- Metaplanet to issue ¥1 billion in bonds to buy Bitcoin.

- Analysis of Bitcoin’s market fundamentals suggested limited impact on the overall price.

Despite a recent downturn in Bitcoin [BTC] price, which influences the broader cryptocurrency market, Japanese company Metaplanet is doubling down on its Bitcoin strategy.

At the time of writing, BTC was trading at $62,825, reflecting a decline of 2.3% in the past 24 hours and a decline of 3.2% in the past week.

Regardless of these market conditions, Metaplanet has unveiled plans to significantly strengthen its Bitcoin holdings.

Details of the investment

Early on June 24, Metaplanet announced a strategic move to issue ¥1 billion ($6.2 million) worth of bonds at a modest 0.5% interest rate to buy Bitcoin.

This indicated a strong commitment to integrating cryptocurrency into its asset management strategy. Part of Metaplanet’s message read:

“Metaplanet Inc. (3350:JP) hereby announces that its Board of Directors has decided to purchase Bitcoin worth 1 billion yen as of today’s meeting. The funds for this purchase will be allocated from the capital raised through the issuance of the second series of ordinary bonds (with guarantees), as separately announced today in the “Announcement on the issuance of the second series of ordinary bonds (with guarantees). ”

Metaplanet has further clarified its financial strategy regarding BTC investments and indicated that BTC designated for long-term holdings will be recorded at acquisition value.

This means they are exempt from market value tax at the end of the financial year. In contrast, other Bitcoin assets will be regularly marked to market on a quarterly basis, with any gains or losses impacting non-operating financial results.

Despite a general policy of holding BTC for longer periods, the company noted that any Bitcoin used for operational purposes would be recorded as a current asset on their balance sheet.

Notably, the decision to acquire more Bitcoin through bond issuance aligns Metaplanet with notable companies like MicroStrategy, which have adopted similar strategies to increase their BTC reserves.

In April Metaplanet initially added Bitcoin to its balance sheetfollowing MicroStrategy’s approach of using debt financing to purchase Bitcoin.

The company’s shift to significant investments in cryptocurrency marks a transition from its previous focus on operating budget hotels.

The move is part of a broader strategy to reduce the company’s dependence on the weakening Japanese yen, which has reached its lowest level against the US dollar since 1990.

Impact on Bitcoin?

With Metaplanet’s substantial financial commitment to Bitcoin, the question remains whether a ¥1 billion ($6.2 million) Bitcoin purchase will significantly impact the market.

To assess this, it is essential to take into account Bitcoin’s fundamental metrics, especially its current supply and demand dynamics.

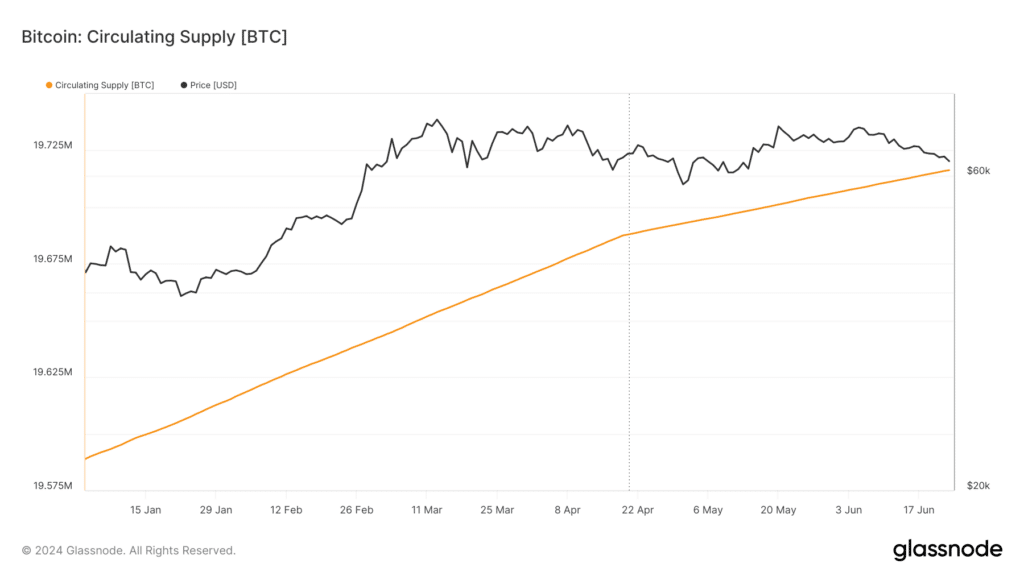

Observing the circulating supply, which has been steady increasingshows that the proposed purchase would represent only a small portion of the market total, indicating that it may not dramatically impact Bitcoin’s price.

Source: Glassnode

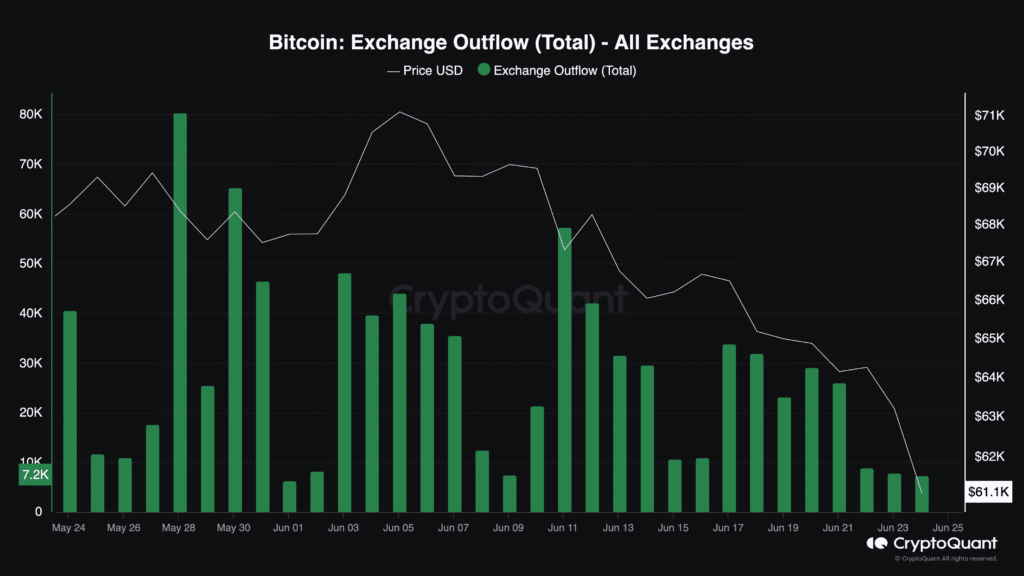

Moreover, it is crucial to examine the demand side, especially the trends in currency outflows. Facts from CryptoQuant shows a 1.75% increase in this metric over the past 24 hours.

However, a broader look revealed a drop in outflows over a month, indicating a decline in buying pressure.

Source: CryptoQuant

On June 23, approximately 7,852 BTC left the exchanges – a sharp drop from the 80,000 BTC listed on May 28.

Read Bitcoin’s [BTC] Price forecast 2024-25

This trend, combined with recent predictions from AMBCrypto that BTC could fall to $61,000, suggested that Metaplanet’s investment on its own is unlikely to cause substantial price movements.

It is part of a broader market context in which demand appears to be declining.