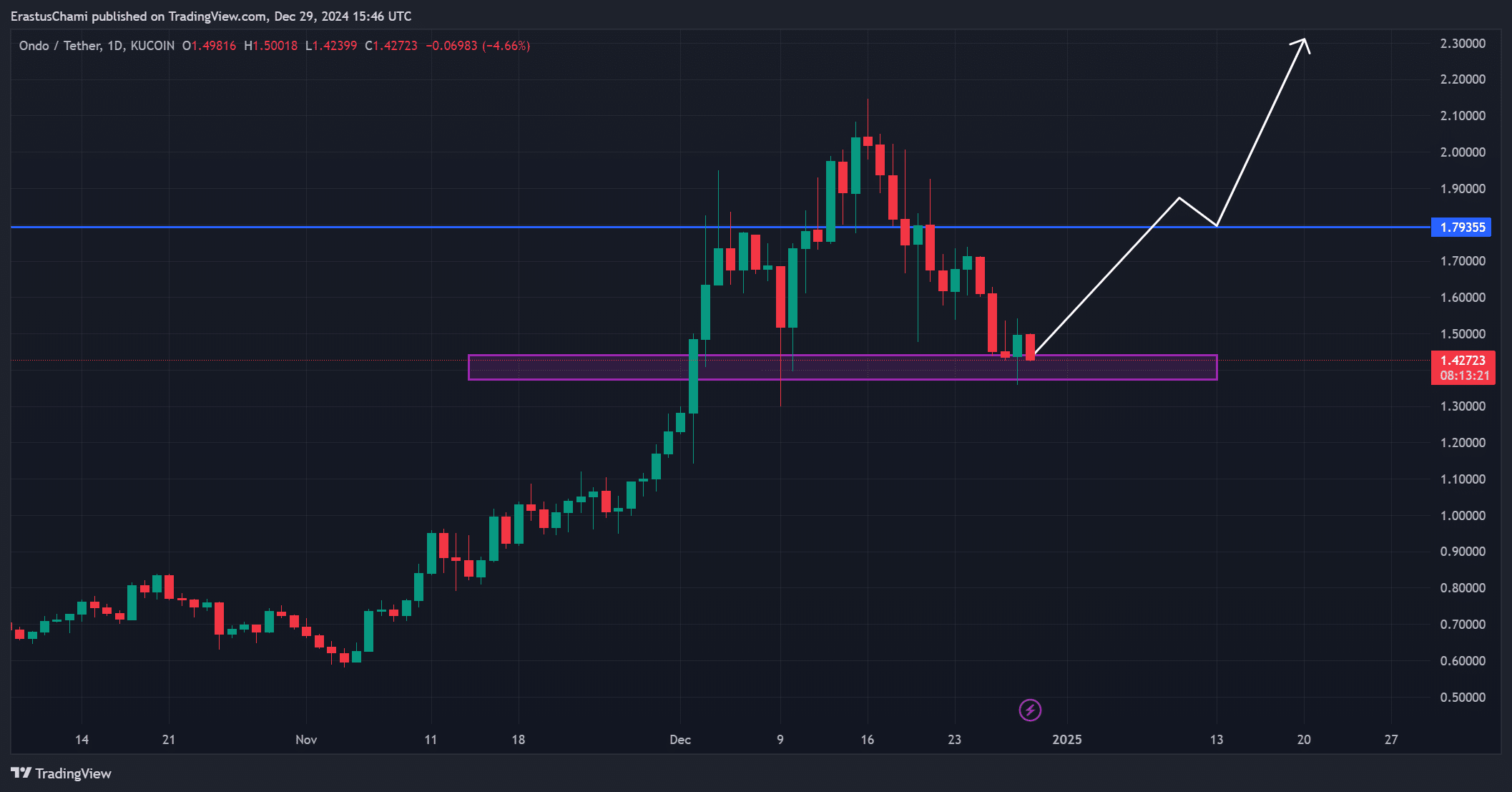

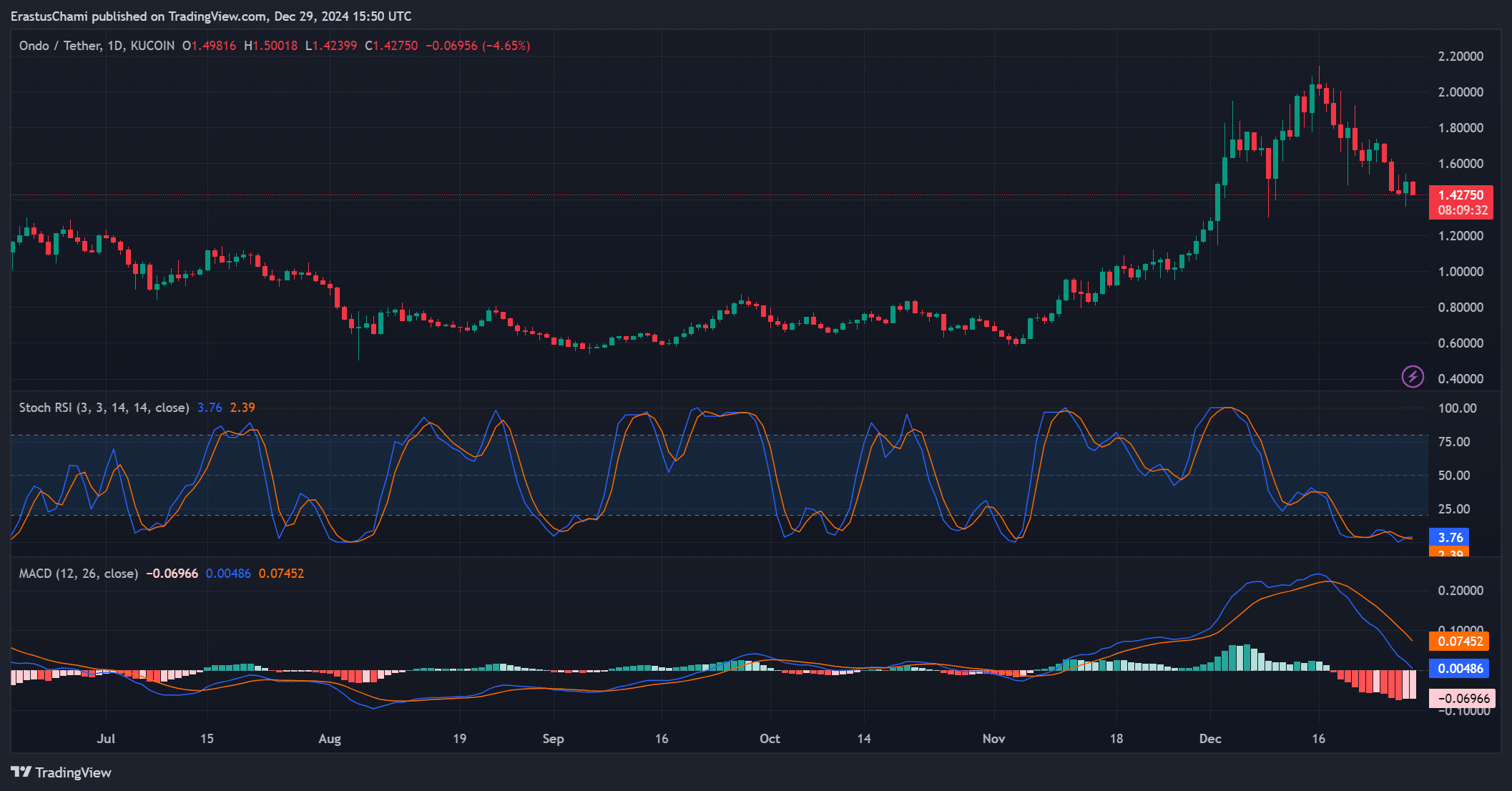

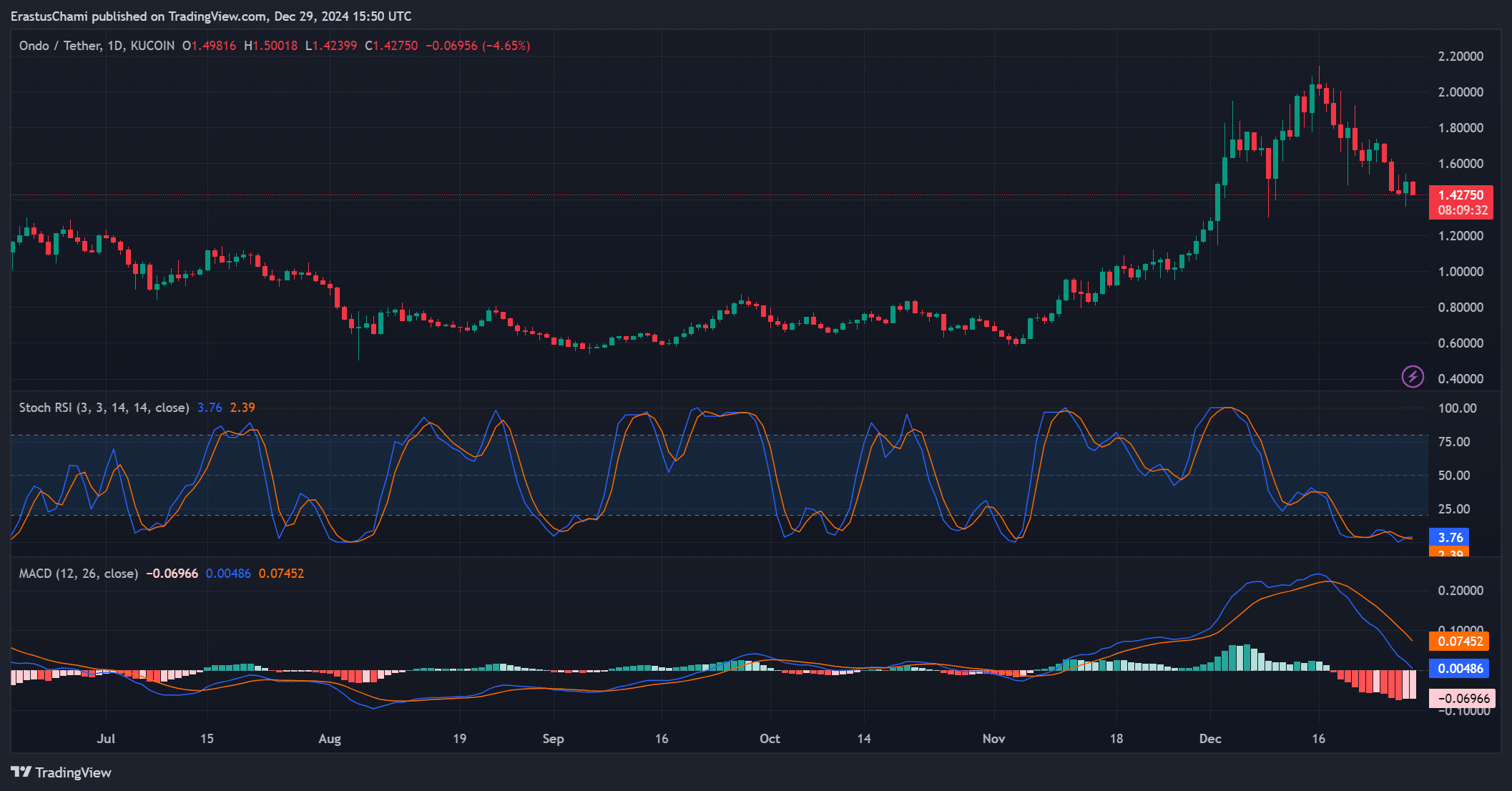

ONDO Price Analysis: Navigating Key Levels

ONDO has been fighting to hold its critical support zone between $1.40 and $1.50 after retreating from a high of $2.00 earlier this month.

Currently, resistance at $1.79 poses a formidable challenge for bulls, with a successful breakout potentially leading to the $2.30 mark.

However, if the support breaks, the price could test the USD 1.20 level, creating room for bearish momentum.

Therefore, its short-term movement depends on its ability to regain higher ground while consolidating within this key range.

Source: TradingView

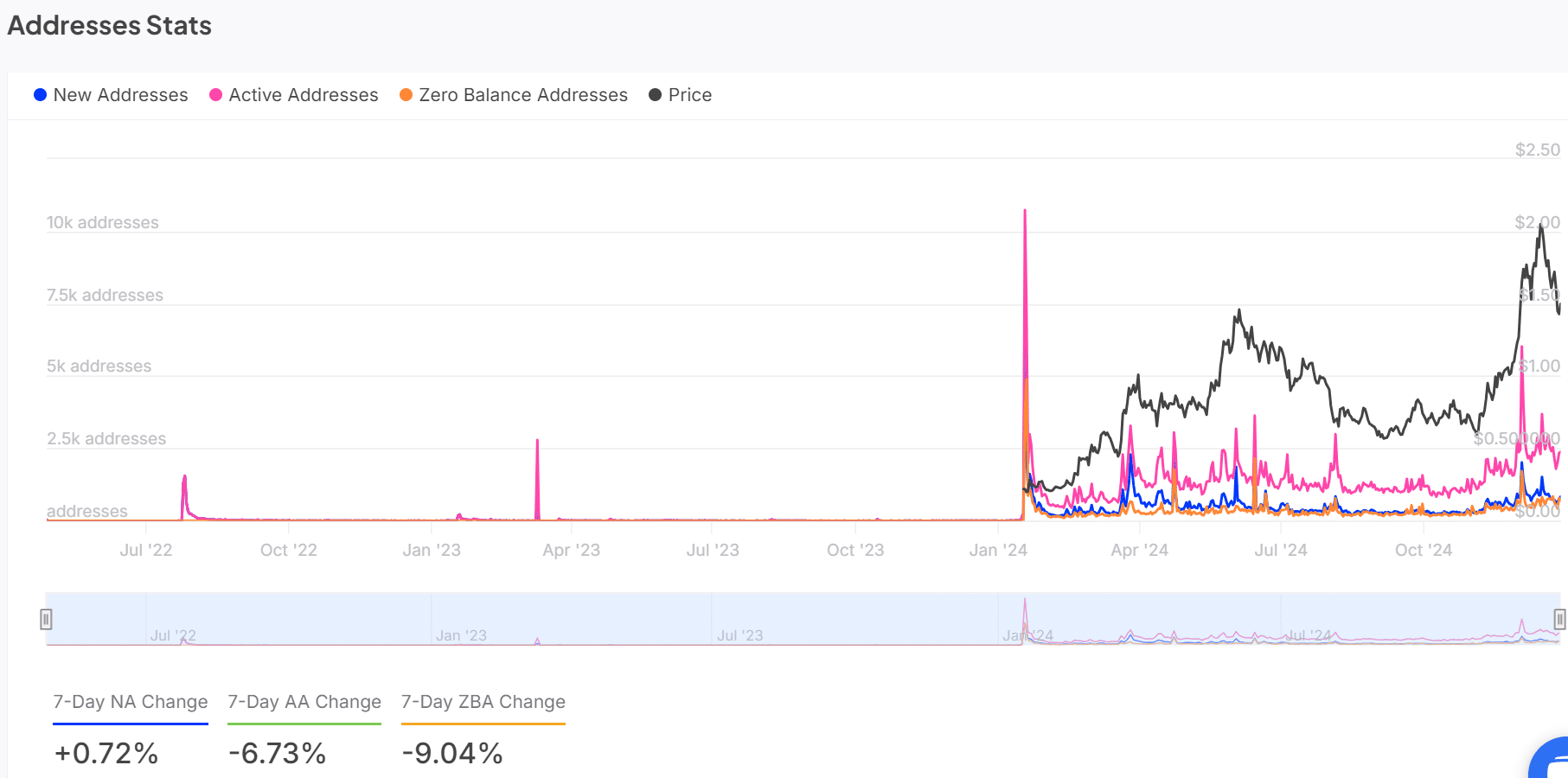

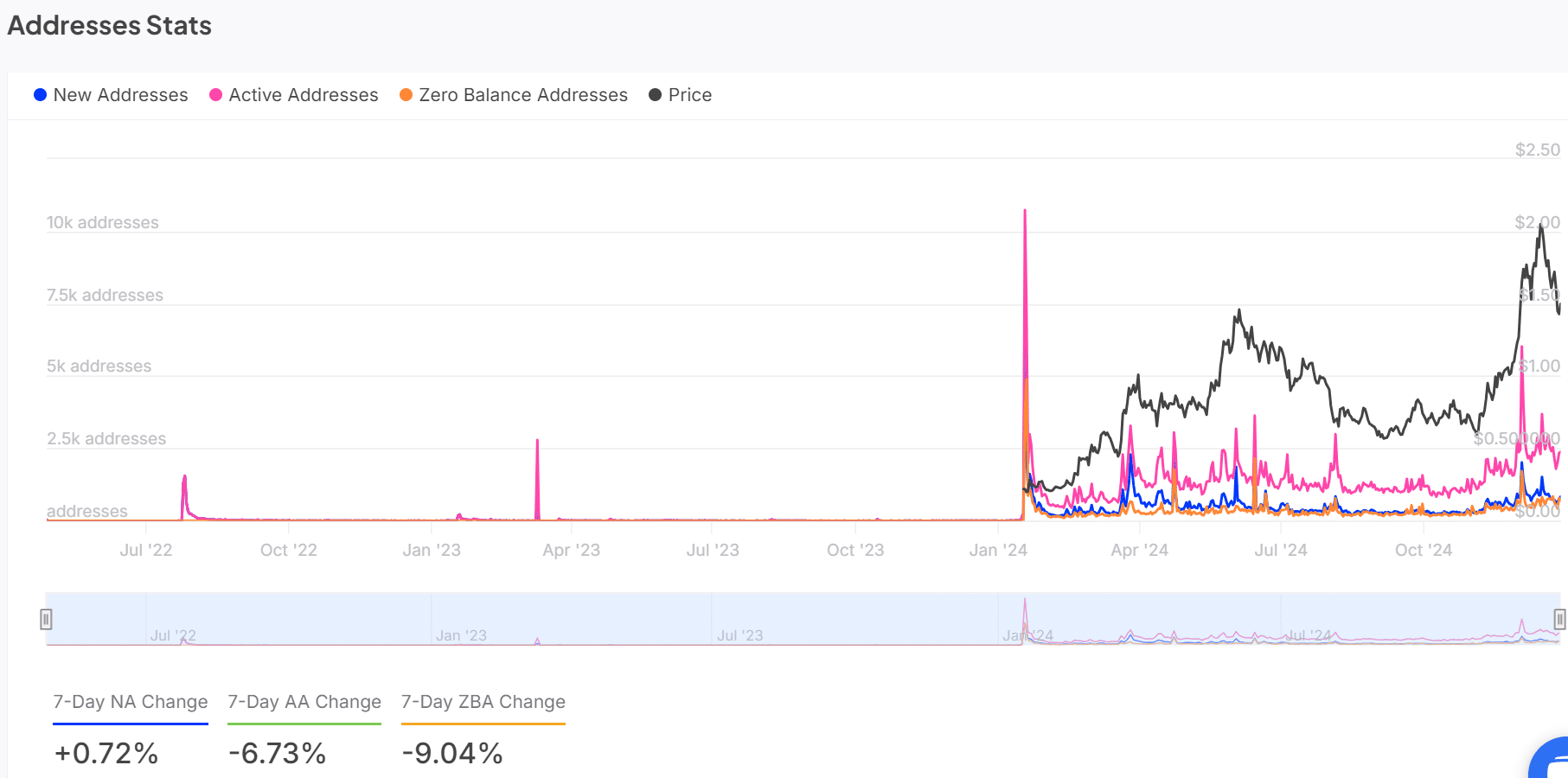

ONDO address statistics: changing trends among holders

The address activity paints a nuanced picture of the token’s ecosystem. The number of new addresses increased slightly by 0.72%, indicating continued interest, but active addresses fell by 6.73% over the past week.

Additionally, zero-balance addresses are down 9.04%, indicating some holders are re-engaged with their wallets.

This shift reflects mixed sentiment as investors recalibrate their positions, balancing optimism and caution amid market volatility.

Source: IntoTheBlock

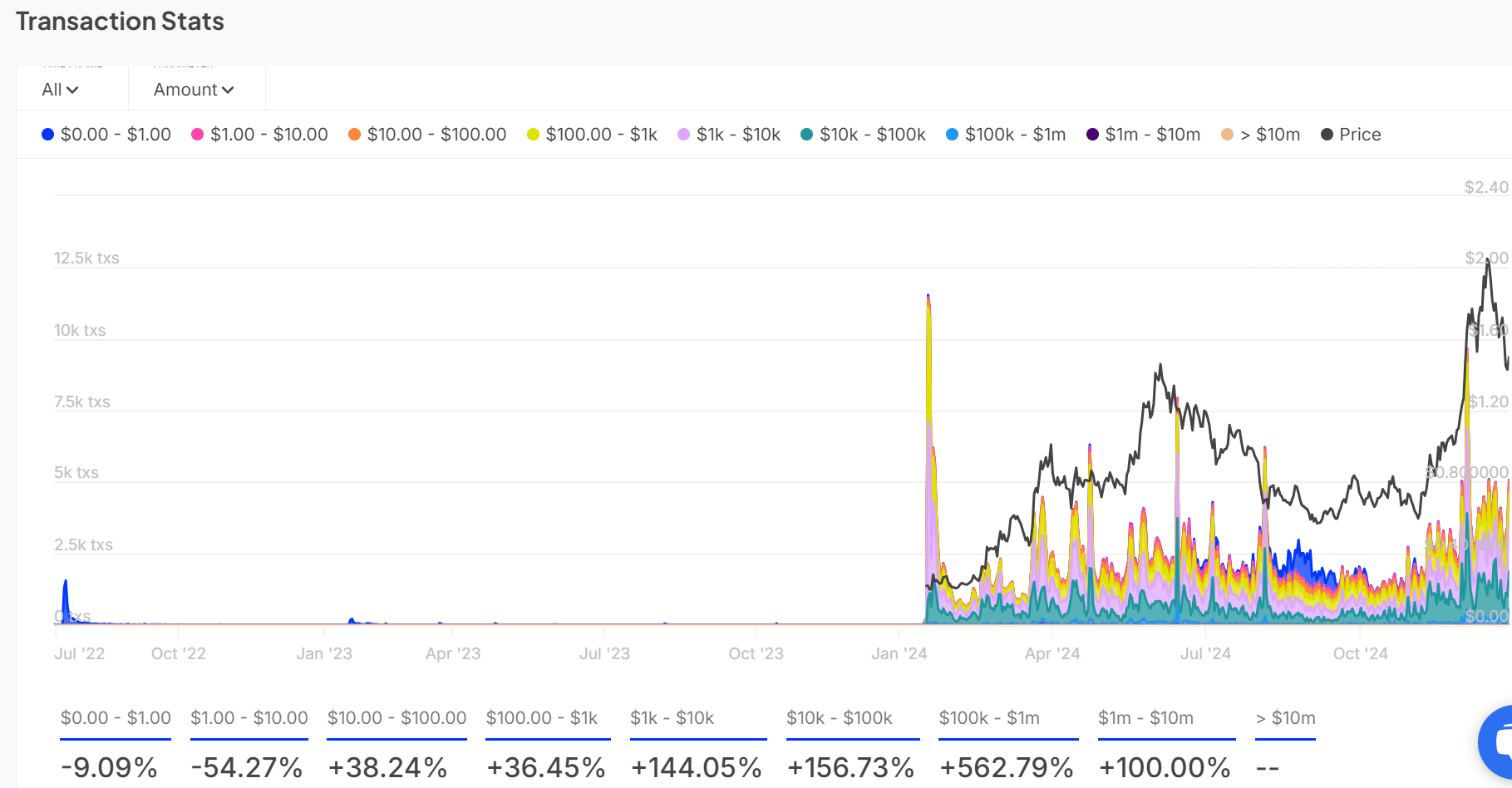

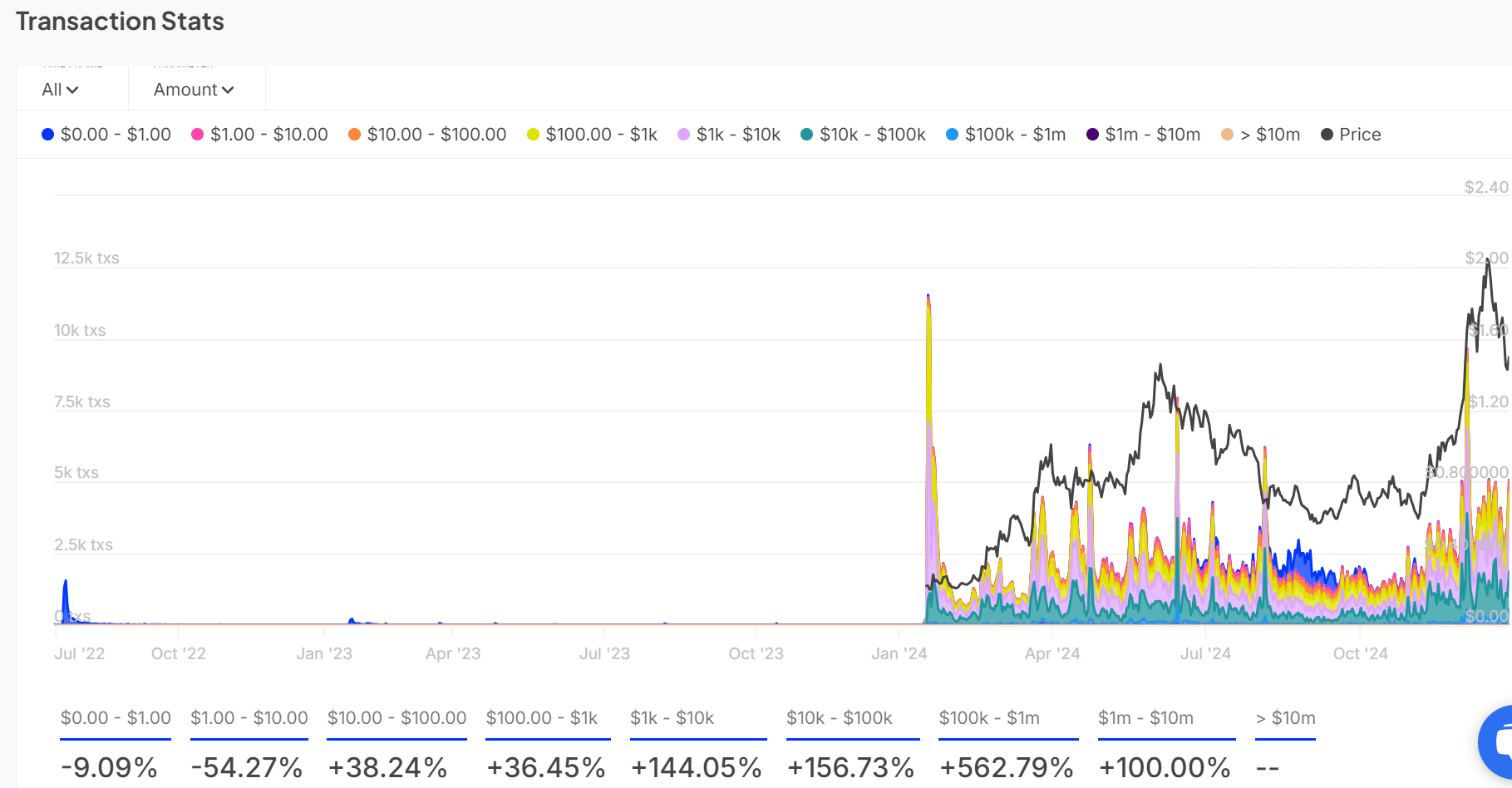

Transaction metrics: rising institutional activity?

Transaction data indicates robust growth in large-value transfers, underscoring increasing confidence in ONDO.

Transactions between $10,000 and $100,000 increased 156.73%, while transactions above $1 million increased 100%.

These figures indicate increased interest from institutional and high net worth investors seeking strategic exposure.

Consequently, this increase in transaction volume fits with the broader story of ONDO’s potential to attract significant capital flows.

Source: IntoTheBlock

Technical Indicators: Will Momentum Turn Bullish?

Technical indicators provide potential signals for recovery. The STOCH RSI of 3.76 indicates oversold conditions, indicating a possible near-term recovery.

Meanwhile, the MACD remains negative at -0.069, but the narrowing gap between the lines signals waning bearish momentum.

If these indicators align with improving sentiment, the token could see a reversal in its recent downtrend.

Source: TradingView

Read Ondo’s [ONDO] Price forecast 2024–2025

ONDO appears to be making a case for a significant rally, supported by whale accumulation, increased high-value trades and bullish technical setups.

While challenges remain, market activity suggests the token is gearing up for a strong upward move. Therefore, it seems increasingly likely that ONDO could cross $2.00 in the coming weeks.